The Crypto Market’s Brutal Harvest: Unpacking the Manipulation Tactics from MYX to COAI

By zhou, ChainCatcher

Since September, the cryptocurrency market has witnessed a series of audacious “harvesting” schemes. From MYX and AIA to COAI, market makers and project teams have colluded, leveraging extreme control and manipulative tactics to siphon funds from unsuspecting retail investors. Despite the blatant signs of these operations, a significant portion of the market continues to chase the elusive “100x coin,” driven by the fear of missing out on a rapid path to wealth.

The Evolution of a “Harvesting Template”: From MYX to COAI

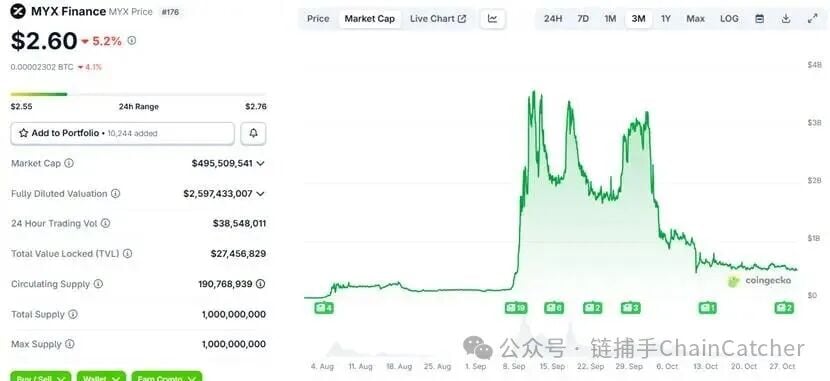

MYX.Finance: The Precedent

The curtain rose on this phenomenon with MYX.Finance, a decentralized derivatives exchange built on the Arbitrum chain. Its native token, MYX, launched on Binance Alpha in early September with an initial market capitalization of approximately $100 million and relatively subdued trading activity. However, in early September, MYX experienced a sudden, explosive surge, with its market cap quickly climbing past $3 billion. This was followed by a period of high-level oscillation, characterized by intra-day “needle-like” pumps and subsequent pullbacks. Funding rates turned negative, and the top ten addresses collectively held over 95% of the token supply. According to Coinglass data, on September 18th, MYX soared by 298.18% in a single day, with an intra-day amplitude reaching 317.11%. This period saw $52.0863 million in short liquidations and $10.5109 million in long liquidations. By early October, the price entered a cascading decline, interspersed with brief, failed rallies before resuming its downward trajectory. MYX has since experienced a protracted downtrend, with its market cap now stabilizing around $500 million.

AIA and COAI: Refining the Strategy

Following MYX, the first wave of copycat projects quickly emerged, with DeAgentAI (AIA) leveraging the AI agent narrative to capture market attention. In early October, AIA’s price briefly surged more than tenfold, only to replicate MYX’s pattern of multiple violent pumps and dumps designed to liquidate retail positions. Its holding concentration reached an astonishing 97%. If AIA was a lightweight imitation of MYX, ChainOpera (COAI) pushed this manipulative model to its extreme.

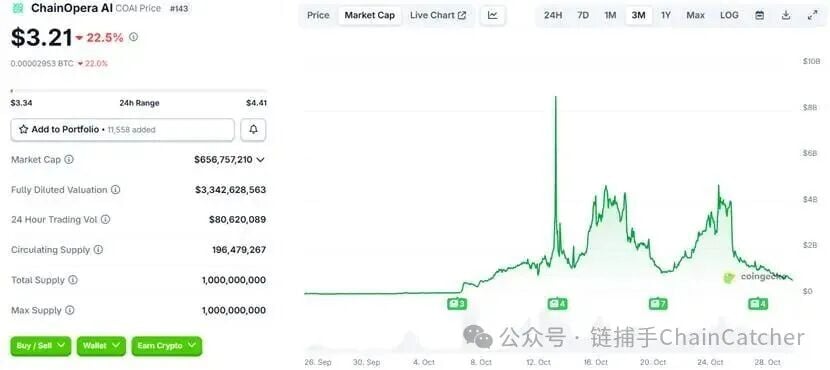

On September 25th, COAI debuted on Binance Alpha and its futures platform with an initial market cap of just $15 million. Within weeks, its price skyrocketed by hundreds of times, with its market cap briefly soaring past $8 billion. Subsequently, the price experienced dramatic fluctuations, oscillating violently between $5 and $25. This pattern of massive surges, followed by brutal 50% crashes, cemented COAI’s reputation as one of the year’s most notorious and volatile tokens. Multiple traders observed that COAI’s top ten holders controlled between 96.5% and 97% of the circulating supply. Market makers would engineer pumps (e.g., an 81% surge on October 15th) to entice retail investors, only to then execute massive dumps (e.g., a 58% crash on October 25th) to liquidate their positions, leaving retail participants with virtually no recourse.

It’s crucial to note that newly launched tokens often exhibit high holding concentration (with the top 10 addresses typically holding 30%-60% of the supply) due to initial distribution among project teams, institutional investors, or market makers (MMs). However, in the realm of new tokens on Alpha, this concentration often reaches extreme levels, with the top 10% of holders controlling between 50% and 80%.

