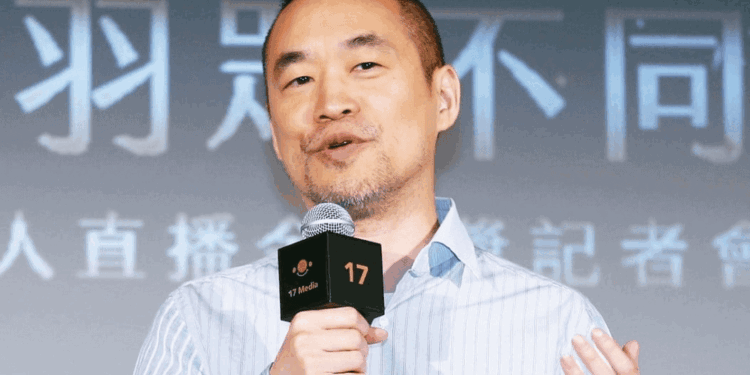

Jeffrey Huang, “Machi Big Brother,” Continues High-Stakes Ethereum Bets Amidst Repeated Liquidations

Jeffrey Huang, the prominent Taiwanese rapper and cryptocurrency figure widely known as “Machi Big Brother,” has once again found himself at the epicenter of crypto market discussions. Despite a recent flurry of liquidations on his Ethereum (ETH) leveraged positions, particularly throughout October, Huang’s unwavering resolve in high-stakes trading has earned him the unofficial moniker “Liquidation King.”

Just recently, as the broader cryptocurrency market experienced a downturn, Huang’s leveraged long position on Ethereum was liquidated yet again. However, this setback did little to dampen his trading enthusiasm. Moments after his position was wiped out, Huang promptly deposited an additional $115,000 into Hyperliquid, immediately re-entering a 25x leveraged long position on ETH. For Huang, this cycle of being “shaken off the ride only to swiftly jump back on” has become an almost daily routine.

As of writing, Huang’s current leveraged position exceeds 1,550 Ethereum, valued at approximately $4.39 million. His entry price stands at $2,883.93, with a liquidation price set at $2,818.37. Given Ethereum’s current trading price of $2,837.97, any significant market fluctuation could trigger another swift liquidation of his substantial holdings.

Data from Hyperdash further illustrates this relentless pattern. For over a week, Huang has been caught in a continuous loop of “adding positions > liquidation > depositing funds,” repeatedly facing losses but consistently re-engaging. This frequent and dramatic trading rhythm has left many observers astonished.

According to Lookonchain’s statistics, since the cryptocurrency market downturn on October 11th, Jeffrey Huang has been liquidated a staggering 145 times.

Machi Big Brother(@machibigbrother) got liquidated again.

Since the Oct 11 market crash, he has already been liquidated 145 times.https://t.co/P6lglcgpo pic.twitter.com/7Z3P7SVfYR

— Lookonchain (@lookonchain) November 20, 2025

Huang’s overall trading performance paints a stark picture. Hyperbot trading statistics reveal that over the past month, out of 10 trades, the market has almost consistently moved against him. Nine of these positions resulted in losses, with only one yielding a profit, bringing his win rate to a mere 10%. Cumulatively, his realized losses have reached an alarming $6.48 million.

This contrasts sharply with his financial standing in September, when his address showed an impressive unrealized profit of $45.66 million, leading many investors to view him as a “market winner.” However, with the market’s sharp reversal in October, these substantial gains have been entirely wiped out, now turning into an unrealized loss exceeding $18.46 million.

These dramatic developments have sparked considerable discussion among crypto enthusiasts. Many lament the double-edged sword of high leverage, which, while amplifying potential gains, equally magnifies risk. Comments from netizens range from the resigned, “He’s either being liquidated or on his way to being liquidated,” to the sarcastic, “Is he an undercover agent sent by the bears?” and “At least Machi Big Brother isn’t running away with liquidity; instead, he keeps adding it – a true crypto role model!” Others express sympathy, stating, “Machi Big Brother’s recent streak is truly heartbreaking; the market is unpredictable, everyone needs to stay strong!”

Regardless of support or skepticism, Jeffrey Huang’s audacious trading maneuvers have undeniably become one of the most talked-about topics in the crypto sphere this month. The future trajectory of Ethereum will determine whether this “Liquidation King” manages a spectacular comeback or continues his cycle of consecutive liquidations, keeping the market on edge.

Disclaimer: This article provides market information only. All content and opinions are for reference purposes only and do not constitute investment advice. They do not represent the views or positions of the author or the publisher. Investors should make their own decisions and trades. The author and the publisher will not be held responsible for any direct or indirect losses incurred by investors’ trading activities.