Authored by: Monad Eco

Translated & Edited by: Tim, PANews

As the Monad public chain mainnet officially launches, this comprehensive guide offers a rapid overview of its burgeoning DeFi ecosystem, spotlighting key projects in lending markets, innovative yield products, and robust liquid staking solutions.

Monad is meticulously engineered to usher in the next era of DeFi, capable of supporting millions of users and processing an immense volume of financial operations daily. With an impressive transaction throughput of 10,000 transactions per second (TPS), a blazing-fast 400-millisecond block time, and high finality, Monad is poised to eradicate pervasive DeFi challenges such as failed transactions, excessive slippage, oracle data latency, and prohibitive gas fees. DeFi applications operating on Monad will achieve the efficiency and speed of centralized exchanges, all while maintaining the integrity of a fully decentralized, on-chain network.

Lending Protocols: Fueling DeFi with Accessible Capital

DeFi lending is pivotal in transforming existing assets into dynamic liquidity. On Monad, it evolves into a sophisticated mechanism for amplifying risk exposure. Users can collateralize Liquid Staking Tokens (LSTs) to borrow stablecoins, strategically loop positions for enhanced yields, or deploy diverse collateral strategies tailored to their participation levels. The lending protocols within the Monad ecosystem are designed to offer differentiated product solutions catering to a broad spectrum of user needs.

Curvance

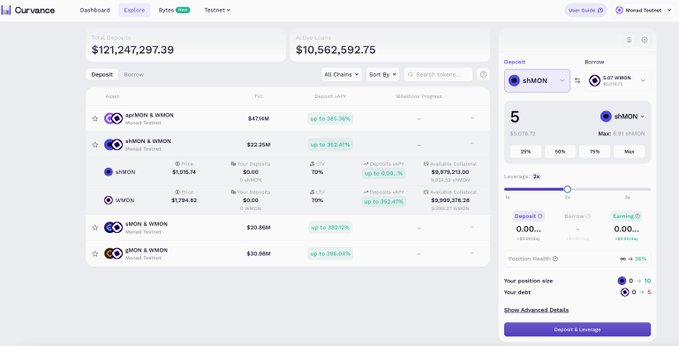

Curvance revolutionizes the creation of leveraged positions, allowing users to convert interest-bearing assets like MON, LSTs, and stablecoins into robust leveraged exposures through a single, streamlined transaction. Its intuitive interface eliminates the cumbersome, repetitive steps of traditional looping operations, such as sequential depositing, borrowing, and re-supplying.

At its core, Curvance prioritizes high capital efficiency, delivering market-leading loan-to-value (LTV) ratios and supporting a wide array of collateral types, including Liquid Staking Tokens, interest-bearing stablecoins, yield derivatives, and vault tokens. The Curvance roadmap also anticipates the integration of more alternative assets, further expanding its utility.

The Curvance protocol features a highly scalable liquidation mechanism, enhancing efficiency through batch liquidations and optimizing fund recovery rates via auction-style settlements. Furthermore, its innovative points program incentivizes both depositors and borrowers, fostering a vibrant and engaged community.

TownSquare

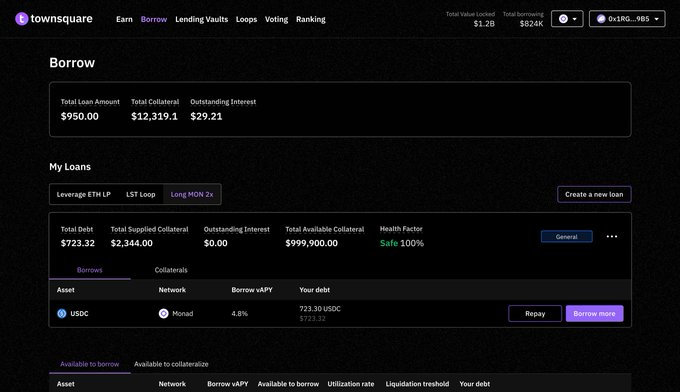

TownSquare adopts a more modular and flexible approach, ideally suited for users who prefer active management of their positions. It enables risk isolation, the mixing of various collateral types, and the customization of each individual loan. Users can establish multiple independent lending positions within a single account, each with its own dedicated collateral portfolio and borrowing objectives.

With TownSquare, you can:

- Utilize Liquid Staking Tokens as collateral to borrow stablecoins.

- Employ stablecoins to borrow MON.

- Combine Liquid Staking Tokens and stablecoins for diversified asset allocation.

All these operations are seamlessly managed through a single wallet, eliminating the need to navigate between disparate interfaces.

