MegaETH: The Real-Time Blockchain Disruptor Captivating the Crypto World

By oxStill

While the Layer 2 (L2) landscape is fiercely competitive, with projects vying for Total Value Locked (TVL), one innovative project has quietly achieved an astounding 100,000 transactions per second (TPS). This groundbreaking contender, MegaETH, has even garnered implicit support from Ethereum co-founder Vitalik Buterin, positioning itself as the “first real-time blockchain.”

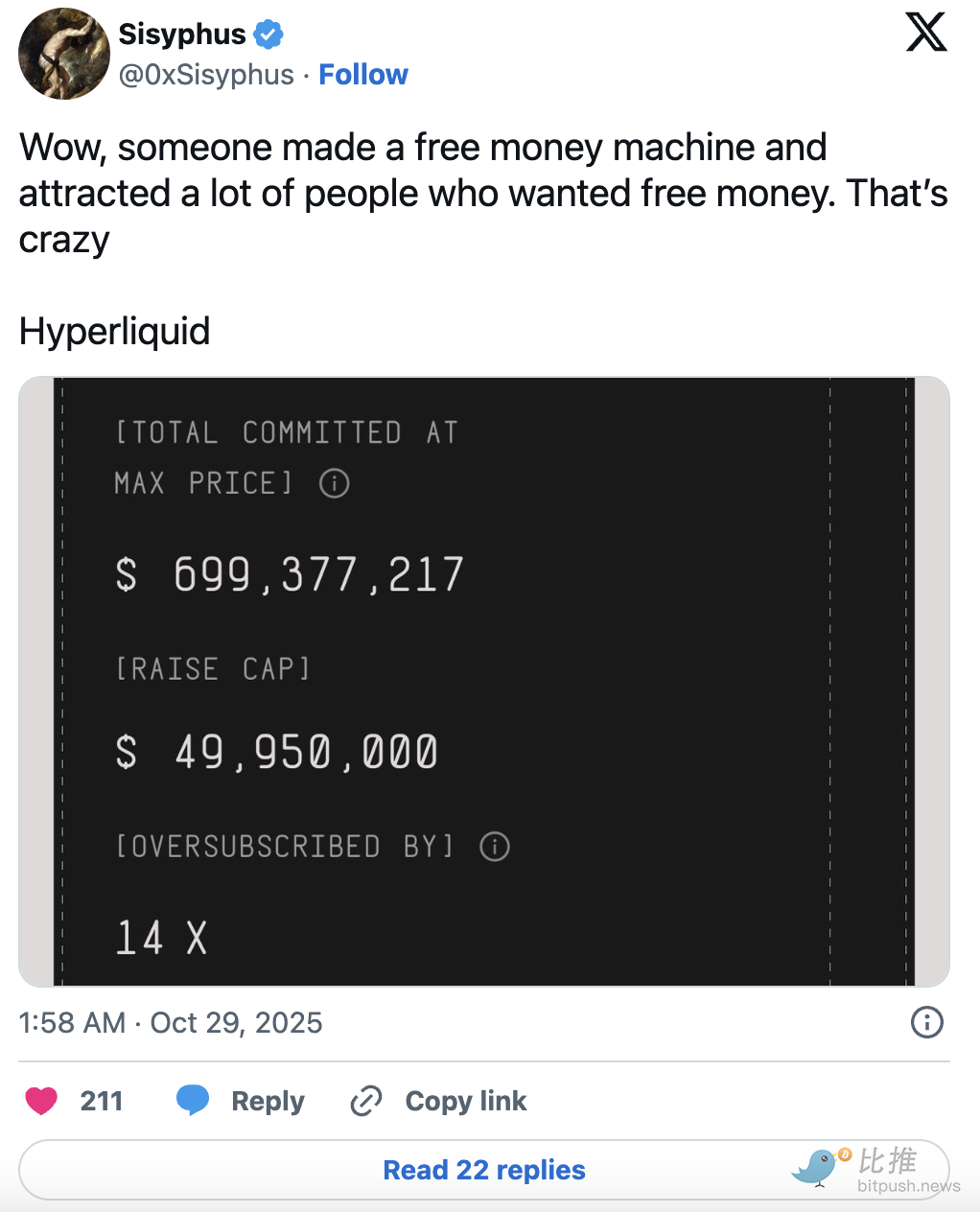

The recent MegaETH public sale has officially concluded, drawing immense attention and participation. Over 50,000 individuals participated, contributing a staggering $1.39 billion in subscriptions, leading to an oversubscription rate of 27.8 times. The market has unequivocally cast its vote with capital, but what do leading professional analysts have to say about this emerging powerhouse?

