Author: Nancy, PANews

Aztec Network’s Return Sparks Debate with Controversial Token Launch

As the cryptocurrency market increasingly signals a shift from bull to bear, a flurry of projects like Monad, MegaETH, and Meteora are racing to launch their tokens, eager to capture the remaining liquidity. Amidst this rush, Aztec Network, a once-prominent name in the privacy sector, has re-emerged after a seven-year hiatus, announcing its token issuance. However, this highly anticipated return has been met with significant controversy surrounding its token sale strategy.

TGE Without Airdrop: Community Discontent Over Valuation and Lock-ups

After years of anticipation and navigating multiple market cycles, Aztec Network has finally unveiled its token launch plan.

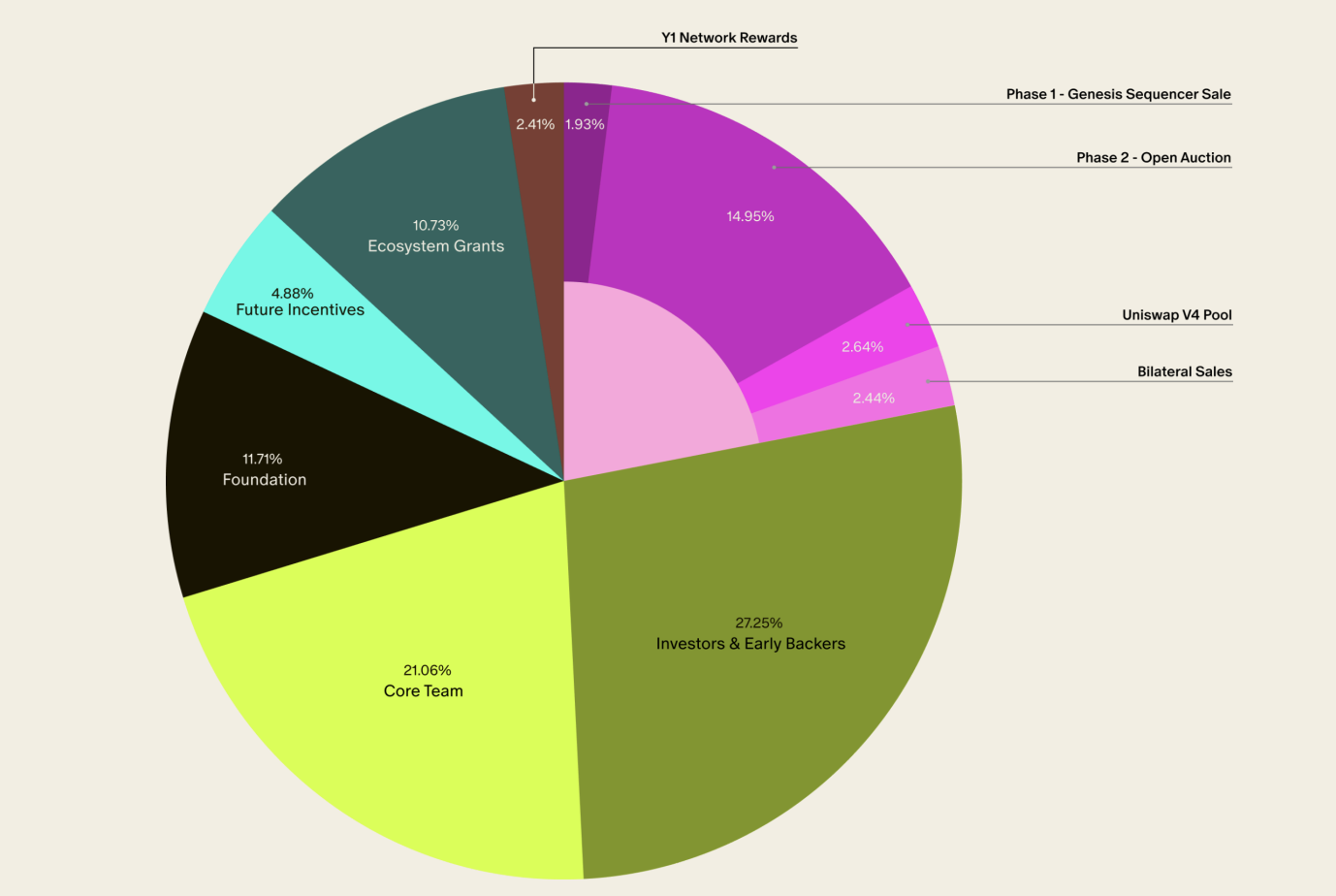

