Tom Lee Declares: Crypto’s Golden Age Just Beginning, Bitcoin to $300K, Ethereum to $20K by 2026

Compiled & Edited by: Yuliya, PANews

At Binance Blockchain Week on December 4th, renowned Wall Street analyst and BitMine Chairman Tom Lee delivered a compelling keynote speech titled “The Crypto Supercycle Is Still Alive.” He posited that the true golden age of cryptocurrency has only just begun, not only projecting audacious target prices of $300,000 for Bitcoin and $20,000 for Ethereum by 2026, but also meticulously explaining why Ethereum’s value is profoundly underestimated and why the traditional Bitcoin “4-year cycle” is no longer relevant.

The Unfolding Crypto Golden Age: Tokenization as the Defining Narrative

Tom Lee commenced his address by reflecting on investment returns over the past decade, underscoring the astonishing growth potential inherent in cryptocurrencies.

He highlighted that an investment in the S&P 500 in December 2016 would have roughly tripled; gold would have quadrupled. A prescient investment in Nvidia would have yielded a 65-fold return. However, those who invested in Bitcoin a decade ago would have seen a staggering 112-fold return, while Ethereum surpassed even Bitcoin, achieving nearly a 500-fold return over the same period.

Despite a challenging price performance in the crypto market in 2025 year-to-date, this year has been marked by several significant fundamental catalysts:

- Governmental Shift: The U.S. government has demonstrated a pro-crypto stance, setting a new precedent for the Western world.

- Strategic Bitcoin Reserves: Multiple U.S. states and the federal government have either planned or executed strategic Bitcoin reserves, marking a monumental step forward.

- ETF Success: BlackRock’s Bitcoin ETF has rapidly ascended to become one of its top five products by fee revenue, an unprecedented achievement for a product launched merely a year and a half ago.

- Traditional Finance Entry: JPMorgan, a long-standing critic of cryptocurrencies, is now launching JPM Coin on Ethereum. Tokenization has become a top priority for all major financial institutions.

- Native Product Breakthroughs: The crypto market has introduced two to three native products that are fundamentally altering traditional financial decision-making. Examples include the prediction market PolyMarket, offering near “crystal ball” insights, and Tether, which has proven itself to be among the top ten most profitable banks globally.

Crucially, Tom Lee asserted that the core narrative for 2025 is tokenization. This movement began with stablecoins, representing Ethereum’s “ChatGPT moment,” as Wall Street suddenly recognized the immense profits to be made simply by tokenizing the U.S. dollar. Now, financial institutions widely believe tokenization will revolutionize the entire financial industry, with BlackRock CEO Larry Fink even hailing it as “the greatest and most exciting invention since double-entry bookkeeping.”

He further elaborated that Larry Fink’s vision of “the beginning of all asset tokenization” will unlock value far beyond current imagination. Tokenization offers five key advantages: fractional ownership, reduced costs, 24/7 global trading, enhanced transparency, and theoretically improved liquidity.

These are merely the foundational elements. Most people perceive tokenization as simple asset division, but the true revolution lies in a second, more profound method: “factorizing” the future value of a business.

Consider Tesla as an illustration. It can be disaggregated and tokenized across multiple dimensions:

- Time Tokenization: Purchasing the net present value of Tesla’s profits for a specific future year (e.g., 2036).

- Product Tokenization: Acquiring the future value of specific product lines (e.g., electric vehicles, autonomous driving, Optimus robots).

- Geographic Tokenization: Investing in the future profits from a specific region, such as its Chinese market.

- Financial Statement Tokenization: Purchasing a tokenized portion of its subscription revenue.

- Founder Value Tokenization: Even stripping out and trading the market’s valuation of Elon Musk himself.

This approach promises to unleash an enormous release of value, and BitMine is actively identifying and fostering projects in this burgeoning domain.

Tom Lee firmly believes that the golden age of cryptocurrency is far from over, with immense growth potential ahead. He explained that currently, there are only 4.4 million Bitcoin wallets holding over $10,000. In stark contrast, nearly 900 million retirement accounts globally hold over $10,000. If all these accounts were to allocate to Bitcoin, it would signify a 200-fold increase in adoption. A Bank of America survey reveals that 67% of fund managers still have zero allocation to Bitcoin. Wall Street aims to tokenize all financial products, and if real estate is included, this represents a market nearing quadrillions of dollars. Therefore, the best era for cryptocurrency is still ahead.

