Aave’s Strategic Evolution: Pioneering On-Chain Capital Markets with V4 and the Aave App

Aave stands as a foundational pillar within the decentralized finance (DeFi) ecosystem, renowned for its robust liquidity and unwavering trustworthiness. Commanding over half of the total value locked (TVL) in the lending market, Aave has cemented its position as the preferred platform for both institutional and retail participants.

Through strategic cross-chain expansion and a steadfast commitment to conservative risk management, Aave has forged a formidable competitive moat. Its continuous innovation, from the V3 protocol’s dual-market structure to the forthcoming Liquidity Hub and Spokes in V4, underscores its evolution. Aave is not merely maintaining its market dominance; it is actively transforming into the essential infrastructure layer for the entire on-chain capital market.

Unparalleled Market Dominance and Strategic Positioning

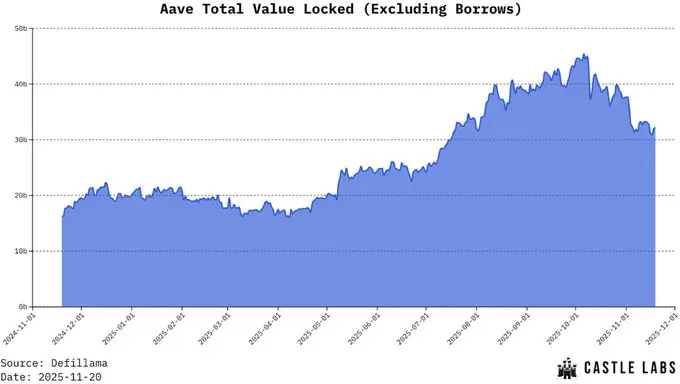

Aave’s leadership in the lending protocol landscape is undisputed, with its TVL dwarfing that of its closest competitors. As of the time of writing, Aave’s TVL hovers around an impressive $54 billion, exceeding five times that of the second-largest lending protocol, Morpho, which stands at approximately $10.8 billion. This immense scale creates a significant barrier to entry, enabling Aave to attract substantial institutional capital while simultaneously offering seamless participation avenues for retail users seeking passive income opportunities.

Aave’s growth trajectory remains consistently strong, recently achieving an all-time high in TVL. This sustained expansion is a testament to its first-mover advantage, relentless product iteration, and a comprehensive multi-chain deployment strategy.

Currently deployed across 19 different blockchains, Aave strategically concentrates the vast majority of its liquidity (over 80%) on the Ethereum mainnet, followed by Plasma. Within the Layer 2 ecosystem, Arbitrum hosts the largest share of Aave’s liquidity, with Linea and Base also seeing significant adoption. This calculated deployment reflects Aave’s core strategy: prioritizing the deep liquidity and security offered by Ethereum, while prudently expanding into Layer 2 networks that demonstrate growing user activity and demand.

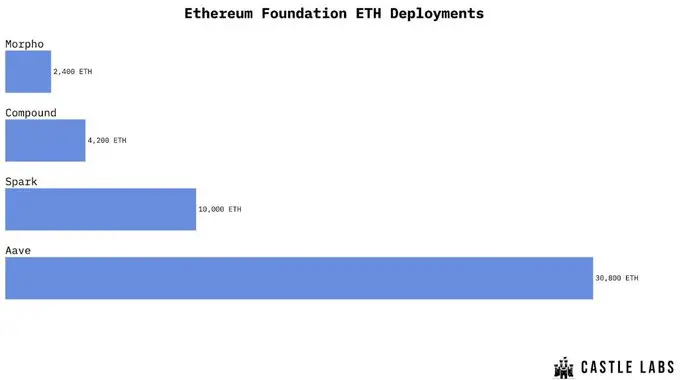

The profound liquidity depth offered by Aave is particularly attractive to high-net-worth individuals and institutional investors. Such users can execute large-scale borrowing and lending operations without triggering significant fluctuations in interest rates. A compelling example of this advantage is the Ethereum Foundation’s decision to deposit 30,800 ETH into Aave in February 2025, validating its capacity for substantial capital deployment.

Furthermore, Aave has strategically ventured into the Real World Asset (RWA) lending sector through its Horizon market, which currently boasts a market size of approximately $600 million. Aave facilitates RWA lending by accepting collateral from reputable issuers like Superstate and Centrifuge, primarily in the form of tokenized money market funds. This initiative positions Aave as a crucial bridge between traditional financial institutions and the burgeoning DeFi space, forming an integral part of its broader strategy to attract institutional funds and complement its extensive existing on-chain user base.

