Source: Hua Li Hua Wai

Navigating Crypto’s Future: Beyond Short-Term Speculation

In our October 17th analysis, we delved into the probability of a phased bear market in the crypto space during Q3/Q4 2026. Our discussion covered various dimensions, including macro factors, the strength of the US dollar, on-chain data, and historical cycle patterns. We also briefly outlined key areas for market focus in 2026.

However, some readers reached out with more immediate concerns: “What you’re discussing feels too distant. I can’t wait until next year. I bought [XXX altcoin] at [XX] cost – can you just tell me if there’s still hope to break even this year? Should I hold on, or cut my losses now and buy the dip next year?” These questions highlight a common dilemma faced by many in the fast-paced world of cryptocurrency.

The Folly of Short-Term Predictions vs. The Power of Long-Term Vision

Such inquiries are a recurring theme. Investment decisions are deeply personal, influenced by individual capital, risk tolerance, and financial objectives. Relying on others for short-term predictions, especially from strangers, is often a gamble. If a prediction fails, it’s easy to blame external factors rather than one’s own choices.

Many are drawn to predicting daily market fluctuations, constantly seeking reasons for every rise and fall. Yet, market movements can be deceptively simple: extended rallies often precede corrections, and prolonged declines typically lead to rebounds. My experience over the past eight years has solidified a fundamental truth: the long-term path to wealth in this market is straightforward – “Buy Bitcoin, then hold.”

The allure of quick riches remains strong for most, and paradoxically, this dynamic benefits long-term holders. Without the constant churn of impatient participants, the market would lack the liquidity and volatility that allows patient investors to thrive. In a sense, we should be grateful for the market’s inherent impatience.

The market operates without sentiment, and our participation should reflect this. In a game of strategic engagement, never anchor your dreams of overnight wealth on others, particularly strangers. Such an approach often leads to emotional and financial distress.

Deep Dive: The US Dollar Index and Bitcoin’s Interplay

For those who prefer analytical rigor over speculative reasoning, the avenues for exploration we touched upon in our October 17th article warrant deeper investigation. Today, let’s expand on one crucial aspect: the relationship between the US Dollar Index (DXY) and Bitcoin, offering a practical example as a supplement to our previous discussion.

Generally, the strength of the US dollar significantly influences global capital flows. A stronger dollar typically attracts capital back to the US, placing downward pressure on risk assets, including cryptocurrencies. Conversely, a weaker dollar tends to encourage capital to seek higher returns in riskier markets.

While Bitcoin is increasingly seen as “digital gold,” it remains a higher-risk asset compared to traditional gold or other asset classes, making it particularly sensitive to shifts in global liquidity.

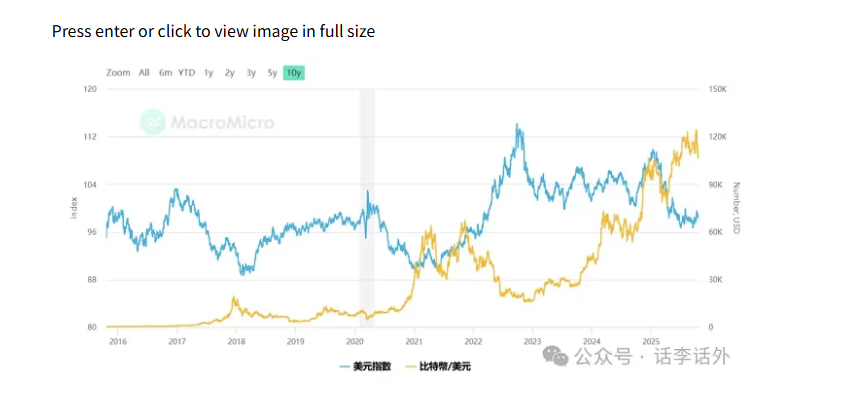

Let’s examine the accompanying chart:

As illustrated above, despite brief periods of positive correlation (e.g., September 2024 to January 2025, a phenomenon we explored in our July 15th article), the overarching trend reveals an inverse relationship. Broadly, the crypto market’s significant bull runs tend to coincide with periods when the US Dollar Index is relatively weaker.

Bringing our focus closer, from mid-2025 onwards, the DXY has largely hovered within a lower range (96-98). Correspondingly, Bitcoin has consolidated in a higher range (USD 100,000-120,000), experiencing mild pullbacks.

Based on this perspective, we can formulate potential short-term Bitcoin scenarios:

- DXY Weakens Further: If the US Dollar Index continues its downtrend in the coming months, breaking below 96, Bitcoin could theoretically see another upward surge, potentially pushing to USD 130,000-140,000, assuming no unforeseen “black swan” events.

- DXY Rebounds and Stabilizes: Should the DXY rebound and firmly hold above 100 in the next few months, Bitcoin might face continued retracement. However, the best-case scenario would likely be sideways consolidation, given the sustained institutional interest and support in this cycle.

