By: Frank, PANews

On December 1st, US time, the Federal Reserve officially announced the conclusion of its Quantitative Tightening (QT) policy. The crypto market responded with a collective surge: Bitcoin (BTC) climbed approximately 8%, reclaiming the $93,000 mark, while Ethereum (ETH) soared nearly 10%, breaking back above $3,000. Altcoins joined the rally, with SUI jumping 20% and SOL increasing by 13%.

In an instant, market sentiment shifted dramatically from stagnation to euphoria. With the end of QT, many anticipate the dawn of a new era of liquidity.

However, dissenting voices quickly emerged, suggesting this sharp increase might merely be a “dead cat bounce” within a bear market, rather than the genesis of a new trend. So, historically, has the conclusion of QT genuinely injected fresh momentum into the market? PANews delves into past instances of QT ending, analyzing the subsequent shifts in the crypto market through a retrospective lens.

2019: From QT’s End to the Brink of the Abyss

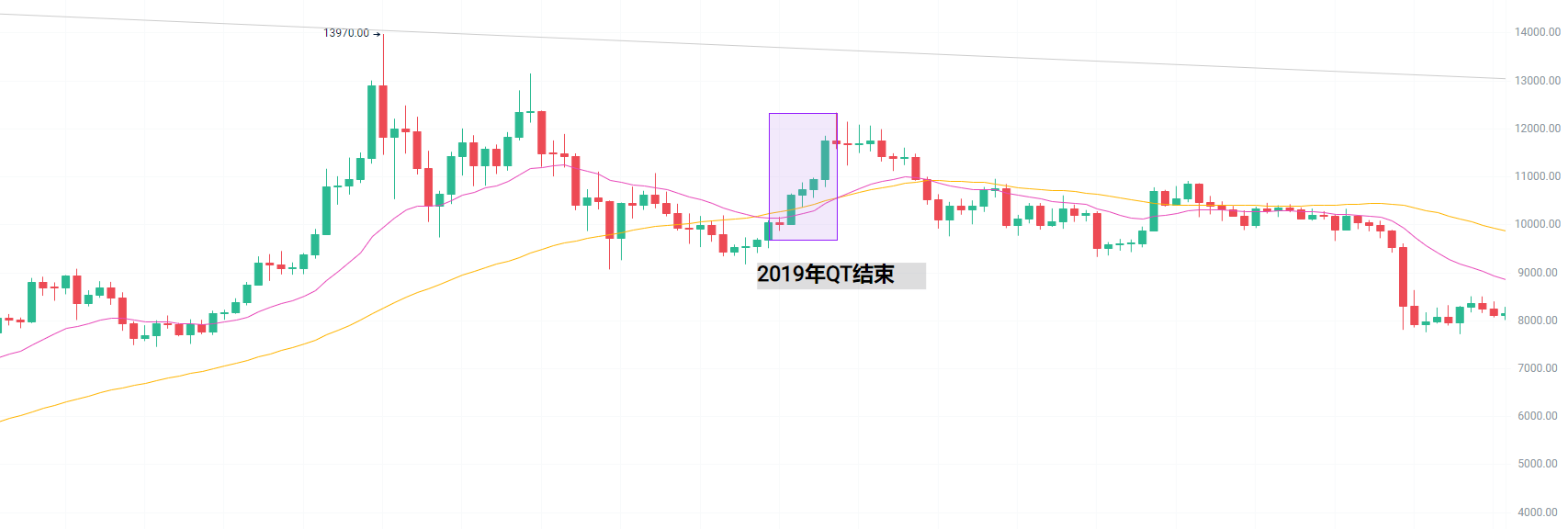

The last time Quantitative Tightening concluded was on August 1, 2019, over six years ago. Let’s rewind to that period.

The summer of 2019 saw the crypto market having just peaked after a mini-bull run. Following the dramatic crash of late 2018, Bitcoin had steadily climbed, reaching a high of $13,970. While still shy of its previous all-time high of $19,000, market sentiment was largely optimistic, with many believing the crypto industry was heading towards a new bull market and poised to break new records.

On July 31, the Federal Reserve, at its Federal Open Market Committee (FOMC) meeting, announced that its Quantitative Tightening (QT) program would officially end on August 1, 2019. At this juncture, Bitcoin had just experienced a significant correction of nearly 30%, falling to around $9,400. Following the Fed’s announcement, BTC saw an intraday rise of up to 6% on July 31 and quickly recovered to the $12,000 level within the subsequent days.

