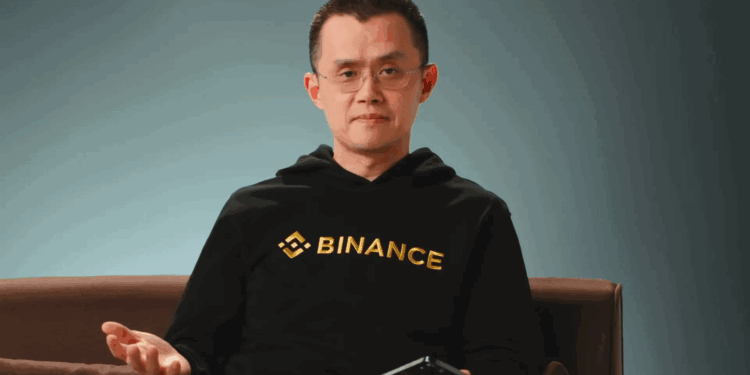

The native token, $ASTER, of the decentralized perpetual contract exchange Aster, has recently captured significant attention, surging by over 20% in a single day. This impressive rally was primarily ignited by an unexpected disclosure from Binance founder Changpeng Zhao (CZ), who revealed his personal acquisition of more than 2.09 million $ASTER, instantly sparking a wave of speculative interest across the crypto market.

This substantial investment by CZ is widely interpreted by the community as a powerful “vote of confidence from a crypto heavyweight,” signaling strong belief in Aster’s underlying project and future potential. Following this revelation, market enthusiasm quickly spread, propelling $ASTER to a 20.5% gain, reaching $1.13 today (October 3rd).

Introducing Aster: A Rebranded Hybrid DEX

Aster emerges as a robust, rebranded decentralized perpetual contract exchange (DEX). The platform’s development team undertook a strategic consolidation of its legacy tokens, including APX, before re-launching its new native token, $ASTER, on the BNB Chain in September this year. With a total supply capped at 8 billion tokens, over half of the $ASTER allocation is dedicated to fostering community engagement through incentives and strategic distributions, such as airdrops and collaborative promotions.

Positioning itself as a “Hybrid Decentralized Exchange (Hybrid DEX),” Aster is engineered to offer a comprehensive suite of trading services. This includes seamless cross-chain perpetual contracts and spot trading functionalities. Furthermore, it provides advanced features catering to professional traders, such as hidden orders and high leverage options. Aster’s innovative approach aims to carve out a significant niche within the intensely competitive decentralized derivatives market.

CZ’s Repeated Endorsement Fuels Momentum

CZ’s recent purchase is not his first public nod to Aster. Back in September, he publicly lauded $ASTER for its “strong start.” Reinforcing his support, Changpeng Zhao took to social media again last night (October 2nd) to announce his personal investment in $ASTER, explicitly stating that he acquired the tokens with his own funds. He further clarified his investment philosophy: “I am not a trader. I buy and hold.”

A screenshot shared by CZ confirmed his holdings, showing over 2.09 million $ASTER purchased at an entry price of $0.913.

Full disclosure. I just bought some Aster today, using my own money, on @Binance.

I am not a trader. I buy and hold. pic.twitter.com/wvmBwaXbKD

— CZ 🔶 BNB (@cz_binance) November 2, 2025

On-Chain Insights and Potential Risks

Further bolstering the project’s profile, on-chain analysis reveals that Aster’s official wallet has recently accumulated a substantial volume of USDT. This accumulation has elevated it to one of the largest wallets on the BNB Chain, second only to Binance itself, indicating significant operational activity and liquidity.

However, amidst the excitement and speculative fervor, analysts are sounding a note of caution regarding potential risks. While $ASTER has demonstrated impressive short-term price appreciation, several factors warrant careful consideration. These include the token’s relatively high supply, the intense competition within the decentralized derivatives space—particularly from established platforms like Hyperliquid—and the observation that the current rally appears to be predominantly “narrative-driven” rather than fundamentally underpinned by significant breakthroughs or long-term value propositions. These elements collectively suggest that a price correction could occur at any given time, advising investors to proceed with prudence.

Disclaimer: This article provides market information only. All content and opinions are for reference purposes only and do not constitute investment advice, nor do they represent the views and positions of BlockTempo. Investors should make their own decisions and transactions. The author and BlockTempo will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.