From Jeff Park, Bitwise Advisor

Compiled by Moni, Odaily Planet Daily

The Shifting Tides of Bitcoin Volatility: Unpacking a Silent Market Transformation

In a span of just six weeks, Bitcoin’s market capitalization witnessed a staggering $500 billion erosion. This downturn was fueled by a confluence of factors: persistent ETF outflows, a notable Coinbase discount, structural selling pressures, and the liquidation of poorly positioned long holdings, all compounded by a conspicuous absence of clear catalysts for a market rebound. Beyond these immediate pressures, lingering concerns such as whale selling, struggling market makers, a scarcity of defensive liquidity, and even existential threats like the quantum crisis continue to impede any swift recovery.

Amidst this turmoil, a critical question has emerged from the community: What exactly is happening to Bitcoin’s volatility?

The truth is, Bitcoin’s volatility mechanism has undergone a profound, yet subtle, transformation.

For the past two years, a prevailing sentiment suggested that the advent of Bitcoin ETFs had ‘tamed’ the digital asset. This narrative posited that institutional oversight and new market structures had curbed Bitcoin’s notorious swings, transforming it from a highly macro-sensitive asset into a more predictable trading instrument. However, a closer look at the last 60 days reveals a different story: the market appears to be reverting to its historically volatile state.

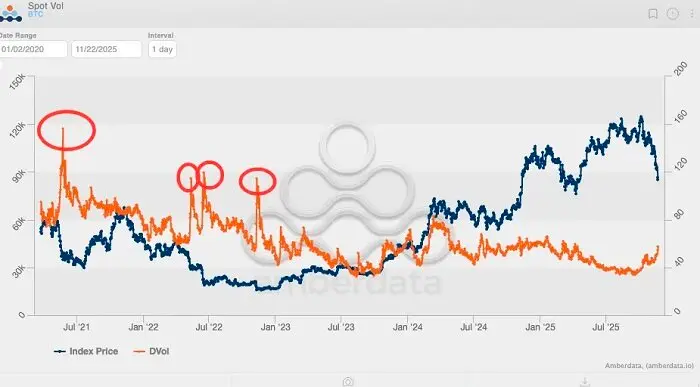

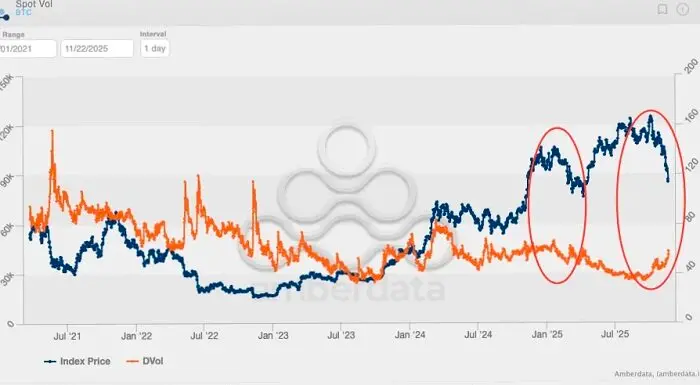

A retrospective analysis of Bitcoin’s implied volatility over the last five years clearly delineates periods of extreme price action:

- The highest peak, a staggering 156%, occurred in May 2021, triggered by a crackdown on Bitcoin mining.

- The second peak, reaching 114%, was observed in May 2022, following the dramatic collapse of Luna/UST.

- A third surge emerged between June and July 2022, coinciding with the liquidation of Three Arrows Capital.

- The fourth significant peak was recorded in November 2022, during the fallout from the FTX collapse.

Significantly, since the FTX collapse, Bitcoin’s implied volatility had not surpassed 80%—until recently. The closest it came was in March 2024, following three months of sustained inflows into spot Bitcoin ETFs.

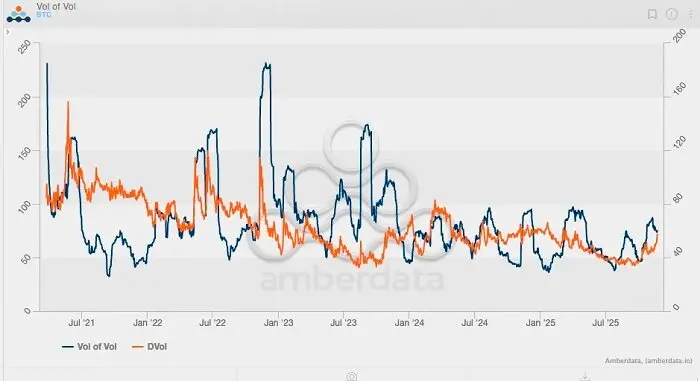

To gain a more granular understanding, we turn to the Bitcoin ‘vol-of-vol’ index—essentially, the second derivative of volatility, reflecting the speed at which volatility itself changes. Historically, this index reached its zenith during the FTX collapse, soaring to approximately 230. Yet, since the regulatory approval of ETFs in early 2024, the vol-of-vol index consistently stayed below 100, with implied volatility trending lower, often detached from spot price movements. This suggested a new era where Bitcoin’s market structure, post-ETFs, seemed to suppress the iconic high-volatility behavior of the past.

The Recent Shift: A Critical Inflection Point

But the last 60 days have marked a significant departure, witnessing Bitcoin’s volatility surge for the first time since early 2024.

