The Altcoin Crash Unveiled: A Deep Dive into the Sudden Plummets of Binance Alpha Projects

By Asher, Odaily Planet Daily

Despite recent glimmers of market recovery, the cryptocurrency world remains shadowed by a pervasive gloom, particularly since the “1011 crash.” A deeply unsettling trend has emerged: a wave of newly launched altcoins, especially those featured on Binance Alpha, appears to be caught in a relentless downward spiral. These tokens have experienced dramatic collapses—single-day halvings, drops exceeding 80%, opening surges followed by steady declines, and concentrated airdrop sell-offs. This article delves into the perplexing “fancy drops” that have shaken investor confidence, meticulously piecing together insights from on-chain data, market maker actions, and the often-telling responses (or silences) from project teams.

Sahara AI: A Sudden 50% Plunge Amidst Liquidation Storms and Short Amplification

On the evening of November 29, Sahara AI’s token, SAHARA, suffered a brutal blow, plummeting over 50% in a short span. Its price has since struggled to recover, currently hovering around $0.03869.

The Sahara AI team swiftly issued a statement the following day, aiming to calm the turbulent waters. Their core assertions were threefold:

- No Insider Selling: All team members and investors remain under lock-up, with the first unlock scheduled for June 2026—a full year away.

- Secure Smart Contracts: No evidence of hacking, tampering, or unauthorized token transfers was found.

- Business as Usual: Internal resource integration is underway, with a focus on accelerating growth, implying no fundamental business issues.

While these points appeared reassuring on the surface, the community’s attention was fixed elsewhere. Prominent KOL “Crypto Fearless” suggested on X that SAHARA’s crash was a consequence of a “major active market maker undergoing serial liquidations.” This theory posited that a large market maker, managing multiple projects, faced scrutiny from an exchange over one particular project, leading to a cascade of risk control actions across all linked positions, with SAHARA becoming an unfortunate casualty.

However, Sahara AI officials quickly refuted this narrative. They clarified that their sole market makers are Amber Group and Herring Global, both of whom are operating normally, without investigation or liquidation. The team attributed the sharp decline primarily to massive liquidations in perpetual contracts and amplified short selling—essentially, a “structural market stampede” rather than an internal failing. They assured the community of ongoing direct communication with relevant exchanges, promising further disclosures once verified information becomes available.

aPriori: The Airdrop Scandal and Eroding Trust

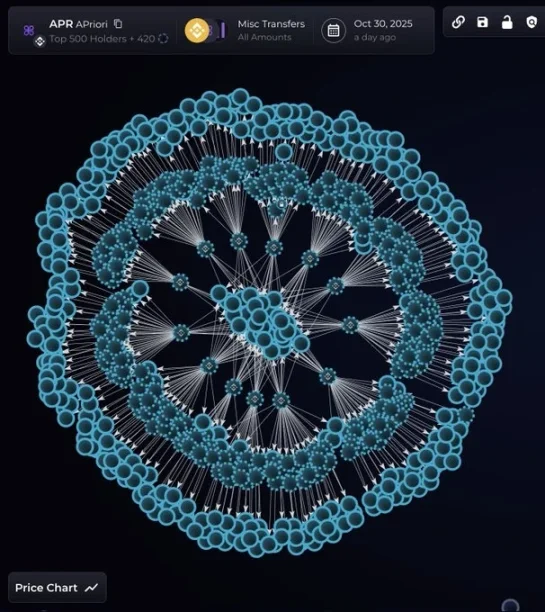

aPriori, a heavily funded project within the Monad ecosystem, opted for an “early” Token Generation Event (TGE) on the BNB Chain ahead of the Monad mainnet launch. On October 23, APR debuted on Binance Alpha and Binance Futures, initially surging past $0.7 before embarking on a relentless descent to its current price of $0.13. While the initial post-launch weakness raised eyebrows, the true catalyst for community outrage emerged weeks later.

The most damning revelation came on November 11, when on-chain data from Bubblemaps exposed a startling fact: 60% of aPriori’s airdrop tokens were claimed by a single entity utilizing 14,000 interconnected wallets. These wallets, in a highly coordinated fashion, each deposited 0.001 BNB via Binance within a short timeframe, then transferred the APR tokens to a new, shared set of wallets.