Unpacking the MegaETH Public Sale: A Fair and Overwhelming Success

According to 0xResearch analysts Boccaccio & Marc Arjoon, securing an allocation above the minimum threshold for MegaETH “could be one of the best opportunities this year.”

The public sale utilized an English auction format, commencing on October 27th at 9 AM ET and running for 72 hours. This mechanism departed from traditional token sales by fostering competitive bidding to establish a fair market price. The system operated by identifying a “clearing price”—the lowest bid at which the entire allocation of 500 million tokens could be filled.

A key feature of this auction was its equitable nature: all successful bidders, regardless of their individual bid amount, paid the same final clearing price. This meant that even if a participant bid the maximum of $0.0999 per token, they would only pay the lower clearing price if determined by the market. Bids below the clearing price were fully refunded, while those at or above received their allocation. This design effectively mitigated common issues like gas fee wars and first-come, first-served disadvantages, ensuring a significantly fairer distribution.

The sale offered 500 million MEGA tokens, representing 5% of the total 10 billion token supply. Conducted entirely on the Ethereum mainnet with USDT as the payment method, the auction’s price range spanned from $0.0001 (implying a Fully Diluted Valuation, FDV, of $1 million) to $0.0999 (representing an FDV of $999 million). Individual participants could bid between $2,650 and $186,282, with increments of $0.0001.

Notably, the structure included a mandatory one-year lock-up period for US qualified investors, offering a 10% discount. Non-US participants had the option to elect the same lock-up terms for the discount. The post-auction timeline included an allocation calculation period (Oct 30 – Nov 5), refund and withdrawal period (Nov 5 – Nov 19), and final allocation/reallocation (Nov 19 – Nov 21).

The overwhelming demand was anticipated. As 0xResearch highlighted, “As the final day approaches, this number is likely to only increase further, with most deposits/bids pouring in during the last few hours. After all, if someone gives you a free money-making machine, the only correct action is to deposit as much capital as possible.”

Expert Insights: Valuation, Opportunity, and Evolving Dynamics

MegaETH’s pre-market trading on Hyperliquid already reflects an FDV of $4.5 billion, offering early depositors a potential 4.5x gain. However, the allocation process factored in elements beyond just bid size, including past wallet interactions, social media influence, and new “community credit” platforms like Ethos. This has led to a surge in Sybil activity, as participants sought to maximize their chances of securing coveted allocations.

0xResearch, having discussed MegaETH extensively on their podcast, maintains an optimistic outlook on the chain. They commend the team’s distinctive approach to ecosystem building, exemplified by initiatives like MegaMafia, and its focus on developing unique applications rather than merely forking existing DeFi protocols like Uniswap or Aave, a common trend among many L2s.

Their analysis yielded two crucial takeaways regarding the current crypto landscape:

- The emergence of chains explicitly prioritizing revenue generation versus those focusing on other narratives (e.g., decentralization). The superior long-term returns between these approaches remain to be seen.

- The shift in significant returns from traditional whitelists and Discord roles (which were susceptible to Sybil attacks and secondary markets) to newer private public markets and pre-deposit mechanisms like Echo and Sonar, which themselves are now experiencing similar Sybil challenges and account trading.

Kunal G’s Financial Model: A Multi-Billion Dollar Opportunity

Kunal G (@kunalgoel), a former Messari executive, has articulated a profoundly bullish perspective on MegaETH. He asserts, “The scale of MegaETH is astonishing; every data calculation upends all intuitive expectations. While the market views it as another ordinary L2, my models show that its actual opportunity far exceeds imagination.”

