By Zhou, ChainCatcher

The cryptocurrency market is currently navigating a protracted downturn. Since November, Ethereum (ETH) has seen its price plummet by nearly 40% from its peak, while Ethereum-focused Exchange Traded Funds (ETFs) have experienced persistent net outflows. Amidst this systemic retreat, BitMine, the largest institutional holder of Ethereum, has emerged as a focal point of market debate.

Intriguingly, capital sentiment is sharply divided: Peter Thiel’s Founders Fund has reportedly halved its stake in BitMine (BMNR), yet Cathie Wood’s ARK Invest and JPMorgan Chase have chosen to increase their positions, going against the prevailing trend. This stark divergence in institutional strategy has thrust BitMine’s ambitious “5% Alchemy” — its goal to acquire a significant portion of Ethereum’s supply — onto the critical stage.

With 3.56 million ETH under its belt, facing an estimated $3 billion in unrealized losses, and its market-to-net-asset-value (mNAV) ratio dipping to 0.86, crucial questions arise: How much longer can BitMine, often seen as one of the last major buyers for Ethereum, sustain its aggressive accumulation? Does its current valuation truly reflect its underlying assets and strategy, or is there a significant market mismatch? And as the broader digital asset treasury (DAT) flywheel appears to be losing momentum, who will step in to provide the necessary buying pressure for Ethereum?

BitMine’s “5% Alchemy”: Sustaining the Strategy Amidst Market Pressures

BitMine, recognized as a prominent cryptocurrency reserve company second only to MicroStrategy, embarked on an ambitious plan to acquire tokens equivalent to 5% of Ethereum’s total circulating supply. As of November 17, the company reported its Ethereum holdings had reached 3.56 million ETH, representing nearly 3% of the total circulating supply and marking the halfway point towards its long-term target of 6 million ETH. Beyond its substantial ETH reserves, BitMine’s diversified portfolio includes approximately $11.8 billion in total crypto assets and cash, comprising 192 Bitcoin, $607 million in unencumbered cash, and 13.7 million shares of Eightco Holdings stock.

The company gained significant market attention in July when it initiated its large-scale accumulation strategy. During this period, BitMine’s stock price (BMNR) mirrored Ethereum’s upward trajectory, establishing a compelling “crypto-to-market-cap” narrative that investors viewed as a novel model within the digital asset space.

However, the narrative has shifted dramatically with the recent market cooling and tightening liquidity. Ethereum’s price decline has cast a shadow over BitMine’s aggressive buying strategy. With an estimated average purchase price of $4,009 per ETH, the company now faces nearly $3 billion in unrealized losses. Despite Chairman Tom Lee’s reiterated public confidence in Ethereum and commitment to “buy the dip,” investor focus has pivoted from questioning BitMine’s purchasing capacity to its financial resilience and sustainability.

Funding the Vision: Dual Engines Under Scrutiny

BitMine’s current cash reserves stand at approximately $607 million, primarily fueled by two strategic channels:

- Crypto Asset Earnings: The company generates short-term cash flow through immersion-cooled Bitcoin mining and consulting services. Concurrently, it engages in Ethereum staking, aiming for long-term returns. BitMine projects its staked ETH will yield approximately $400 million in net income annually.

- Secondary Market Financing: BitMine has implemented an “At-The-Market” (ATM) stock sales program, enabling it to issue new shares for cash at any time without predefined pricing or volume. This mechanism has successfully raised hundreds of millions of dollars, attracting significant institutional interest from firms like ARK Invest, JPMorgan Chase, and Fidelity. Tom Lee explicitly stated that capital raised from substantial institutional purchases of BMNR would be directed towards acquiring more ETH.

While this dual-engine approach of ETH accumulation and revenue generation aims to redefine corporate capital allocation, evolving market conditions are challenging the model’s stability. BMNR’s stock price has plummeted roughly 80% from its July peak, with its current market capitalization of approximately $9.2 billion falling below its ETH holdings value of $10.6 billion (calculated at $3,000 per ETH). This results in an mNAV of 0.86, a discount that underscores prevailing market anxieties regarding the company’s unrealized losses and the long-term viability of its funding strategy.

Ethereum’s Fading Pillars: Divergence in Buying Power and Staking Retreat

The broader macroeconomic landscape offers little solace for the crypto market. The Federal Reserve’s hawkish signals have diminished the likelihood of a December rate cut, contributing to overall market weakness and a significant decline in risk appetite. Ethereum, currently testing the $3,000 mark, has plummeted over 30% from its August peak of $4,900. This sharp correction compels a critical re-evaluation: if previous price support was driven by reserve companies and institutional accumulation, who will step in as these buying forces recede?

