Author: Wenser, Odaily Planet Daily

The Resurgence of Privacy Coins: Unpacking the Forces Behind ZEC and DASH’s Surge

With ZEC’s market capitalization soaring to a new peak above $7 billion and DASH contracts reaching all-time highs, privacy-focused cryptocurrencies have dramatically re-entered the mainstream spotlight. The question on many minds is, “What year is it?” Amidst a volatile and often downward-trending market, privacy coins stand out as a resilient sector, not just holding steady but actively appreciating, leading many to place considerable hope in their future. High-profile figures like crypto KOL Ansem have equated ZEC’s significance to that of Bitcoin, while BitMEX co-founder Arthur Hayes has twice predicted ZEC will hit $10,000. Yet, beneath this fervent rally, privacy coins may be playing a more nuanced role as an alternative mechanism for “value transfer.” This article offers a concise analysis and discussion of the underlying reasons for the recent surge in privacy coins, providing insights for our readers.

Privacy Coin Market Rekindles Enthusiasm: A Multifaceted Analysis

The emergence and evolution of privacy coins are not a recent phenomenon but a journey spanning years.

DASH first gained recognition as a “privacy token” in 2014. Preceding it, Bytecoin pioneered the space by introducing the CryptoNote protocol and utilizing Ring Signatures for anonymous transactions.

In 2016, ZEC was launched, distinguished by its use of zk-SNARKs (zero-knowledge proof technology) to enable “optional privacy,” granting users the choice between transparent or shielded transactions. Concurrently, Monero (XMR) forked from Bytecoin, adopting the RingCT protocol to offer default, full privacy protection, which quickly garnered significant market acclaim.

Following 2019, regulatory pressures and exchange delistings caused a chill in the privacy coin market. However, new projects continued to innovate, such as ZEN, which introduced the concept of sidechain privacy, and ARRR, which achieved 100% mandatory privacy.

Strictly speaking, privacy coins could be considered the cryptocurrency sector “most aligned with the spirit of decentralization after BTC.” The recent collective surge in privacy coins, beyond Silicon Valley investor Naval’s high-profile endorsement of ZEC, is underpinned by several complex factors—

US Government’s $15 Billion BTC Confiscation: A Potential Catalyst

On October 14, news broke via a court filing that the U.S. Department of Justice had confiscated a substantial amount of BTC—127,271 coins valued at $15 billion—from Cambodian Prince Group founder Chen Zhi. This event cast a fresh shadow over the traditional “advantages” of cryptocurrency, such as decentralization and anonymity.

When the “iron fist” of regulation directly impacts an individual, even vast personal wealth can prove insufficient to resist its grasp. This incident significantly reignited market demand and attention for privacy coins, highlighting their potential as a safeguard against such actions.

Celebrity Endorsements and Institutional Backing Fuel Liquidity

Among the recent surge, ZEC, a benchmark in the privacy sector, has undoubtedly been the most striking performer. The initial impetus for its price ascent can be traced back to October 1, when Silicon Valley investor Naval quoted a post by Helius founder Mert: “Bitcoin is insurance against fiat. ZCash is insurance against Bitcoin.” At that time, ZEC’s price was merely around $68.

On October 20, Naval revisited ZEC, emphasizing its advantages: “(Despite XMR and other privacy coins being delisted from CEXs), this is why Zcash offers a transparent option—to remain listed on exchanges for as long as possible. However, as we gradually enter the DEX era, this is now less important.” His words conveyed strong confidence in ZEC’s technological direction.

The influence of investment titans and billionaires acted like a “butterfly effect,” igniting a full-blown “privacy coin storm” across the crypto market.

Furthermore, Grayscale’s ZCSH Trust, holding over $100 million in assets, and Coinbase’s listing of ZEC have provided significant institutional validation, attracting substantial market liquidity to ZEC and the broader privacy coin sector.

Continuous Innovation: Privacy Projects Advance with Technical Upgrades

Recently, the Electric Coin Co. (ECC), the organization behind ZEC development, released its Q4 2025 roadmap. This strategic plan focuses on reducing technical debt, enhancing privacy and usability for Zashi wallet users, and ensuring the smooth management of development funds. Key initiatives include adding temporary transparent addresses for all ZEC swaps using the NEAR Intents protocol, generating a new transparent address after funds are received, and supporting Pay-to-Script-Hash (P2SH) multisignature for Keystone hardware wallets.

