Bitcoin Plunges as BOJ’s Hawkish Stance Triggers Yen Carry Trade Unwind

The cryptocurrency market experienced a significant downturn in early Asian trading, with Bitcoin plummeting below the $86,000 mark. This sharp decline was triggered by escalating market expectations of an imminent interest rate hike by the Bank of Japan (BOJ), which sent Japan’s 2-year government bond yield soaring to a 17-year high and fueled a surge in risk aversion across financial markets.

Investors are increasingly betting on the Bank of Japan’s move to finally conclude its ultra-loose monetary policy, a stance maintained for several years. This anticipation caused the yield on Japan’s 2-year government bonds, a key indicator highly sensitive to monetary policy shifts, to briefly touch 1.01% – a level not seen since 2008.

BOJ Governor’s Hawkish Signal Unleashes Market Volatility

The catalyst for this market upheaval was the latest statement from BOJ Governor Kazuo Ueda. On December 1st, Ueda indicated that the central bank would “appropriately judge whether to raise interest rates” at its upcoming December policy meeting, taking into account domestic and international economic conditions, inflation trends, and financial markets. This declaration was widely interpreted by the market as the most hawkish signal from the BOJ to date.

Following Governor Ueda’s remarks, the Japanese Yen strengthened considerably. This appreciation of the Yen immediately put accelerated unwinding pressure on “Yen carry trades,” a strategy that has been a significant driver of global risk assets throughout the year.

A “Yen carry trade” involves investors borrowing the low-interest Japanese Yen and then investing these funds into higher-yielding assets, such as U.S. equities or cryptocurrencies. When the Yen strengthens or Japan raises its interest rates, the cost of borrowing Yen increases. This forces investors to sell their risk assets and buy back Yen to repay their loans, leading to a broad market sell-off.

Crypto Markets Bear the Brunt of Capital Withdrawal

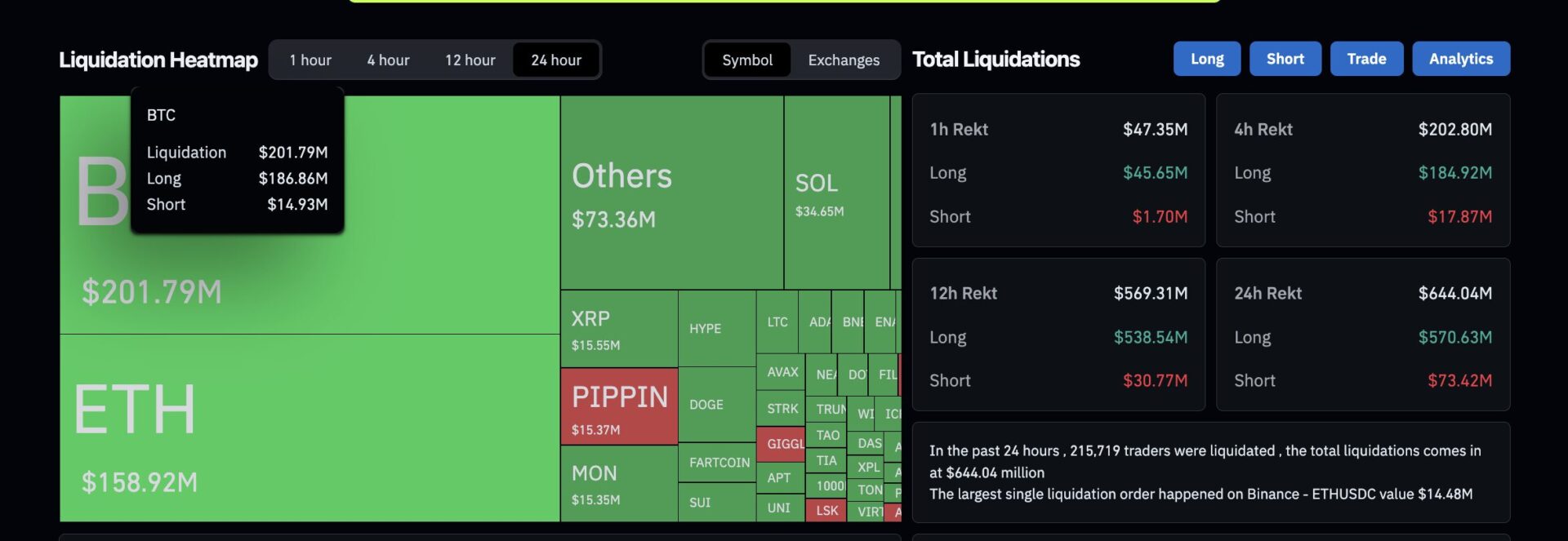

The cryptocurrency market, known for its sensitivity to short-term liquidity fluctuations, particularly in Asia, became a primary casualty of this sudden capital withdrawal. Bitcoin, for instance, saw a dramatic plunge from $90,000 earlier this morning, dropping to a low of $85,739. This represented a single-day decline of 5.6%, leading to the liquidation of over USD 180 million in long positions within a 24-hour period.

Ethereum, the second-largest cryptocurrency by market capitalization, also suffered a severe blow, falling to a low of $2,809. Over the same 24-hour timeframe, Ethereum witnessed the liquidation of USD 139 million in long positions, highlighting the widespread impact of the BOJ’s perceived shift.

Disclaimer: This article is provided for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views or positions of BlockCast. Investors should make their own decisions and trades. The author and BlockCast shall not be held responsible for any direct or indirect losses incurred by investors’ transactions.