Author: AJC

Source: Messari’s Upcoming “Crypto Themes 2026”

The Cryptomoney Imperative: Driving Industry Evolution

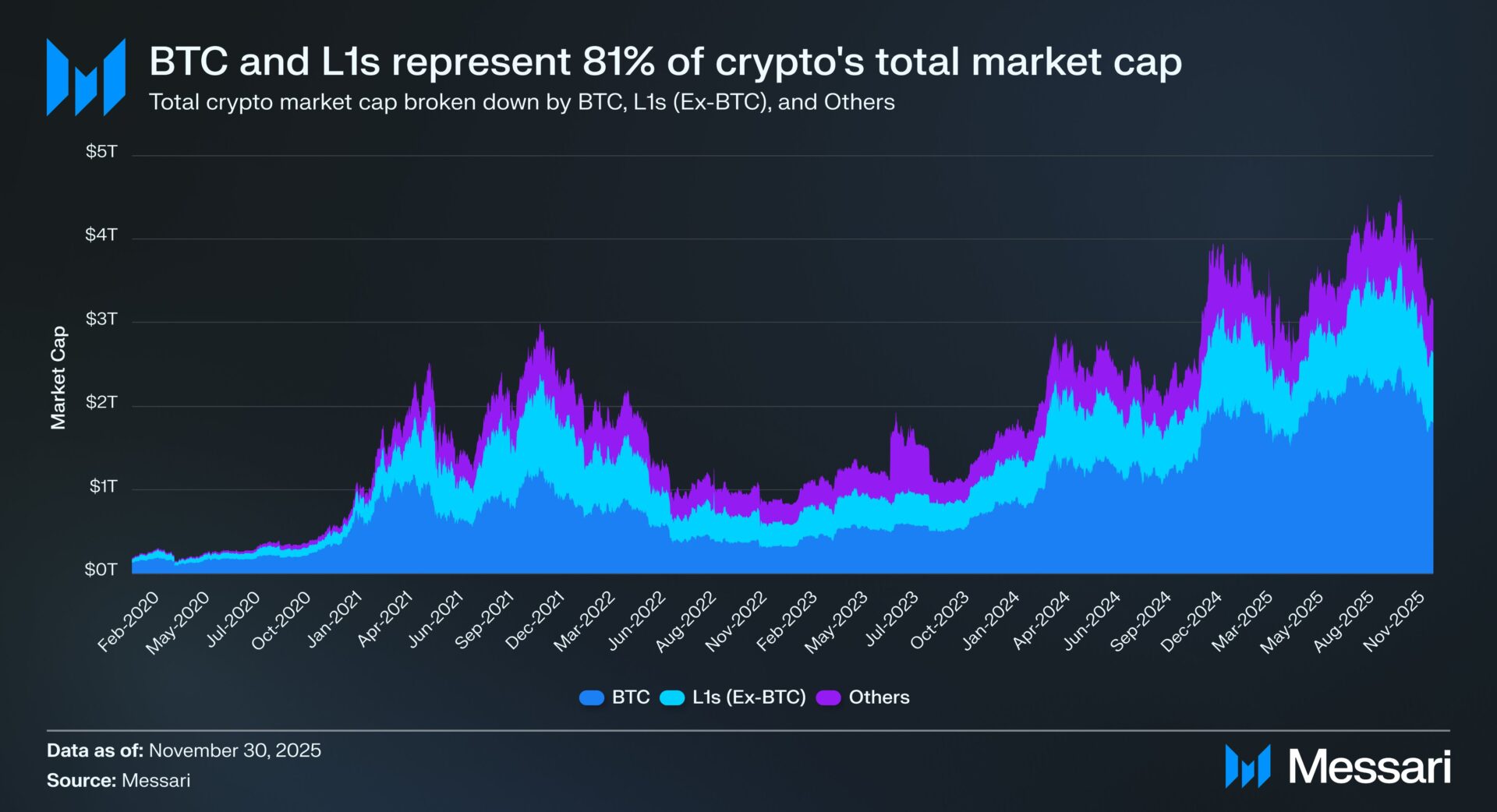

Understanding the concept of “cryptomoney” is paramount, as it represents the ultimate investment target for the vast majority of capital within the crypto industry. The total cryptocurrency market capitalization stands at a staggering $3.26 trillion. Bitcoin (BTC) alone accounts for $1.80 trillion, or 55% of this total. Of the remaining $1.45 trillion, approximately $0.83 trillion is concentrated in other Layer 1 (L1) tokens. In aggregate, roughly $2.63 trillion—around 81% of all crypto capital—is allocated to assets that the market already perceives as money or believes could accrue a significant monetary premium.

Given this landscape, it is crucial for traders, investors, capital allocators, and builders alike to comprehend how the market assigns and withdraws this monetary premium. In the crypto sphere, few factors influence valuation more profoundly than the market’s willingness to recognize an asset as a form of money. Consequently, predicting where future monetary premium will accumulate is arguably the most critical element in constructing an industry-leading portfolio.

While our focus has predominantly been on Bitcoin, the other $0.83 trillion in assets—those that may or may not be considered cryptomoney—warrant deeper examination. We anticipate Bitcoin will continue to capture market share from gold and other non-sovereign stores of wealth in the coming years. But what does this mean for L1s? Will a rising tide lift all boats, or will Bitcoin partially close its gap with gold by drawing monetary premium away from L1s?

