The Great Bitcoin Wealth Transfer: From Early Adopters to Institutional Dominance

Insights from the latest Bitwise Quarterly Market Report.

In the dynamic world of cryptocurrency, a simple yet profound adage often rings true: “When in doubt, zoom out.” This sentiment perfectly encapsulates the core insight from the latest Bitwise Quarterly Market Report, which unveils a pivotal shift in the Bitcoin landscape.

The data, meticulously compiled by River, offers a clear lens into prevailing trends, providing crucial context for understanding the unique characteristics of the current Bitcoin cycle.

Unpacking the Great Wealth Transfer in Bitcoin

At the heart of this market evolution is a monumental “wealth transfer”: Bitcoin is steadily migrating from its pioneering retail investors to powerful institutional entities, including funds, Exchange-Traded Products (ETPs), corporations, and even sovereign government entities.

Unlike traditional asset classes, where institutional adoption typically precedes retail interest, Bitcoin’s journey began with grassroots enthusiasts – the cypherpunks and early adopters. Only later did the likes of family offices, professional fund managers, and ETFs begin to integrate BTC into their portfolios.

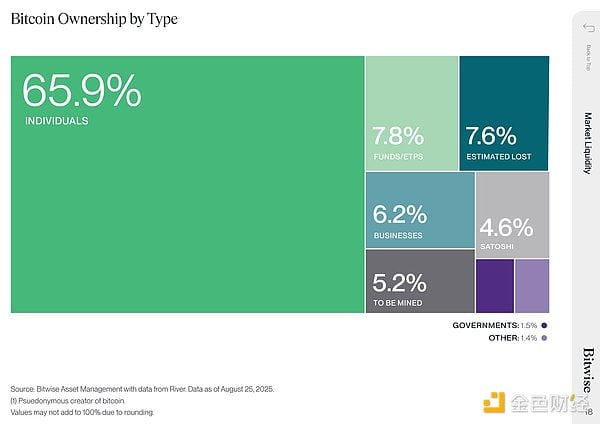

Remarkably, individual retail investors still command approximately 66% of the total Bitcoin supply, meaning the vast majority remains outside institutional hands (as illustrated in the distribution matrix above). This contrasts sharply with traditional markets, where institutional ownership often dominates. For instance, recent 13F filings reveal:

- iShares 20+ Year Treasury Bond ETF (TLT): 79% institutional ownership

- SPDR S&P 500 ETF (SPY): 58% institutional ownership

- SPDR Gold ETF (GLD): 36% institutional ownership

Further underscoring this nascent stage, a recent Bank of America Global Fund Manager Survey indicated an average allocation of just 0.4% to crypto assets (including Bitcoin and other tokens). Even prominent Bitcoin ETFs like IBIT currently show only 26% institutional ownership.

These figures strongly suggest that, as the industry frequently states, “we are still in the early innings” of institutional Bitcoin adoption. Nevertheless, the ongoing, large-scale wealth transfer from early retail holders to institutional investors is undeniable, poised to exert far-reaching and potentially transformative impacts on the asset’s future.

Bitcoin Adoption: Evolving Trends and Cycle Dynamics

1. Long-Term Trends in Bitcoin Accumulation

It’s crucial to recognize that this wealth transfer is not an overnight event but a persistent, long-term trend. The reality of Bitcoin’s supply dynamics highlights this: a significant portion of Bitcoin is illiquid, held by long-term holders. Only about 14.5% of the total supply resides on exchanges like Coinbase or Binance, offering relative liquidity, while the remainder is largely stored in illiquid, off-chain wallets.

This wealth won’t simply shift without compelling economic incentives. Many early holders have set ambitious psychological price targets—often upwards of $1 million per BTC—or specific financial goals, such as funding a home purchase, before considering a sale. With Bitcoin’s current market price hovering around $115,000, a substantial price increase will be necessary to entice these dormant tokens back into the active market via exchanges.