Challenging the Bitcoin 4-Year Cycle: A New Paradigm for Price Discovery

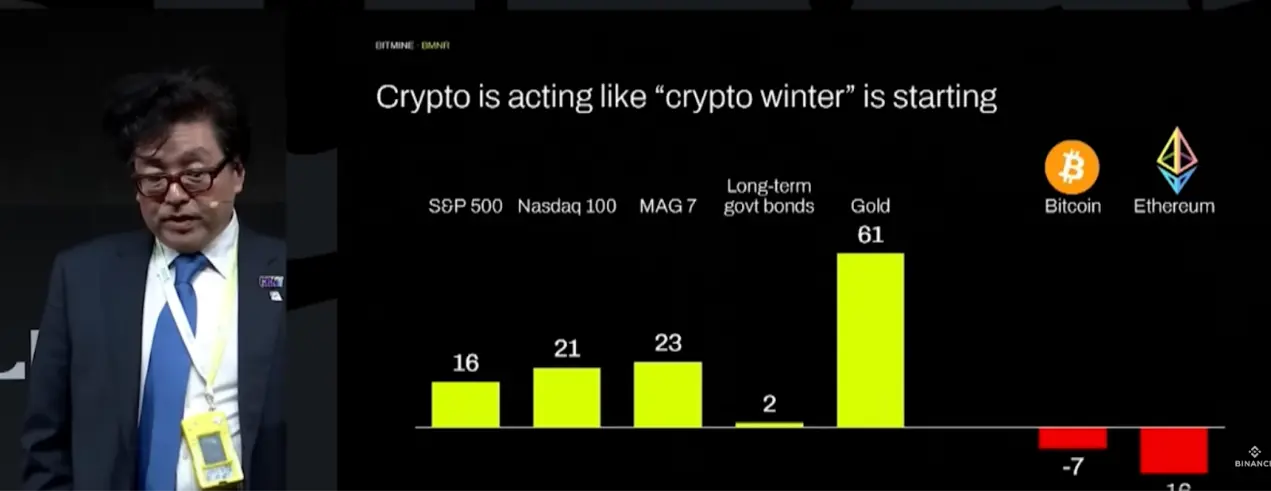

While bullish on the long-term prospects of cryptocurrency, Tom Lee candidly admitted that the current crypto market performance resembles a “winter,” starkly contrasting with traditional assets. Gold has surged 61% year-to-date, and the S&P 500 is up nearly 20%, while Bitcoin and Ethereum have yielded negative returns. He referenced Jeff Dorman of Arca’s aptly titled article: “The Unexplainable Sell-off.”

