Navigating Uncertainty: Fed’s Policy Pivot and the High-Stakes Trump-Xi Summit

Global financial markets are abuzz following a pivotal week marked by significant policy shifts and crucial geopolitical negotiations. Yesterday evening, the Federal Reserve delivered an anticipated quarter-point interest rate cut (0.25%). However, the more impactful revelation was the concurrent announcement: the Fed will cease its balance sheet reduction, or quantitative tightening (QT), starting in December. This signals a major strategic reorientation, indicative of a cooling U.S. economy and the Fed’s proactive stance to preempt future economic headwinds. While the rate cut itself had little immediate market impact—largely priced in since early October—the cryptocurrency market exhibited its characteristic volatility.

Bitcoin’s Rollercoaster: Reacting to Macroeconomic Cues

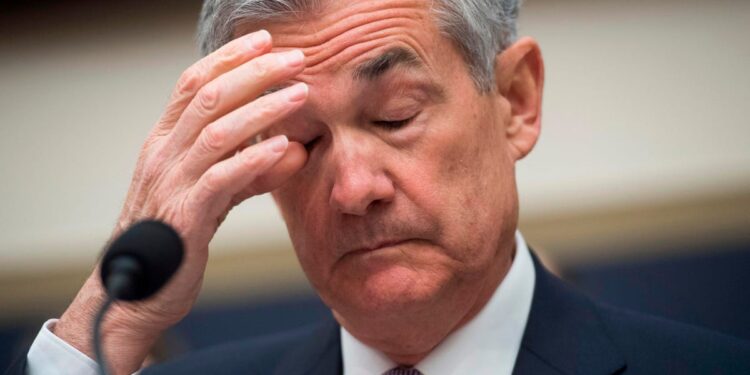

Prior to the Fed’s interest rate decision, Bitcoin experienced a notable downturn, briefly dipping below the $112,000 mark. This sharp decline, occurring around 10 AM as U.S. equity markets opened, is often characteristic of liquidation events. Given that the rate cut was widely expected, its announcement offered little upward momentum for the digital asset. Further market jitters ensued after Federal Reserve Chair Jerome Powell expressed concerns regarding inflation and employment, triggering a pullback across both U.S. stocks and the broader crypto market, with Bitcoin briefly touching below $110,000.

The Geopolitical Wildcard: Trump-Xi Summit Takes Center Stage

Today, the financial world’s gaze shifts to Seoul, South Korea, where President Trump and President Xi Jinping are scheduled to meet at 11 AM. This high-stakes summit is poised to address critical tariff and trade disputes between the two economic superpowers. Market participants are cautiously optimistic, hoping for an agreement that could de-escalate trade tensions, improve bilateral relations, and alleviate domestic economic pressures in both nations.

Indeed, the outcome of the Trump-Xi meeting is arguably more consequential than the Fed’s recent rate adjustment. While a positive resolution is widely hoped for, significant uncertainties loom. China’s often opaque negotiating stance and President Trump’s notoriously unpredictable demeanor inject considerable unpredictability into the market. Furthermore, true clarity might only emerge once President Trump returns home and offers his definitive remarks, leaving market trends ambiguous in the interim.

A critical question for investors is whether a positive outcome, if achieved, has already been fully “priced in” by the market, potentially leading to a “buy the rumor, sell the news” scenario. The coming weekend will likely reveal the true market reaction to these crucial developments.

Disclaimer: This article is intended solely for market information purposes. All content and views are for reference only and do not constitute investment advice, nor do they represent the views and positions of Blockcast. Investors should exercise their own judgment and make independent trading decisions. The author and Blockcast disclaim all responsibility for any direct or indirect losses incurred by investors’ transactions.