On November 13th, Aztec disclosed its tokenomics, revealing a genesis supply of 10.35 billion AZTEC tokens. The distribution is as follows: 27.26% allocated to investors and early supporters, 21.06% to the core team, 11.71% to the foundation, 10.73% for ecosystem grants, 4.89% for future incentives, and 2.41% for Y1 Network Rewards. The remaining 21.96% (approximately 2.27443 billion tokens) is earmarked for a V4 liquidity pool auction (2.64%), a Phase 1 genesis sequencer sale (1.93%), and Bilateral Reserves (2.44%). AZTEC tokens will primarily facilitate sequencer staking, network governance, and cover network fees, with an annual inflation cap of 20% to be determined by governance decisions.

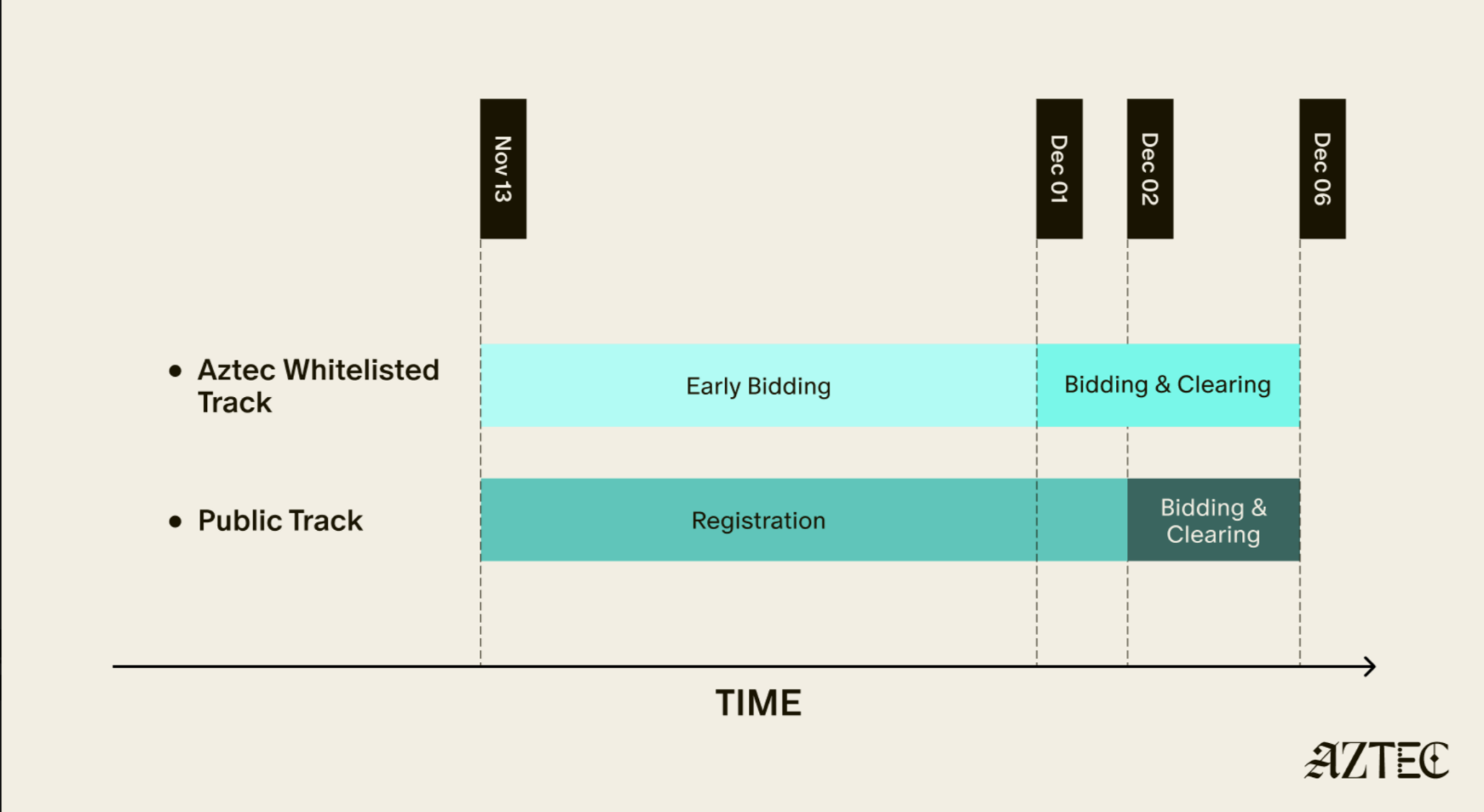

Aztec is initiating its Token Generation Event (TGE) through a series of AZTEC token sales. The Genesis Sequencer Sale commenced on November 13th at 22:00 (UTC) and will conclude on December 1st at 22:00 (UTC). This will be followed by an Open Auction, running from December 1st at 22:00 (UTC) to December 6th at 22:00 (UTC).