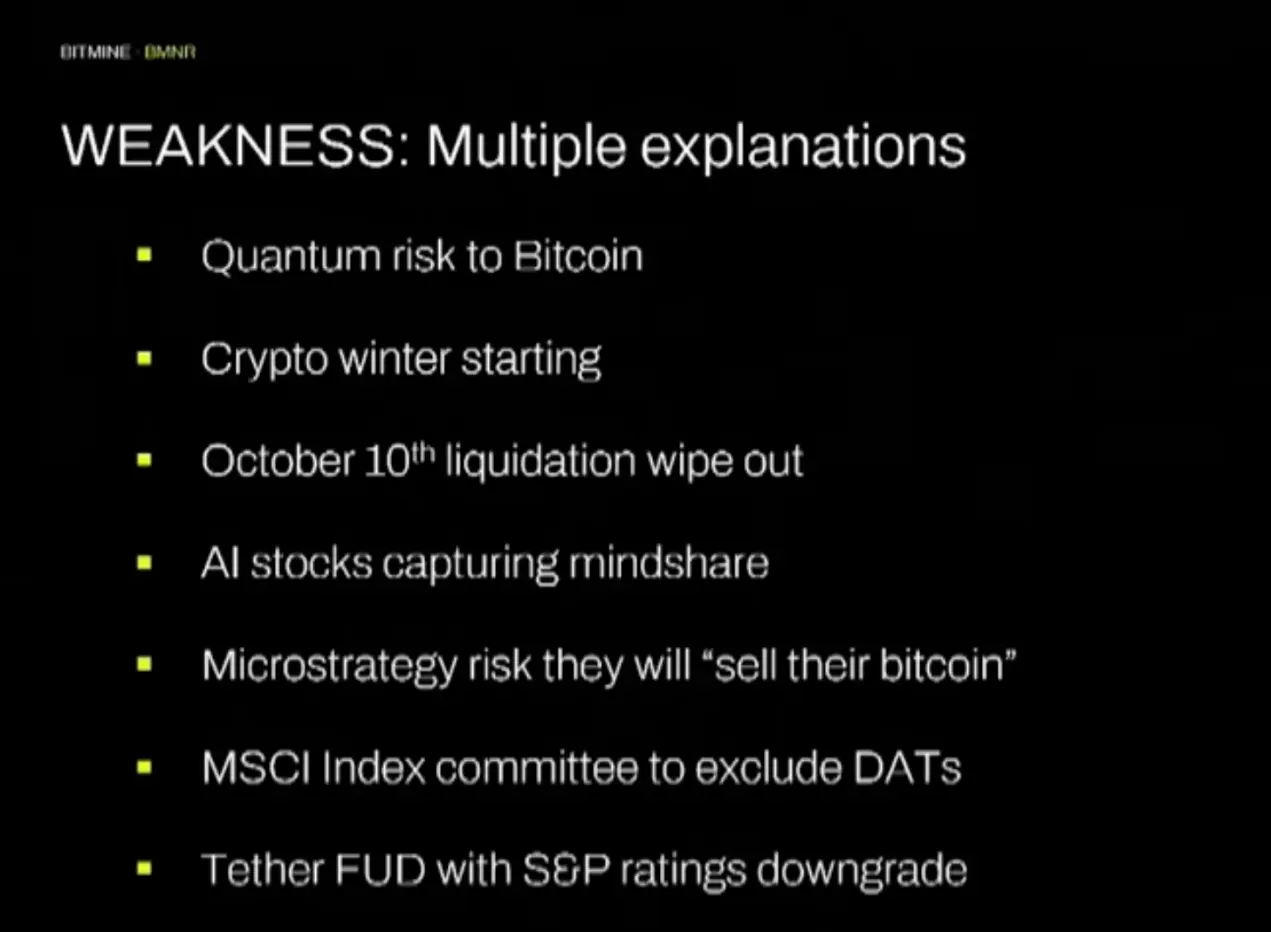

He further indicated that Bitcoin’s turning point occurred on October 10th. Prior to this, Bitcoin had risen 36% year-to-date, but subsequently entered a downturn. Numerous explanations have circulated: quantum computing risks, the four-year cycle theory, the historic liquidation event on October 10th, attention diverted by AI stocks, rumors of MicroStrategy potentially selling Bitcoin, MSCI’s possible exclusion of digital asset treasury companies from indices, and Tether’s rating downgrade.

However, Tom Lee argued that this downturn is intimately linked to deleveraging. After the FTX collapse, it took eight weeks for the market to restore price discovery. From the October 10th liquidation event to the present, approximately seven and a half weeks have passed, nearing a similar price recovery period.

To gain a more precise market perspective, Tom Lee revealed that Fundstrat engaged legendary market timing expert Tom DeMark. Acting on his advice, they significantly slowed Ethereum purchases, halving their weekly acquisition volume to 50,000 ETH. However, BitMine has recently resumed aggressive accumulation, purchasing nearly 100,000 ETH last week, double the amount of the preceding two weeks. This week’s purchasing volume is even higher, as they are confident that Ethereum’s price has bottomed.