A closer look at the key market participants reveals a stark divergence across three primary buying segments: ETFs, digital asset treasury (DAT) companies, and on-chain funds.

ETFs: A Slowdown in Institutional Demand

The influx of capital into Ethereum-related ETFs has visibly decelerated. These ETFs collectively hold approximately 6.3586 million ETH, accounting for 5.25% of the total supply. However, data from SoSoValue indicates that as of mid-November, total net assets in Ethereum spot ETFs stood at around $18.76 billion, with net outflows this month significantly outpacing inflows, including a notable single-day outflow of $180 million. This trend marks a shift from the steady upward trajectory observed from July to August, now characterized by volatile declines.

This slowdown not only diminishes a crucial source of potential major buying but also signals that market confidence has yet to fully recover from the recent downturn. ETF investors typically represent medium to long-term capital allocations, and their withdrawal suggests a deceleration in incremental demand for Ethereum from traditional financial channels. When ETFs cease to provide upward momentum, they can, paradoxically, amplify short-term market volatility.

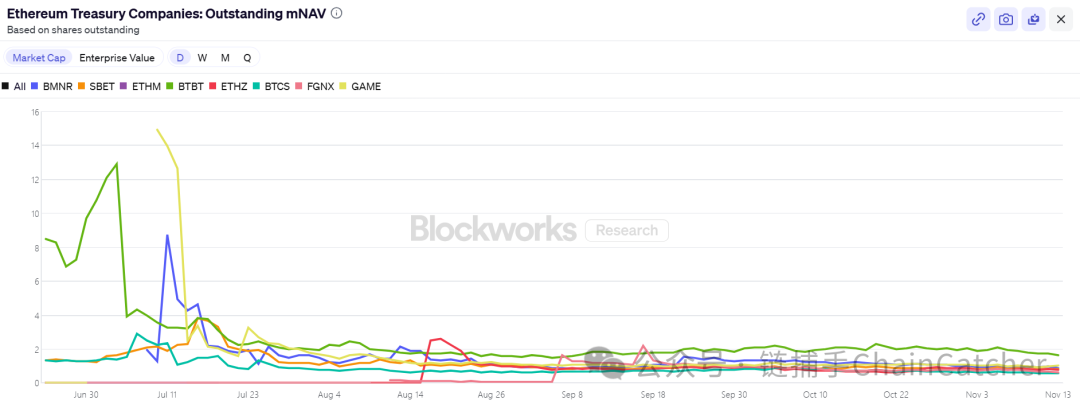

Digital Asset Treasury (DAT) Companies: A Sector in Flux

The DAT sector is also experiencing a period of significant divergence. Strategic Ethereum reserves held by DAT companies total 6.2393 million ETH, or 5.15% of the supply. However, the pace of accumulation has slowed considerably in recent months, with BitMine emerging as almost the sole major player still engaged in large-scale buying. In the past week, BitMine added another 67,021 ETH, adhering to its “buy the dip” strategy. In contrast, SharpLink has not made any further purchases since acquiring 19,300 ETH on October 18, and with an average cost of approximately $3,609, it too is currently facing unrealized losses.

Compounding this trend, some small and medium-sized reserve companies are being forced to contract. For instance, ETHZilla sold approximately 40,000 ETH in late October to repurchase shares, aiming to narrow its stock’s discount and stabilize its price. This divergence signifies a shift within the reserve industry from widespread expansion to a more selective structural adjustment. While leading enterprises leverage their capital and conviction to continue buying, smaller firms grapple with liquidity constraints and debt pressures. The market’s momentum is thus transferring from broad incremental buying to a few “lone warriors” who retain significant capital advantages.

On-Chain Dynamics: Whales and Long-Term Holders Shift Stance

On the blockchain, short-term capital flows are still predominantly driven by whales and high-frequency trading addresses, yet these do not provide sustainable price support. Recent liquidations of prominent Ethereum bulls have somewhat eroded trading confidence. Coinglass data reveals that the total open interest in ETH futures contracts has nearly halved since its August peak, indicating a rapid contraction of leveraged capital and a simultaneous cooling of both liquidity and speculative fervor.

Adding to the selling pressure, several Ethereum ICO wallet addresses, dormant for over a decade, have recently been reactivated and begun transferring funds. Glassnode reports that long-term holders (addresses holding for over 155 days) are currently divesting approximately 45,000 ETH daily, valued at about $140 million. This represents the highest selling level since 2021, clearly signaling a weakening of current bullish forces.

