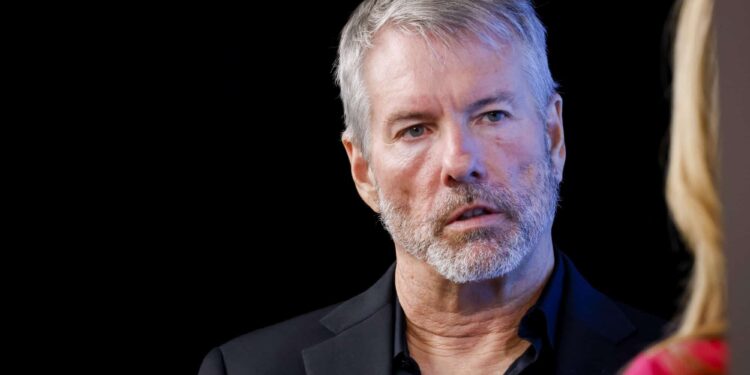

Michael Saylor: Bitcoin on Track for $150,000 This Year, $20 Million in Two Decades

Bitcoin maximalist and MicroStrategy founder Michael Saylor has issued a bold forecast, predicting Bitcoin could surge to an astounding $150,000 by the end of this year. Looking further ahead, Saylor believes the flagship cryptocurrency could reach an astonishing $20 million within the next two decades, driven by the widespread adoption from Wall Street, tech giants, and major banking institutions.

Institutional Embrace Fuels Short-Term Surge

Saylor, whose company MicroStrategy famously holds a staggering 640,808 Bitcoins—valued at approximately $71.4 billion—shared his insights in a recent interview with CNBC. He highlighted a significant shift in Bitcoin’s market dynamics, noting that its volatility is “gradually fading” as the ecosystem matures with the introduction of novel derivatives and sophisticated hedging tools.

“I believe Bitcoin’s price will continue to slowly but surely climb,” Saylor asserted, attributing this newfound stability to the robust institutional-grade infrastructure now taming Bitcoin’s historically wild price swings.

Long-Term Vision: $1 Million and Beyond

When pressed on specific price targets, Saylor pointed to a growing consensus among financial analysts that “Bitcoin reaching $150,000 by year-end” is becoming a widely accepted projection. He further expressed confidence, stating he “can’t think of any reason” that would prevent Bitcoin from steadily ascending to $1 million within the next four to eight years.

Saylor then unveiled his most ambitious long-term prediction: “My long-term forecast is – assuming an average annual increase of 30%, Bitcoin reaching $20 million in 20 years, this is actually not far-fetched.” This projection underscores his unwavering belief in Bitcoin’s exponential growth potential.

A New Era of Institutional Acceptance

Saylor’s optimistic pronouncements arrive amidst a palpable resurgence of bullish sentiment in the cryptocurrency market. This renewed enthusiasm is fueled by consistent capital inflows into Bitcoin spot ETFs, increasing accumulation by sovereign wealth funds, and a growing tide of institutional adoption. He emphasized a pivotal shift in the financial landscape:

“I think the most exciting thing is that 12 months ago, you couldn’t use Bitcoin, or package Bitcoin as collateral, to get a loan from any major US bank.”

“But now, you see – Bank of America, JPMorgan, Wells Fargo, and BNY Mellon – all starting to embrace this type of asset.”

This mainstream embrace by some of the world’s most influential financial institutions signals a profound transformation in how traditional finance views and integrates digital assets, laying a solid foundation for Bitcoin’s projected ascent.

Disclaimer: This article is intended for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views and positions of the publisher. Investors should make their own decisions and trades. The author and publisher will not bear any responsibility for direct or indirect losses resulting from investor transactions.