Author: Frank, PANews

Tether’s Golden Empire: A Borderless Central Bank in the Making?

Tether, the issuer of USDT, the world’s largest stablecoin, is embarking on an aggressive accumulation of physical gold at an unprecedented pace. This strategic pivot signals a profound transformation, positioning Tether far beyond a mere cryptocurrency company.

The Unprecedented Gold Rush

Tether’s Q3 2025 report reveals a staggering surge in its gold reserves, which have skyrocketed to $12.9 billion from approximately $5.3 billion at the close of 2024. This represents a net increase of over $7.6 billion in just nine months. Market analysts indicate that Tether has been acquiring more than one ton of gold per week over the past year—a pace that eclipses the gold accumulation rates of most sovereign central banks.

But Tether’s ambition doesn’t stop at mere acquisition. The company has actively moved to secure controlling stakes in gold mines and has successfully recruited top-tier precious metals traders from global financial giants. These strategic maneuvers suggest a grander vision: Tether is meticulously constructing what appears to be a “borderless central bank,” powered by US Treasuries as its primary profit engine, and fortified by gold and Bitcoin as its “hard core” value assets. Yet, this seemingly flawless commercial empire begs a critical question: is such an audacious vision truly sustainable?

Tether’s Alchemy of Profit: $12.9 Billion in Gold, Billions in Gains

Tether’s financial performance in 2025 has been nothing short of spectacular. Its net profit for the first nine months alone exceeded $10 billion, propelling the company’s valuation to an estimated $500 billion, a figure comparable to industry titans like OpenAI.

This multi-billion dollar profit stream is a testament to Tether’s unique “alchemy,” primarily composed of two key elements:

-

Operating Profit: Derived from the stable interest income generated by its substantial holdings of approximately $135 billion in US Treasury bonds.

-

Unrealized Gains: Significant book profits stemming from its reserves in gold and Bitcoin, which have experienced substantial appreciation during the robust 2025 bull market.

While Tether has not publicly detailed the precise breakdown of its profits, informed analysis allows for a reasonable estimation. US Treasury bonds are estimated to have contributed around $4 billion, based on a 4% annualized return.

Gold’s contribution, however, stands out. Beginning 2025 at approximately $2,624 per ounce, gold prices surged by an impressive 47% to $3,859 by September 30. Based on Tether’s $5.3 billion gold holdings at the end of 2024, this existing inventory alone generated roughly $2.5 billion in unrealized gains. Factoring in newly acquired gold throughout 2025, it’s estimated that $3 billion to $4 billion of Tether’s total profits originated from gold’s appreciation. Bitcoin’s unrealized gains contributed an additional $2 billion.

This makes gold an undeniably critical component of Tether’s revenue strategy. More than just a source of profit, Tether is effectively mirroring the strategic reserve logic of sovereign nations, aiming to control the entire gold supply chain, from mining to trading.

In June 2025, Tether Investments acquired a substantial 37.8% strategic equity stake in Elemental Altus Royalties Corp., a Canadian-listed gold royalty company, with an option to increase its holding to 51.8% for a controlling interest. This royalty model allows Tether to secure a stable share of gold production for decades without the operational risks associated with mining, thus fortifying the supply security of its gold reserves.

Further demonstrating its commitment, Tether successfully lured two of the world’s leading precious metals traders from HSBC in November. One notable recruit, Vincent Domien, previously served as HSBC’s Global Head of Metals Trading and is a current board member of the esteemed London Bullion Market Association (LBMA).

Beyond physical assets, Tether’s influence extends to the digital realm with Tether Gold (XAUT), an independent gold-backed token with a market capitalization exceeding $2.1 billion. In a move to expand its ecosystem, Tether, in partnership with Singaporean financial services firm Antalpha, plans to raise at least $200 million for a “Digital Asset Treasury” (DAT) project. This fund aims to accumulate XAUT tokens and establish an “institutional-grade gold-backed lending solution.”

The “US Treasury-Gold” Loop: Forging a Borderless Central Bank

Through these meticulously planned initiatives, Tether has engineered a sophisticated and seemingly robust business model:

-

Dollar Absorption: Tether issues USDT, drawing in nearly $180 billion in global capital.

-

Treasury Investment: The vast majority of these funds are then invested in highly liquid and secure US government bonds.

-

Interest Generation: During periods of high interest rates, Tether effortlessly accrues billions in “risk-free” annual interest from these Treasury holdings.

-

Gold Acquisition: A portion of these profits is strategically allocated to accumulating physical gold and investing in the gold industry, serving as a hedge against potential US Treasury devaluation or interest rate cut risks.

-

Excess Reserves & Growth: By maintaining substantial gold and Bitcoin reserves, Tether achieves an elevated reserve ratio, enhancing the security and brand value of its stablecoin, which in turn facilitates further stablecoin issuance and market dominance.

