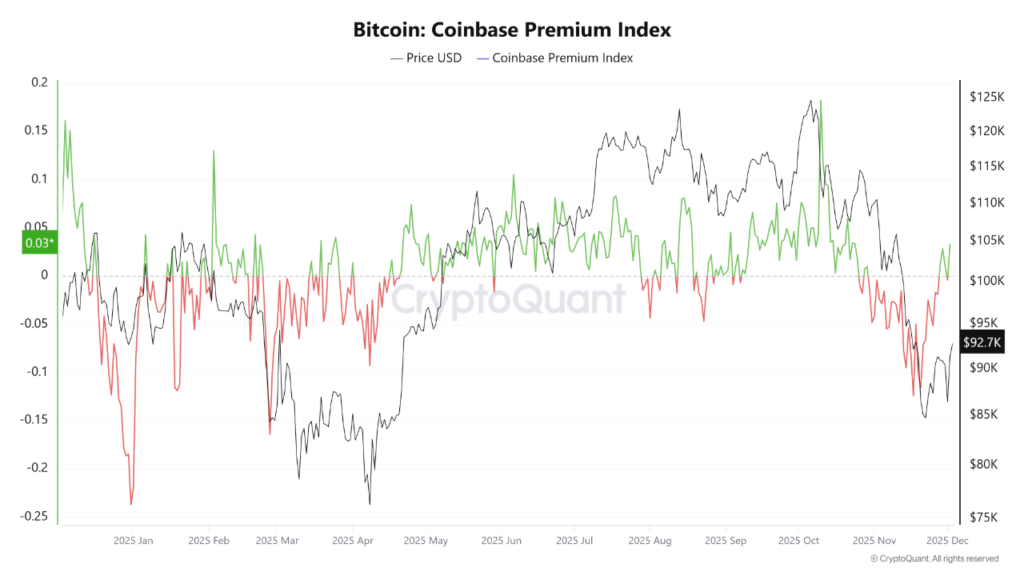

Crypto Market Rebound: Coinbase Premium Surges, Signaling Renewed Demand and Liquidity Shift

Following a recent market flash crash, a significant shift in crypto market sentiment is underway, as evidenced by the Coinbase Premium Index returning to positive territory. This marks the first time since November that the index has moved out of a sustained period of selling pressure and into a positive premium zone. Historically, a positive Coinbase Premium is a strong indicator of renewed demand from both U.S. retail investors and institutional players. Given the increasing dominance of the U.S. market in the global crypto landscape, the relevance of this index has never been higher.

Parallel to this, Binance’s spot and perpetual contract trading volumes have shown a consistent upward trend. This suggests that the market’s liquidity is actively responding to the rising Coinbase Premium, potentially fueled by the anticipation of the Federal Reserve concluding its Quantitative Tightening (QT) policy. It’s crucial to understand that while improvements in the U.S. market are vital, sustained rallies often require robust trading volume support from global platforms like Binance. Historically, market uptrends gain stronger momentum when both Coinbase’s premium and Binance’s trading activity align, typically following a period of consolidation.

Further reinforcing this narrative, the spot price differential between Binance and Coinbase has recently narrowed. This convergence points towards a market in a consolidation phase, indicating a rebalancing of capital flows. Moreover, an analysis of Binance’s liquidity levels reveals a subtle but discernible increase in potential demand. This collective evidence strongly suggests that after the significant market correction observed in November, cryptocurrency prices are now actively establishing a new, foundational bottom.

The intricate interplay between the Coinbase Premium and Binance’s liquidity metrics paints a promising picture of a gradually improving market price structure. Should the Coinbase Premium Index maintain its positive trajectory, coupled with a concurrent rise in Binance’s buying volume, the crypto market could be poised for a new and sustained uptrend. Conversely, a reversal in these indicators, with the index falling back into negative territory, might signal a return to heightened volatility and renewed short-term selling pressures.

Disclaimer: This article is intended solely for market information purposes. All content and views expressed herein are for reference only and and do not constitute investment advice. They do not represent the views or positions of BlockTempo. Investors are advised to conduct their own due diligence and make independent trading decisions. The author and BlockTempo shall not be held responsible for any direct or indirect losses incurred by investors as a result of their transactions.