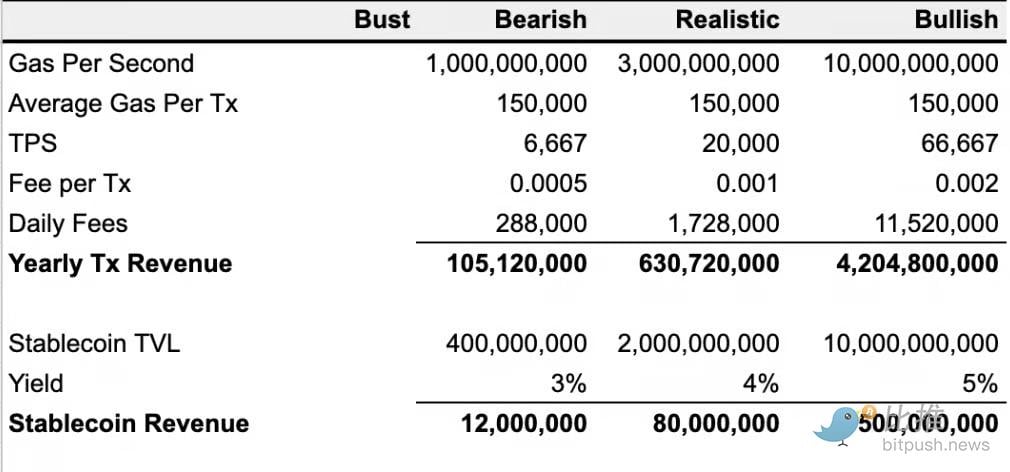

Kunal G developed a four-scenario model to project MegaETH’s potential:

- Optimistic Scenario: MegaETH achieves its advertised performance of 10 Gigagas per second, equivalent to 66,667 typical transactions.

- Realistic Scenario: Actual scale reaches one-third of expectations, translating to 3 Gigagas per second or 20,000 transactions.

- Pessimistic Scenario: Scale is only 10% of advertised, at 1 Gigagas per second or 6,667 transactions.

- Failure Scenario: The project entirely fails, with its FDV locked at $200 million.

Even under the **Pessimistic Scenario**, assuming a conservative transaction fee as low as $0.0005 (lower than most L1s and L2s), MegaETH could generate $288,000 in daily revenue from transaction fees alone, annualizing over $100 million.

The revenue potential escalates dramatically with scale:

- In the **Realistic Scenario**, annual revenue could reach $600 million.

- Under the **Optimistic Scenario**, with a slight increase in transaction fees to $0.001-$0.002, annual revenue could skyrocket to an astounding $4.2 billion.

Beyond transaction fees, MegaETH’s native stablecoin, MegaUSD, is poised to generate substantial additional revenue through protocol yields. Depending on its Total Value Locked (TVL), this component could contribute eight to nine-figure annual revenues. Furthermore, the project plans to internalize Maximal Extractable Value (MEV) revenue through sequencer rights and cabinet hosting services. A “stake-to-access” model is also set to positively impact the ecosystem by reducing circulating supply and boosting delegated staking yields.