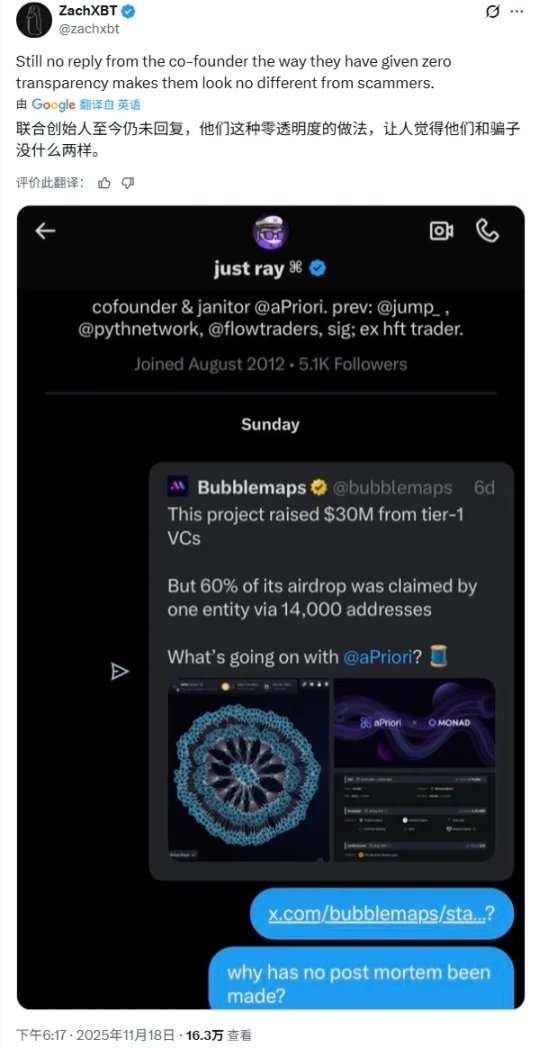

Beyond the sheer scale of the manipulation, what truly infuriated the community was the project team’s deafening silence. On November 14, Bubblemaps publicly stated they had reached out to the aPriori team for an explanation regarding the 60% airdrop claim by a single entity, but received no response.

Further compounding the issue, renowned blockchain detective ZachXBT revealed on X that his private inquiries to an aPriori co-founder about the “insider trading” allegations also went unanswered as of November 18.

With the official X account falling silent and Discord administrators seemingly vanishing, community sentiment rapidly spiraled from disappointment to outright anger, fueling questions like:

- “Has the project team abandoned the project?”

- “Are they already working on their next venture?”

- “How could a highly funded project engage in such practices?”

It wasn’t until November 21 that the team finally broke its silence. However, their statement conspicuously sidestepped the core allegations, merely asserting “no evidence of the team or foundation claiming airdrops was found.” They attempted to redirect attention towards the Monad mainnet airdrop, promising “a large number of unlocked APR airdrops” to the Monad community. This response was widely perceived as “evading the crucial issues” and did little to quell the mounting skepticism.

Tragically, when the Monad mainnet eventually launched, aPriori’s related airdrop event garnered almost no attention, and its official channels once again fell into silence. In less than a month, a once-promising, highly funded project saw its community trust vanish, leaving a trail of unanswered questions.