A Closer Look at Layer 1 Valuations

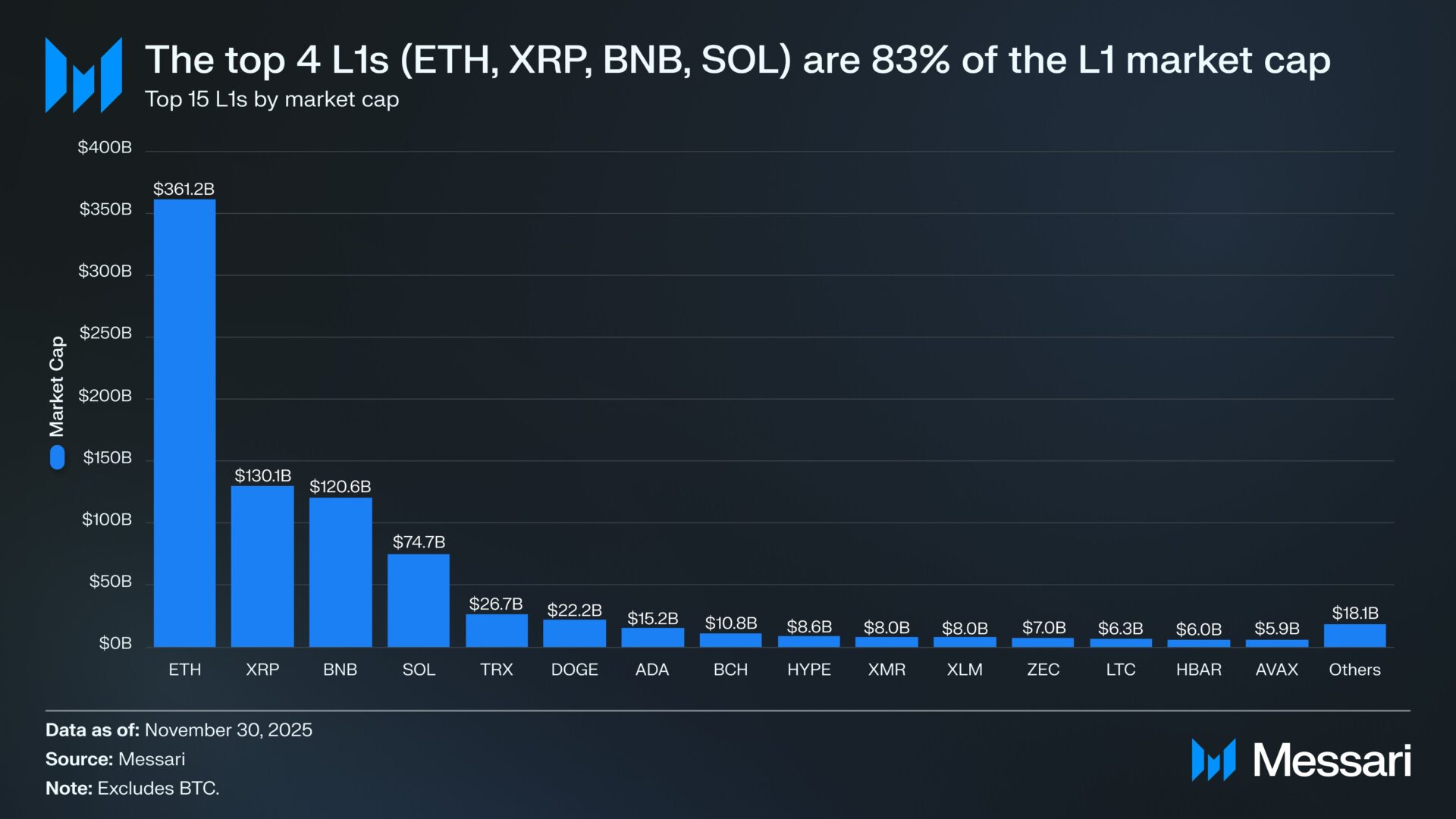

To begin, it’s beneficial to grasp the current valuation levels of L1s. The top four L1s—Ethereum ($361.15 billion), XRP ($130.11 billion), BNB ($120.64 billion), and SOL ($74.68 billion)—collectively command a market capitalization of $686.58 billion, representing 83% of the entire L1 sector. Beyond these dominant four, valuations drop sharply (TRX, for instance, has a market cap of $26.67 billion). Interestingly, however, the “long tail” of L1s remains substantial, with L1s outside the top 15 collectively holding $18.06 billion, or 2% of the total L1 market cap.

Crucially, L1 market capitalization does not solely reflect an implied monetary premium. L1 valuation frameworks primarily encompass three distinct elements:

- Monetary Premium

- Real Economic Value (REV)

- Demand for Economic Security

Therefore, an L1 project’s market capitalization is not merely a consequence of the market deeming it “money.”