Yet, this upward momentum proved fleeting. On September 26, the crypto market faced another sharp decline, with prices plummeting to a low of $7,800. While October brought a brief resurgence, stimulated by positive blockchain policy news from China on the 24th, the market soon reverted to bear market volatility and panic. This period of uncertainty persisted until the unprecedented “3.12” crash in 2020, coinciding with the eve of the Federal Reserve’s Quantitative Easing (QE) measures.

Concurrently, the US Nasdaq index experienced a sustained rally from August 2019 to February 2020, consistently setting new highs. It reached a then-record peak of 9838 points in February 2020. Both the Nasdaq and the crypto market entered a state of collapse between February and March 2020.

This historical script outlines the crypto market’s trajectory from the end of the previous QT cycle to the onset of the Fed’s QE. In this historical period, Bitcoin and the broader crypto market appeared to receive a temporary boost from the conclusion of QT. However, without the initiation of QE, they quickly reverted to a downward trend.

Of course, every moment in history is unique.

That summer, news such as Facebook’s announcement of the Libra project and Bakkt launching physically settled Bitcoin futures significantly buoyed market sentiment. Conversely, the collapse of the PlusToken Ponzi scheme in June 2019, leading to substantial selling pressure, weighed heavily on the entire crypto market.

Current Landscape: Tenfold Growth, More Stable Trajectories

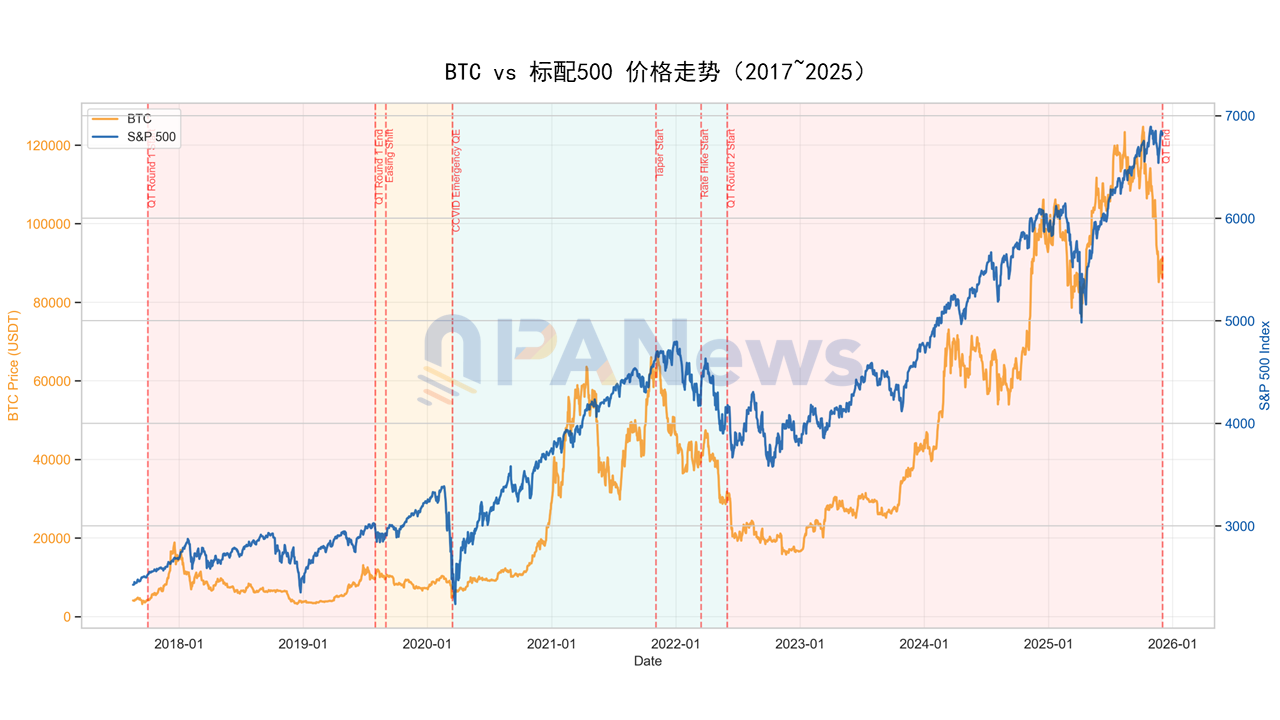

How does the present differ from the past? This past December, Bitcoin experienced a significant correction of over 36% after hitting a recent all-time high of $126,199 in October. While the specifics of price and candlestick patterns diverge from the past, the cyclical stage appears to mirror 2019—a period of major volatility following a bull run. This phase can be interpreted either as the onset of a bear market or as a mid-cycle pause for consolidation.

