Bitcoin’s Crossroads: Fear Index, Death Cross, and Macroeconomic Headwinds

Following the conclusion of the US government shutdown last week, the market failed to gain traction, instead undergoing a significant correction that saw Bitcoin (BTC) tumble to the $95,000 mark. As the weekend unfolded, the crypto community became fixated on two pivotal indicators: the Fear Index and the Death Cross. These indicators have ignited a fervent debate: Is Bitcoin’s current price a cyclical bottom, or does it portend further downside?

The Fear Index: A Glimmer of Hope?

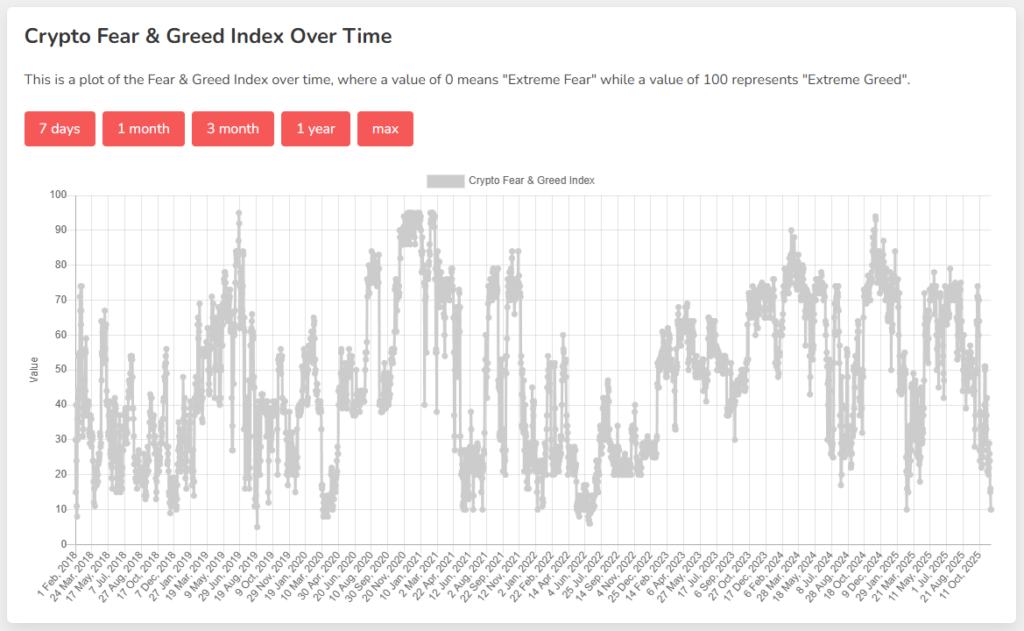

The Fear Index, a gauge of market sentiment, registered a reading of 10 on two occasions in 2025: this past weekend and the day after former President Trump’s “Liberation Day” announcement of reciprocal tariff policies in April. For proponents of a bottom, this low reading presents a prime ‘buy the dip’ opportunity, especially given historical precedents.

Indeed, every instance of the Fear Index dropping to 10 or below has historically been followed by a notable BTC rebound within a month. However, it’s crucial to remember that similar lows were observed multiple times during the 2021-2022 bear market, suggesting that while a rebound is possible, the true implications for a definitive market bottom remain uncertain.

The Death Cross: A Bearish Omen?

Adding to the market’s apprehension is the appearance of a “Death Cross” on Bitcoin’s daily chart. This technical pattern occurs when the 50-day Simple Moving Average (SMA) falls below the 200-day SMA (the inverse being a “Golden Cross”). This phenomenon has manifested several times in recent years, carrying significant implications for BTC’s trajectory.

Historically, if the BTC price manages to reclaim the 50-day SMA within one to two weeks post-cross, it often signals a strong short-term rebound. Conversely, continued decline, reminiscent of 2021, typically ushers in an extended bear market. Alarmingly, the current BTC decline following this Death Cross has been more pronounced than previous instances. Therefore, if Bitcoin fails to rebound towards the $100,000 vicinity this week, we face a significantly elevated technical probability of entering a prolonged bear market.

Macroeconomic Volatility Ahead

The re-opening of the US government means a deluge of critical economic data is slated for release this week. This influx of information is poised to trigger substantial volatility across both traditional equities and the cryptocurrency market. Favorable data could bolster expectations for a December interest rate cut, potentially fueling a market rally. Conversely, disappointing figures, stoking fears about the US economic trajectory, might induce investor panic, even in the face of a Federal Reserve rate reduction.

Furthermore, as the year-end and Christmas holidays approach, European and American markets traditionally see early investor withdrawals. Should market conditions deteriorate, thwarting the eagerly anticipated ‘Christmas rally,’ investors might initiate de-risking strategies as early as November, potentially leading to further downward pressure.

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice, nor do they represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.