Monetary Premium, Not Revenue, Drives L1 Valuations

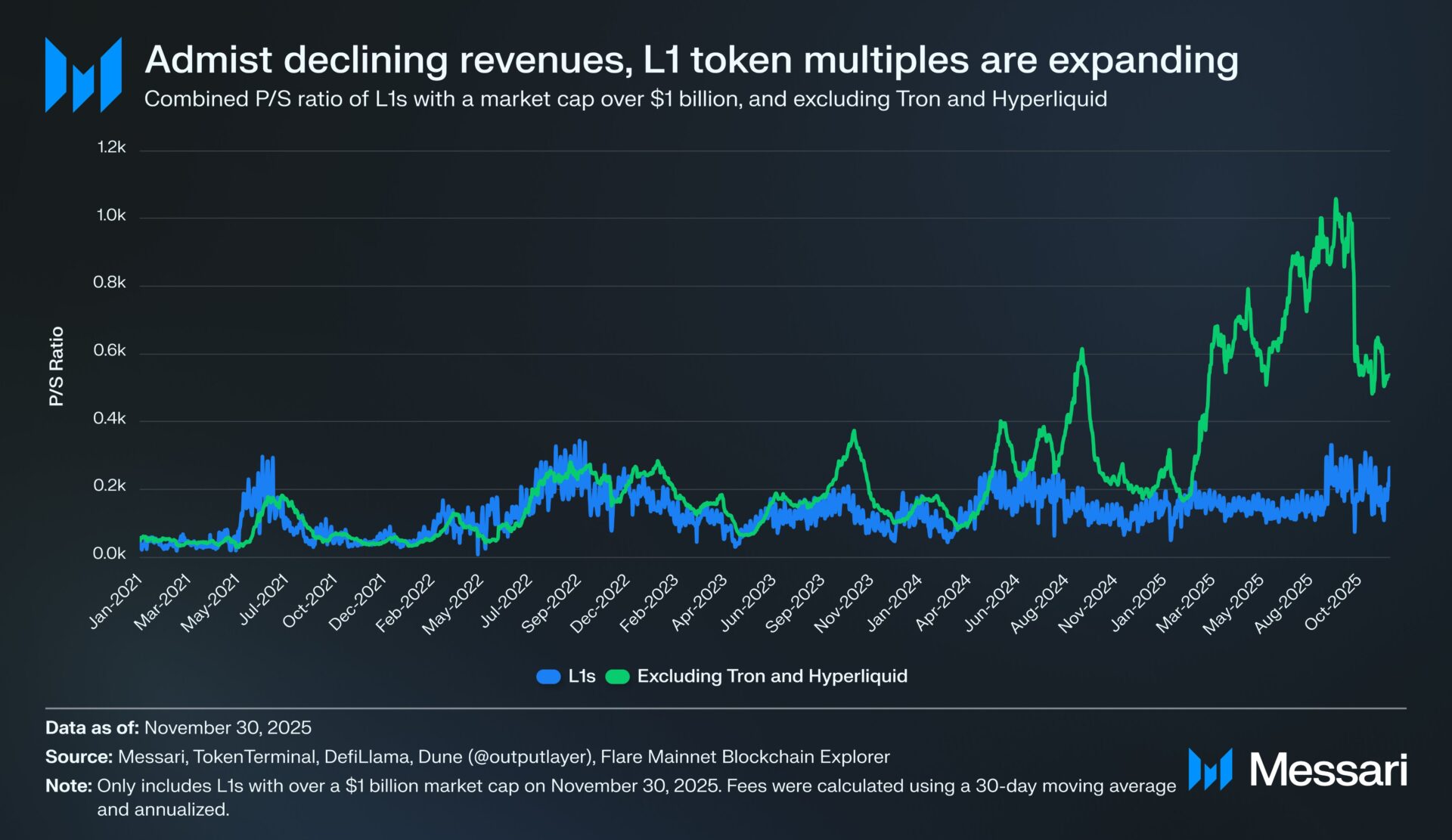

Despite these competing valuation frameworks, there’s a growing tendency in the market to assess L1s through a revenue-driven lens rather than focusing on monetary premium. Over the past few years, the aggregate Price-to-Sales (P/S) ratio for all L1s with a market capitalization exceeding $1 billion has remained relatively stable, typically fluctuating between 150x and 200x. However, this aggregate figure is misleading due to the inclusion of outliers like TRON and Hyperliquid. In the last 30 days, TRX and HYPE generated 70% of the revenue for this group but accounted for only 4% of its market capitalization.

Excluding these two outliers reveals a stark reality: L1 valuations have consistently risen even as revenue has declined. The adjusted P/S ratios have steadily climbed:

- November 30, 2021 – 40x

- November 30, 2022 – 212x

- November 30, 2023 – 137x

- November 30, 2024 – 205x

- November 30, 2025 – 536x

A Real Economic Value-based explanation might posit that the market is simply pricing in future revenue growth. However, this explanation doesn’t withstand scrutiny. Across the same basket of L1 tokens (still excluding TRON and Hyperliquid), revenue has declined in every year except one:

- 2021 – $12.33 billion

- 2022 – $4.89 billion (down 60% YoY)

- 2023 – $2.72 billion (down 44% YoY)

- 2024 – $3.55 billion (up 31% YoY)

- 2025 – $1.7 billion annualized (down 52% YoY)

We contend that the simplest and most direct explanation is that these valuations are driven by monetary premium, not by current or anticipated future revenue.