This intricate series of operations transforms Tether from a conventional cryptocurrency company into a powerful “shadow bank” or, arguably, a non-sovereign central bank. Its combined holdings of US Treasuries and gold reserves now surpass those of many nation-states.

Within this self-reinforcing cycle, Tether has emerged as one of the most profitable companies globally. Its expansion efforts now reach into diverse sectors such as AI, education, power, and agriculture, further broadening its formidable commercial footprint. Critically, as the stablecoin industry continues its rapid ascent, Tether, with its unique “seigniorage” capabilities, is poised to exert unparalleled influence across a multitude of global industries and regions—a level of impact perhaps never before achieved by a single commercial entity.

Cracks in the Empire: Three Looming Threats

However, even the most perfect blueprints often conceal inherent vulnerabilities. Tether’s ambitious “perfect logic” now faces a trifecta of challenges: regulatory scrutiny, market volatility, and escalating competition. Any one of these could derail its vision of a borderless central bank.

Threat One: The Regulatory Wall

While gold reserves have fueled Tether’s immense profits, they have simultaneously become its most significant obstacle on the path to regulatory compliance. In July 2025, the US enacted the “GENIUS Act,” which mandates that stablecoin issuers operating within the United States must back their reserves 100% with “high-quality liquid assets,” specifically USD cash or short-term US Treasury bonds.

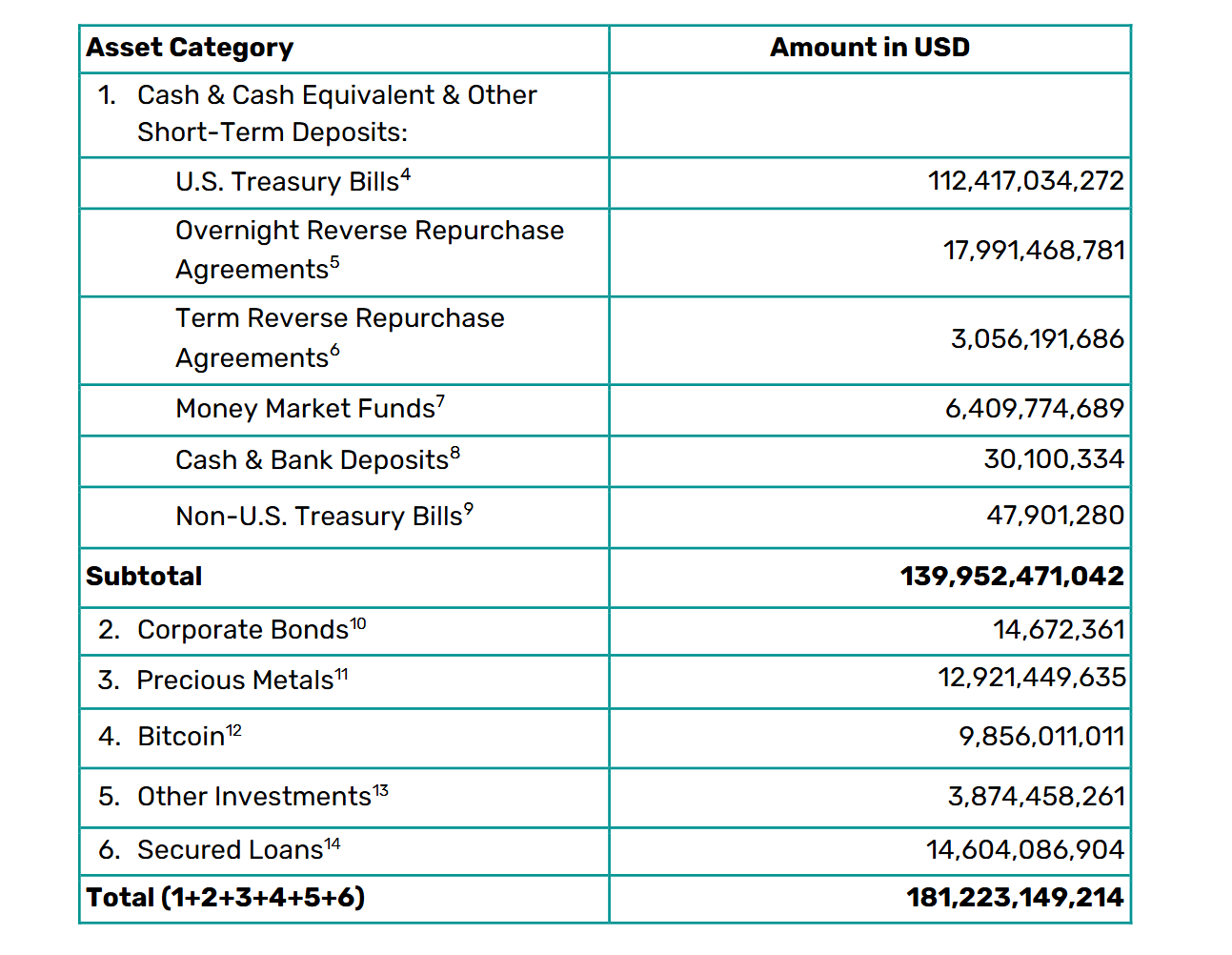

This legislation strikes at Tether’s core strategy. According to its Q3 report, Tether’s total reserves stood at $181.2 billion, backing $174.4 billion in issued USDT. Crucially, $12.9 billion in gold, $9.9 billion in Bitcoin, and various other investments and loans are all classified as “non-compliant assets” under the GENIUS Act.