Arthur Hayes, co-founder of BitMEX, recently observed that while USD liquidity contraction since April 9 was initially offset by ETF inflows and DAT purchases for Bitcoin, this dynamic has concluded. He argues that the basis is no longer attractive enough for institutional investors to continue buying ETFs, and with most DATs trading at a discount below their market-to-net-asset-value, investors are increasingly shying away from these derivative securities.

Ethereum’s Staking Ecosystem Retreats

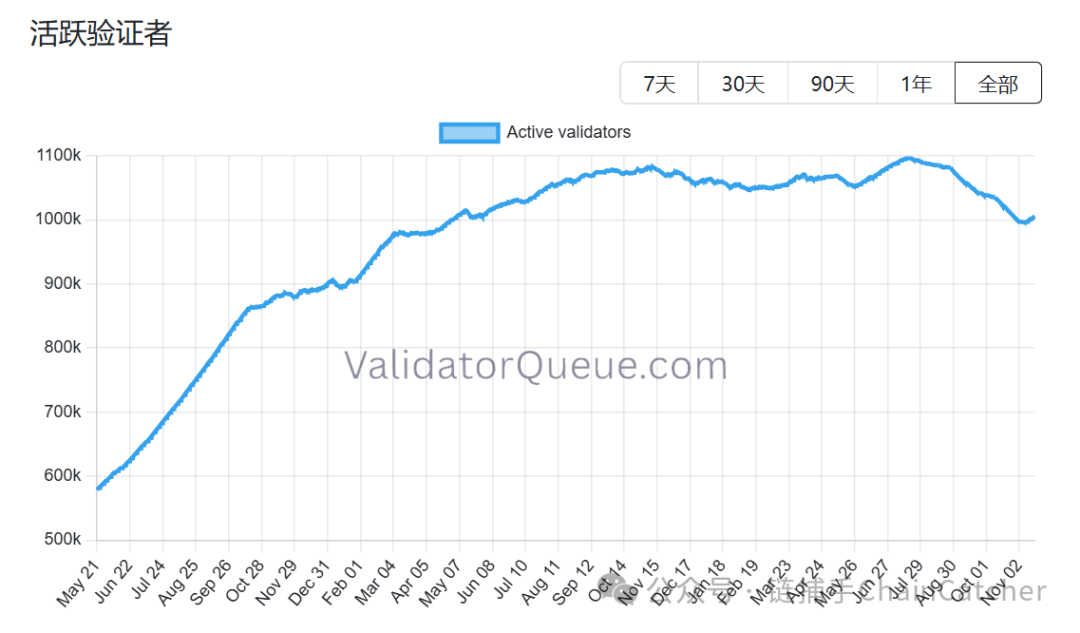

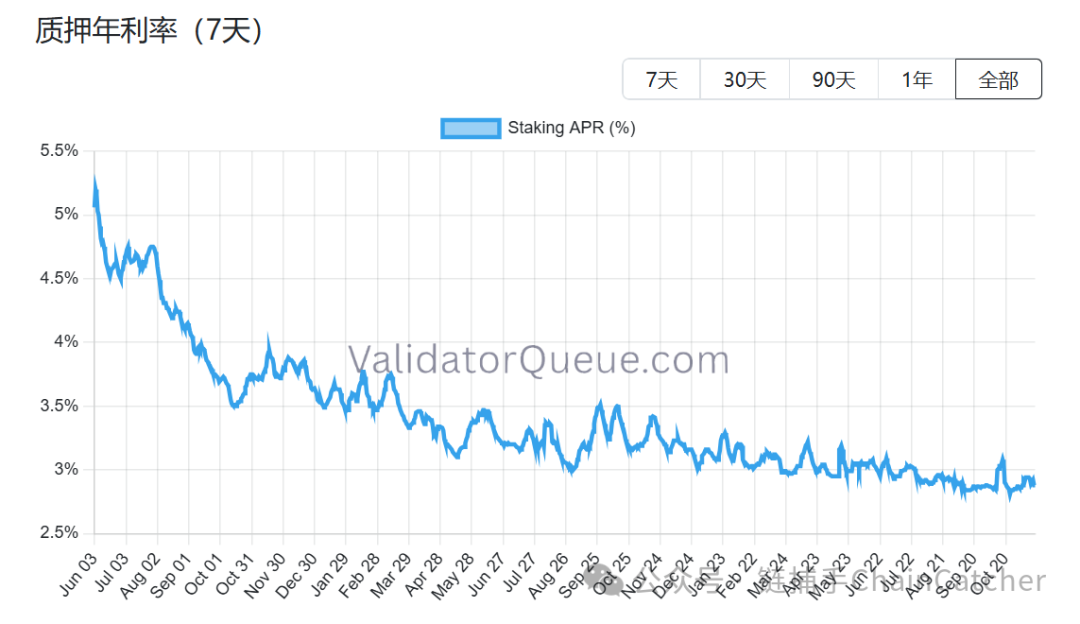

The challenges extend to Ethereum’s native staking ecosystem, which is also showing signs of contraction. Beaconchain data indicates that the number of daily active Ethereum validators has decreased by approximately 10% since July, reaching its lowest level since April 2024. This marks the first such significant decline since the network’s pivotal transition from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism in September 2022.

