The Inevitable Dance: Political Incentives and the Rise of Debt

In the grand tapestry of economic forces, some principles, much like the genius of Satoshi Nakamoto or the immutable laws of time and compound interest, operate independently of human will. One such principle governs government finance: expenses are met either through taxation (savings) or through issuing debt.

For governments, taxes are the equivalent of savings. Yet, the unpopularity of taxes stands in stark contrast to the universal appeal of spending. This fundamental disconnect creates a powerful political incentive: when delivering benefits, politicians overwhelmingly prefer to issue debt rather than raise taxes. The allure of borrowing from the future is undeniable, especially when the political architects of today’s spending are likely to be out of office when tomorrow’s bills come due.

This inherent bias towards debt issuance raises a critical question: If governments are “hardcoded” by political incentives to favor borrowing over taxation, how do the purchasers of this burgeoning US national debt finance their acquisitions? Do they tap into their own capital, or do they, too, rely on borrowing?

Understanding the financing mechanisms of US Treasury buyers, particularly within the framework of Pax Americana, is paramount to forecasting future US dollar creation. Should the marginal buyer of US Treasury bonds finance their purchases through credit, identifying their lenders becomes the next crucial step. This identity then reveals whether these financiers are conjuring money into existence through lending or simply deploying existing capital.

If our investigation reveals that the financiers of Treasury bonds create money in the lending process, a profound conclusion emerges:

Government-issued debt directly increases the money supply.

The validity of this premise allows us to estimate the potential upper limits of credit creation by these financiers. The stakes are high, as my core argument posits: sustained growth in government borrowing, as projected by major financial institutions and government agencies, will inevitably lead to an expansion of the Federal Reserve’s balance sheet.

An expanding Federal Reserve balance sheet translates directly into increased US dollar liquidity, a powerful tailwind for the prices of Bitcoin and other cryptocurrencies. Let’s meticulously unravel this logical puzzle.

Unpacking the Debt Conundrum: Key Questions Answered

Will President Trump finance deficits through tax cuts?

No. Recent actions by President Trump and Congressional Republicans have extended the 2017 tax cuts, precluding this as a deficit reduction strategy.

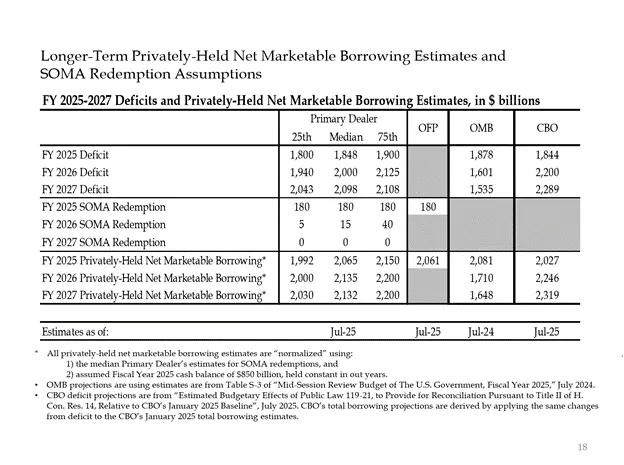

Is the US Treasury borrowing to cover the federal deficit, and will this trend continue?

Yes. Projections from leading bankers and US government bodies consistently forecast annual deficits around $2 trillion, which will be financed by an equivalent amount of borrowing.

Given these affirmative answers, the equation is clear:

Annual Federal Deficit = Annual Public Debt Issuance

Now, let’s delve into the primary purchasers of this debt and their financing strategies.

Who’s Devouring the Debt? The Marginal Buyers Revealed

1. Foreign Central Banks

The precedent set by the “Pax Americana” willingness to seize funds from a nuclear power and major commodity exporter like Russia has eroded confidence among foreign holders of US debt. Foreign central bank reserve managers are acutely aware of expropriation risks, increasingly opting for gold over US Treasuries. This shift is clearly reflected in the significant surge in gold prices following Russia’s invasion of Ukraine in February 2022. Consequently, foreign central banks are no longer the marginal buyers of US debt.