The token sale will leverage Uniswap’s innovative Continuous Clearing Auction (CCA) mechanism. This system is designed to bootstrap liquidity and enable transparent price discovery for new or low-liquidity tokens on Uniswap v4. Operating entirely on-chain, CCA sets a single clearing price per block, prioritizing higher bids and allocating tokens proportionally for identical bids. Upon auction completion, proceeds are automatically used to establish a liquidity pool on v4. Aztec is notably the first project to adopt this mechanism, offering an optional ZK Passport module for private and verifiable participation.

Community Outcry: No Airdrop, High Valuation, and KYC Requirements

Despite Aztec’s significant funding and high profile as a privacy project, its token sale plan has drawn considerable criticism from the community. Many early adopters, who had invested substantial time and capital in anticipation of an airdrop, were left disappointed by the official announcement that no airdrop would occur. Instead, Aztec emphasized a “community-first” approach, granting early bidding eligibility to network contributors, including testnet node operators, Aztec Connect users, zk.money users, and active community members. Over 300,000 addresses have reportedly been whitelisted.

Further exacerbating community dissatisfaction are the proposed valuation and lock-up conditions. The AZTEC token’s starting Fully Diluted Valuation (FDV) is set at $350 million, with a public sale allocation of 14.5%. While Aztec claims this price represents an approximately 75% discount compared to the implied valuation of its latest equity funding round, many community members argue that this valuation is disproportionately high given the project’s current output and market conditions. Additionally, the token sale imposes lengthy lock-up periods: proceeds from both the Genesis Sale (which requires a minimum stake of 200,000 AZTEC) and the Open Auction will be locked for 12 months. Tokens acquired in the public auction may only be unlocked after 90 days, subject to a governance vote.

In the current subdued market, where many TGEs perform poorly post-launch, these stringent lock-up terms significantly amplify financial risk for participants. It’s worth noting that the whitepaper mentions 0.12% of tokens (approximately 12.42 million) are allocated to “non-internal early contributors, community members, and related interested individuals,” with most of these to be distributed before the token sale begins.

Adding to the controversy, Aztec’s requirement for participants to complete KYC and mint an NFT to enter the auction process stands in stark contrast to its core privacy narrative, becoming another focal point of community debate.

From Privacy Pioneer to Business Pivot: Aztec’s Journey Back to the Spotlight

Since its inception in 2018, Aztec has been a leading force in developing privacy solutions for Ethereum. Public records indicate that Aztec secured over $119 million across four funding rounds between 2018 and 2022, attracting investments from industry heavyweights such as Vitalik Buterin, ConsenSys, Paradigm, a16z, Ethereal Ventures, and Coinbase Ventures.

