Following a significant 36% retreat from its all-time high, Bitcoin has seen a sharp decline in market sentiment, with price volatility seemingly decoupling from underlying fundamentals. However, leading research firm K33 offers a contrarian view, identifying this steep downturn as a classic “emotional overcorrection.” Far from being a cause for alarm, K33 suggests this period is subtly unveiling compelling long-term investment opportunities, positioning it as an ideal entry point for discerning investors.

Bitcoin’s Unprecedented Underperformance Against Nasdaq

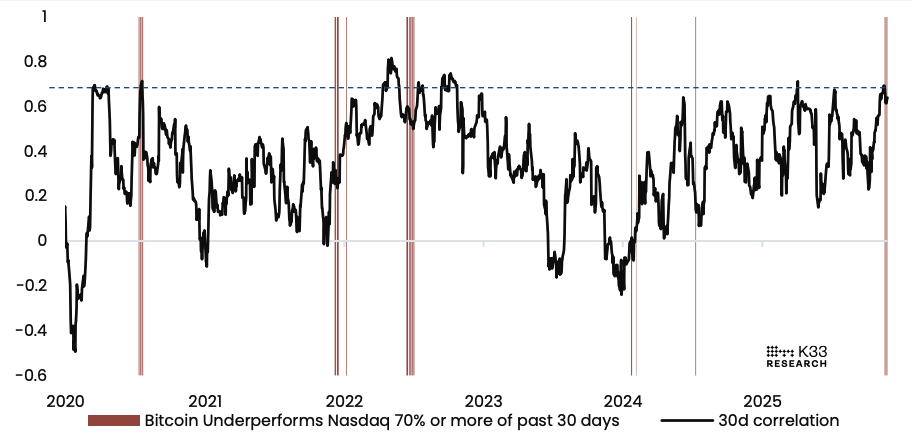

In a recent report, Vetle Lunde, Head of Research at K33, highlighted a striking trend: Bitcoin has underperformed the Nasdaq index on 70% of trading days over the past month. This degree of relative weakness is exceptionally rare, observed only a handful of times since 2020. Quantifying this divergence, Bitcoin’s performance against the Nasdaq has deteriorated by a notable 30% since October 8th.

Historically, instances of such pronounced Bitcoin weakness relative to the Nasdaq have coincided with significant shocks to the broader cryptocurrency market. These include:

- July 2024: Sell-offs initiated by Mt. Gox and the German government.

- January 2024: Substantial capital outflows from Grayscale products.

- June 2022: The cascading effects of widespread collapses across the crypto ecosystem.

The Deleveraging Event: A Catalyst for Current Weakness

Vetle Lunde pinpoints the “deleveraging event” of October 10th as the genesis of Bitcoin’s current relative underperformance. Alarmingly, Bitcoin’s valuation against the QQQ ETF (which mirrors the Nasdaq 100 Index) has plummeted to its lowest point since November 2024.

Lunde further underscores that Bitcoin has entirely surrendered the relative strength it accrued since the US elections, breaching critical relative support levels established in 2021 and early 2024. A distinct characteristic of this downturn, unlike previous crises, is Bitcoin’s amplified response to equity market movements: it plunges more severely during stock market declines yet exhibits a weaker rebound during rallies. K33 interprets this behavior as a clear indicator of a “cooling risk appetite” pervading the crypto market, sustaining persistent selling pressure.

A Fundamental Disconnect: Long-Term Opportunity Amidst Structural Shifts

Despite the immediate headwinds, Vetle Lunde highlights crucial long-term catalysts that distinguish the current market from previous cycles. The impending “Clarity Act” is poised to facilitate greater participation from traditional financial institutions, while forthcoming policy developments are expected to expand access to Bitcoin investment for a broader audience. These factors, Lunde argues, are fundamentally reshaping Bitcoin’s market structure.

He asserts, “We contend that the present valuation of Bitcoin, relative to other risk assets, exhibits a significant disconnect from its underlying fundamentals. For long-term investors, we view Bitcoin as a compelling buying opportunity at these price levels.”

