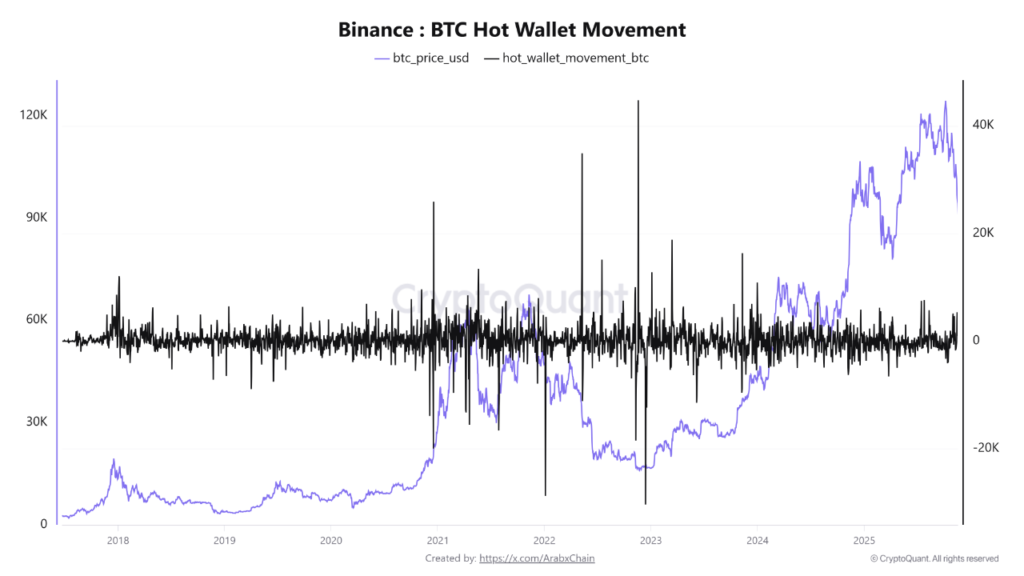

Binance Witnesses Unprecedented Hot Wallet Activity Amidst Soaring Bitcoin Reserves: A Deep Dive into Market Dynamics

Recent analysis from Arab Chain reveals a significant surge in Binance’s “Hot Wallet Movement” indicator. This key metric, reflecting internal exchange activity, has soared to an astounding 5,400 Bitcoin in a single day—a level not seen since August of last year. This dramatic increase coincides with Binance’s Bitcoin reserves climbing to 582,000 BTC, marking a new peak since September 2023. These combined indicators offer crucial insights into the current state of the crypto market, suggesting a pivotal shift in internal liquidity dynamics rather than external capital outflows.

Typically, heightened hot wallet activity signals an intensification of trading behavior. In the present context, this surge strongly points towards an escalation of selling pressure originating from within the exchange. The crucial detail here is that despite this active movement, Binance’s Bitcoin reserves are not diminishing; instead, they are expanding. This suggests that holders, after depositing their Bitcoin, are choosing to retain their assets on the platform rather than withdrawing them. Instead, they are actively transferring these substantial amounts internally, very likely in preparation for significant sell-offs.

This pattern aligns closely with recent market trends, particularly Bitcoin’s price trajectory towards the $90,000 range. Periods of increased volatility, such as those observed recently, often trigger rapid position adjustments among short-term investors and large-scale holders, commonly referred to as “whales.” The internal movement of 5,400 BTC in a single day is therefore more than just routine transfers; it signifies a massive volume of Bitcoin actively circulating within Binance, poised for immediate transactions, predominantly sales.

It’s vital to distinguish this from withdrawal-driven hot wallet activity, which would typically lead to a substantial decrease in exchange reserves. The actual increase in Binance’s reserves unequivocally confirms that liquidity remains firmly within the platform. Concurrently, the climbing hot wallet indicator underscores aggressive trading activity, which is highly probable to be contributing to the prevailing downward pressure in the market.

Disclaimer: This article is for market information purposes only. All content and views are for reference only, do not constitute investment advice, and do not represent the views and positions of BlockTempo. Investors should make their own decisions and trades, and the author and BlockTempo will not bear any responsibility for direct or indirect losses resulting from investor transactions.