JPMorgan Chase, in a candid 2025 analysis, warned that if Tether seeks compliant operation in the US, it may be compelled to divest its “non-compliant assets,” including its substantial holdings of Bitcoin and precious metals.

This scenario has already unfolded in Europe. Due to Tether’s non-compliance with the EU’s MiCA regulations, nearly all major exchanges, including Coinbase and Crypto.com, delisted USDT within the European Economic Area (EEA) between late 2024 and March 2025.

As the GENIUS Act’s specifics are phased in over the next 18 months, compliant US exchanges like Coinbase and Kraken will likely face similar pressures. While Tether maintains it does not serve US customers, a collective blocking by American exchanges would severely impair its global liquidity, effectively forcing its withdrawal from the world’s largest regulated market.

Tether’s proactive response underscores the gravity of this threat. In September 2025, it announced the formation of Tether America and appointed former White House advisor Bo Hines as CEO (related reading: “29-year-old Crypto Newcomer Bo Hines: From White House Crypto Liaison to Fast-Tracked CEO of Tether America’s Stablecoin“). The company plans to launch USAT, a new stablecoin, in December, designed to be 100% compliant (backed solely by US Treasuries) for the American market. This appears to be a strategic “firewall,” sacrificing USDT’s US market presence to safeguard its global gold and Bitcoin reserve strategy. However, USAT seems more of a tactical maneuver than a fundamental shift for Tether.

Threat Two: Bear Market Devastation

As previously discussed, Tether’s profitability hinges on two primary drivers: US Treasury yields and the appreciation of gold and Bitcoin. Its exceptional 2025 performance was largely buoyed by the record-breaking prices of these assets.

However, this profit structure inherently carries significant risk. A shift in market sentiment in 2026 could see Tether’s profit growth decelerate or even reverse into losses.

Firstly, several leading financial institutions predict that the Federal Reserve will enter an interest rate cutting cycle in 2026. Estimates suggest that a 25-basis-point rate cut by the Fed could reduce Tether’s annual revenue by $325 million.

Secondly, while the gold and Bitcoin markets enjoyed a fervent bull run in 2025 and remain optimistic amidst rate cut expectations for 2026, markets are inherently unpredictable. Should gold and Bitcoin enter a bear market cycle (though their asynchronous movements are a core element of Tether’s hedging strategy), Tether’s gains from these assets would shrink dramatically, potentially eroding profits in a new market phase.

Furthermore, a broader crypto bear market would inevitably slow or even decrease stablecoin issuance, directly impacting Tether’s overall profitability.

Threat Three: The Rise of Competitors

The tightening regulatory environment is fundamentally reshaping the stablecoin landscape. The US GENIUS Act and the EU’s MiCA regulations are effectively clearing the path for “pure-bred” compliant stablecoins.

The primary beneficiary of this shift is Circle’s USDC. Embraced by regulators as a compliance leader, USDC’s circulation reached $73.7 billion by the end of Q3 2025, boasting an impressive 108% year-on-year growth.

In contrast, while Tether retains its market dominance, its growth momentum shows signs of faltering. September 2025 data indicates that while USDT’s scale expanded to $172 billion, its growth rate has notably lagged behind USDC. According to PANews’ “2025 Global Stablecoin Industry Development Report,” if current growth trends persist, USDC is projected to surpass USDT around 2030.

In essence, Tether’s “gold strategy” is a double-edged sword: a formidable moat protecting its empire, yet also a potential vulnerability that could erode its commercial foundations. Objectively, however, this risk-hedging business logic remains one of the most ingenious designs conceived within the crypto world. Institutions like JPMorgan Chase and Goldman Sachs anticipate that the Fed’s 2026 rate cut cycle, far from triggering a bear market, could instead serve as “fuel” to propel gold and Bitcoin prices to unprecedented highs. If this scenario materializes, Tether’s “gold strategy” could indeed elevate it to new, unparalleled heights.

(The above content is an authorized excerpt and reproduction from our partner PANews. Original Link )

Disclaimer: This article is provided for market information purposes only. All content and views are for reference and do not constitute investment advice. They do not represent the views or positions of the author or BlockTempo. Investors should make their own decisions and conduct their own transactions. The author and BlockTempo will not be liable for any direct or indirect losses incurred by investors’ transactions.