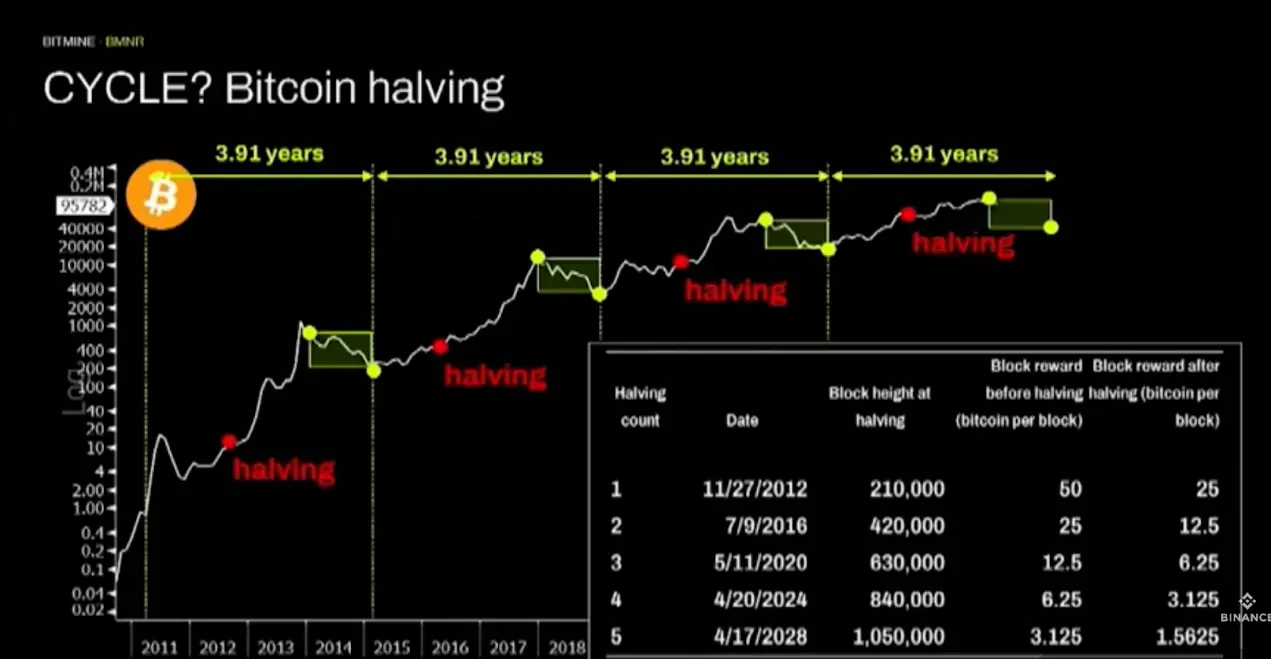

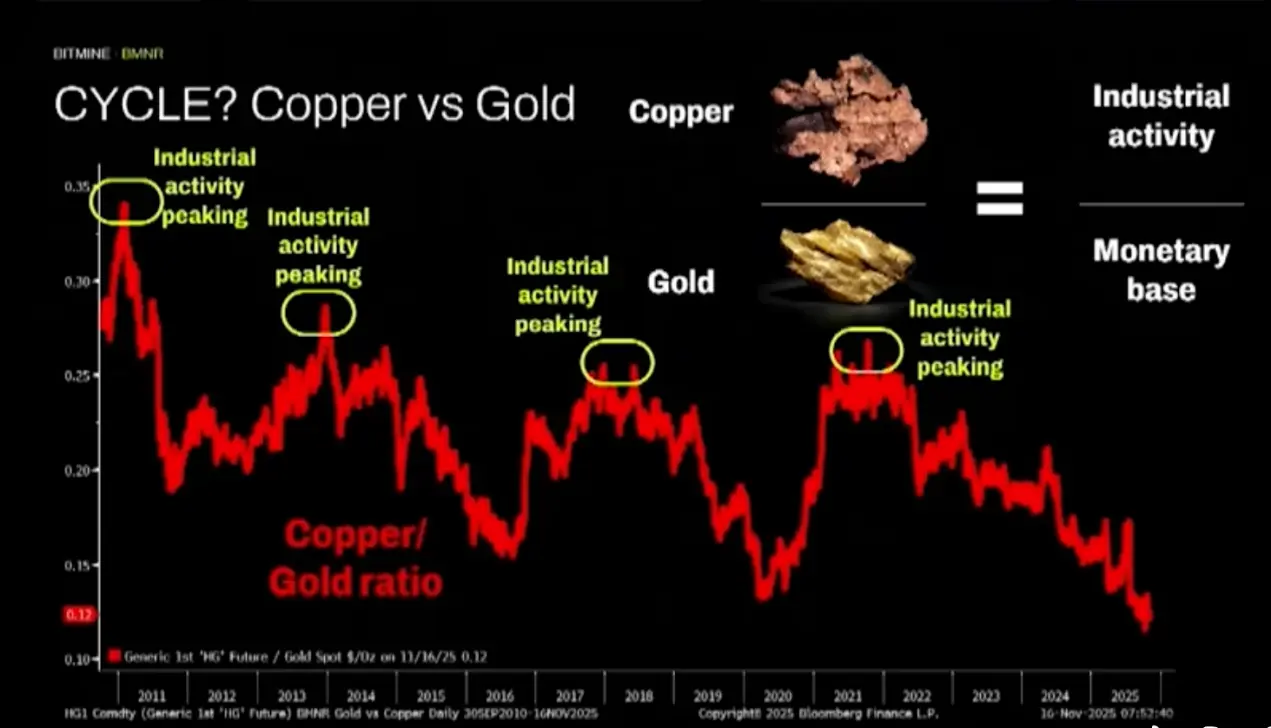

