Bitcoin’s Unexpected Plunge: Unpacking the Market’s Counter-Intuitive Reaction to Bullish News

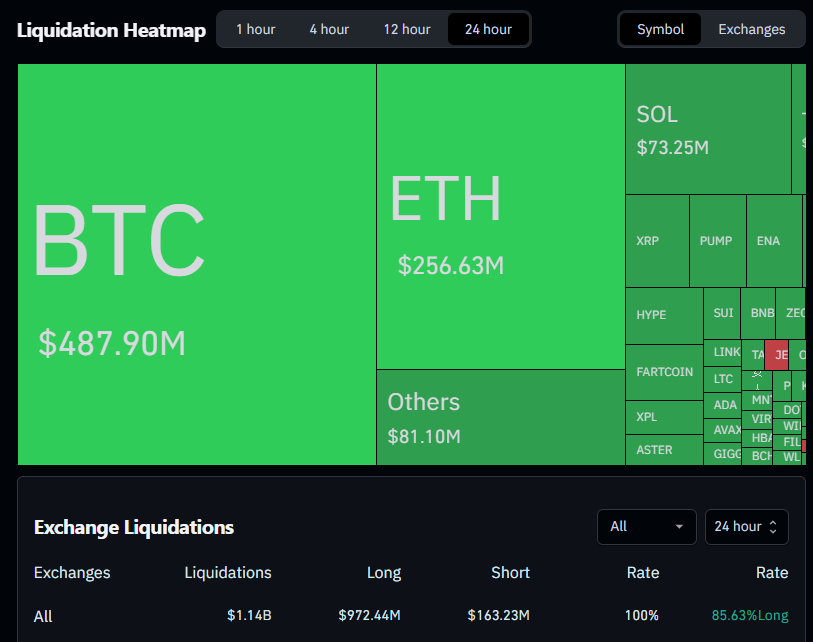

Yesterday promised a wave of positive catalysts for the global financial markets: the Federal Reserve cut interest rates, announced an end to quantitative tightening by December, and a significant US-China trade agreement was reached, signaling a year-long truce in trade hostilities. Yet, the cryptocurrency market, in particular, appeared to largely disregard these developments. Bitcoin experienced an initial dip following the Trump-Xi meeting, followed by a further decline during the opening of the US stock market, ultimately breaching the crucial $11,000 support level. Over the past 24 hours, the crypto market witnessed nearly $1.1 billion in liquidations, with a staggering $900 million originating from long positions. This suggests that many traders, anticipating a rebound from the seemingly successful US-China talks, were caught off guard by the sharp correction that ensued.

While a definitive consensus on the precise cause of this counter-intuitive market reaction remains elusive, a prevailing sentiment points to the classic “buy the rumor, sell the news” phenomenon. With all major positive news events now realized, the market lacked fresh catalysts to sustain upward momentum. Further dampening bullish sentiment were hawkish remarks from Federal Reserve Chair Jerome Powell, who, in a speech early yesterday, suggested it was premature to discuss a December rate cut. This recalibration of expectations naturally fostered a risk-off environment. Despite the persistent market downturn, a considerable number of traders continued to maintain long positions. This bullish bias, potentially influenced by prominent figures or “insiders” reportedly long on BTC, ETH, and SOL, inadvertently transformed these leveraged bets into “fuel” for the cascading liquidations, exacerbating the market’s decline.

In the wake of the Fed’s actions and the US-China trade talks, the market now grapples with a palpable lack of clear direction. Lingering concerns persist regarding potential reversals from China or sudden policy shifts from the Trump administration. Any resurgence of trade tensions would undoubtedly destabilize an already delicate market, potentially triggering another significant downturn. As previously highlighted, a sustained breach below the critical $11,000 Bitcoin price level could usher in a prolonged consolidation phase or even a more substantial correction. Therefore, if Bitcoin fails to reclaim the $11,000 threshold by the weekend, investors should exercise heightened caution and prepare for increased market volatility in the coming days.

Disclaimer: This article is for market information purposes only. All content and views are for reference only, do not constitute investment advice, and do not represent the views and positions of BlockBeats. Investors should make their own decisions and trades. The author and BlockBeats will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.