Core Functionality and Architectural Innovation

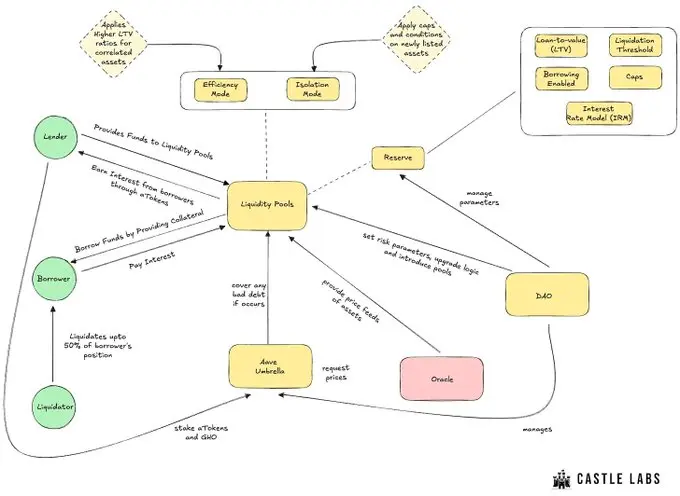

At its heart, Aave operates on a sophisticated liquidity pool model. Users deposit their assets into shared liquidity pools, in return receiving aTokens that represent their deposited positions. These aTokens accrue interest over time and can be subsequently utilized as collateral to borrow other assets.

The Aave V3 platform introduced a groundbreaking dual-market structure, each designed with distinct functionalities:

- Aave Prime Market: Optimized for capital efficiency, this market exclusively supports blue-chip assets. Its signature “High-Efficiency Mode” allows for exceptionally high Loan-to-Value (LTV) ratios, up to 95%, for highly correlated assets such as wstETH and WETH, with a liquidation threshold set at 96.5%. This market currently holds approximately $1.17 billion in assets.

- Aave Core Market: With a broader scope and a staggering size exceeding $42 billion, the Core market supports a diverse array of assets. Its primary focus is robust risk control, implemented through an “Isolation Mode” that limits exposure to higher-risk assets and enforces stricter LTVs, typically below 85%.

This innovative dual-market architecture reflects Aave’s commitment to balancing optimal capital efficiency with paramount system security. However, this structure also inherently leads to liquidity fragmentation, as capital cannot flow freely between the Prime and Core markets. Addressing this challenge is a central objective of the upcoming V4 iteration.

The diagram below illustrates the interconnected components within the Aave ecosystem, highlighting their synergistic operation that underpins Aave’s status as a leading money market protocol.

Liquidity Pools and Reserve Parameters

Each token market on Aave is underpinned by a reserve, with critical parameters meticulously managed by the Aave DAO:

- Loan-to-Value (LTV): Defines the maximum percentage of collateral value that can be borrowed. For example, an 85% LTV allows a user to borrow $850 against $1,000 worth of ETH collateral.

- Liquidation Threshold: The point at which the collateral’s value, relative to the loan, can trigger a liquidation. This is typically set slightly above the LTV to provide a safety buffer.

- Borrowing Enabled: A toggle that determines whether borrowing is permitted for a specific reserve.

- Caps: Upper limits imposed on supply or borrow amounts, designed to prevent the system from becoming overly exposed to volatile or high-risk assets.

- Interest Rate Model: A dynamic mechanism that adjusts borrowing and lending costs based on the utilization rate of the funds. High utilization rates drive up interest, incentivizing repayments or encouraging additional supply.

Collectively, these parameters establish an adaptive and decentralized risk management framework for Aave, continuously updated through community governance to respond effectively to evolving market conditions.

Aave Umbrella (Formerly Safety Module)

The Aave Umbrella system, previously known as the Safety Module, provides a crucial layer of security. Users can stake aTokens or GHO to earn rewards, with these staked assets serving as a vital backstop against potential protocol bad debt. In the event of an insolvency scenario, these staked assets can be liquidated to cover losses. Furthermore, designated sub-DAOs offer initial bad debt guarantees of up to $100,000, establishing an effective insurance mechanism for the protocol.

Robust Liquidation Mechanism

The liquidation mechanism is another cornerstone of Aave’s operational robustness. Every loan position is continuously monitored by a “health factor,” calculated as follows:

Health Factor = (Collateral Asset Value × Liquidation Threshold) / Borrowed Value

A position becomes eligible for liquidation when its health factor drops below 1. For instance, if a user deposits $1,000 worth of ETH as collateral with an 88% liquidation threshold and borrows $800 in USDC, their initial health factor would be 1.1. Should the price of ETH fall to $900, the health factor would decrease to 0.99, immediately triggering the liquidation process.

