Crypto Predictions 2025: A Retrospective Analysis of Industry Forecasts

Author: Deep Tide TechFlow

As the year-end approaches, the crypto industry is once again poised for a deluge of 2026 predictions and outlooks from major institutions. But before we gaze into the future, it’s invaluable to first cast a critical eye on the past. After all, while making forecasts is commonplace, their accuracy is the true measure of insight.

Let’s recall the vibrant market sentiment at the close of 2024. Bitcoin had just broken the $100,000 barrier, and optimism was running high. Predictions for the year ahead (2025) were largely bullish: Bitcoin was projected to surge towards $200,000, stablecoin market capitalization was expected to double, AI agents were poised to ignite on-chain activity, and a flurry of crypto unicorns were anticipated to go public. Now, a full year later, how many of these ambitious forecasts actually materialized?

We’ve meticulously reviewed various prediction reports from the close of last year, selecting the most prominent views from key institutions and individuals. This comprehensive retrospective aims to identify whose crystal ball was clearest and who might need a new one for 2026.

1. VanEck: A Mixed Bag with a 10% Accuracy Rate

VanEck’s 10 major predictions issued at the close of 2024 largely missed the mark for 2025, achieving a mere 10% accuracy. The sole correct forecast was the establishment of Bitcoin strategic reserves.

The remaining nine predictions were not just slightly off, but often erred by orders of magnitude. For instance, VanEck projected a crypto market peak in Q1 2025, with Bitcoin reaching $180,000, followed by new highs by year-end. In reality, both the timing and price targets proved to be diametrically opposite to market performance this year.

Furthermore, their market size estimations leaned heavily towards optimism. Tokenized securities were predicted to hit $50 billion, while actual figures for this year ranged between $30 billion and $130 billion. DeFi Total Value Locked (TVL) was forecasted at $200 billion, yet it hovered around $120-130 billion. NFT trading volume, predicted at $30 billion, settled closer to an estimated $5-6.5 billion.

Overall, while VanEck demonstrated sharp accuracy in discerning policy shifts, they consistently overestimated the scale of the on-chain economy.

2. Bitwise: 50% Accuracy, Strong on Policy, Weak on Price

Bitwise presented 10 predictions at the end of 2024, hitting 50% accuracy for 2025. Their strengths lay primarily in regulatory and institutional adoption trends, though like VanEck, they systematically overestimated price and market scale.

Their foresight regarding policy and institutional integration was remarkably accurate. Predictions such as Coinbase and MicroStrategy entering major US stock indices came true this year. The “Year of Crypto IPOs” materialized with several crypto companies going public, and the number of nations holding Bitcoin soared from 9 to nearly 30.

However, Bitwise’s price targets universally missed. The predicted prices for Bitcoin, Ethereum, and Solana significantly exceeded the tokens’ actual performance this year. Coinbase’s stock, predicted to reach $700, only hit $250, a substantial 65% short of the target. Similarly, their $50 billion estimate for RWA tokenization proved to be an overestimation.

In summary, Bitwise displayed acute policy intuition, accurately grasping regulatory shifts and the pace of institutional integration.

3. Coinbase: Near 100% Accuracy by Focusing on Direction, Not Price

Coinbase’s predictions, categorized into “Macro” and “Disruption,” were predominantly directional rather than precise numerical forecasts, embodying a forward-looking trend analysis.

Some core verifiable predictions included:

Other predictions, while broadly correct, were harder to quantify:

Notably, Coinbase deliberately avoided specific price targets, choosing instead to concentrate on pivotal policy shifts and overarching industry trends. This strategy resulted in nearly all their core directional predictions proving accurate for 2025.

Regulatory turning points were fully validated: their forecast of a “most crypto-friendly Congress ever” leading to positive developments and more asset ETF approvals indeed came to pass this year.

Their general direction for stablecoins and DeFi was also correct: predicting “explosive growth and expansion into commercial payments” for stablecoins saw validation with Mastercard’s June announcement supporting USDC/PYUSD/USDG, Coinbase’s payment platform integrating Shopify, and Stripe launching USDC subscription payments this year.

The predicted DeFi resurgence also materialized, with DeFi TVL reaching $120 billion, nearing a three-year high since May 2022 this year.

While this “direction-only, no-specific-points” approach might lack sensational headlines, it proved to be the most robust and least susceptible to misjudgment in hindsight.

4. Galaxy Research: A Granular Approach with a 26% Hit Rate

Galaxy Research’s team of researchers collectively issued 23 predictions at the end of 2024, making it the most quantitative and detailed report among all institutions reviewed. However, its accuracy rate for 2025 stood at just 26%.

