By Seed.eth

The concept of “on-chain US stocks” is far from new, yet amidst a prolonged crypto market downturn and a lack of clear direction for major cryptocurrencies, this sector has unexpectedly emerged as a vibrant trading frontier.

For the past year, numerous projects have attempted to bridge US stock indices, Treasury yields, and even individual equities onto the blockchain. However, most of these initiatives remained in the realm of “shadow assets.” They were often plagued by excessive reliance on oracle price feeds, insufficient trading depth, or significant price discrepancies compared to traditional markets, preventing them from truly becoming “substitutable markets.”

A significant shift appears to be underway with Hyperliquid’s HIP-3 upgrade. This pivotal technical enhancement enables the permissionless creation of native on-chain order book perpetual markets. This innovation largely moves beyond the previous dependence on synthetic assets or oracle-driven models for traditional asset trading on-chain, paving the way for independent, self-price-discovering markets directly on the blockchain.

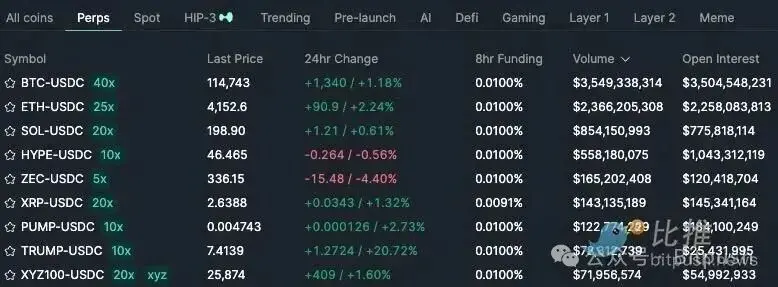

A prime example is TradeXYZ’s XYZ100. Since its inception, its trading volume has soared, consistently achieving daily turnovers in the tens of millions of dollars. Its open interest (OI) ceiling has steadily increased from an initial $25 million to an impressive $60 million, underscoring its rapid adoption and market confidence.

Unveiling TradeXYZ: Bridging Traditional Finance and Decentralized Trading

As an indigenous protocol nurtured within the Unit ecosystem on Hyperliquid, TradeXYZ is pioneering the tokenization of Real-World Assets (RWAs), such as US stocks and indices, for seamless integration into on-chain trading environments. The protocol supports both spot and perpetual contract trading, leveraging Unit Protocol for efficient spot asset liquidity and settlement. Users benefit from the simplicity of USDC for deposits, withdrawals, and transactions. At its core, TradeXYZ offers equity-based perpetual contracts, meticulously engineered on the HIP-3 standard, designed to forge a robust connection between traditional financial markets and the decentralized trading experience.

XYZ100: A New Benchmark for On-Chain Equities

The flagship XYZ100 product operates on a fully on-chain Central Limit Order Book (CLOB) model, offering traders up to 20x leverage and uninterrupted 24/7 access. Price integrity is maintained by anchoring to the CME (Chicago Mercantile Exchange) Nasdaq futures oracle. During off-market hours, an 8-hour Exponential Moving Average (EMA) is applied to smooth price movements, mitigating extreme volatility.

HIP-3’s official activation around October 13, 2025, coincided almost perfectly with TradeXYZ’s launch of XYZ100. Initially, alpha access was granted exclusively to the first 100 whitelisted users who had accumulated over $5 million in trading volume on Hyperliquid. This strategic rollout quickly bore fruit: within a mere two days, XYZ100’s trading volume surged past $63 million, with Open Interest (OI) hitting $15 million—significantly outperforming other RWA perpetual contract DEXs.

Why the Exodus? Crypto Traders Pivot to US Equities

The shift in trader sentiment is palpable. The “high volatility, low certainty” often associated with cryptocurrencies is increasingly being overshadowed by the “stable growth” narrative of US equities. While Bitcoin shows signs of institutional accumulation, the “leverage collapse” on October 11 served as a stark reminder of crypto’s inherent risks, leaving many retail investors cautious.

Conversely, the US stock market is currently experiencing a remarkable bull run, with the S&P 500, Dow Jones, and Nasdaq indices achieving consecutive historical highs this week. On-chain trading platforms capitalize on unique advantages to attract a global investor base: 24/7 uninterrupted trading, no KYC verification, and up to 20x leverage empower users across diverse time zones—from Asia to Europe—to manage their positions around the clock, free from the constraints of traditional market T+1 settlement cycles and weekend closures.

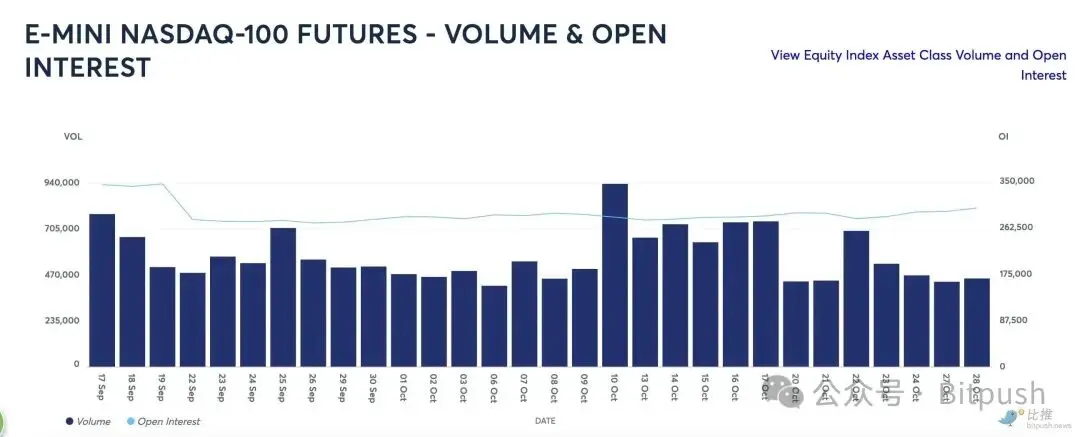

Despite this burgeoning interest, it’s crucial to acknowledge the scale disparity. The daily trading volume of traditional Nasdaq E-mini futures on the CME still commands hundreds of billions of dollars, making the current on-chain asset volume a mere fraction by comparison. This highlights the immense growth potential, yet also the nascent stage of the on-chain RWA market.