From a fundamental perspective, today’s crypto market has garnered significant recognition from traditional finance. The market no longer reacts with the same fervor to major corporations entering or adopting crypto; public companies employing crypto treasury strategies and the advent of cryptocurrency ETFs have become commonplace. The overall market capitalization of crypto has surged approximately tenfold compared to 2019. Crucially, market dominance has shifted decisively from retail investors to institutional players.

In terms of market trends, while the outcomes may appear similar, the underlying processes are vastly different. To better illustrate the historical trends surrounding these two QT endings, PANews juxtaposed Bitcoin’s performance two years prior to the 2019 QT conclusion with its performance two years leading up to the current (hypothetical 2025) QT end. By normalizing the starting prices to 100, an intriguing pattern emerges: the gains leading up to both QT conclusions are remarkably similar, at 142% in 2019 and 131% currently, meaning both cycles saw approximately a 2.4x increase.

However, the trajectory of these gains reveals a stark contrast. The recent two-year cycle shows Bitcoin’s price movements to be significantly more stable, lacking the dramatic surges and crashes characteristic of the previous cycle.

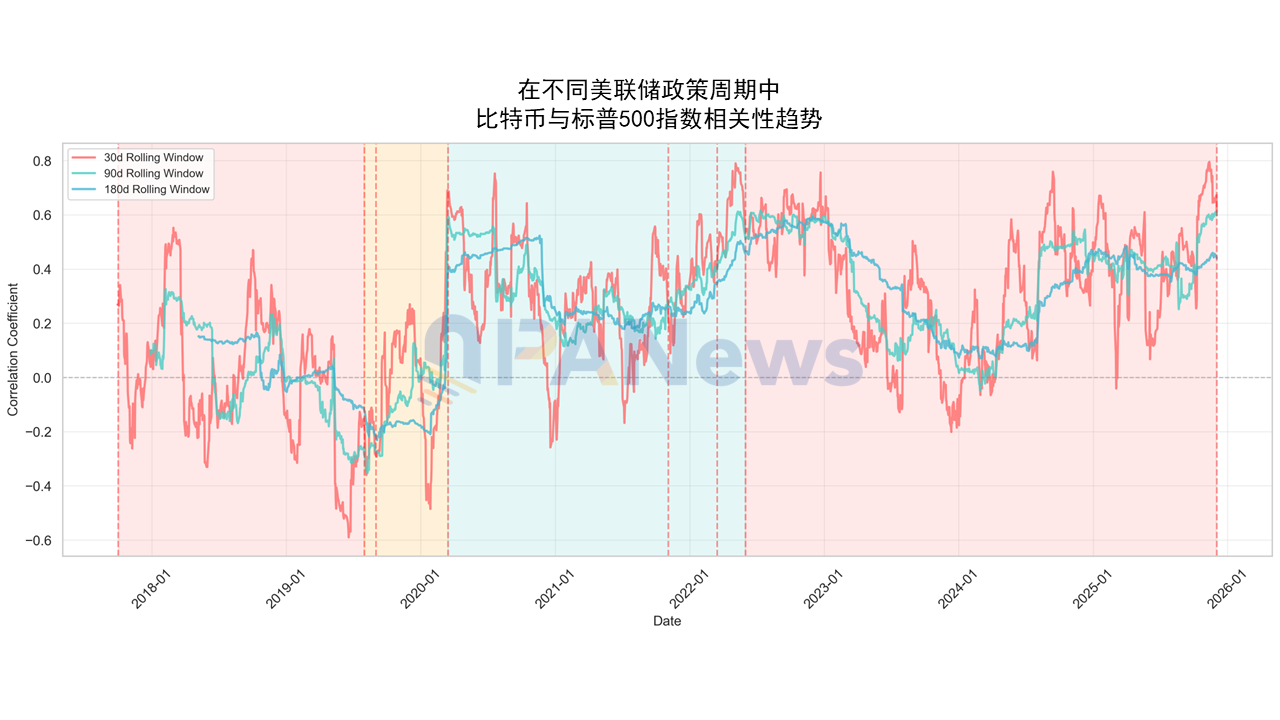

Another pivotal factor is the current crypto market’s heightened correlation with US equities, consistently maintaining a strong correlation coefficient between 0.4 and 0.6. In contrast, the correlation between BTC and the S&P 500 in 2019 largely hovered between -0.4 and 0.2, indicating little to no significant relationship, or even a negative one.

While the general direction of movement (up or down) often aligns, in a zero-sum game, capital has preferentially flowed into US tech stocks due to their higher perceived certainty, rather than cryptocurrencies. Taking the Federal Reserve’s QT end announcement on December 2nd as an example: prior to this news, the Nasdaq had also undergone a correction but had already embarked on a recovery, nearing its previous high of 24019 points. Bitcoin’s performance, by comparison, was considerably weaker, exhibiting a larger decline during its correction and a more subdued rebound before the news broke. This can partly be attributed to crypto’s inherent volatility as a risk asset, but overall, the crypto market increasingly resembles a technology-themed stock within the broader US equity landscape.

QT is Not the Starting Gun, QE is the True Salvation

Bitcoin’s trajectory often mirrors US equities, and altcoins, in turn, follow Bitcoin. This interconnectedness means the crypto market’s future movements are increasingly tied to shifts in the broader macroeconomic environment. As a “follower,” the “stop-the-bleeding” policy of QT’s conclusion alone may be insufficient to sustain an independent rally. What the market truly craves is a genuine “blood transfusion”—Quantitative Easing (QE).