2. The US Private Sector

With the 2024 personal savings rate at 4.6% (according to the US Bureau of Labor Statistics) and the federal deficit at 6% of GDP in the same year, the private sector’s capacity to absorb the national debt is insufficient. The sheer scale of the deficit dwarfs private savings, preventing them from being the marginal buyers.

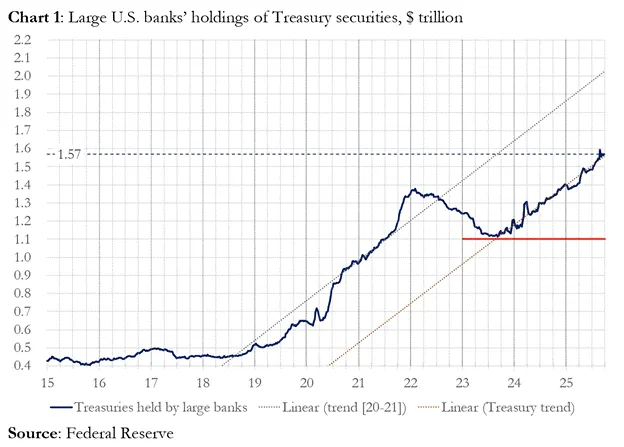

3. Commercial Banks

Are the four major money center commercial banks significantly stepping up to purchase US debt? The data suggests otherwise.

In fiscal year 2025, these four banks acquired approximately $300 billion in US debt, a fraction of the $1.992 trillion issued by the Treasury in the same period. While their participation is notable, they are not the ultimate marginal buyers.

4. Relative Value (RV) Hedge Funds: The Marginal Player

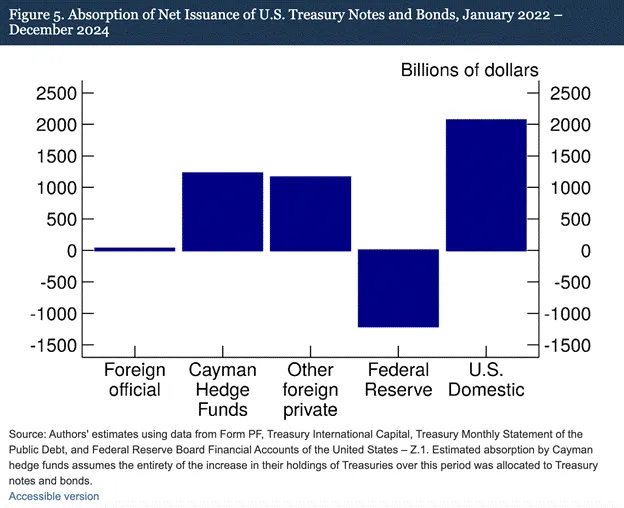

A recent Federal Reserve document explicitly acknowledges Relative Value (RV) hedge funds as the marginal buyers of Treasury bonds.

“Our findings indicate that Cayman Islands hedge funds are increasingly becoming the marginal foreign buyers of US Treasury bonds and notes.”

Between January 2022 and December 2024 – a period marked by the Federal Reserve’s balance sheet reduction (Quantitative Tightening or QT) – Cayman Islands hedge funds net purchased an astonishing $1.2 trillion in Treasury bonds. This figure represents 37% of net Treasury issuance, nearly matching the combined purchases of all other foreign investors.

The typical trading strategy for RV funds involves:

- Purchasing spot Treasury bonds.

- Simultaneously selling corresponding Treasury futures contracts.

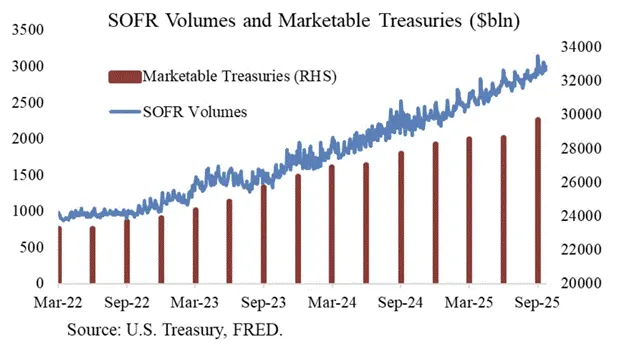

As illustrated by Joseph Wang’s insightful chart, SOFR trading volume serves as a reliable proxy for RV fund engagement in the Treasury market. The clear correlation between growing debt burdens and rising SOFR volumes underscores RV funds’ role as the marginal buyers of Treasury bonds.