In retrospect, their policy prediction team performed exceptionally well, boasting a 100% hit rate. Conversely, their price and market size forecasts were almost entirely incorrect. The prediction of DOGE breaking $1, in particular, appears excessively optimistic in hindsight.

Despite these misses, Galaxy’s predictions regarding ecosystem development showed promise. For instance, their forecast that most mining companies would transition to AI and high-performance computing proved to be a significant trend amidst this year’s AI boom.

This case illustrates that even for professional research institutions, a high volume of granular predictions doesn’t guarantee accuracy; the market often takes unexpected turns.

5. HashKey: Accurate on Trends, Overly Optimistic on Price (70% Accuracy)

HashKey’s predictions for 2025, made at the close of 2024, generally demonstrated precise judgment on regulatory compliance progress (ETFs, stablecoin legislation) and shifts in ecosystem structure (rise of DEXs, L2 differentiation). However, they remained overly optimistic regarding price cycles, achieving a 70% accuracy rate.

Interestingly, HashKey’s report also served as a barometer for the prevailing sentiment within the crypto community at the time. After HashKey Group released its top 10 market predictions for 2025, nearly 50,000 community users voted on sixteen popular forecasts compiled by HashKey researchers, analysts, and traders.

The results showed that 50% of voters favored the prediction that “Bitcoin would surpass $300,000, Ethereum would exceed $8,000, and the total crypto market capitalization would reach $10 trillion.” Ironically, this most highly-voted prediction now appears the least likely to be realized by the end of this year.

6. Delphi Digital: Consumer DeFi as a Highlight (40% Accuracy)

Delphi Digital’s predictions for 2025, made at the end of 2024, proved more accurate concerning technological infrastructure and consumer-grade applications. A standout forecast was: “2025 will be a critical development node for consumer DeFi, with an increasing number of crypto users fully embracing on-chain financial services.”

Indeed, this year witnessed the emergence of various crypto-linked debit cards (“U-cards”) and tokenized US stocks. Furthermore, traditional financial applications like Robinhood have progressively begun to integrate on-chain functionalities, validating Delphi’s foresight in this area.

7. Messari: Trend-Focused with 55% Accuracy

While Messari is primarily a data analysis platform, its predictions for 2025 leaned towards identifying “trend directions” rather than “specific numbers.” In hindsight, their judgment on major trends proved relatively accurate, achieving a 55% accuracy rate.

8. Framework Co-founder Vance Spencer: Portfolio-Driven Optimism (25% Accuracy)

Beyond institutional forecasts, we also examined some representative individual predictions from the past year. Vance Spencer, co-founder of Framework, offered his insights for 2025, particularly concerning the crypto landscape:

Evidently, Vance assigned significant predictive expectations to projects within Framework’s investment portfolio, such as Glow, Daylight, and Berachain, representing the energy and public chain sectors respectively. Additionally, some quantitative targets, like the projection of $1 billion in daily ETH ETF inflows, proved to be overly aggressive for this year.

