Prediction markets remain largely misunderstood by the broader public, yet this very lack of comprehension presents an unparalleled opportunity. We are currently witnessing a profound transformation in how markets operate, how information is valued, and how the future itself is shaped.

The ‘iPhone Moment’ for Finance

Every technological revolution is preceded by a peculiar phase where established mindsets fail to grasp the impending disruption. In 2007, Nokia executives famously dismissed the iPhone, remarking, “It doesn’t even have a keyboard.” They compared it to a phone, missing its true comparison to a computer. The iPhone wasn’t merely a better mobile device; it fundamentally disrupted the concept of single-function gadgets.

Prediction markets are at a similar juncture today. Many perceive platforms like Polymarket as little more than niche, illiquid gambling sites. They compare them to sports betting platforms like DraftKings or derivatives exchanges like CME, concluding they fall short. This mirrors Nokia’s error. Polymarket isn’t striving to be a superior betting site; it’s poised to redefine the entire landscape of professional financial markets. Consider the fundamental nature of every financial instrument, stripped of its complexity:

- Options: A wager on whether a future price level will be reached.

- Insurance: A bet on whether a catastrophic event will occur.

- Credit Default Swaps: A wager on whether an entity will default.

- Sports Betting: A bet on the outcome of a sporting event.

Trillion-dollar industries have been constructed around inherently binary questions, each with its own intricate infrastructure, regulatory frameworks, and monopolistic intermediaries profiting from the friction.

Polymarket distills this complexity to its essence: creating a market for any observable event, allowing participants to trade, and resolving the outcome once reality unfolds. It doesn’t aim to outcompete DraftKings in sports betting or CME in derivatives. Its ambition is far more foundational: to reduce all markets to their most basic units and then rebuild from that bedrock. Polymarket is the “iPhone,” and everything else is merely an “app.”

Trading the Worldview: Multi-Angle Market Participation

Consolidating all trading activity onto a single platform unlocks a universe of possibilities. Imagine, five years ago, trying to construct a position reflecting a nuanced view like, “I believe the Federal Reserve will raise interest rates, but tech stocks will still rally because Donald Trump will make positive remarks about AI.” You would need accounts at multiple institutions, navigate diverse regulatory frameworks, and contend with various forms of leverage. The “Trump AI comments” aspect might not even have a market.

On Polymarket, such a trade is three clicks away. Crucially, these are not three isolated bets, but a coherent worldview expressed through interconnected positions. You could buy “Fed pauses rate hike” as “No,” “Nasdaq hits all-time high” as “Yes,” and “Trump mentions AI in next speech” as “Yes.” The interplay, the correlation between these events, *is* the trade itself.

