Crypto Market Finds Respite: Bitcoin Nears $90,000 as Key Indicators Signal Shifting Tides

The cryptocurrency market experienced a significant surge last night, mirroring a rebound in US equities. Bitcoin briefly touched the $90,000 mark, while Ethereum reclaimed the crucial $3,000 level, marking a notable recovery in recent times. This uplift arrived just ahead of the US Thanksgiving holiday, a period typically associated with positive pre-holiday stock performance. While this year’s pre-Thanksgiving rally was modest, it provided a much-needed breath of fresh air to a crypto market that has recently been navigating a period of uncertainty.

Looking closer at Bitcoin’s trajectory, the $90,000 threshold now stands as a critical short-term resistance level. A sustained breakthrough and consolidation above this point in the coming days would be instrumental in fueling further upward momentum for the leading cryptocurrency.

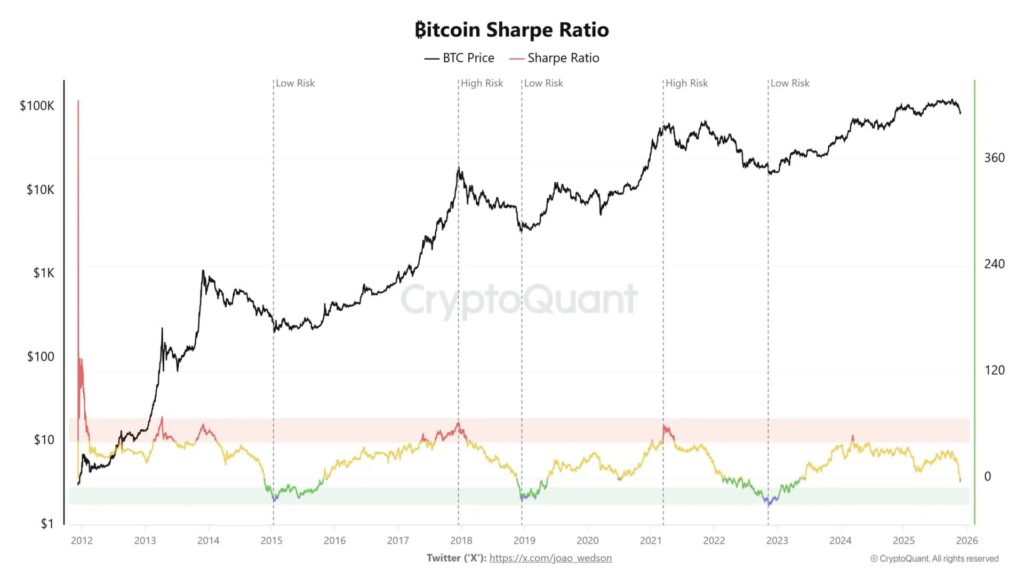

Adding another layer to market analysis, a compelling chart depicting Bitcoin’s Sharpe Ratio has been circulating among crypto investors. This chart illuminates the historical relationship between Bitcoin’s market cycles and its Sharpe Ratio. Historically, when the Sharpe Ratio enters the “green zone,” it signals that Bitcoin’s price is in a bottoming-out phase. A transition to the “blue line” then indicates the precise cycle bottom. Intriguingly, the current data shows the Sharpe Ratio just beginning to turn green, potentially indicating the nascent stages of a bear market. Given its remarkable accuracy over the past decade, this indicator is drawing considerable attention.

With the US stock market closed for Thanksgiving and no major economic data releases scheduled for Friday, the market is anticipated to remain relatively calm over the next two days. Yesterday’s rally was significantly bolstered by unemployment figures that came in lower than anticipated, underscoring the underlying resilience of the US economy. However, from a longer-term perspective, robust economic data might temper expectations for a December interest rate cut. Nevertheless, a series of recent dovish remarks from Federal Reserve officials has seen market expectations for a December rate cut rebound to over 80%. Consequently, the crypto market’s future direction will largely hinge on the performance of US equities throughout December.

Disclaimer: This article is intended for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.