JPMorgan Warns MicroStrategy Faces Billions in Outflows Amid Potential Index Exclusion

New York, NY – Investment banking giant JPMorgan Chase has issued a stark warning regarding MicroStrategy, often dubbed a “Bitcoin whale” due to its substantial cryptocurrency holdings. A recent report from the Wall Street firm suggests the company is bracing for a potential “capital storm,” with analysts predicting billions of dollars in “fund exodus” if MicroStrategy is removed from key equity indices such as MSCI.

The Shrinking Premium and Index Exclusion Fears

A team of analysts led by Nikolaos Panigirtzoglou highlighted on Wednesday that MicroStrategy’s stock performance has significantly lagged behind Bitcoin itself in recent months. This underperformance is attributed not only to investors questioning the rationale behind the stock’s “high valuation premium,” which has led to a sharp contraction in its premium space, but also to a deeper market concern: the looming possibility of the company being “swept out” of major indices.

Currently, MicroStrategy remains a constituent of influential benchmarks including the Nasdaq-100 Index, the MSCI USA Index, and the MSCI World Index.

Billions at Risk: The Passive Fund Factor

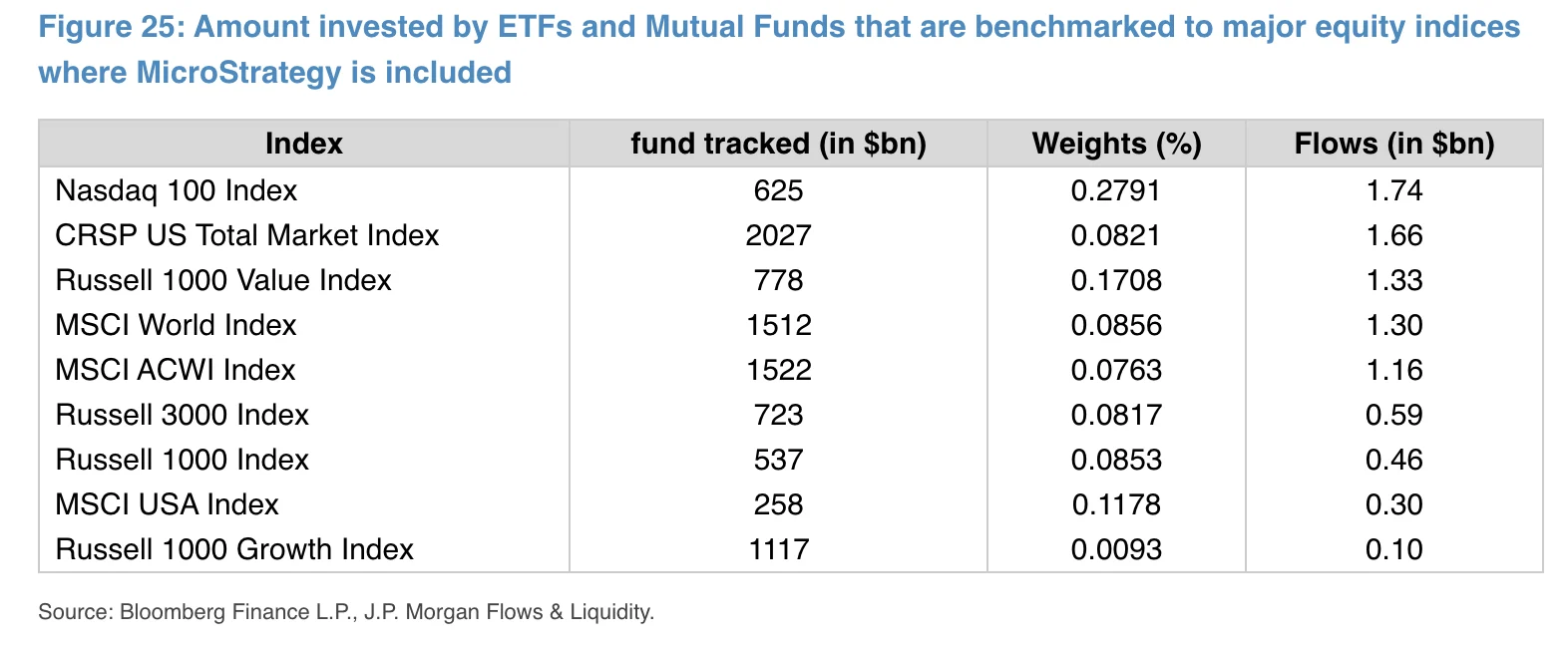

JPMorgan’s estimates reveal a significant dependency on passive investment vehicles. Out of MicroStrategy’s approximately $50 billion market capitalization, an estimated $9 billion is held by passive funds that meticulously track these aforementioned indices. This mechanism has, in effect, allowed Bitcoin to indirectly permeate a broad spectrum of retail and institutional investment portfolios.

However, analysts caution that this influx of capital could rapidly reverse into a colossal sell-off if MicroStrategy faces delisting.

Should MicroStrategy be removed from these indices, the high proportion of passive fund holdings would exert immense pressure on the company’s valuation. JPMorgan projects that an exclusion from MSCI indices alone could trigger an outflow of approximately $2.8 billion. If other index providers follow suit, the total capital outflow could escalate dramatically, potentially reaching $8.8 billion.