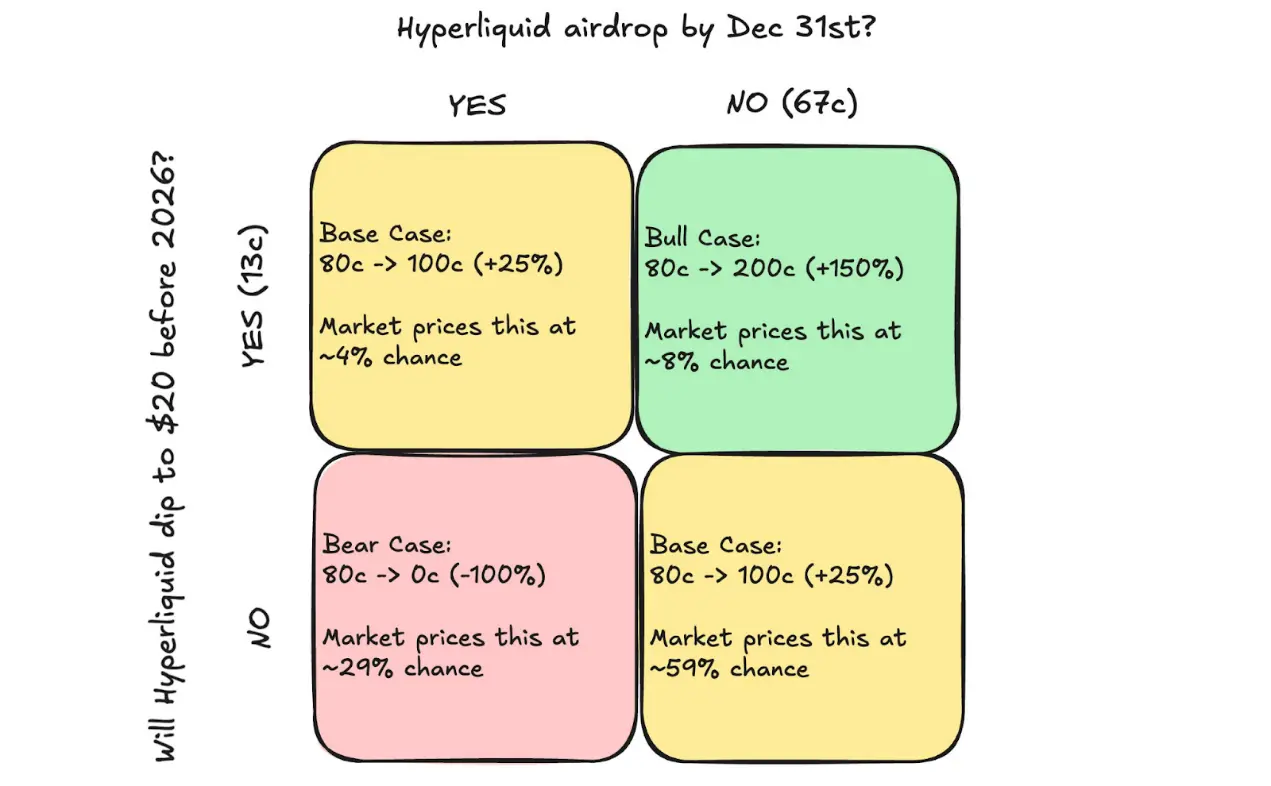

For those still grappling with the concept, consider a real-world example from last month on Polymarket. You could have built a position by buying “Hyperliquid will not conduct an airdrop by December 31” as “No” for $0.67, and simultaneously buying “Hyperliquid will fall below $20 by 2026” as “Yes” for $0.13. Let’s dissect the potential outcomes:

- Maximum Profit: Hyperliquid conducts no airdrop and drops below $20 this year. Given current market conditions, this perspective seems rational and should be priced higher than the implied 8% market rate. You capitalized on an undervalued outcome.

- Modest Gain: Hyperliquid conducts an airdrop and drops below $20, or it drops below $20 but no airdrop occurs. These represent the most probable outcomes, with a 63% chance.

- Total Loss: Hyperliquid conducts an airdrop and its price remains above $20. Considering widespread market concerns about new supply from team unlocks, an airdrop introducing more supply would likely elicit a very negative reaction. This outcome’s probability should be less than 29%, meaning you were effectively selling this result at a premium.

While this might sound like hedging, it’s far more profound. It articulates a complex perspective on how the market processes new token supply, a view virtually impossible to express elsewhere.

Traditional markets force you to compress intricate worldviews into crude, directional bets. You might hold a sophisticated thesis that Nvidia’s earnings will exceed expectations, yet the stock will sell off due to “buy the rumor, sell the news” dynamics. In options markets, you’re limited to calls and puts, perhaps constructing awkward spreads to approximate your view, all while incurring hefty option premiums. On Polymarket, you simply buy “Nvidia beats earnings” as “Yes” and “Nvidia stock drops 5% post-earnings” as “Yes,” precisely articulating your nuanced conviction.

The true genius emerges when you begin to identify cross-market correlations that shouldn’t exist but do. Imagine a hurricane threatening Florida while the Tampa Bay Buccaneers play in Detroit. Conventional wisdom deems these events unrelated. However, you might posit that if the hurricane devastates Florida, NFL referees would subtly favor the Buccaneers to craft an inspiring narrative. You could then bet $0.60 that the Buccaneers won’t win, while simultaneously betting $0.20 that the hurricane will hit Florida. You’re not betting on an outcome; you’re betting on a *correlation structure*. You profit from your understanding of how narratives influence officiating.