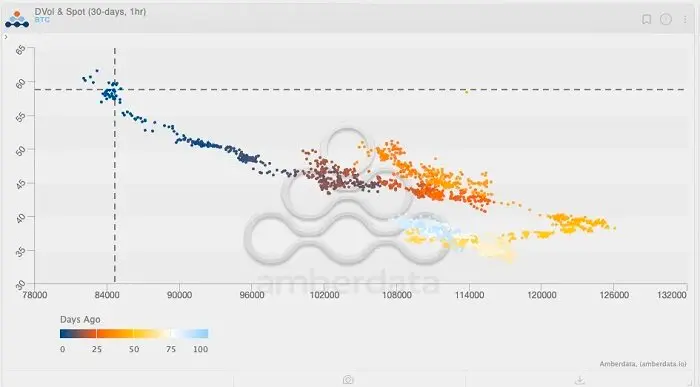

Observing the accompanying chart, particularly the color gradient indicating recent activity (from light to deep blue representing ‘days ago’), reveals a brief but crucial window where the spot Bitcoin vol-of-vol index climbed to around 125, accompanied by rising implied volatility. These indicators initially hinted at a potential market breakthrough, aligning with the historically positive correlation between volatility and spot price. Yet, contrary to expectations, the market did not rally; instead, it reversed course, leading to a downward trend.

What’s even more compelling is the persistence of rising implied volatility (IV) even as spot prices declined—a rare phenomenon in the post-ETF landscape. This unique divergence suggests we might be at another critical ‘inflection point’ for Bitcoin’s volatility dynamics, potentially signaling a return to pre-ETF implied volatility patterns.

The Power of Skew and Options in Price Discovery

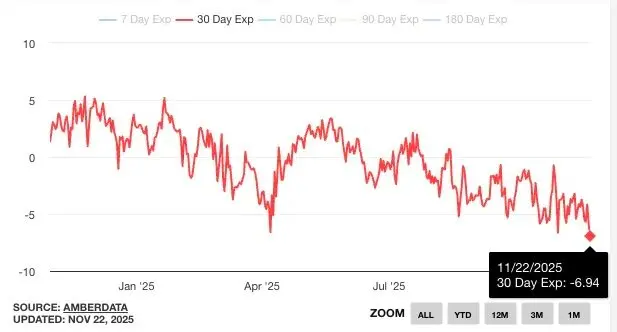

To further dissect this trend, a look at the skew chart is illuminating. During significant market downturns, the skew for put options typically spikes rapidly, reaching as low as -25% during the three major historical events discussed earlier.

However, the most revealing data point isn’t found in market crashes, but in January 2021. During this period, the skew for call options surged past +50%, marking Bitcoin’s last true ‘mega-gamma squeeze’. This event saw Bitcoin’s price explode from $20,000 to $40,000, driven by the breach of its 2017 all-time high, an influx of momentum funds, and an explosive increase in realized volatility. Traders were compelled to buy spot/futures to hedge their short gamma exposure, which in turn further propelled prices. This era also marked Deribit’s first record-breaking retail inflows, as traders discovered the immense leverage of out-of-the-money (OTM) call options.

This analysis underscores a crucial point: it is the evolution of option positioning—not merely spot trading—that has historically engineered decisive moves pushing Bitcoin to new highs.

With Bitcoin’s volatility trends once again reaching an inflection point, there’s a strong indication that price action could, once more, become option-driven. Should this transformation persist, Bitcoin’s next major rally may not solely depend on ETF inflows, but rather emerge from a dynamic, volatile market where more investors seek to capitalize on these swings, as the market begins to fully grasp Bitcoin’s profound potential.

As of November 22, 2024, Deribit’s top five open interest positions by nominal USD value illustrate this speculative interest:

- $85,000 Put Option, expiring December 26, 2025, with $1 billion in Open Interest.

- $140,000 Call Option, expiring December 26, 2025, with $950 million in Open Interest.

- $200,000 Call Option, expiring December 26, 2025, with $720 million in Open Interest.

- $80,000 Put Option, expiring November 28, 2025, with $660 million in Open Interest.

- $125,000 Call Option, expiring December 26, 2025, with $620 million in Open Interest.

Furthermore, BlackRock’s IBIT top ten option holdings as of November 26 further highlight institutional engagement:

While specific put options show substantial open interest, the overall demand for calls, particularly out-of-the-money (OTM) strikes, is also robust. This suggests a market positioning for significant upside potential, with call option strike prices generally further OTM compared to puts, indicating a speculative bullish bias.

Wall Street’s Self-Sustaining Volatility Machine

Observing Bitcoin’s two-year implied volatility chart, the sustained demand for volatility over the past two months closely mirrors the period from February to March 2024—a time many remember as the explosive surge fueled by Bitcoin ETF inflows. This pattern suggests a critical insight: Wall Street thrives on volatility. High volatility in Bitcoin is essential to attract and engage more investors, as the financial industry is inherently trend-driven and aims to maximize profits, especially ahead of year-end bonuses.

Volatility, in essence, acts as a self-sustaining, profit-driven machine for the institutional landscape.

Outlook: The Weeks Ahead

While it remains premature to definitively declare a volatility breakout or predict the subsequent ETF fund flows, and indeed, spot prices could continue their descent. However, if spot prices continue to decline from current levels while implied volatility (IV) simultaneously climbs, it would present a compelling case for a significant price rebound, particularly within a ‘sticky option’ environment where traders maintain a preference for long option positions.

Conversely, should the sell-off persist with volatility stagnating or even declining, the path out of this downturn would narrow considerably, exacerbated by the negative externalities of recent structural selling. In such a scenario, the market might not be merely searching for a rebound but rather gradually solidifying a potential bearish trend.

The coming weeks promise to be exceptionally insightful.