Navigating Bitcoin’s December: Key Levels, Fed Uncertainty, and Market Volatility Ahead

Bitcoin (BTC) recently demonstrated a notable recovery, climbing from the $80,000 mark to retest the $90,000 level. As previously analyzed, the $91,000 threshold has firmly established itself as a critical bull-bear demarcation line. Throughout the past weekend, BTC’s price repeatedly probed this pivotal level, yet broader market movements remained subdued as the month drew to a close.

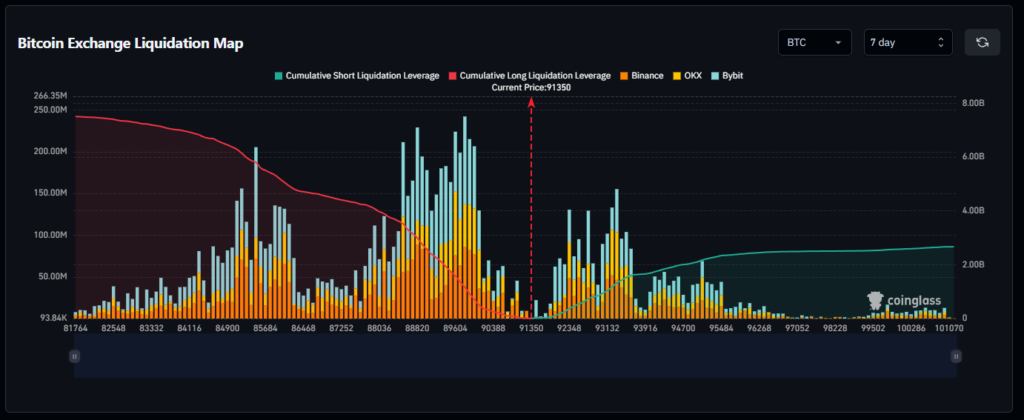

Resurgent Market Sentiment Meets Liquidation Risks

Despite the quiet close to the month, a subtle warming in the crypto market last week reignited investor sentiment. However, this resurgence comes with a caveat. A glance at recent liquidation maps reveals a significant concentration of long positions. While indicative of renewed optimism, this density also serves as a potent warning signal: a highly concentrated long market increases the susceptibility to cascading downward liquidations, potentially triggering sharp price corrections.

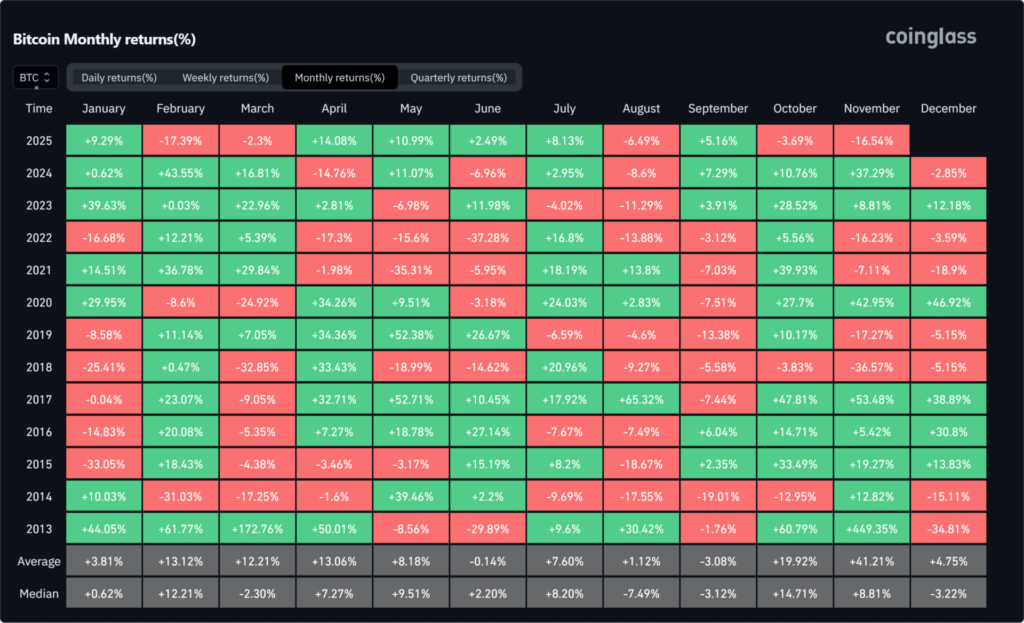

Historical Precedent: Bitcoin’s November-December Performance

Examining Bitcoin’s historical monthly returns since 2017 uncovers a compelling pattern: if November concludes with a decline, December typically follows suit with subpar performance, often marking two consecutive months of negative returns. Historically, December’s market dynamics are influenced by year-end holidays, including Christmas and New Year. Consequently, significant market volatility usually concentrates within the first two weeks of the month. Post-Winter Solstice, markets tend to quiet down, with traditional financial markets often utilizing the “Christmas rally” for profit-taking and hedging strategies. This trend underscores the importance of meticulous position allocation during this period.

December’s Unprecedented Crossroads: The Fed’s “Blind Chess”

However, this December is poised to be anything but calm. Following a recent U.S. government shutdown, a significant backlog of crucial economic data remains unreleased. This creates an extraordinary situation for the Federal Reserve’s interest rate meeting on December 10th, where policymakers will be compelled to make a decision without the customary comprehensive data references. Current market consensus anticipates a quarter-point rate cut. Yet, the critical question remains: is such a cut truly appropriate given the informational void? Furthermore, decisions regarding the 2026 dot plot will essentially be made in a state of “blind chess” by Fed governors.

Should subsequent economic data, once released, contradict the premise for a rate cut, the market could face a “catastrophic adjustment” before the year’s end. Investors are therefore strongly advised to prepare for potential heightened volatility and to manage their portfolios with extreme caution.

Disclaimer: This article is provided for market information purposes only. All content and views expressed herein are for reference and informational purposes only and do not constitute investment advice. They do not necessarily represent the views or positions of Blockcast. Investors are solely responsible for their own investment decisions and transactions. The author and Blockcast shall not be held liable for any direct or indirect losses incurred as a result of investor transactions based on this information.