From MYX to COAI, the market maker’s playbook has grown increasingly sophisticated: first, generate hype with a trending narrative; then, leverage highly concentrated holdings and control advantages to effortlessly manipulate token prices; and finally, use futures contracts to amplify capital effects, enabling high-level profit-taking. If retail investors collectively open short positions, the market makers can not only profit from funding rates but also utilize liquidation funds to further pump the price, solidifying their manipulative control.

FOMO-Driven Narratives: When “Control is Justice” Takes Hold

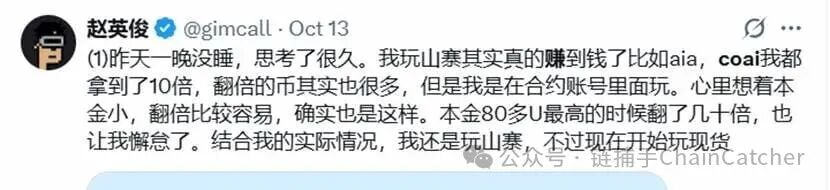

Recently, numerous users on X (formerly Twitter) have been showcasing their short-term trading victories, creating a survivor bias that overshadows the vast losses from liquidations. This cultivates a dangerous illusion of low-expectation, high-reward opportunities.

The community’s attitude has also undergone a significant shift. Initially, MYX was heavily criticized as a “three no’s project” (no code maintenance, no buyback commitment, no community foundation), with its multi-billion dollar market cap deemed irrational. Now, however, some investors, swept up by FOMO, are gradually embracing the notion that “control is justice,” dreaming that the story of overnight riches will magically become their own.

Crypto investor @huahuayjy suggested that the emergence of MYX holds epoch-making significance for the crypto space, aggressively pushing the ceiling for altcoins and making market makers and project teams aware of the potential for massive profits through pumping. Subsequent imitators, they argue, could drive a mini-altcoin bull run. However, dissenting voices counter that a genuine altseason requires overall liquidity expansion and an influx of new capital, not just a few projects playing “hot potato.” Some even theorize that the MYX model might signal the tail end of a bull market, making it increasingly difficult for smaller projects to gain traction.

Furthermore, KOL sanyi.eth reflected on their own experience, stating that after incurring losses by shorting MYX, they have actively avoided such highly volatile “demon coins.” While COAI surged from $0.3 to $61 before retracing to $18, and the project had previously secured approximately $17 million in funding and positioned itself in the AI sector, indicating a non-negligible foundation, its price-to-valuation ratio clearly showed an overheated market. Retail participation in such extremely volatile tokens, sanyi.eth concluded, often leads to liquidation or exorbitant fee payments.

The fact that a large number of retail investors continue to flock to MYX and COAI indicates that the market’s pursuit of fairness has gradually given way to the chase for speculative gains. In other words, as long as there’s a chance to gamble on futures, many are unconcerned whether market makers and project teams are orchestrating the trades.

Notably, according to X user @hellosuoha, the trading depth of projects like MYX, AVNT, and IP at the KBW 2025 conference in Seoul last month garnered significant attention. Their underlying market makers have now become prime contacts for potential new token issuers. This similar pattern is being frantically replicated, and the future may see an influx of more MYX-style projects. In such an ecosystem, retail investors consumed by FOMO will only face more frequent liquidation lines.

Does the Alpha Narrative Amplify the Harvesting Effect?

Fundamentally, the extreme volatility observed in these tokens post-listing stems from two primary factors: direct manipulation by market makers and project teams, and the Binance Alpha platform’s narrative, which accelerates retail investor entry, providing a broader “hunting ground” for manipulators. This has enabled the evolution of a standardized playbook that allows for faster replication and more brutal exits.

This dynamic might also reveal one of Binance Alpha’s implicit design intentions: to attract speculators with its low circulation and high volatility characteristics. After all, there will always be those willing to pay for volatility – some arrive for airdrop farming, others stay for short-term profits, and ultimately, some pay the ultimate price amidst the fluctuations.

Beyond highly controlled tokens like MYX, AIA, and COAI, the Alpha platform has seen numerous other irregularities: some projects launch only to immediately crash to zero or experience flash crashes, while others are implicated in false narratives or code plagiarism. Overall, the platform’s motivation to attract speculative capital appears to far outweigh its role in incubating projects.

To put it another way, Alpha’s emergence is not inherently flawed; it is merely a high-volatility experimental ground focused on early-stage new products. However, when narrative, market structure, and human psychology converge, volatility transforms into a harvesting machine. According to CoinMarketCap data, Binance Alpha’s 24-hour trading volume exceeds $8 billion, surpassing many medium and small-sized crypto exchanges. This indicates that such “wild growth” is no accident but rather a product of the interplay between capital and traffic.

Conclusion: Navigating the Speculative Storm

On one side, market makers and project teams leverage the high volatility of the Alpha platform to create lucrative exit channels. On the other, retail investors remain fixated on the illusion of the next “100x coin.” Greed and fear intertwine, a timeless testament to human nature. Rather than blindly chasing the next COAI, it is imperative to reflect on one’s own position within this high-stakes game.

(The content above is an excerpt and reproduction authorized by our partner PANews. Original Link | Source: Chaincatcher)

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views and positions of BlockBeats. Investors should make their own decisions and trades, and the author and BlockBeats will not bear any responsibility for direct or indirect losses incurred by investor transactions.