Author: Wenser; Editor: Hao Fangzhou

Source: Odaily Planet Daily

The Crypto Conundrum: Navigating a New Era of Market Uncertainty

In the early hours of October 30th, the Federal Reserve delivered on expectations, announcing a 25-basis-point interest rate cut and confirming the cessation of its balance sheet reduction program by December 1st. Contrary to conventional wisdom, the cryptocurrency market did not rally; instead, it experienced minor fluctuations and a slight downturn. Meanwhile, the U.S. stock market surged, with Nvidia, fresh from boosting investor confidence at its GTC Fall Conference, shattering global records by surpassing a $5 trillion market capitalization. This, coupled with earlier news of the Shanghai Composite Index reclaiming the 4,000-point mark after a decade, has led some to lament: “It’s getting tough out here. Maybe it’s time to shift to U.S., Hong Kong, or A-shares.”

Observing the current market landscape, a stark reality emerges: if present trends persist, the enthusiasm for crypto trading will dwindle significantly. It is no exaggeration to state that the cryptocurrency market faces a new “industry crisis.” What distinguishes this crisis from previous ones is its dual nature, caught between internal stagnation and external pressures. Innovation within the sector is faltering, while sector-specific bubbles rotate at an accelerating pace. Large capital entities increasingly dictate the pricing of mainstream digital assets, rendering traditional retail investor strategies obsolete. The prevailing sentiment is one of fatigue among long-time participants, fostering a world where “only insiders truly profit.” This contrasts sharply with external markets—gold, Japanese and Korean equities, and the Nasdaq—which are reaching new all-time highs. The cryptocurrency market, once lauded for its wealth-generating effects and ability to attract new entrants, now struggles for relevance. Data confirms this: institutional net inflows have stalled, and the allure of DAT and ETFs has faded.

To truly overcome these challenges and thrive, the cryptocurrency market urgently requires a massive influx of capital, significantly broader attention, and enhanced liquidity.

External Headwinds: Why Traditional Assets Are Outperforming

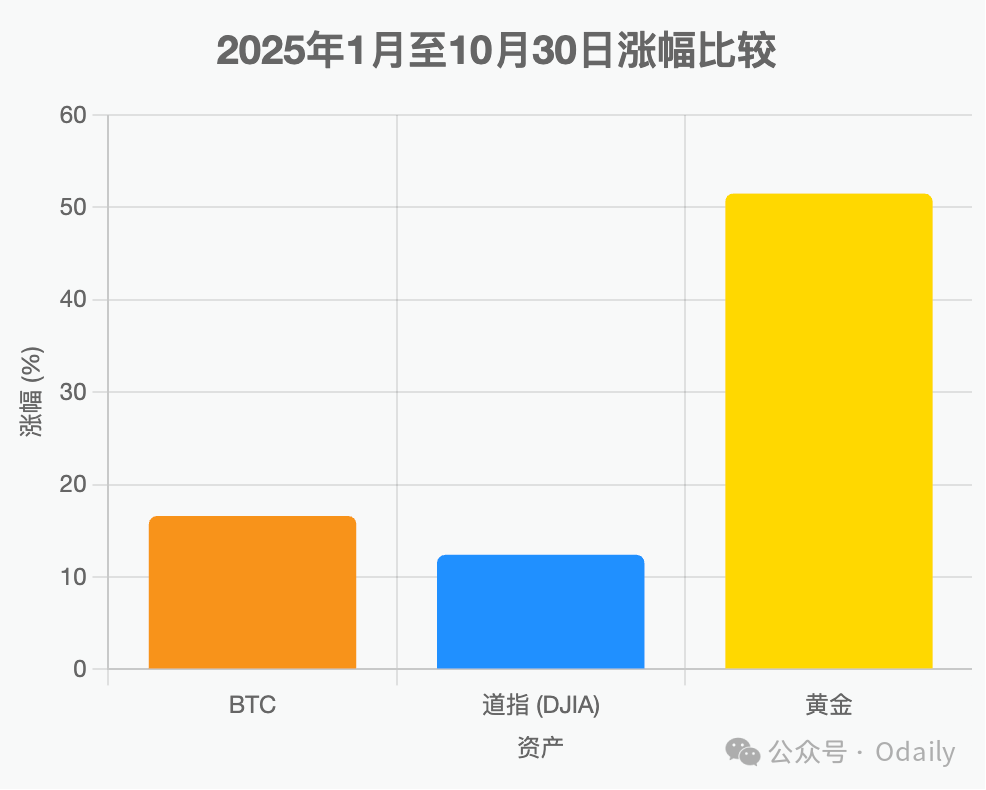

BTC’s Performance Lags Gold, Marginally Outpaces Dow

A direct comparison of asset performance reveals a telling story. While Bitcoin (BTC) has seen an approximate 17% increase year-to-date, gold boasts a far more impressive gain exceeding 50%. Although the Dow Jones Industrial Average’s growth hasn’t matched BTC’s, it recently touched a new record high of 48,000 points. In contrast, BTC has fallen from over $125,000 to approximately $111,000, illustrating its comparatively weaker performance.

Compared to the widely accepted safe-haven asset of gold, BTC’s perceived role as a hedge and its inherent high risk and volatility are increasingly questioned. When macroeconomic shifts or global regional crises emerge, BTC has not experienced the anticipated surge in demand. Instead, many now view it as another asset class within the U.S. stock market, prone to “only following downturns.”