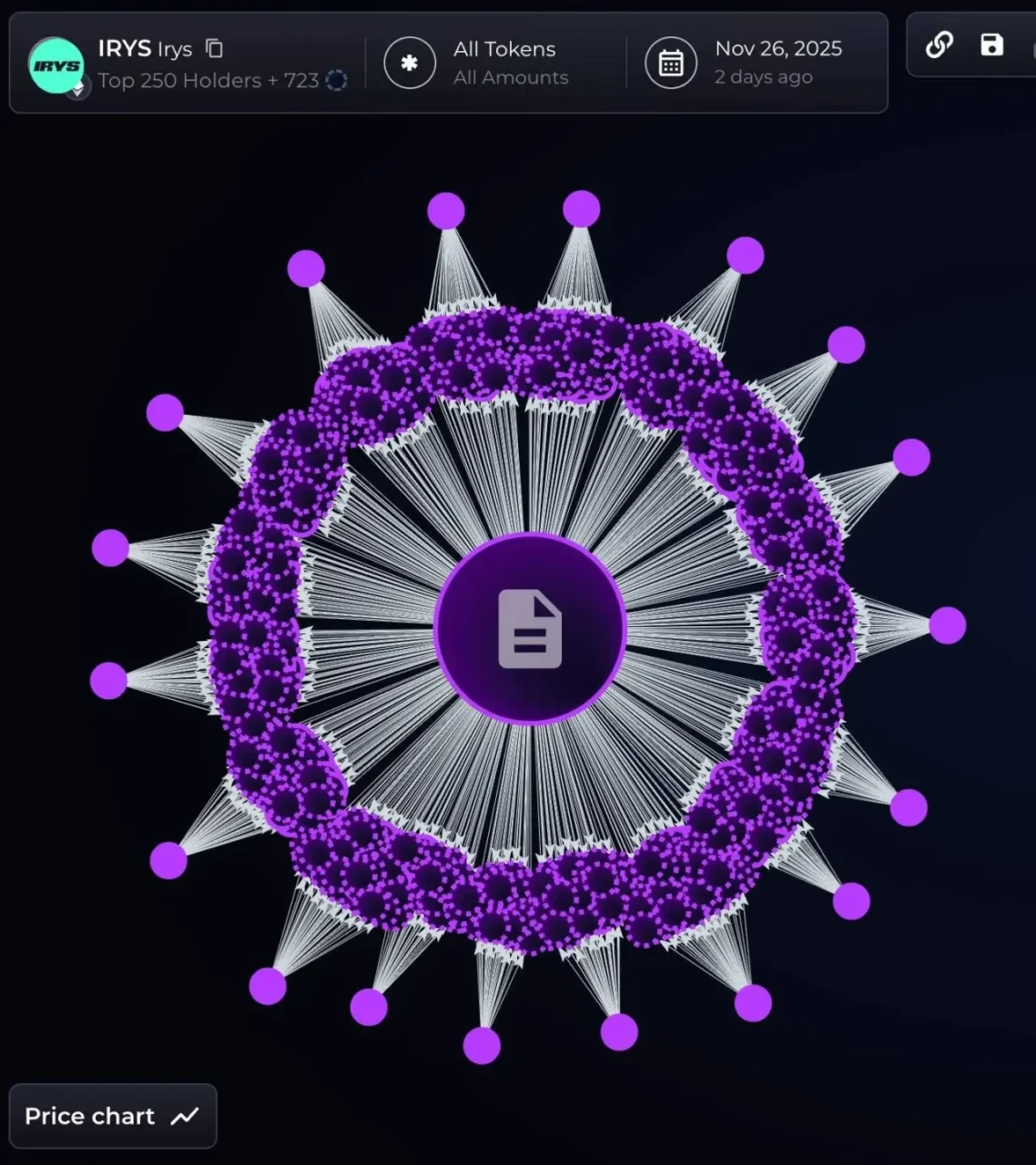

Irys: $4 Million Dumped in a Coordinated Sybil Airdrop Attack

Irys, an L1 public chain specializing in “data intelligence” with nearly $20 million in funding, is now facing intense scrutiny over its airdrop and pre-mainnet launch on-chain activities. The market is rife with suspicions of “insider trading” and a coordinated dump.

Pre-Launch Red Flags: 900 Addresses Centralized Funding

On November 28, the on-chain data analytics platform Bubblemaps unveiled alarming findings: just one day before the IRYS mainnet launch, 900 distinct addresses received ETH transfers from the Bitget exchange within specific timeframes. These addresses exhibited strikingly uniform characteristics:

- Zero Prior History: All were brand-new wallets with no previous on-chain activity.

- Consistent ETH Amounts: Each received similar, small amounts of ETH.

- Coordinated Airdrop Claims: All 900 addresses proceeded to claim IRYS airdrops on launch day, collectively securing approximately 20% of the total allocation.

Deep Dive: A Textbook Sybil Cluster

Bubblemaps’ further investigation segmented these 900 addresses into 20 deposit batches, each containing roughly 50 addresses. The analysis revealed undeniable patterns:

- Timeline: Bitget executed 20 rounds of deposits between November 21 and 24.

- Operational Uniformity: Every batch displayed identical patterns in address generation, activation, and operational paths, consistently receiving small ETH amounts.

- Synchronized Behavior: Addresses were simultaneously active for brief periods, executing identical transaction pathways.