- DXY Sustains Strong Rebound: A prolonged DXY rally would signal a significant decrease in risk appetite. Bitcoin wouldn’t just face a pullback; it could potentially drop towards institutional cost bases. With MicroStrategy’s average cost around USD 74,000, a speculative estimate places this potential floor around USD 70,000-80,000.

Each of these conclusions carries a specific probability. Our goal is to align our actions with the highest probability outcome while meticulously preparing a “Plan B” – a robust strategy for managing unexpected market shifts or “black swan” events.

Unpacking the Dollar Index: The Fed’s Influence

Given these varying outcomes, the next critical question arises: How might the US Dollar Index move in the coming months? To answer this, we must identify the macro factors driving dollar strength. Among the numerous variables, the Federal Reserve’s interest rate policy stands out as the most pivotal.

Current market consensus strongly anticipates a rate cut this month (October), with another likely before year-end, as depicted below:

What does this mean for the dollar? In theory, an accelerated pace of Fed rate cuts would narrow the interest rate differential, diminishing the dollar’s attractiveness. Thus, in the short to medium term, this is generally bearish for the dollar.

If the Fed’s rate cut schedule unfolds as anticipated, coupled with fresh rate cut expectations early next year (2026), it’s plausible the DXY could continue to trade at lower levels, potentially dipping below 96 by year-end or in Q1 of next year.

Connecting this back to our three Bitcoin scenarios, a general deduction emerges: Bitcoin (and gold) could experience another rally by year-end or in the first quarter of next year.

Beyond the Simple Chain: Nuances and Deeper Analysis

It’s crucial to acknowledge that this is a simplified, single-factor deduction. In reality, the relationship is more complex. Fed rate cuts don’t always immediately weaken the dollar, nor does a weaker dollar guarantee an immediate Bitcoin surge. Market expectations often price in these events in advance; for instance, the 2-3 rate cuts anticipated for Q4 this year might already be partially reflected in recent price movements.

Furthermore, as we discussed in our August 8th and August 27th articles, if future Fed rate cuts are driven by concerns of an impending US economic recession, this would not necessarily benefit risk assets, especially highly volatile cryptocurrencies.

For a more comprehensive and robust analysis, expand your research beyond this single chain. Consider delving into US Treasury yield trends, employment data, government fiscal spending and deficits, and even the monetary policies of major global economies like Japan and Europe. These additional layers of analysis can provide invaluable insights for those willing to undertake the deeper research.

Crafting Your Own Investment Edge: DYOR and Risk Management

Ultimately, investment preferences and analytical approaches are diverse. Some favor macro-level analysis, others leverage on-chain data, some integrate news sentiment, while many seek opportunities directly from technical chart patterns. There is no inherently “good” or “bad” method. The key is to cultivate a personal, robust strategy that aligns with your style. Engage in diligent “Do Your Own Research” (DYOR), understand probabilities, and integrate sound risk management (position sizing) into your decision-making. This disciplined approach is what truly enhances your probability of success.

The Elusive Nature of “Time” in Trading

Finally, let’s address the often-misunderstood concept of “timeframes” in trading – terms like “short-term,” “medium-term,” and “long-term” frequently appear in market commentary. What do these terms actually mean?

For me, primarily a Position Trader, “short-term” typically spans 1-3 months, “medium-term” 3-6 months, and “long-term” implies holding an asset for several years. However, these definitions are highly subjective:

- A Day Trader might consider “short-term” to be minutes or hours, “medium-term” a few days, and anything over a week as “long-term.”

- A Swing Trader’s “short-term” could range from days to weeks, “medium-term” from weeks to a few months, and “long-term” anything beyond six months.

- For institutional investors, “short-term” might mean 1-2 years, and “long-term” could extend to many years, even decades. Warren Buffett’s decade-plus holding of Apple stock exemplifies an institutional “long-term” perspective.

This variability highlights a crucial point: simply reading a blogger’s “short-term” prediction for Bitcoin and immediately acting upon it can lead to frustration if the market moves differently within your own perceived timeframe. The correct approach involves two steps: First, understand your own trading style and preferred timeframe. Second, when consuming content from others, ascertain their trading style and the timeframes they operate within. This alignment ensures more meaningful learning and communication, preventing misinterpretations and managing expectations effectively.

This concludes our discussion for today. All images and data sources referenced in the main text have been compiled and backed up in the “Hua Li Hua Wai Notion Communication Group Edition.” Please note that the content provided herein reflects personal views and analysis, intended solely for educational and informational exchange, and does not constitute investment advice.

(The above content is an excerpt and reproduction authorized by partner PANews, Original Link | Source: Hua Li Hua Wai)

Disclaimer: This article is for market information purposes only. All content and views are for reference only, do not constitute investment advice, and do not represent BlockTempo’s views and positions. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses resulting from investor transactions.