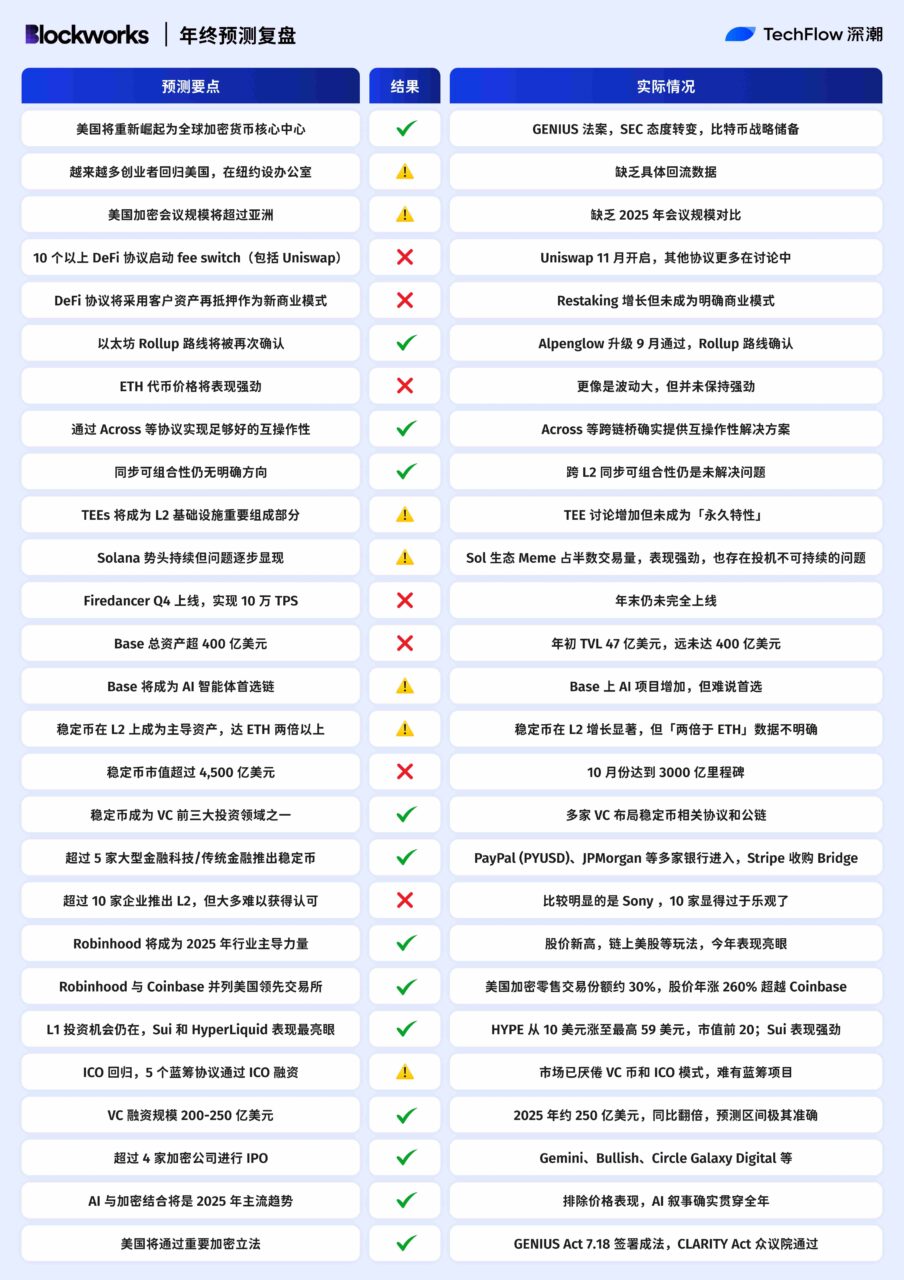

9. Blockworks Co-founder Mippo: High Volume, Decent Accuracy (48%)

Mippo (X: @MikeIppolito_), co-founder of Blockworks, made the most extensive list of predictions among all individuals and institutions reviewed for 2025. Despite the sheer volume, his accuracy rate was respectable at 48%, hitting nearly half his forecasts.

A notable highlight was his entirely correct prediction regarding the resurgence of Robinhood. He also accurately identified promising Layer 1 investment opportunities, such as Hyperliquid and SUI, both of which saw impressive token performance this year.

10. Alliance DAO Co-founders Wang Qiao & Imran: BTC Over-Optimism, Prediction Market Insight (50% Accuracy)

Wang Qiao and Imran, co-founders of Alliance DAO, also shared their predictions for 2025 during a podcast discussion. Their crypto-related insights are summarized below:

It’s evident that both co-founders were overly optimistic about Bitcoin’s performance. Even their lowest forecast of $150,000 remained significantly distant from Bitcoin’s peak price this year. However, their judgment regarding prediction markets was exceptionally precise, effectively anticipating this key trend a full year in advance.

Key Takeaways from a Year of Crypto Forecasts

Reviewing the past year’s predictions reveals several clear patterns and valuable lessons:

- Quantity vs. Accuracy: There’s an inverse relationship between the number of predictions made and their overall accuracy. The more specific points an entity attempts to forecast, the higher the likelihood of error.

- The Peril of Price Targets: Attempts to predict specific price points and numerical targets almost universally proved to be wishful thinking rather than accurate foresight.

- Policy Foresight Reigns: Predictions concerning policy shifts and regulatory environments were remarkably reliable. The improvement in the regulatory landscape and a growing crypto-friendly stance in the US were accurately foreseen by almost all institutions and individuals.

Ultimately, the true value of these annual institutional predictions lies not in “telling you what to buy,” but in “revealing what the industry is thinking.” We should view these forecasts as indicators of industry sentiment and prevailing narratives. Relying on them as definitive investment guides, however, could lead to disappointing outcomes.

Cultivate a healthy habit: maintain skepticism towards any prediction that includes specific numerical targets, regardless of whether it originates from a prominent KOL, a respected institution, or an industry titan. This isn’t to criticize these industry leaders; rather, even incorrect predictions offer value. They illuminate what the market once believed, underscoring the fundamental truth that no one can truly predict the future.

(The above content is an excerpt and reproduction authorized by partner PANews. Original Link | Source: Deep Tide TechFlow)

Disclaimer: This article is for market information purposes only. All content and opinions are for reference only and do not constitute investment advice. They do not represent the views and positions of BlockTempo. Investors should make their own decisions and transactions. The author and BlockTempo will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.