RV funds execute this strategy to capitalize on minuscule spreads between these two instruments. Given that these spreads are measured in mere basis points (1 basis point = 0.01%), profitability hinges entirely on leveraging their purchases through financing.

This brings us to the most pivotal aspect of our analysis, crucial for understanding the Federal Reserve’s impending actions:

How do RV funds finance their massive Treasury bond purchases?

The Repo Market, Stealth QE, and the Mechanics of Dollar Creation

RV funds finance their Treasury acquisitions via repurchase agreements, or “repo.” In a streamlined transaction, the newly purchased Treasury securities serve as collateral for an overnight cash loan, which is then used to settle the Treasury purchase. When cash is plentiful, repo rates typically trade at or below the Federal Reserve’s federal funds rate upper bound. But why is this the case?

How the Federal Reserve Orchestrates Short-Term Rates

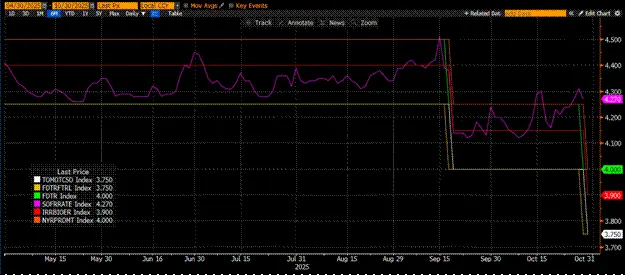

The Federal Reserve employs two primary policy rates to define the federal funds rate corridor: an upper bound (currently 4.00%) and a lower bound (currently 3.75%). To maintain the actual short-term rate, the Secured Overnight Financing Rate (SOFR), within this target range, the Fed utilizes several key tools, listed here from lowest to highest associated rate:

- Overnight Reverse Repurchase Agreement Facility (RRP): Money market funds (MMFs) and commercial banks park cash here overnight, earning interest. The reward rate aligns with the federal funds rate lower bound.

- Interest on Reserve Balances (IORB): Commercial banks earn interest on excess reserves held at the Federal Reserve. The reward rate falls between the upper and lower bounds.

- Standing Repo Facility (SRF): Activated during periods of cash tightness, the SRF allows commercial banks and other eligible financial institutions to pledge qualified securities (primarily US Treasuries) in exchange for cash from the Federal Reserve. Essentially, the Fed creates new money to swap for collateralized securities. The reward rate is pegged to the federal funds rate upper bound.

The relationship between these tools defines the rate corridor:

Federal Funds Rate Lower Bound = RRP < IORB < SRF = Federal Funds Rate Upper Bound

SOFR, a composite rate reflecting various repo transactions, is the Federal Reserve’s target rate. Should SOFR trade above the federal funds rate upper bound, it signals severe cash tightness within the system—a critical issue. A surging SOFR would cripple the highly leveraged fiat financial system, bringing it to a halt.

Such a scenario would devastate marginal liquidity providers, who rely on predictable, low-cost rollovers of their liabilities near the federal funds rate. Facing massive losses, they would cease to provide liquidity. Without affordable leverage, no one would purchase US Treasuries, leaving the US government unable to finance itself at sustainable costs.

The Retreat of Marginal Cash Providers

What drives SOFR above its upper bound? The answer lies with the marginal cash providers in the repo market: money market funds (MMFs) and commercial banks.

- Money Market Funds (MMFs) Exit: MMFs seek minimal credit risk for short-term interest. Historically, they moved funds from RRP to the repo market when RRP rates were below SOFR. However, the current attractiveness of short-term Treasury bills has prompted MMFs to withdraw funds from RRP and lend directly to the US government instead. RRP balances have now effectively hit zero, signaling MMFs’ near-complete withdrawal from the repo market’s cash supply.