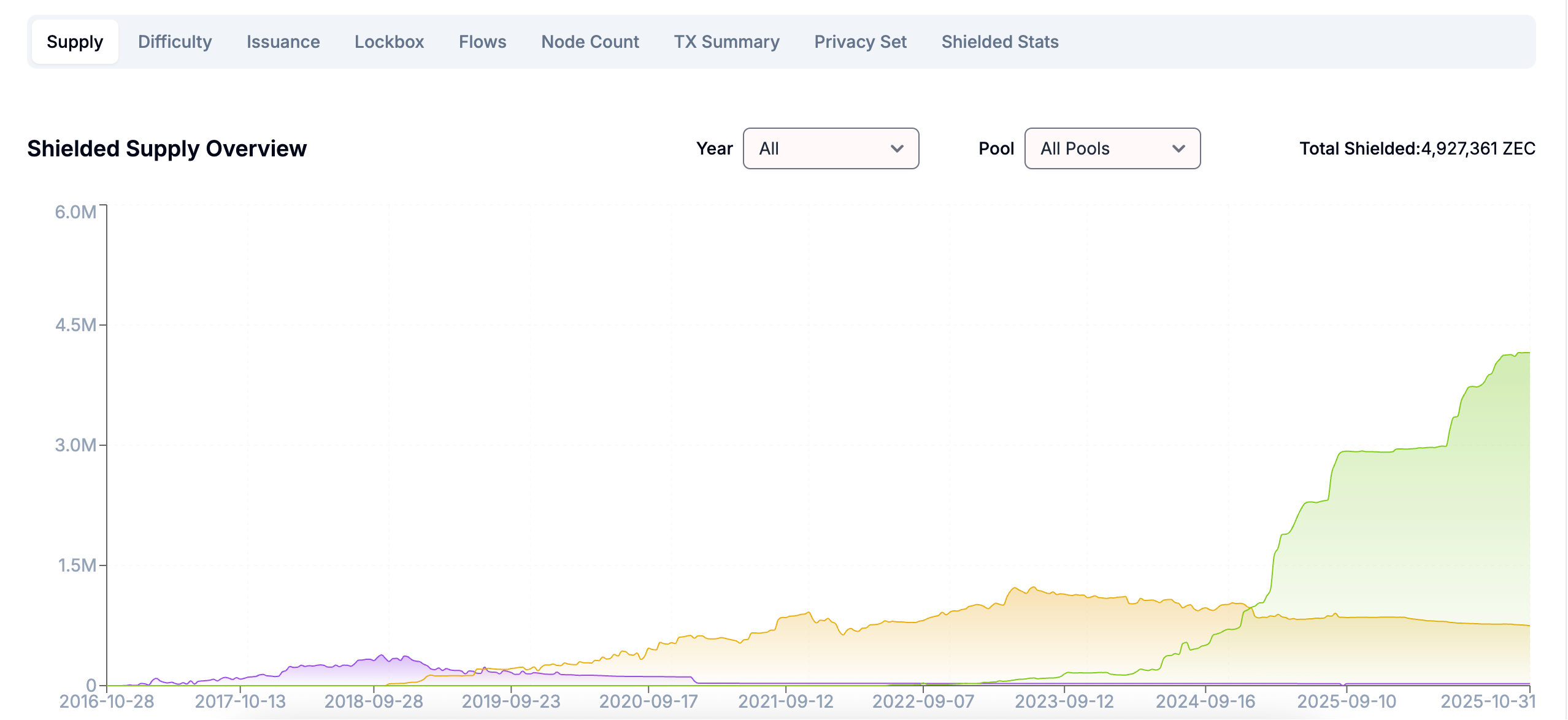

Simultaneously, recent data indicates that Zcash’s privacy pool (Shielded Supply) token total has surpassed 4.9 million, reaching an impressive 4.927 million, approximately 30% of the total circulating supply. This surge, likely influenced by the Orchard ecosystem upgrade, clearly demonstrates a significant increase in real adoption.

Meanwhile, veteran privacy coin DASH is also advancing its Evolution testnet, with future plans to support privacy-focused DeFi. By integrating cross-chain bridges (such as Solana integration), DASH aims to boost its Transactions Per Second (TPS) to over 1000, potentially attracting a wave of new projects to its ecosystem.