Beyond Passive: A Negative Signal and Liquidity Concerns

While active fund managers are not strictly bound to mirror index changes, analysts emphasize that an index exclusion would send a powerful “negative signal” across the market. Such a move could not only cast doubt on MicroStrategy’s future capacity to issue debt or raise additional capital but also lead to a significant depletion of trading volume and liquidity. This, in turn, could deter large institutional investors from entering or maintaining positions in the stock.

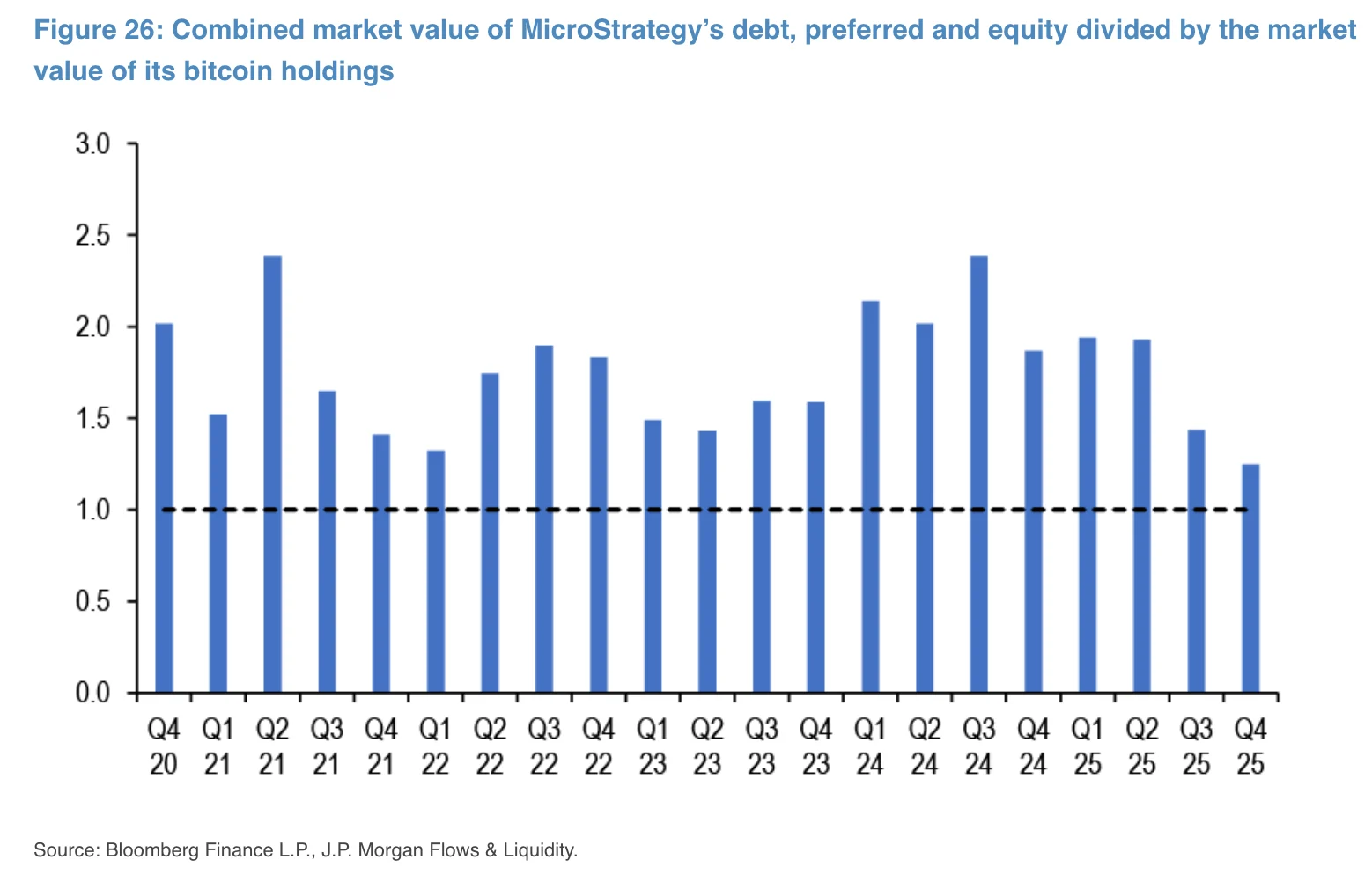

The report further notes that the ratio of MicroStrategy’s total enterprise value (encompassing debt, preferred stock, and equity) to the value of its held Bitcoin has plummeted to its lowest level since the onset of the COVID-19 pandemic.

An unfavorable decision from MSCI could push this critical ratio further towards 1. This would signify that the market no longer assigns any premium to MicroStrategy, effectively viewing the company solely as a straightforward “Bitcoin holding vehicle” without any additional value or strategic advantage.

The Decisive Date: January 15, 2026

JPMorgan has pinpointed January 15, 2026, as a “decisive” day for MicroStrategy’s stock. This critical timeline stems from an announcement made by MSCI late last month.

MSCI initiated a consultation process to gather feedback on potentially excluding companies from its indices if their primary business involves Bitcoin or cryptocurrency reserves, and if these holdings constitute 50% or more of their total assets. This consultation period is set to conclude on December 31st of this year. The results of this consultation are expected to be announced on January 15th next year (i.e., January 15, 2025). Any subsequent changes to index constituents would then take effect during the February 2026 index review. JPMorgan’s designation of January 15, 2026, as a “decisive” day likely refers to the finalization or official announcement of MicroStrategy’s index status for this upcoming February review.

Disclaimer: This article is for market information purposes only. All content and opinions are for reference only, do not constitute investment advice, and do not represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.