This is why prediction markets aren’t competing with existing markets: they operate on an entirely different plane of abstraction. All other markets offer you a single lever to pull. Polymarket provides an infinite number of levers, and critically, it allows you to pull specific combinations of those levers that align with your actual perception of how the world functions.

Why the Smart Money is Missing the Point on Liquidity

The most common critique leveled against prediction markets invariably centers on liquidity. “You can’t make large trades,” “the spreads are too wide,” “it’s just gamblers betting their lunch money.” This isn’t a flaw; it’s your opportunity.

Let’s consider the mechanics of why liquidity will inevitably explode. Traditional market making is relatively straightforward: you typically make markets for assets with clear correlations to other instruments. Stock options are linked to stock prices, futures to spot prices. Everything has a hedge, a correlation, a model to lean on. This is why a handful of firms like Citadel and Jane Street can make markets across thousands of instruments.

Prediction markets are inherently more challenging. Each market type demands specialized intelligence systems:

- Sports Markets: Require models that update with every score, injury report, and weather forecast.

- Political Markets: Demand natural language processing to analyze polls, speeches, and social media sentiment.

- Event Markets: Need machine learning systems to calculate base rates from historical data.

- Mention Markets: Rely on language models trained on thousands of transcripts.

It’s simply impossible for one market maker to monopolize all these markets, as each requires entirely distinct expertise.

In the long run, this fragmentation is a boon for liquidity. Instead of a few monolithic giants controlling all market making, we will see a proliferation of highly specialized market makers. Some quantitative analysts will become the world’s foremost experts in pricing mention markets. Other teams will dominate weather-related events, while still others will specialize in celebrity behavior. What appears to be a weakness—fragmentation—will actually foster resilience and depth.

Within the next five years, an entirely new breed of financial firm will emerge: the prediction market specialist. They won’t make markets in stocks or bonds; they will make markets in *reality itself*. The companies that first achieve this at scale will become the foundational pillars of the new financial system.