Liquidators are incentivized to repay up to 50% of the borrower’s outstanding debt in exchange for a discounted portion of the collateral. This mechanism not only safeguards Aave’s solvency but also creates a dynamic market opportunity for arbitrageurs and specialized liquidation bots.

Efficiency Mode and Isolation Mode

- Efficiency Mode: Designed to maximize borrowing capacity for highly correlated assets, such as ETH staking derivatives. This mode facilitates capital-efficient operations including recursive lending, looping strategies, and leveraged staking.

- Isolation Mode: Effectively mitigates risks associated with newer or highly volatile tokens by restricting the types of assets that can be borrowed and imposing strict limits on exposure.

These sophisticated mechanisms embody Aave’s core philosophy: continuously enhancing capital efficiency within controlled risk parameters, while always maintaining a prudent and cautious approach to expansion.

Aave V4 and the Game-Changing Aave App

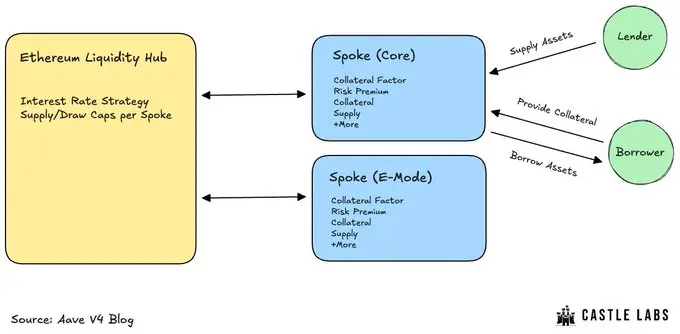

The recently launched Aave V4 on testnet represents a pivotal advancement, directly addressing the challenge of liquidity fragmentation and propelling Aave towards becoming a modular lending infrastructure.

At the core of V4 is the **Liquidity Hub**, a centralized aggregator designed to unify liquidity from both the Prime and Core markets. This innovation ensures that funds flow dynamically to where they are most needed, rather than remaining locked in isolated silos, thereby significantly enhancing capital efficiency and reducing idle deposits.

A complementary innovation is **Spokes**, specialized market instances that connect directly to the Liquidity Hub. Each Spoke can be configured with independent parameters—for example, supporting long-tail assets or setting specific supply and borrowing caps. The Liquidity Hub then ensures that all Spoke parameters operate within the overarching system rules. This modular design allows for “edge innovation” and experimentation while safeguarding the security and stability of the core system.

Collectively, these upgrades signify Aave’s transformation from a singular lending protocol into the foundational layer of the on-chain capital market. Through intelligent liquidity integration and a modular architectural design, Aave V4 is laying the groundwork to remain the cornerstone of DeFi lending for years to come.

In another significant development this week, Aave unveiled the **Aave App**, a product designed to empower retail users with access to competitive annualized yields of up to 6.5%, complemented by balance protection of up to $1 million.

This launch marks a monumental leap forward, democratizing access to the DeFi landscape for a broad segment of retail users who previously faced significant barriers. The Aave App seamlessly integrates both on-chain and off-chain services, delivering an optimized and user-friendly experience. Its highly competitive annualized yield surpasses those offered by traditional investment avenues such as bonds and conventional bank deposits, presenting a superior alternative for the average user.

Conclusion: Aave’s Enduring Leadership in On-Chain Finance

Aave is strategically solidifying its position as the leading on-chain financial institution. The two major advancements recently announced—the V4 upgrade (currently in testnet) and the launch of the Aave App—are perfectly aligned with its ambitious development roadmap. V4 heralds a shift towards a more flexible and modular architecture, while the Aave App is poised to onboard entirely new user demographics into the DeFi ecosystem. Furthermore, its Horizon RWA market continues to enhance the utility of tokenized assets, providing users with convenient avenues to borrow funds against them.

As the undisputed frontrunner in on-chain lending, Aave has established profound market dominance. It remains one of the premier platforms for institutions, ‘whales,’ and everyday DeFi users seeking to deposit stablecoins and other digital assets. Bolstered by its unparalleled scale and robust risk control mechanisms, Aave’s leadership position is set to endure for the foreseeable future.

While the lending sector will undoubtedly see the emergence of diverse protocols, with some successfully carving out and cultivating niche markets, Aave stands as the benchmark. It consistently leverages its profound liquidity and sheer scale to reinforce its competitive moat, relentlessly driving innovation across the industry.