TownSquare operates on a unified liquidity pool model, where lenders contribute to a shared pool, while borrowers can construct personalized positions. For correlated assets (e.g., MON and MON-LSTs), TownSquare introduces an “Efficiency Mode,” granting traders seeking to expand their directional exposure access to even higher loan-to-value ratios.

TownSquare’s future plans include supporting a diverse range of Monad Liquid Staking Tokens and more established assets. It also aims to integrate with WLFI’s USD1 stablecoin and issue sUSD1, an interest-bearing token specifically designed for direct incorporation into looping strategies.

Other lending protocols slated to launch on Monad include:

Yield Products: Unlocking Passive Income Opportunities

Beyond its robust lending services, the Monad ecosystem presents a suite of innovative yield products, empowering users to effortlessly capitalize on ecosystem opportunities. These products encapsulate sophisticated investment strategies, active management functionalities, and essential liquidity into easily tradable and usable assets within the DeFi landscape. This ensures that yield generation is both feasible and highly composable from day one. This section highlights two pioneering yield vaults set to launch with the Monad mainnet.

MON Vault: Actively Managed Asset Allocation for Optimized Returns

Developed by Mellow and operated by Steakhouse, the MON Vault offers an actively managed strategy designed for users seeking to earn yield without the complexities of manual operations. It represents a hands-off approach to maximizing MON returns.

Instead of depositing into various independent pools or strategies, users simply deposit their MON tokens. The MON Vault then intelligently and automatically allocates these funds to the most optimal opportunities, including Liquid Staking Tokens, various lending markets, or emerging ecosystem incentive programs.

The MON Vault’s primary focus areas include:

- Proactive allocation across a diverse range of MON yield opportunities.

- Dynamic strategy adjustments in response to the launch of new liquidity platforms and LSTs.

- Efficient routing to a multitude of staking strategies.

The ultimate goal is to create a low-intervention MON yield strategy that precisely captures risk-controlled yield opportunities while maintaining liquidity, composability, and seamless portability across the entire Monad ecosystem.

earnAUSD Vault: Enhanced Yield for High-Liquidity Stablecoins

A collaborative effort by Agora and Upshift, the earnAUSD Vault provides Monad ecosystem users with a comprehensive, one-stop solution for stablecoin yield. Users simply deposit Agora’s USD-pegged stablecoin, AUSD, to receive the freely circulating, interest-bearing earnAUSD token, thereby eliminating the need for personal investment strategy management.

The earnAUSD Vault strategically allocates AUSD assets across multiple yield-generating channels within the Monad ecosystem. As the ecosystem matures, future strategies are anticipated to incorporate more diversified value-added opportunities, such as basis trading and structured yield strategies.

The earnAUSD design is predicated on three core functionalities:

- Optimized Allocation: Automatically allocates funds to markets offering the most compelling risk-adjusted returns.

- Deep Composability: Supports seamless integration across various lending protocols, decentralized exchanges (DEXs), and perpetual futures exchanges.

- Liquidity-First Design: earnAUSD retains its utility as collateral, can be traded in liquidity pools, and benefits from comprehensive ecosystem support.

Furthermore, the earnAUSD Vault integrates the native incentive layers of Agora and Upshift, crafting a unified yield product specifically tailored for stablecoin users entering the Monad ecosystem.

MON Staking and Liquid Staking: Securing the Network, Maximizing Returns

In addition to its innovative lending protocols and yield products, the Monad DeFi ecosystem encompasses essential MON staking and advanced liquid staking services. By staking MON, users contribute to the security and integrity of the network while earning valuable staking rewards. Users can directly stake their MON tokens with validator nodes via platforms like Gmonads or the MonadVision staking dashboard.

Liquid staking offers a transformative alternative to traditional staking. Users who stake their assets receive corresponding Liquid Staking Tokens (LSTs). These LSTs are highly composable within the broader DeFi ecosystem, enabling stakers to simultaneously earn staking rewards and actively participate in other DeFi activities. By maintaining the liquidity of LST tokens, users can engage in a multitude of applications, including asset trading, lending, and providing liquidity across the entire DeFi landscape.

Several protocols within the Monad ecosystem currently provide LSTs:

Thanks to their widespread integration across the ecosystem, these LST tokens empower MON stakers to earn additional yield beyond the foundational staking rewards, unlocking a new dimension of capital efficiency.

The launch of the Monad mainnet is merely the genesis of a vibrant, multi-category DeFi ecosystem, with numerous protocols poised to join the ranks of those mentioned above. This initial suite of foundational protocols will enable users to immediately begin experiencing, optimizing, and strategically positioning themselves to fully unleash the immense potential of a high-performance, full-chain DeFi environment.