L1 Tokens Consistently Underperform Bitcoin

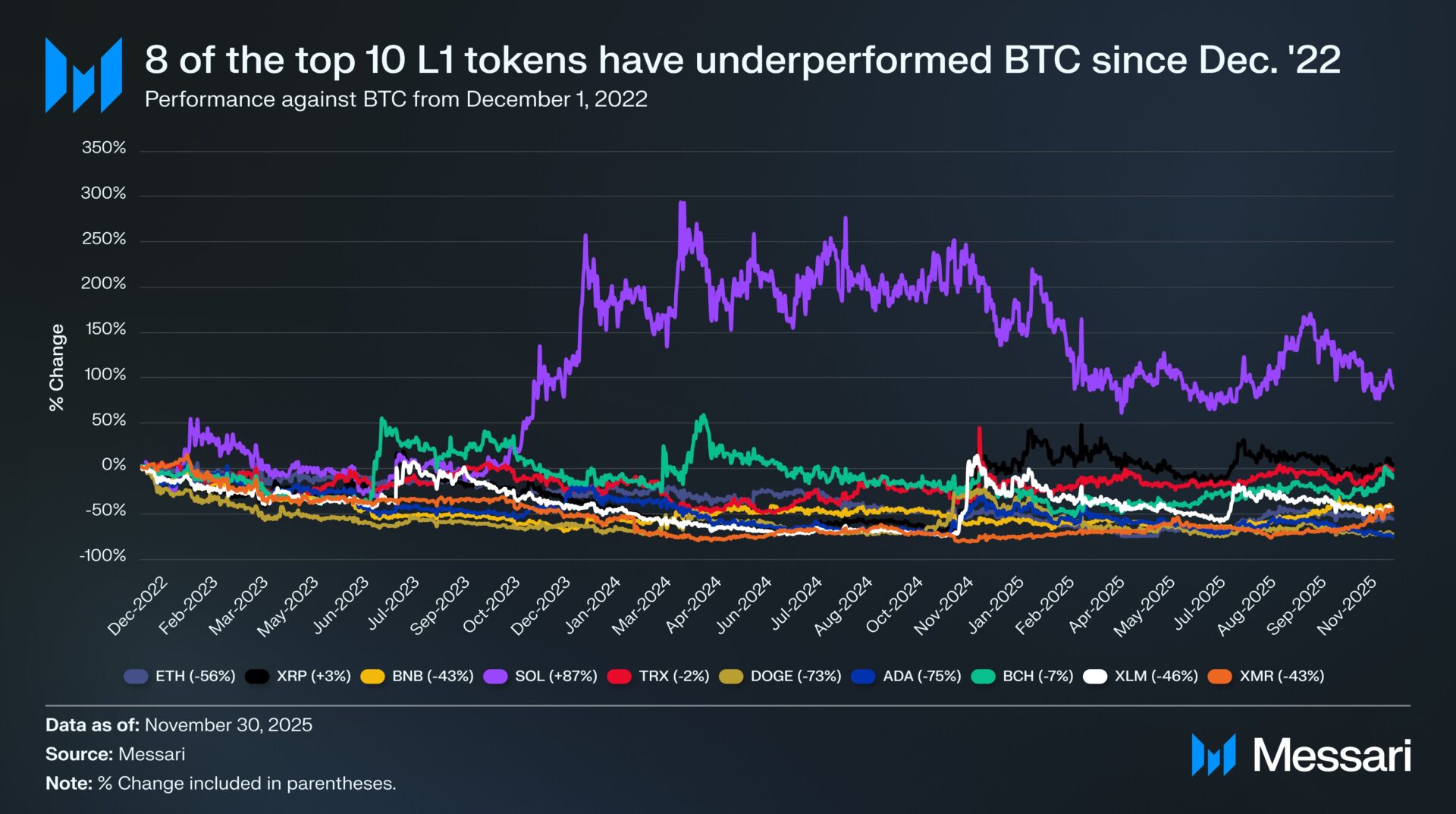

If L1 valuations are indeed driven by monetary premium expectations, the next step is to understand what shapes these expectations. A straightforward test is to compare the price performance of L1s against BTC. If monetary premium expectations primarily mirror BTC’s price movements, then these assets should exhibit a similar beta coefficient to BTC. Conversely, if monetary premium expectations are driven by factors unique to each L1 asset, we would anticipate a much weaker correlation with BTC and more idiosyncratic performance.