In the crypto market, while token value often reigns supreme, robust technical strength is indispensable. Without continuous technological advancement and improved user experience, even the most dramatic token price surges can prove to be ephemeral, leaving investors with little more than dashed hopes.

Is Privacy a Shield or a Means to an End? The “Dumping Medium” Hypothesis

Beyond the objective factors discussed, another compelling hypothesis for the privacy coin surge posits their utility as a tool for “anonymous cash conversion.”

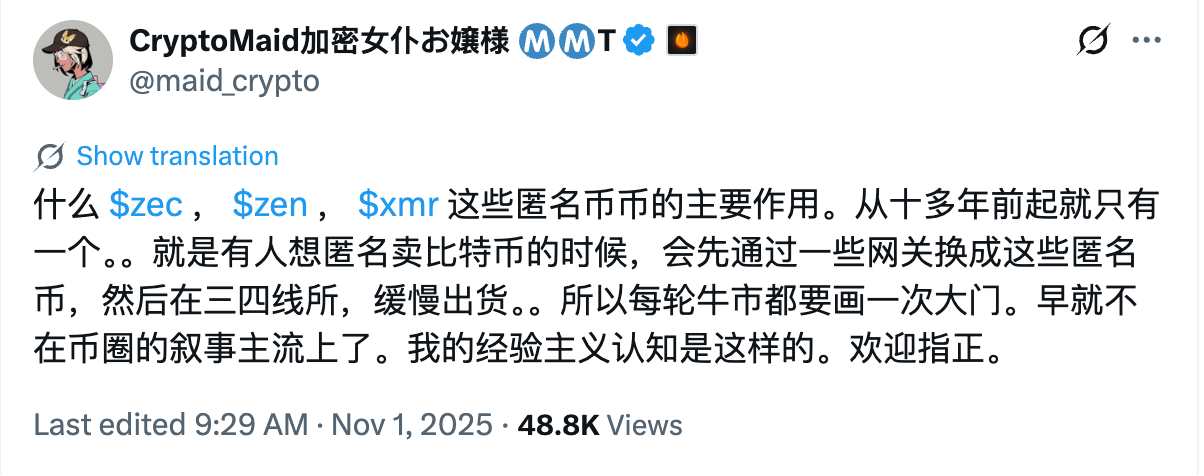

Crypto KOL CryptoMaid articulated this view, stating: “The primary role of anonymous coins like ZEC, ZEN, and XMR, for over a decade, has been singular—when someone wants to sell Bitcoin anonymously, they first convert it into these anonymous coins via certain gateways, and then slowly liquidate them on smaller, tier-three or tier-four exchanges. So, every bull run requires a ‘grand gate’ to be drawn. This narrative has long since left the core crypto discourse.”

It’s worth noting that, in light of recent downward trends in BTC, this perspective holds a certain degree of analytical weight.

Often, concepts like “decentralization” and “privacy” serve merely as packaging for the underlying profit motives. What truly matters is the interest carried by the concept itself.

The world is a bustling marketplace, driven by the ebb and flow of profit, and the cryptocurrency market exemplifies this dynamic.

Conclusion: Privacy is Not a Panacea, Speculation Offers Only a Short-Term Fix

It is crucial to understand that privacy coins are not a “panacea.” As Super Jun from the Benmo community pointed out, “Upon investigation, it was discovered that two specific privacy coins had removed their privacy features two years ago, meaning they no longer technically qualify as privacy coins.” Further inquiry revealed that one such project lacked a mainnet entirely, existing merely as a standard token on the Base chain. (Odaily Planet Daily Note: Several users in the comments section indicated this critique was directed at the privacy token project ZEN.)

In the pursuit of privacy within the crypto space, no investor wishes to be part of a project that is purely idealistic, waving the banner of “decentralized ideals” without substantial underlying value. Yet, even more so, no one wants to become a mere “air coin investor,” as the consequences of such investments are often profoundly painful.

(The content above is an authorized excerpt and reprint from our partner PANews, original link | Source: Odaily Planet Daily)

Disclaimer: This article is for market information purposes only. All content and opinions are for reference only and do not constitute investment advice. They do not represent the views and positions of BlockBeats. Investors should make their own decisions and trades. The author and BlockBeats will not bear any responsibility for direct or indirect losses resulting from investor transactions.