- Commercial Bank Constraints: Banks are willing to supply reserves to the repo market when IORB rates are below SOFR. Yet, their capacity to provide cash is directly tied to their reserve levels. Since the Federal Reserve initiated Quantitative Tightening (QT) in early 2022, bank reserves have plummeted by trillions of dollars. As balance sheet capacity dwindles, banks are compelled to demand higher rates for providing cash.

Since 2022, both MMFs and commercial banks, the traditional marginal cash providers, have significantly less liquidity to inject into the repo market. Inevitably, a point will be reached where neither is willing or able to supply cash at rates at or below the federal funds rate upper bound.

Simultaneously, the demand for cash is escalating. Relentless government spending under both former President Biden and current President Trump necessitates ever-increasing Treasury issuance. RV funds, as the marginal buyers of this debt, must secure financing in the repo market.

If these funds cannot consistently access daily funding at or just below the federal funds rate upper bound, they will cease buying US Treasuries, rendering the US government unable to finance its operations at an affordable rate.

The Activation of SRF: Ushering in Stealth Quantitative Easing

Recognizing a similar liquidity crisis in 2019, the Fed established the Standing Repo Facility (SRF). The SRF guarantees an unlimited supply of cash at the SRF rate (the federal funds rate upper bound) against acceptable collateral. This assures RV funds that, regardless of market tightness, they can always obtain financing at a known, albeit worst-case, rate.

When the SRF balance rises above zero, it serves as a clear indicator: the Federal Reserve is effectively printing money to honor the commitments made by politicians.

Treasury Issuance = Increase in US Dollar Supply

Stealth Quantitative Easing (Stealth QE): The Federal Reserve has two primary mechanisms for ensuring ample system liquidity. The first is traditional Quantitative Easing (QE), which involves purchasing bank securities to create bank reserves. The second, and increasingly relevant, is the free lending to the repo market through the SRF.

QE has become a “dirty word,” widely associated by the public with inflationary money printing. To sidestep accusations of fueling inflation, the Federal Reserve will endeavor to frame its policies as distinct from QE. This strategic maneuver implies that the SRF will emerge as the primary conduit for newly created money to flow into the global financial system, rather than through direct QE operations that expand bank reserves.

This is a temporary measure, buying only a limited amount of time. Ultimately, the exponential expansion of Treasury issuance will necessitate the repeated and substantial utilization of the SRF. Remember, the Treasury Secretary (Buffalo Bill Bessent, as the article playfully refers) not only needs to issue approximately $2 trillion annually to fund government operations but also trillions more to roll over maturing debt.

Stealth Quantitative Easing is on the horizon. While the precise timing remains uncertain, if current money market conditions persist and the mountain of Treasury debt continues to grow, the SRF balance, as the lender of last resort, must expand. As the SRF balance swells, so too will the global fiat US dollar supply. This phenomenon is poised to reignite the Bitcoin bull market.

Current Market Stagnation: A Strategic Opportunity

Before the full force of Stealth QE takes hold, a period of capital consolidation is essential. Expect continued market volatility, particularly until the resolution of any potential US government shutdown.

Currently, the Treasury is actively borrowing through debt auctions, a process that temporarily drains US dollar liquidity. However, this borrowed money has not yet been fully spent, which would otherwise inject liquidity back into the market. The Treasury General Account (TGA) currently holds approximately $150 billion above its target of $850 billion. This excess liquidity will only be released into the market once government operations resume. This temporary liquidity siphon is a significant contributor to the current subdued state of the crypto market.

As the four-year cycle anniversary of Bitcoin’s 2021 all-time high approaches, many investors may mistakenly interpret this period of market weakness and fatigue as a market top, leading them to prematurely divest their holdings. This is, of course, assuming they haven’t already been “cleaned out” during recent altcoin corrections.

Such a misinterpretation would be a critical error. The underlying logic of the US dollar money market is irrefutable. While this corner of finance is often obscured by complex jargon, once these terms are translated into the fundamental concepts of “money printing” or “money destruction,” the overarching trend becomes remarkably clear and actionable.