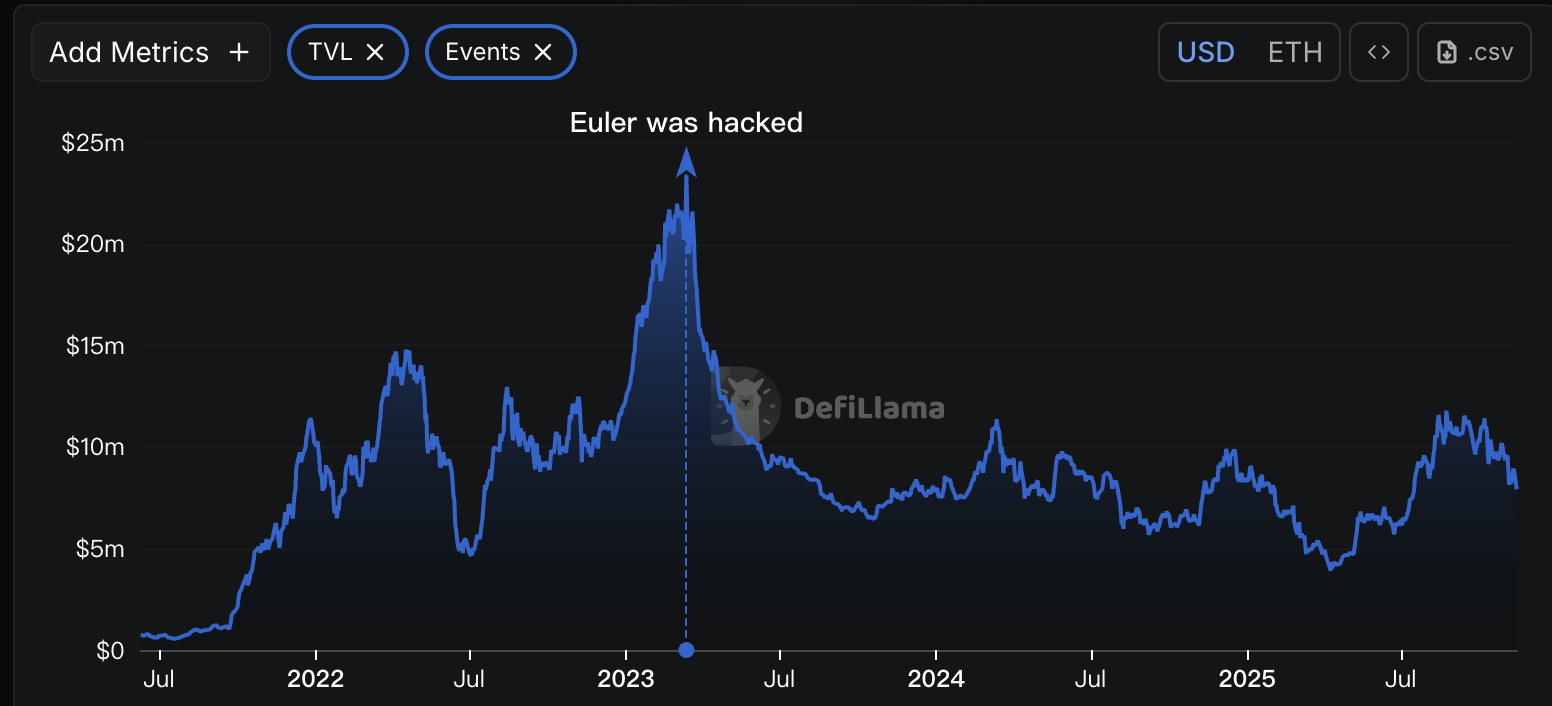

Despite substantial funding and high market visibility, Aztec’s ecosystem development faced hurdles. The regulatory landscape for privacy projects became particularly challenging after the U.S. OFAC sanctioned Tornado Cash in 2022. In March 2023, Aztec announced a significant business pivot, gradually phasing out its DeFi privacy bridge, Aztec Connect, and discontinuing deposit functionalities for zk.money. The official statement clarified that this decision was driven by commercial considerations, not regulatory contact, with a renewed focus on the zero-knowledge universal language Noir and the research and development of a next-generation encrypted blockchain. This pivot significantly impacted the Aztec ecosystem, which at its peak boasted tens of millions in transaction volume and hundreds of thousands of users across Aztec Connect and zk.money.

Following a period of waning interest in privacy narratives, Aztec’s market visibility declined despite continuous product updates. According to DeFi Llama data, Aztec’s Total Value Locked (TVL) plummeted from a peak of $21 million to a low of approximately $4 million.

However, the privacy sector began showing signs of recovery towards the end of last year. A pivotal moment arrived in November 2023 when a U.S. court ruled that OFAC’s sanctions on Tornado Cash were unlawful. This was followed by its removal from the sanctions list in March 2024, sending a positive signal across the crypto privacy landscape.

Seizing this opportune moment, Aztec announced the establishment of its foundation in February this year, immediately fueling speculation about its token launch plans. Subsequently, Aztec rolled out a public testnet, successfully re-engaging users and driving a rebound in TVL. Within just four weeks, the platform saw the development of over 30 new applications and connected more than 17,000 nodes. Aztec has since continued its progress with network upgrades, developer ecosystem expansion, and optimizations for cross-chain functionality and performance.

The recent surge in prices for privacy coins like Zcash has further amplified market attention on the privacy sector, providing a relatively favorable window for Aztec’s token launch. Nevertheless, the current crypto market remains volatile, with narratives evolving rapidly. The key challenge for Aztec, much like other projects leveraging token launches for short-term attention and liquidity, will be to demonstrate its ability to sustain ecosystem development and attract long-term participation from developers and users. Only time will tell if Aztec can truly solidify its position in the evolving privacy landscape.

(The above content is an excerpt and reproduction authorized by our partner PANews. Original Link)

Disclaimer: This article provides market information only. All content and opinions are for reference only, do not constitute investment advice, and do not represent the views and positions of BlockBeats. Investors should make their own decisions and trades. The author and BlockBeats will not bear any responsibility for direct or indirect losses incurred by investor transactions.