As a proxy for L1s, we examined the performance of the top ten L1 tokens by market capitalization (excluding HYPE) relative to Bitcoin (BTC) since December 1, 2022. These ten assets represent approximately 94% of the total L1 market capitalization, thus serving as a strong indicator for the sector. During this period, eight of these ten assets absolutely underperformed Bitcoin, with six lagging BTC by 40% or more. Only two assets outperformed Bitcoin: XRP and SOL. XRP’s excess return was a mere 3%, which we won’t overemphasize given XRP’s historical retail-driven capital flows. The sole asset that significantly outperformed Bitcoin was SOL, yielding 87% more than BTC.

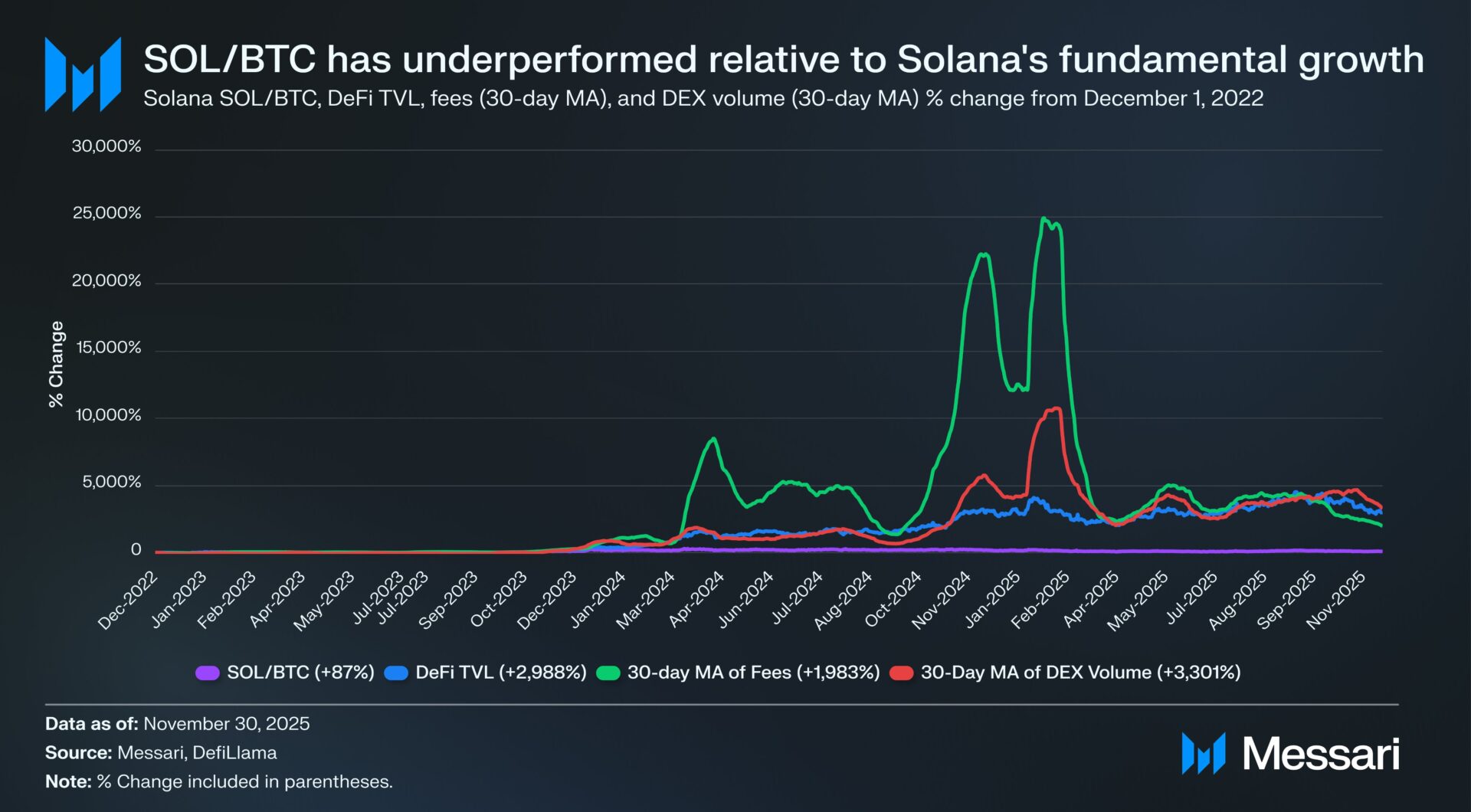

Upon closer inspection of SOL’s outperformance, it actually paints a picture of potential underperformance. During the same period that SOL outperformed BTC by 87%, Solana’s fundamentals experienced parabolic growth. DeFi Total Value Locked (TVL) surged by 2988%, fees increased by 1983%, and DEX volume skyrocketed by 3301%. By virtually every metric, Solana’s ecosystem grew 20 to 30 times since late 2022. Yet, SOL, the asset designed to capture this growth, only outperformed BTC by 87%.

Read that again.

To achieve significant outperformance against BTC, an L1’s crypto ecosystem doesn’t just need to grow 200-300%. It requires 2000-3000% growth to generate even double-digit outperformance.

In summary, we believe that while L1 valuations are still predicated on expectations of future monetary premium, market confidence in these expectations is subtly eroding. Simultaneously, the market has not lost faith in BTC’s monetary premium, and Bitcoin’s lead over L1s continues to widen.