Examining the market’s performance after the previous QT cycle, the crypto market did experience a brief rebound in anticipation of QT ending. However, the overall trend remained a volatile decline until the Federal Reserve announced “unlimited QE” after March 15, 2020, at which point it began to surge alongside the US stock market.

At this current juncture, while QT has concluded, the Federal Reserve has not yet officially entered a phase of Quantitative Easing. Nevertheless, mainstream financial institutions generally anticipate a mild easing of US economic and Fed policy, predicting continued rate cuts and potentially even a resumption of QE.

Several institutions, including Goldman Sachs and Bank of America, forecast sustained Fed rate cuts into 2026, with some predicting two cuts in 2026. Deutsche Bank and others project a possible QE restart as early as Q1 2026. However, there’s a risk these expectations are already priced in. Goldman Sachs, in its November 2026 Global Market Outlook, noted: “The baseline outlook for global markets in 2026 is moderately positive, with Fed easing, improved fiscal policy, and fading tariff impacts supporting growth. However, the market has already priced in these expectations, and vigilance is required against the risk of underperforming expectations.”

Furthermore, even with expectations of Quantitative Easing, cryptocurrency is no longer the market’s primary hot topic. The ascendancy of the AI market is increasingly siphoning attention and capital away from crypto. Many Bitcoin mining companies are already pivoting towards AI computing networks. In November, seven of the top ten crypto mining companies by hash rate reported generating revenue from their AI or high-performance computing projects, with the remaining three planning to follow suit.

In conclusion, whether viewed through historical precedent or current realities, the present end of QT does not appear to herald a new bull market. The true catalyst for a significant “blood transfusion” remains the commencement of Quantitative Easing.

Moreover, even if QE is initiated, the crypto market, now ten times larger and exhibiting more stable trends than in 2019, faces questions about its capacity for past tenfold growth. And, we must acknowledge that blockchain or cryptocurrency is no longer the brightest star on the market stage; AI currently holds that spotlight.

All these transformations cast a thick fog of uncertainty over the future of the crypto market. Both excessive optimism and undue pessimism are, for now, misplaced.

(The above content is an excerpt and reproduction authorized by partner PANews, original link )

Disclaimer: This article is for market information purposes only. All content and opinions are for reference only, do not constitute investment advice, and do not represent the views and positions of Blockcast. Investors should make their own decisions and trades. The author and Blockcast will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.