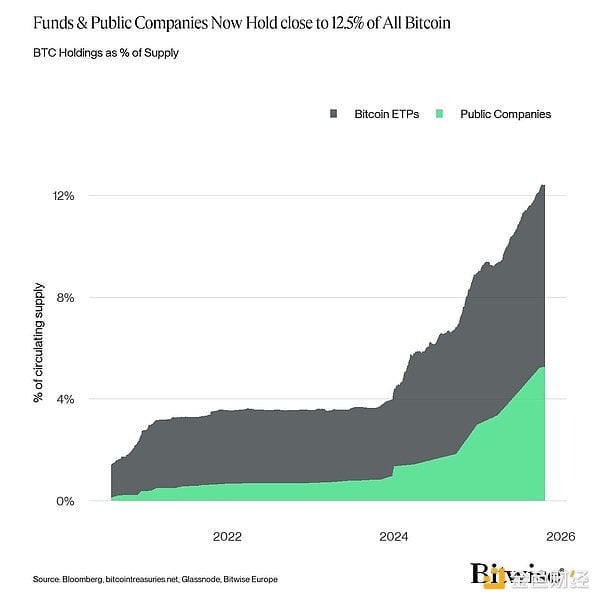

Simultaneously, the proliferation of Bitcoin ETFs is democratizing access, allowing millions of individual investors to gain exposure through trusted vehicles. Publicly traded companies are also increasingly holding Bitcoin, making it accessible to hundreds of thousands of diverse investors. As of this report, institutional investors (including ETPs and public companies) collectively control approximately 12.5% of the Bitcoin supply—a figure that continues to climb rapidly.

2. The Evolving Nature of Bitcoin’s Market Cycles

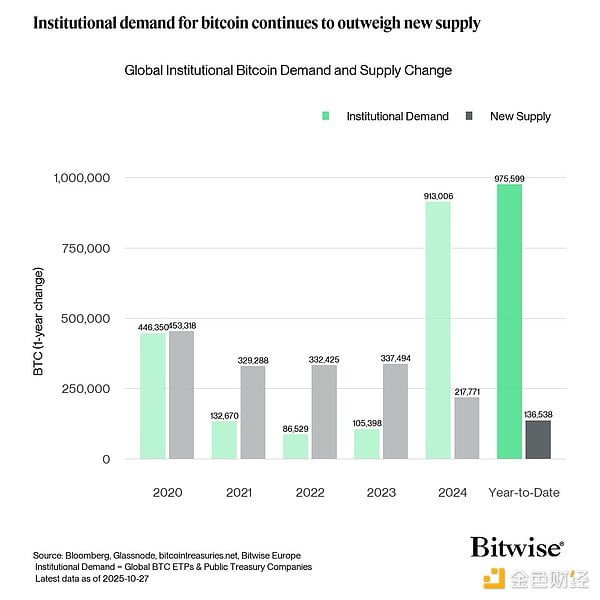

Historically, Bitcoin’s distinct bull and bear cycles have largely been attributed to its halving events, which occur approximately every four years (or every 210,000 blocks), effectively cutting the new supply of Bitcoin in half. However, the influence of these halvings is visibly diminishing with each cycle, both in absolute terms and relative to the overall circulating supply.

As institutional adoption accelerates and the structure of demand evolves, the halving effect is becoming less pronounced. Data projected for 2025, for instance, suggests that institutional demand alone could be approximately 7 times greater than the supply reduction caused by the halving event!

Concurrently, the impact of traditional macroeconomic cycles on Bitcoin’s price action is growing stronger, cementing its status as a genuine “macro asset.” Our quantitative analysis provides compelling evidence: over 80% of Bitcoin’s price volatility in the past six months has been driven by broader macro factors, such as global growth expectations and monetary policy shifts, with token-specific factors contributing less than 5%.

This increasing dominance of macroeconomic forces implies a significant paradigm shift: future Bitcoin market cycles are likely to synchronize more closely with global macro and business cycles, rendering the traditional “halving-driven” four-year cycle increasingly obsolete. Ultimately, Bitcoin’s accumulation and distribution patterns will be dictated by the prevailing macroeconomic environment—periods of expansion and prosperity versus contraction and recession—thereby influencing short-term price movements based on shifting risk appetite.

Conclusion

The “Great Wealth Transfer” signifies that Bitcoin’s price must ascend to significantly higher levels—far beyond current valuations—to effectively incentivize further widespread adoption and complete the migration from its early retail base to a broader institutional investor landscape.

The sustained influx of institutional capital underscores Bitcoin’s evolution into a true “macro asset.” This fundamental shift heralds a future where Bitcoin’s market cycles will increasingly be shaped by global macroeconomic and business trends, rather than solely by its inherent halving events.