Market Size Limitations and Liquidity Shortages

Beyond performance, the sheer scale of the cryptocurrency market presents a significant hurdle. With a total market capitalization hovering around $3-4 trillion, it remains a relatively small “slice of the pie” compared to the nearly $70 trillion U.S. stock market. After almost 17 years of development, the total crypto market cap still represents less than 10% of the U.S. equity market, and its proportion within the global economic system is even more negligible.

To put these macroeconomic figures into a more tangible perspective, consider Nvidia’s revenue projections. At its recent GTC conference, CEO Jensen Huang announced an anticipated $500 billion in GPU sales over five quarters from the Blackwell and upcoming Rubin chips. This single revenue stream from Nvidia alone already exceeds Ethereum’s (ETH) current market capitalization. Simply put, Nvidia’s annual revenue from a single business segment can surpass the total market value Ethereum has accumulated over a decade.

Focusing on retail investment data, Nasdaq individual investor trading volume reached an astounding $6.6 trillion in the first half of 2025 alone. In comparison, the liquidity within the cryptocurrency market appears as a mere puddle next to an ocean.

Stagnant Narratives: Crypto Left Behind by Mainstream Innovation

In addition to the aforementioned data and market factors, a significant challenge facing the crypto market today is its struggle with narrative fatigue.

Compared to the thriving frontier technologies, particularly in the artificial intelligence (AI) sector, many projects and their narratives within the crypto industry are falling behind. While AI companies have launched numerous models this year, including Claude Code, GPT-5, Deepseek V3.1, and Qwen3 MAX, “Crypto x AI projects” — many still in the conceptual or token stage — are far less active than they were a year ago. Market attention and investor capital have largely been diverted towards internal industry trends like DAT treasuries, treasury management, and meme coins, indicating a lack of compelling, externally relevant innovation.

Internal Challenges: Erosion of Trust and Value

The October 11th Crash: A Blow to Crypto Liquidity

The current chill in cryptocurrency trading and project development can be directly attributed to the industry-wide crash on October 11th. Verified reports indicate that this massive market downturn resulted in liquidations totaling at least $30-40 billion, effectively shrinking the overall cryptocurrency market by approximately 1% in a single day. On the Coinglass platform alone, over 1.6 million individuals faced liquidations. Countless investors, witnessing their accounts plummet to zero, have permanently exited this high-risk, rapidly evolving space.

Undoubtedly, the “October 11th Crash” exacerbated the already fragile liquidity within the crypto market, making it significantly harder for new capital to enter in the short term.

Ephemeral Trends and Fragmented Attention

The fragmented nature of market hotspots is another prominent internal concern. One day, the market might be speculating on “the intentions of the two saints” or engaging with Chinese-themed meme coins; the next, a previously hyped project like X402 is being re-promoted, garnering widespread attention. As market sentiment oscillates, simply holding stablecoins or engaging in yield farming has become the preferred choice for many.

These fleeting market trends are dizzying, scattering investor attention like confetti, making it impossible to piece together a coherent understanding of the market’s true direction.

The “Insider Game”: Trump’s Influence and Market Manipulation

Another internal challenge facing the cryptocurrency market stems from the “TACO” (Trump-esque) theatrics that have unfolded since Donald Trump’s ascent to power. From the tariff trade wars initiated in April to subsequent delays in high-tariff policies across various nations, and the shifting dynamics of US-China relations culminating in recent bilateral meetings, Trump’s modus operandi involves first issuing “harsh words” that send markets into a tremor, causing widespread declines. Subsequently, a dramatic reversal often occurs, pulling both traditional financial and crypto markets back from the brink, sometimes triggering inexplicable rallies.

The persistent volatility in the cryptocurrency market since Bitcoin’s all-time high is undeniably linked to the highly active and influential presence of Donald Trump, his family, and inner circle, who exert significant sway over market sentiment and trends.

Simply put, if you’re not part of the “insider circle,” you’re likely serving as their ATM.

The Rise of “Wealth Management Schemes”: Crypto as a “Piggy Bank”

On one hand, the exhaustion of industry narratives has led many crypto projects into intense internal competition, resulting in severe homogenization. On the other hand, an increasing number of projects are operating as “wealth management programs,” often backed by prominent investment institutions or boasting impressive backgrounds and ecosystem support, becoming rare focal points of market attention.

Events like Circle’s nearly 10x listing gain, the stablecoin issuance boom, and the lucrative Plasma (XPL) airdrop have regrettably convinced many that the only viable path is to convert liquid funds into economic returns through these schemes.

The cryptocurrency market is no longer the experimental ground for technology and innovation it once was; instead, it increasingly resembles a giant “piggy bank.” This morning’s news reported that MegaETH, a flagship project in the Ethereum ecosystem, has raised $1 billion in its public sale (exceeding its actual cap of $50 million by 20 times). In such a market, even the initial deposit quotas for top-tier projects like Stable are reportedly being filled by “rat trading” (insider pre-allocation).

Conclusion: Nurturing the Remaining Community — The Engine of the Next Bull Run

Finally, from the perspective of a resilient crypto investor, I implore all cryptocurrency projects and trading platforms to cherish the community that remains engaged. As crypto penetration grows, we, the few who have endured multiple industry trials and stayed at the table, will be the crucial providers of liquidity for the future.

My ultimate hope is that the next bull market will be driven by project teams who have dedicated years to building and who truly embody genuine value. Can we still count on you?

(The above content is an excerpt and reprint authorized by our partner PANews. Original Link | Source: Odaily Planet Daily)

Disclaimer: This article is for market information purposes only. All content and opinions are for reference only, do not constitute investment advice, and do not represent the views or positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses incurred by investor transactions.