The Uncomfortable Truth About Truth

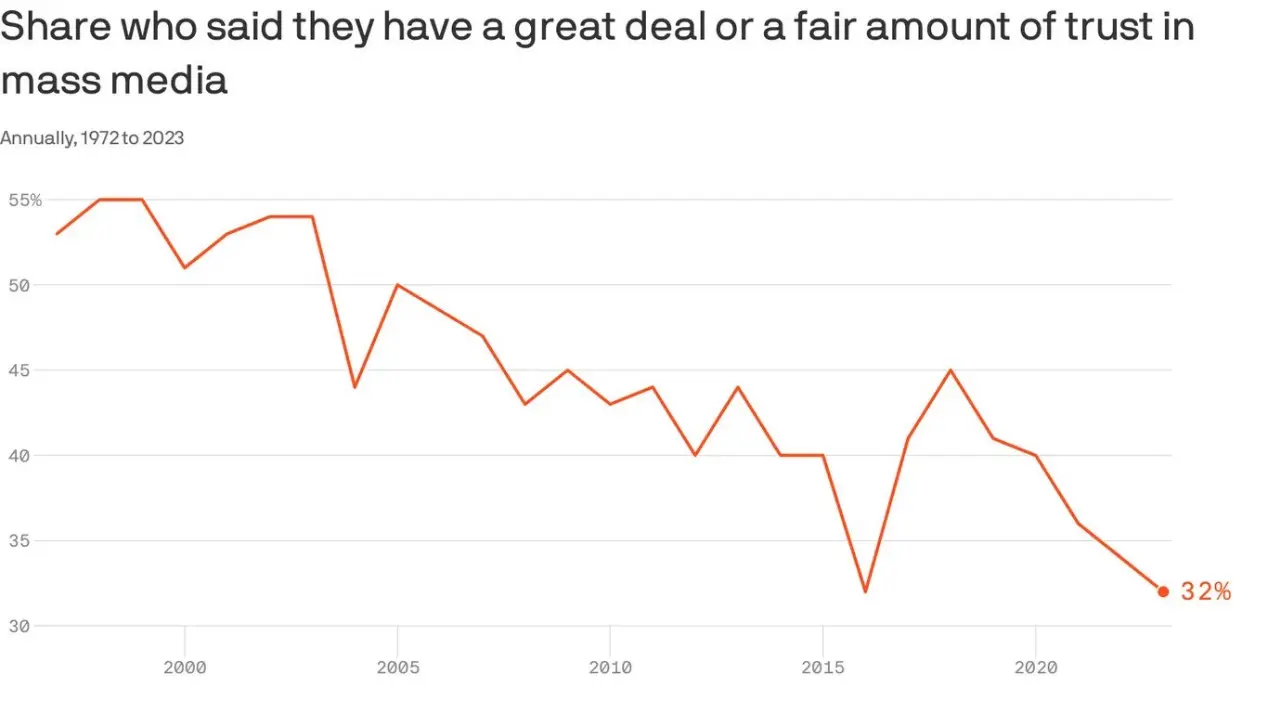

Prediction markets aren’t truly about prediction at all; they are about creating an economic incentive for truth. We live in a peculiar era where everyone has an opinion on everything, yet no one has any real skin in the game. Your favorite analyst might have been wrong about a recession twice in a row. Commentators on financial news channels have decimated countless portfolios. Yet, they retain their platforms, their audiences, and continue to be wrong without consequence.

This dynamic is unsustainable, and deep down, everyone knows it. Society has constructed an information ecosystem that rewards engagement over accuracy. Being loud is more important than being right, a problem exacerbated by social media. Today, the most popular opinion, regardless of its veracity, often becomes the “correct” one. The person with the most followers becomes the expert, and the expert is simply the one who garners the most likes.

Prediction markets completely invert this model. Suddenly, being right has value, and being wrong carries a cost. The market doesn’t care if you graduated from Harvard, have a blue checkmark, or have authored books on finance. It only cares if you are correct. When you build a system that exclusively rewards accuracy, something remarkable happens: accurate individuals suddenly have a reason to speak, and inaccurate individuals finally quiet down.

But this isn’t merely a transfer of wealth from the wrong to the right. Prediction markets are constructing a parallel information system that operates on a fundamentally different mechanism than the existing media ecosystem.

- In the Old World: Information spreads through social networks, contingent on its virality.

- In Prediction Markets: Information is priced according to its alignment with reality.

These are distinct selection mechanisms, and they will produce dramatically different outcomes.

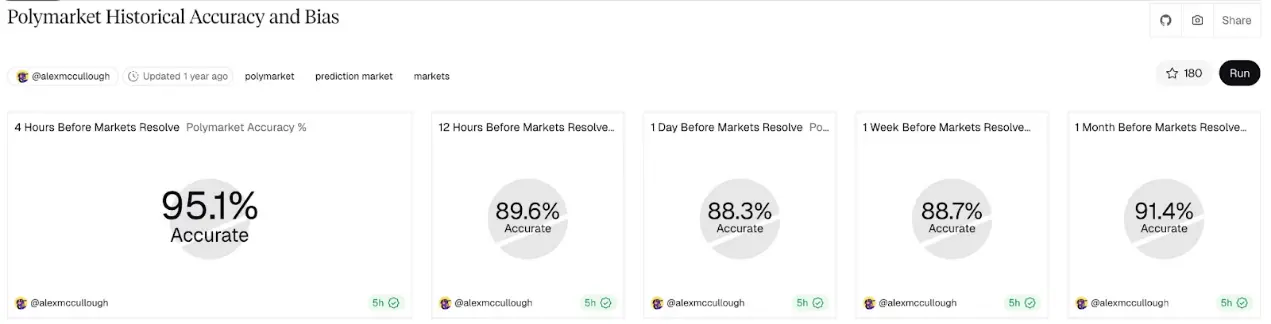

Polymarket is still in its nascent stages, yet its accuracy is already astonishing. Political markets have proven more predictive than any poll aggregator. Federal Reserve markets fluctuate before economists even update their forecasts. This isn’t because prediction market traders are inherently smarter; it’s because the incentive structure is geared towards being correct, not towards being entertaining.

