USDT Influx Signals Heightened Crypto Market Activity Ahead of Anticipated Fed Rate Cut

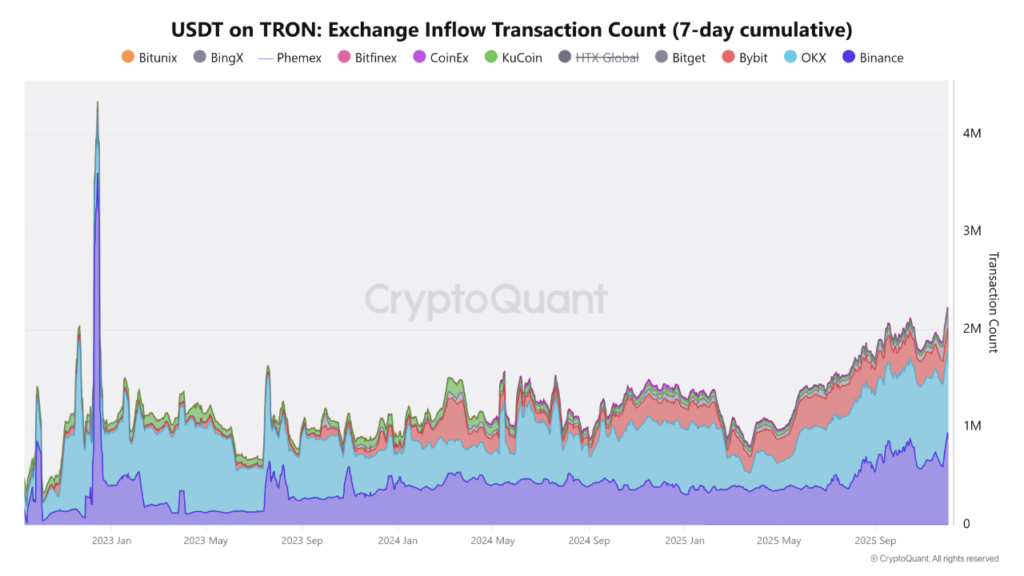

A recent analysis by Arab Chain reveals a substantial surge in USDT deposits across leading cryptocurrency exchanges. Binance, a dominant player in the digital asset space, recorded an astonishing 946,000 deposit transactions within a mere seven days. This significant increase is deeply intertwined with the current volatile and highly active cryptocurrency market environment—a period characterized by frequent liquidity shifts and intensified trading. Such dynamic conditions are prompting investors, particularly large institutions, to strategically reallocate their portfolios and channel liquidity towards platforms offering superior efficiency and execution capabilities.

Binance Emerges as the Preferred Liquidity Hub Amidst Market Volatility

In this dynamic landscape, Binance stands out as the most attractive destination for capital. Its profound liquidity and seamless trade execution make it a preferred choice, especially during periods of elevated trading volumes. A sharp rise in deposit volumes is often interpreted as a strong signal that investors are gearing up to establish new positions, bolster existing ones, or swiftly react to significant price fluctuations. This trend aligns perfectly with recent market movements, where Bitcoin and other major altcoins have experienced rapid gains followed by sharp corrections. In such volatile scenarios, top-tier exchanges prove indispensable for navigating market turbulence effectively and efficiently.

Broader Market Trends and the Anticipated Federal Reserve Decision

While Binance leads the charge, other major exchanges like OKX (approximately 841,000 transactions) and Bybit (225,000 transactions) have also witnessed notable growth in USDT deposits, though they remain considerably behind Binance’s impressive figures. Typically, an increase in USDT deposits during an upward price trend indicates investors are positioning themselves to capitalize on market momentum. Conversely, during market downturns, deposits of other cryptocurrencies might suggest traders are preparing to sell or implement hedging strategies.

This heightened activity is further amplified by the upcoming announcement of the Federal Reserve’s interest rate decision next week. With widespread market expectations of a quarter-point rate cut, an overarching sense of optimism about the future market trajectory prevails. This positive sentiment is indirectly fueling the significant inflow of USDT into exchanges, as investors prepare for potential market rallies following anticipated monetary easing.

Disclaimer: This article is provided for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views and positions of Blockcast. Investors should make their own decisions and conduct their own trades. The author and Blockcast will not bear any responsibility for direct or indirect losses incurred from investor transactions.