This decline is primarily attributable to two factors:

- Profit-Taking Exits: The earlier Ethereum price surge this year led to an unprecedented peak in validator exit queues, as staking operators hastened to unstake their ETH and realize profits.

- Reduced Profitability: A combination of falling staking yields and rising borrowing costs has rendered leveraged staking largely unprofitable. Ethereum’s current annualized staking yield is approximately 2.9% APR, a significant drop from its historical high of 8.6% recorded in May 2023.

With three major buying pathways simultaneously under pressure and the staking ecosystem receding, Ethereum’s next phase of price support faces a profound structural test. BitMine, though still actively buying, appears increasingly isolated in its efforts. Should even this last significant pillar falter, the market stands to lose more than just a stock or a wave of capital; it risks undermining the very foundational belief in the Ethereum narrative itself.

BitMine’s Valuation Conundrum: A Potential Mismatch?

Following discussions on BitMine’s funding challenges and the broader market’s receding buying interest, a more fundamental question emerges: Is the BitMine narrative truly exhausted? Current market valuations appear to overlook critical structural differences that distinguish BitMine from its peers.

A Differentiated Strategy: BitMine vs. MicroStrategy

BitMine has, from its inception, adopted a fundamentally different strategic approach compared to MicroStrategy. MicroStrategy heavily relies on convertible bonds and preferred shares for secondary market fundraising, incurring hundreds of millions in annual interest expenses, with its profitability intrinsically tied to a unilateral appreciation in Bitcoin’s price. BitMine, conversely, while diluting equity through new share issuances, operates with virtually no interest-bearing debt.

Crucially, its substantial ETH holdings generate an estimated $400-500 million in annual staking revenue. This represents a relatively rigid and predictable cash flow, significantly reducing BitMine’s debt correlation to price fluctuations compared to MicroStrategy’s model.

Moreover, this staking revenue is merely the starting point. As one of the world’s largest institutional ETH holders, BitMine possesses unique optionality that MicroStrategy’s Bitcoin holdings cannot replicate. This includes leveraging staked ETH for advanced strategies such as restaking (potentially earning an additional 1-2%), operating robust node infrastructure, locking in fixed income through yield tokenization (e.g., a guaranteed return of around 3.5%), or even issuing institutional-grade ETH structured notes. These are sophisticated financial maneuvers deeply embedded within the Ethereum ecosystem that offer diverse avenues for value creation.

Market Discount and Institutional Insight

Despite these inherent advantages, BitMine’s (BMNR) US stock market capitalization currently trades at approximately a 13% discount to the underlying value of its ETH holdings. While this discount isn’t the most extreme within the broader Digital Asset Treasury (DAT) sector, it notably deviates from historical market pricing for comparable assets. Bear market sentiment has undoubtedly amplified the perceived impact of unrealized losses, potentially overshadowing the value of BitMine’s robust revenue buffer and the strategic optionality offered by its deep integration into the Ethereum ecosystem.

Recent institutional actions suggest that some sophisticated investors are recognizing this potential valuation discrepancy. On November 6, ARK Invest notably increased its position by 215,000 shares, valued at $8.06 million, while JPMorgan Chase held 1.97 million shares at the end of the third quarter. These moves are unlikely to be speculative “bottom-fishing” but rather strategic decisions predicated on a long-term conviction in the compound growth trajectory of the Ethereum ecosystem. Should Ethereum’s price stabilize or experience a modest rebound, the inherent stability of BitMine’s staking revenue could facilitate a more rapid mNAV recovery path compared to purely leveraged reserve models.

The question of whether a true valuation mismatch exists appears to be answered by the data and institutional positioning. The remaining uncertainty lies in when the broader market will recognize and pay for this scarcity. The current discount, therefore, represents both a risk and a significant point of divergence for investors. As Chairman Tom Lee aptly put it, the current market pain is short-term and will not alter the long-term Ethereum supercycle. And, by extension, it may not diminish BitMine’s pivotal role within that unfolding cycle.