This synchronized, highly organized behavior perfectly aligns with the characteristics of a “Sybil cluster,” strongly suggesting a premeditated and orchestrated attack.

The Cash-Out Trail: From Airdrop to Exchange

Tracking 500 of these addresses unveiled an identical, systematic process:

- Airdrop Claim: Each address claimed its allocated IRYS tokens.

- Address Washing: All tokens were immediately transferred to a brand-new, intermediary address.

- Exchange Transfer: The intermediary address then forwarded the IRYS tokens directly to the Bitget exchange.

- Presumed Sale: It is highly probable that these tokens were promptly sold on the exchange.

To date, an estimated $4 million worth of IRYS tokens has flowed into the Bitget exchange via this meticulously planned route.

IRYS “Insider Trading” Address Bubble Map

Irys’ Official Stance: Denying Insider Involvement, Pledging Airdrop Improvements

In response to the on-chain revelations of the IRYS airdrop Sybil cluster, the project team conducted an internal investigation, corroborating findings with partners and exchanges. Their official response emphasized:

- No Team or Investor Link: The investigation concluded that the Sybil cluster wallets claiming airdrops have no association with team, foundation, or investor wallets. IRYS tokens held by the team, foundation, and founders remain unsold and are subject to existing lock-up and vesting schedules.

- Acknowledging Airdrop Design Flaws: While the project deployed various anti-Sybil mechanisms pre-launch, successfully mitigating some arbitrage, they admit these measures were insufficient to completely thwart the sophisticated Sybil attack. The team views these vulnerabilities as inherent design issues within the airdrop mechanism itself, not execution errors by partners, and has committed to future improvements.

- Forward-Looking Strategy: The team promised regular updates on network growth, ecosystem development, and key company milestones. Product and ecosystem plans include continuous protocol optimization, expanded integration scenarios, advanced data applications, and sustained support for long-term users and developers.

The official statement underscored that this incident will not impede the IRYS mainnet’s operation or derail the project’s long-term vision. The team aims to rebuild community trust through consistent development and transparent communication, moving beyond mere verbal assurances.

Tradoor: Centralization and a Catastrophic 80% Drop

Tradoor, another project launched on Binance Alpha, saw its token, TRADOOR, briefly touch an all-time high of $6.64 on December 1. However, this peak was short-lived, as the token then plummeted by nearly 80% within the next 24 hours, crashing to $1.47. It currently trades around $1.39.

On-chain data paints a stark picture of Tradoor’s extreme lack of decentralization: a mere 10 addresses control a staggering 98% of the total supply, with one single address holding an alarming 75% of all tokens. This leaves a minuscule circulating supply and a DEX liquidity pool totaling less than $1 million, making the token highly susceptible to price manipulation and instant collapse from even a moderately large sell order.

Further eroding investor confidence were persistent issues surrounding airdrop delays and flaws in the staking mechanism. The promised airdrop, initially slated for “soon,” was pushed back to February 2026. This, coupled with staking vulnerabilities, left retail investors with virtually no protection during the market’s sharp downturn. Compounding the tragedy, the TRADOOR crash occurred during the early morning hours (4-5 AM local time in China), catching most retail investors asleep and leaving them to wake up to irreversible losses.

The Golden Rule: Prioritize Profit-Taking in a Volatile Market

As crypto trader Ansem wisely articulated on the X platform, the primary phase of value accumulation within the cryptocurrency industry is “essentially over.” He posits that the vast majority of tokens—dubbed “95% garbage”—are unlikely to sustain long-term value. The true future of value capture, according to Ansem, lies in stablecoins and the blockchain infrastructure being built by established fintech giants like Stripe, Coinbase, and Robinhood on their proprietary chains, rather than the myriad of token projects currently populating the market.

Therefore, even amidst the current signs of a crypto market rebound, and the potential for high-momentum altcoins to stage brief rallies, investors must remain vigilant. While some may “catch a wave” of short-term gains, blindly chasing exorbitant profits (multiple or tenfold returns) is a perilous strategy. The phenomenon of “fancy falling” altcoins is far from over. In this volatile environment, the most prudent approach remains to “know when to quit” – strategically taking profits and securing gains when the opportunity arises.

(The above content is excerpted and reproduced with authorization from partner PANews, original link | Source: Odaily Planet Daily)

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.