The Intensifying Race for On-Chain US Equities

As the on-chain US stock phenomenon gains momentum, the entire ecosystem is undergoing rapid evolution, with multiple protocols strategically entering the market from diverse angles:

- xStocks (Solana & BNB Chain): This protocol, through its alliance ecosystem, facilitates spot trading for over 80 US stocks and ETFs. A standout feature allows users to directly collateralize and borrow against tokenized assets like Apple or Tesla shares. Boasting a cumulative trading volume exceeding $2 billion—representing 58.4% of tokenized stock trading volume in 2025—and over 30,000 daily active users, xStocks is actively capturing market share from traditional retail platforms like Robinhood.

- Derive.xyz: Targeting advanced traders, Derive.xyz specializes in multi-chain options and perpetual contracts, encompassing Bitcoin, Ethereum, and select RWA indices. It distinguishes itself with institutional-grade tools and real-time oracle feeds. Despite higher fees and a steeper learning curve, its total trading volume has reached an impressive $18.6 billion, with its RWA perpetual sub-market consistently maintaining an average monthly trading volume of $500 million.

- Kraken xStocks: Benefiting from the robust backing of the Kraken exchange, this platform has secured preliminary SEC approval and is strategically migrating to Layer 2 networks like Arbitrum to enhance composability. It has achieved a cumulative trading volume exceeding $5 billion, with over 37,000 unique holders across more than 60 assets. However, its model, which is not fully on-chain custodial, still presents inherent centralization risks.

- Vest Markets: Taking an innovative approach, Vest Markets focuses on mitigating slippage issues during weekend trading through its Request for Quote (RFQ) fulfillment mechanism. It has recorded a 24-hour trading volume of $34.05 million. While its blockchain audit and LP incentive models are noteworthy innovations, the platform’s market depth currently remains a challenge.

- Ostium (Arbitrum): Ostium delivers a fully on-chain experience for synthetic RWA perpetual contracts. Beyond US equities, it has expanded its offerings to include major commodities like crude oil and gold. The protocol has witnessed remarkable growth, with its Total Value Locked (TVL) increasing by over 150% and Q1 perpetual contract trading volume reaching $2.36 billion, making it a crucial option for entry-level users seeking zero-KYC access.

Navigating the Landscape: Risks and Challenges Ahead

Despite the exhilarating growth, the burgeoning on-chain US equities sector is not without its controversies and inherent challenges.

- Market Depth and Model Suitability: Kaledora, co-founder of Ostium Labs, raises a pertinent point: the on-chain order book model, designed to reconstruct market depth, may be more apt for crypto-native assets than for traditional financial instruments. Traditional assets, by nature, possess a more stable, centralized, and profoundly deeper liquidity structure. Kaledora posits that a superior approach might be an “on-chain brokerage model,” which would directly reference price depth from TradFi markets via on-chain channels, rather than attempting to establish a competing order book on-chain that vies with giants like the CME.

- Oracle and Manipulation Risk: A critical vulnerability lies in the reliance on oracles and the potential for manipulation. During non-trading hours for traditional markets, on-chain prices depend on algorithms for smoothing trends, a mechanism that is not infallible. A prior incident involving PAXG gold contracts saw millions of dollars in positions liquidated due to abnormal price fluctuations. This serves as a stark warning for all RWA products: the risk of price deviation is very real when traditional markets are closed, yet on-chain trading continues unabated.

- Regulatory Uncertainty: The specter of regulatory uncertainty looms large. The US Securities and Exchange Commission (SEC) is actively scrutinizing the compliance of these on-chain US stock products. Should they ultimately be classified as securities, existing DeFi protocols might face stringent requirements, including the need to obtain specific licenses. While many projects are proactively exploring compliance pathways, the majority currently operate within a delicate regulatory gray area.

Conclusion: Where Opportunity Lies

The crypto world, once content to revolve around its own orbit of new chains, tokens, and narratives, is now maturing. True financial power, it recognizes, lies in its ability to facilitate access to markets where global capital genuinely seeks participation.

Nasdaq, with its multi-trillion-dollar liquidity and home to the world’s most valuable companies, represents an undeniable magnet for this capital.

Ultimately, for astute participants in the crypto space, the specific battlefield is secondary to the presence of genuine opportunity. The convergence of DeFi innovation and traditional market stability presents a compelling new frontier.

Disclaimer: This article is provided for informational purposes only and does not constitute financial or investment advice. All content and views expressed are for reference and discussion, not an endorsement or recommendation. Investors should exercise caution, conduct their own due diligence, and make rational decisions based on their personal circumstances. All investment risks are borne by the investor.

(This content is an authorized excerpt and reproduction from our partner PANews. Original Article Link | Source: BitPush)

Further Disclaimer: This article is intended solely to provide market information. All content and opinions are for reference only, do not constitute investment advice, and do not represent the views or positions of BlockTempo. Investors are advised to make their own investment decisions and transactions. The author and BlockTempo shall not be held liable for any direct or indirect losses incurred by investors’ transactions.