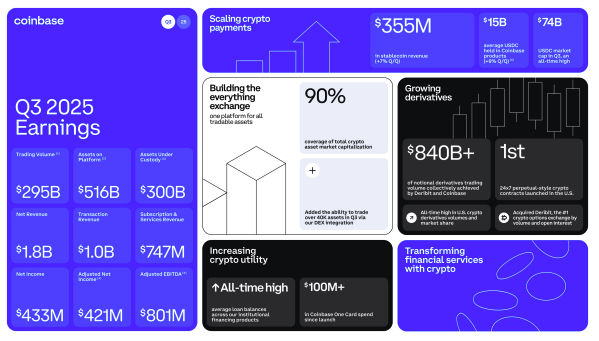

Coinbase (NASDAQ: COIN), a leading cryptocurrency exchange, has unveiled its robust third-quarter earnings report, significantly surpassing market expectations. The impressive performance was fueled by a surge in trading activity, a notable rebound in crypto asset prices, and consistent growth across its subscription and services offerings. The company reported a substantial 58% year-over-year increase in quarterly revenue, reaching $1.9 billion, comfortably exceeding FactSet analysts’ consensus estimate of $1.8 billion.

Following the announcement, Coinbase’s stock briefly climbed approximately 1.5% in after-hours trading. However, the company prudently cautioned investors about the inherent volatility of the cryptocurrency market, advising against extrapolating current performance to predict future outcomes. Looking ahead, Coinbase projected October’s trading revenue to be around $385 million, with Q4 subscription and services revenue anticipated to fall between $710 million and $790 million.

Trading Revenue Surges Past $1 Billion as Retail Investors Re-Engage

As the cornerstone of Coinbase’s operations, trading revenue in Q3 soared to $1 billion, a remarkable increase from $573 million in the prior year’s corresponding quarter. Total trading volume for Q3 climbed to $295 billion, signaling a significant resurgence of market interest. Notably, retail trading volume witnessed a 37% quarter-over-quarter expansion, emerging as the primary catalyst behind the revenue surge.

Coinbase’s adjusted EBITDA for Q3 stood at an impressive $801 million, up from $449 million a year ago, underscoring a healthier earnings structure and enhanced cost management capabilities. Operating expenses saw a 9% quarter-over-quarter reduction, contributing to a solid net profit of $433 million.

Simultaneous Growth in Institutional and Retail Trading, Deribit Acquisition Proves Strategic

Coinbase highlighted growth across both its institutional and retail trading segments. Institutional trading revenue more than doubled to $135 million. A significant portion of this growth, approximately $52 million in quarterly revenue, was attributed to Deribit, the crypto options platform acquired in August, demonstrating the strategic success of the integration.

Concurrently, retail trading revenue also saw a healthy increase to $844 million, marking a 30% rise from the previous quarter. This was largely driven by heightened activity in small and medium-sized tokens and the continuous expansion of its advanced trader community.

In its shareholder letter, Coinbase articulated: “Q3 was a strong quarter for the company, as we delivered solid financial results, continued to ship innovative products, and laid the groundwork for our vision of an ‘exchange of everything.'”

Subscription and Services Revenue Remains Robust, USDC Holdings Reach Record High

Beyond its core trading activities, Coinbase’s subscription and services revenue experienced a 14% quarter-over-quarter increase, reaching $747 million in Q3. Stablecoin-related revenue contributed $355 million to this figure, predominantly stemming from the platform’s average USDC holdings achieving an all-time high, exceeding $15 billion.

Blockchain rewards revenue also demonstrated substantial growth, climbing 28% quarter-over-quarter to $185 million. This was primarily a result of on-chain earnings boosted by the price resurgence of Ethereum (ETH) and Solana (SOL).

Base Network Achieves Profitability, Emerging as a New Growth Engine for Coinbase

A significant highlight from the earnings report is Coinbase’s announcement that its Layer 2 scaling network, Base, achieved profitability in Q3. The network’s revenue grew in tandem with increased transaction volume and rising Ethereum prices. Despite a reduction in per-transaction fees partially offsetting some gains, Base successfully turned a profit overall.

Coinbase underscored Base’s distinct advantages of “high speed and low cost,” positioning it as a “trusted preferred network” for developers and enterprises building decentralized applications.

By the end of Q3, Coinbase’s U.S. dollar assets totaled $11.9 billion, primarily bolstered by $3 billion in convertible debt financing and a steadily expanding operational cash flow.

Coinbase Bolsters Digital Asset Reserves with Significant Q3 Purchases of Bitcoin and Ethereum

Further demonstrating its confidence in the digital asset market, Forbes reported that Coinbase augmented its Bitcoin holdings by $299 million through weekly purchases in Q3, now possessing 14,548 Bitcoins. As of September 30, the fair market value of crypto assets held by Coinbase for investment purposes reached $2.6 billion, with $1.6 billion allocated to Bitcoin and an additional $1 billion held in various crypto assets as collateral.

Coinbase CEO Brian Armstrong subsequently confirmed the company’s Q3 accumulation of 2,772 Bitcoins. Jesse Pollak, co-founder of Base, further disclosed that Coinbase also added 11,933 Ethereum to its reserves during Q3, with plans to continue increasing these holdings.

Disclaimer: This article is intended solely for providing market information. All content and views are for reference only and do not constitute investment advice. They do not represent the opinions or positions of BlockTempo. Investors should make their own decisions and conduct their own trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses incurred by investors’ trading activities.