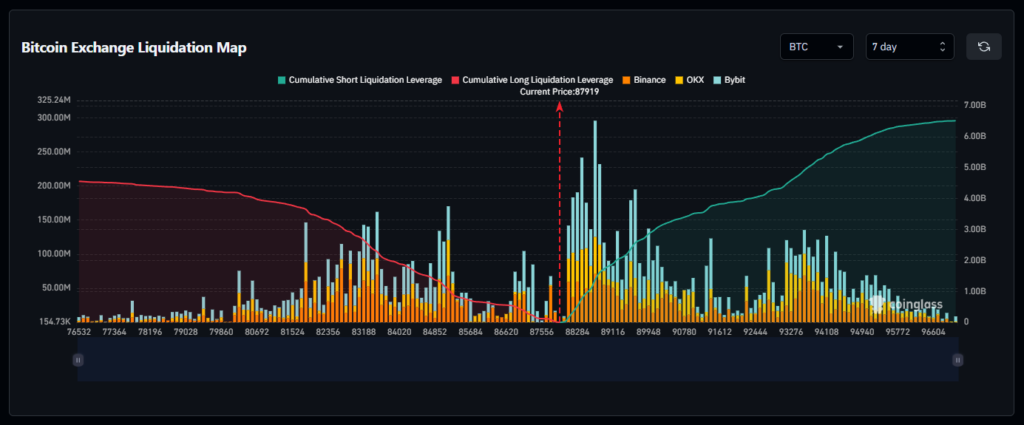

The cryptocurrency market experienced a robust rebound this Monday, mirroring positive movements in US equities. Bitcoin (BTC) successfully breached the $88,000 threshold, while Ethereum (ETH) reclaimed the $2,900 level. This upward momentum saw a significant clearing of short liquidity, particularly as BTC moved past the $88,000-$89,000 range, liquidating numerous short positions. The immediate trajectory for BTC hinges on the performance of US stocks, though a notable accumulation of long liquidity has yet to materialize. Absent any significant negative catalysts, Bitcoin may consolidate around the $88,000 mark.

Adding a layer of complexity to the current market sentiment are recent unconfirmed rumors alleging that JPMorgan is actively shorting MicroStrategy. The purported strategy aims to capitalize on MicroStrategy’s potential exclusion from the MSCI index, intending to destabilize both the company and, by extension, the broader cryptocurrency market. This speculation contributed to a wave of selling pressure last week, as short-term holders sought to hedge positions, briefly pushing Bitcoin down to the critical $80,000 support level. Analysts have warned that a decisive break below $80,000 could usher in a more severe market correction, making this developing narrative one to monitor closely.

The coming days are pivotal, with key US economic data releases on the horizon. Tonight, the Producer Price Index (PPI) will be announced, followed by the more impactful Personal Consumption Expenditures (PCE) report tomorrow. Concerns linger that a potential cancellation of the core PCE data, similar to other recent data omissions, could exert significant downward pressure on the market. While dovish remarks from some Federal Reserve governors last Friday did bolster sentiment and contribute to yesterday’s rally by slightly increasing the probability of a December rate cut, an ambiguous economic outlook could easily trigger another market downturn given the current delicate sentiment.

Disclaimer: This article is for market information purposes only. All content and opinions are for reference only, do not constitute investment advice, and do not represent the views or positions of the author or Blockcast. Investors should make their own decisions and trades. The author and Blockcast will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.