Unpacking the “Shakeout”: Insights from Trading Data

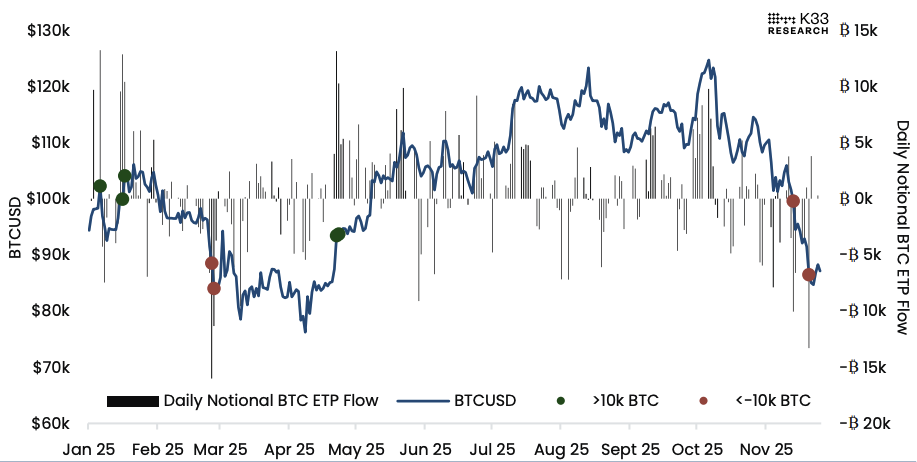

Vetle Lunde suggests that Bitcoin is nearing a “sell-side exhaustion zone,” evidenced by several extreme signals in recent trading activity. On November 21st, Bitcoin briefly touched $80,500, triggering a massive surge in spot trading volume to $14.3 billion – marking the 6th highest volume day in 2025. The single-day transaction volume reached an impressive 169,523 Bitcoins, the 4th highest recorded this year.

Lunde notes that prior to October, daily spot trading volumes surpassing $10 billion were typically observed around significant market highs or lows. In the current sell-off, this phenomenon has occurred four times, signaling robust buying interest emerging near new support levels. While these bounces have been short-lived, they underscore a persistent underlying demand at lower price points.

Futures Market Dynamics: Deleveraging and Shifting Sentiment

Analyzing the futures market, Vetle Lunde highlights intriguing dynamics. Within CME contracts, despite a generally compressed term structure, the near-month premium unexpectedly increased during the recent price decline – a pattern previously seen during Bitcoin’s bottoming and rebound phase from February to April. Furthermore, CME open interest has fallen to a seven-month low of approximately 132,000 Bitcoins, reflecting a diminished risk appetite among institutional players.

In the perpetual futures market, open interest initially spiked to a yearly high of 325,000 Bitcoins during the sell-off. However, it subsequently retreated to around 300,000 Bitcoins as funding rates turned negative. Lunde interprets this as aggressive long positions being unwound, indicating an improvement in the previously overheated leverage conditions from the prior week. Despite this deleveraging, overall open interest in perpetual futures remains elevated.

Surging ETP Outflows Signal “Panic Redemptions”

Perhaps the most compelling signal of market pressure stems from significant outflows in Bitcoin Exchange Traded Products (ETPs). This year, daily outflows exceeding 10,000 Bitcoins have only occurred four times, with two of these instances recorded this month alone. Notably, November 20th saw an outflow of 13,302 Bitcoins, marking the second-largest single-day outflow of the year. Over the last 30 trading days, net outflows have surpassed 62,000 Bitcoins, reaching levels not seen since mid-March.

Vetle Lunde characterizes this surge in ETP outflows as “panic redemptions,” a classic manifestation of market sentiment temporarily detaching from underlying fundamentals.

K33’s Strategic Re-entry and Cautious Outlook

K33 itself demonstrated a tactical approach, reducing its Bitcoin holdings when the price reached $95,000. However, as market panic escalated and Bitcoin dipped to $83,200, the firm strategically re-entered with a portion of its capital.

Despite this re-entry, Vetle Lunde maintains a prudent stance: “Considering the elevated open interest in perpetual contracts and Bitcoin’s historical tendency to form ‘W-shaped’ reversal structures during bottoming processes, we will not fully replenish all positions in a single move.”

Disclaimer: This article is provided for market information purposes only. All content and opinions are for reference and do not constitute investment advice. They do not represent the views or positions of the author or Blockcast. Investors should make their own investment decisions and trades. The author and Blockcast will not be held responsible for any direct or indirect losses incurred by investors as a result of their trading activities.