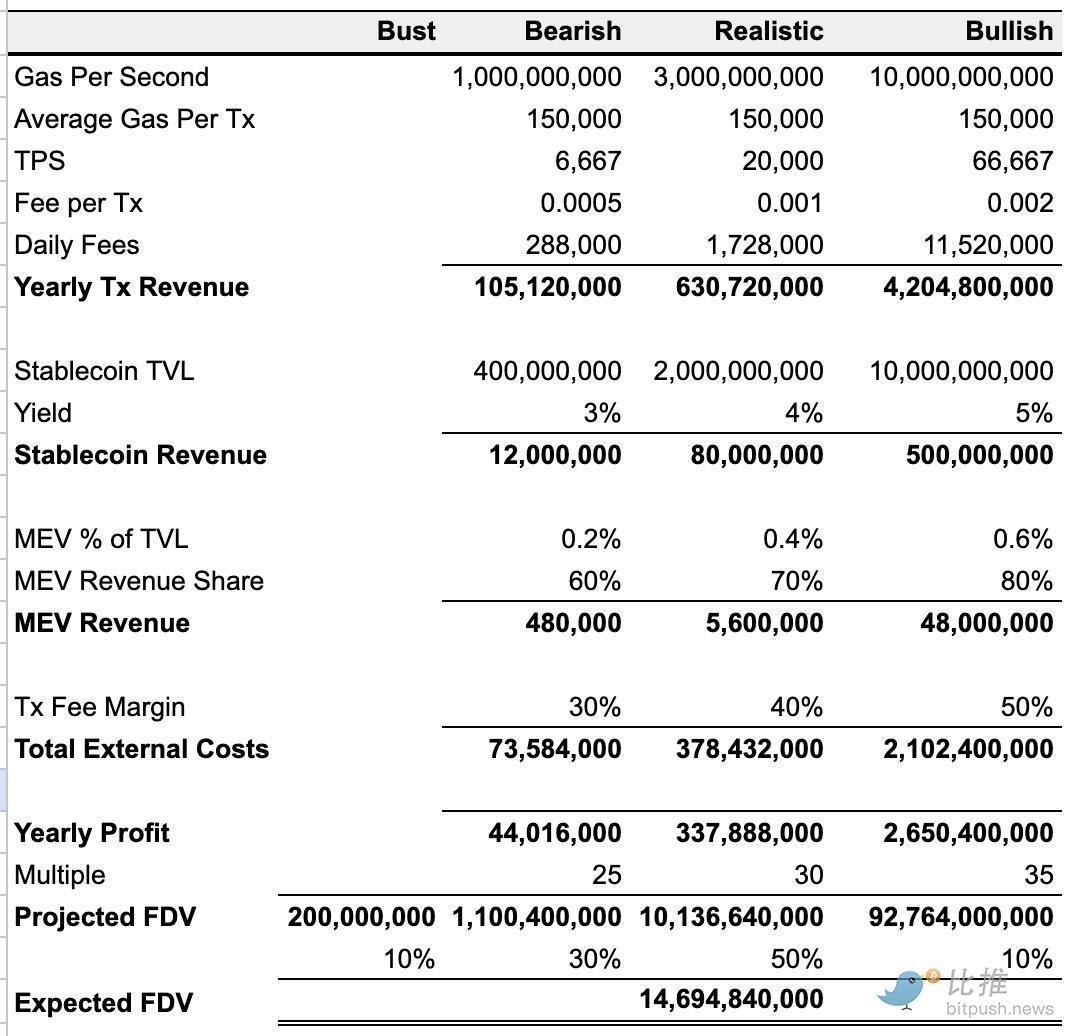

Kunal G’s model conservatively accounts for 50-70% of transaction revenue being allocated to essential infrastructure costs, including the data availability layer (DA), sequencers, proofs, and oracles. Despite the demanding operational requirements, he notes that costs scale proportionally with throughput, lending clarity to the financial projections.

His baseline scenario forecasts annual profits exceeding $300 million. Applying a 30x Price-to-Earnings (P/E) ratio to this figure suggests an FDV of approximately $10 billion.

By integrating the probabilities of all modeled scenarios, the weighted expected FDV for MegaETH is estimated to be between $14 billion and $15 billion. This projection represents a potential gain of over 3 times the current price on Hyperliquid perpetual contracts and an impressive more than 14 times the ICO price.

Key Risks and the Path Forward

Despite the immense potential, Kunal G highlights two primary risks: the execution efficiency of the mainnet launch and the quality of ecosystem applications. The former is particularly critical, given the unprecedented scale MegaETH aims to achieve; successful execution would truly position them as pioneers. Regarding ecosystem applications, the initial roster appears robust, featuring a healthy blend of both nascent and established projects, suggesting a promising start.

(The above content is excerpted and reproduced with permission from partner PANews, original link | Source: Bitpush)

Disclaimer: This article is for market information purposes only. All content and opinions are for reference only and do not constitute investment advice. They do not represent the views and positions of BlockBeats. Investors should make their own decisions and trades. The author and BlockBeats will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.