Bounty Markets, Not Prediction Markets

The public’s persistent labeling of these as “prediction markets” is akin to calling Bitcoin “digital gold”—technically accurate, yet it entirely misses the more profound implication. True prediction markets are passive observers. They price probabilities but do not intervene in outcomes. But Polymarket isn’t passive, and this is the crucial distinction: any market with human participants implicitly creates a reward for altering the outcome.

Consider this concrete example. When a market was created to predict whether a green object would be thrown during a WNBA game, someone performed the following calculation:

- Purchase $10,000 worth of “Yes” shares at $0.15 per share.

- Throw the object themselves.

- Collect $66,000 when the market resolves to “Yes.”

- After accounting for legal fees and a lifetime ban, net approximately $50,000.

Theoretically, the equilibrium for this WNBA disruption should be: Compensation = Criminal Charges + Social Shaming + Lifetime Ban + Effort Required. If the compensation is too high, it attracts imitators; if too low, no one acts. *The market will find the accurate equilibrium price.*

But the “prediction market” transformed into a bounty market—it wasn’t predicting if someone *would* throw an object; it was offering a specific sum for someone to *make it happen*. This is not a bug, nor is it manipulation; it is the most significant, yet unmentioned, feature of prediction markets.

Let’s consider a thought experiment. I decide to run for Mayor of New York. The market offers reasonably fair odds of 0.5%. At these odds, I could buy 20 shares, each valued at $5,000, for a total of $100,000. If I win, each share yields $1,000,000. The situation becomes intriguing when I escrow these shares as compensation for my campaign team. I hire 20 dedicated campaigners (or, hypothetically, “killers” in the context of extreme incentives), promising each $1,000,000 upon success.

This experiment creates something that shouldn’t exist: a market-funded political campaign, where the stakes increase as the odds decrease. The market is effectively saying, “This outcome is so improbable that we’ll give you 20-to-1 odds to make it a reality.” Prediction morphs into a bounty. The market isn’t merely observing reality; it is actively funding specific futures.

Some events remain entirely unaffected by this bounty mechanism. Becoming president, for instance, carries such immense intrinsic value that any prediction market bounty would not significantly augment the existing incentives. However, for thousands of other events—from corporate decisions to cultural phenomena to sports outcomes—the bounty mechanism is real and active.

We are not witnessing the future of prediction markets as envisioned by Robin Hanson (a key architect of modern prediction market mechanisms), guiding governance through collective intelligence. Instead, we are seeing something far stranger: markets that pay people to bring about specific futures.

Conclusion: The Future is Being Built

My prediction is that within a decade, the Polymarket model will subsume a significant portion of traditional finance. This isn’t merely because it offers a more cost-effective and efficient trading platform. It’s because integrating all markets into a single, primitive platform, and then rebuilding upon that foundation, is inherently more efficient than maintaining thousands of specialized market structures.

The dominoes will fall in this order:

- DraftKings: Sports betting is fundamentally a prediction market with worse odds.

- CBOE (Chicago Board Options Exchange): Options are merely complex binary bets on price levels.

- Insurance: Nothing more than a unilateral prediction market.

- Credit Markets: Bankruptcy prediction with additional layers of complexity.

Each vertical will resist, attempt to regulate, but ultimately yield. They will realize they are not competing against a better product, but against a superior principle.

What we are truly witnessing is a radical reorganization of how markets function. You are no longer betting on prices, interest rates, or volatility. You are betting on events, the correlations between events, and, most importantly, on the ability to *change the probabilities* of those events.

Astute investors should prepare for this now. This means not just buying tokens or trading markets, but contemplating what happens when every observable event has a liquid market. What occurs when every corporate decision has a prediction market? What are the implications when every piece of legislation has odds? What transpires when every cultural trend has a price?

Prediction markets are not just building better markets; they are constructing a machine capable of incentivizing people to create the future.