While cryptomoney technically doesn’t require fees or revenue to underpin its valuation, these metrics are vital for L1s. Unlike Bitcoin, an L1’s core value lies in establishing an ecosystem that supports its token (including applications, users, throughput, economic activity, etc.). However, if an L1’s ecosystem usage declines year-over-year, partly reflected in reduced fees and revenue, that L1 loses its sole competitive advantage over Bitcoin. Without genuine economic growth, it becomes increasingly difficult for the market to believe the cryptomoney narrative for these L1s.

Looking Ahead: The Shifting Sands of Crypto Valuation

Looking ahead, we do not anticipate a reversal of this trend in 2026 and beyond. With few exceptions, we expect Bitcoin to continue eroding the market share of other L1 assets. Their valuations, primarily driven by expectations of future monetary premium, will steadily decline as the market increasingly recognizes Bitcoin as the most competitive cryptomoney. While Bitcoin will face its own challenges in the coming years, these issues remain unclear and subject to numerous unknowns, insufficient to provide substantial support for the current monetary premium of other L1 assets.

For L1 platforms, the burden of proof has undeniably shifted. Their narrative is no longer as compelling when compared to Bitcoin, and they cannot indefinitely rely on general market euphoria to sustain their valuations. The era where the mere idea of “we might one day become money” was enough to support multi-trillion dollar valuations is fading. Investors now possess a decade of data indicating that L1 monetary premium is only sustainable during periods of rapid platform growth. Outside of these rare bursts of activity, L1s consistently lag Bitcoin, and when growth inevitably slows, the monetary premium vanishes.

(The content above is an authorized excerpt and reprint from our partner PANews. Original Link | Source: Jinse Finance)

Disclaimer: This article is for market information purposes only. All content and views are for reference only, do not constitute investment advice, and do not represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses resulting from investor transactions.