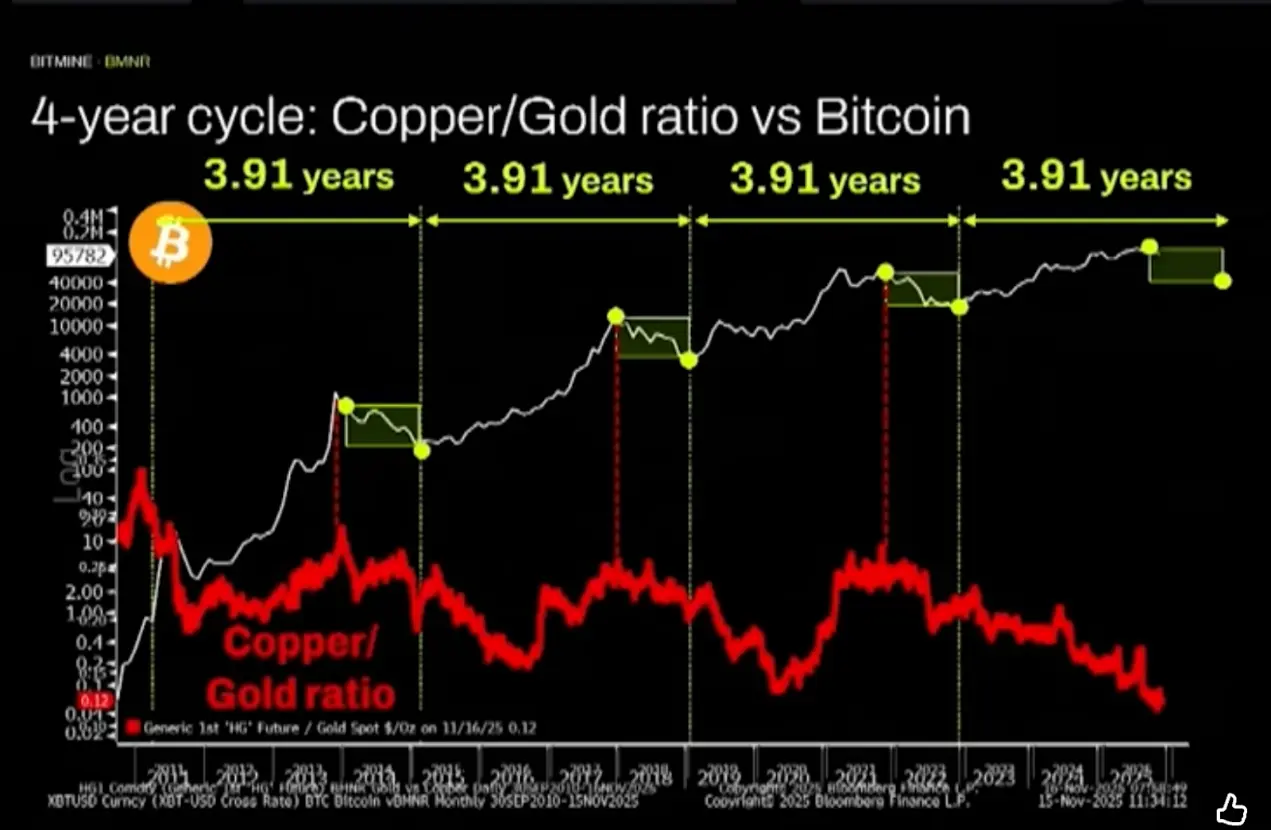

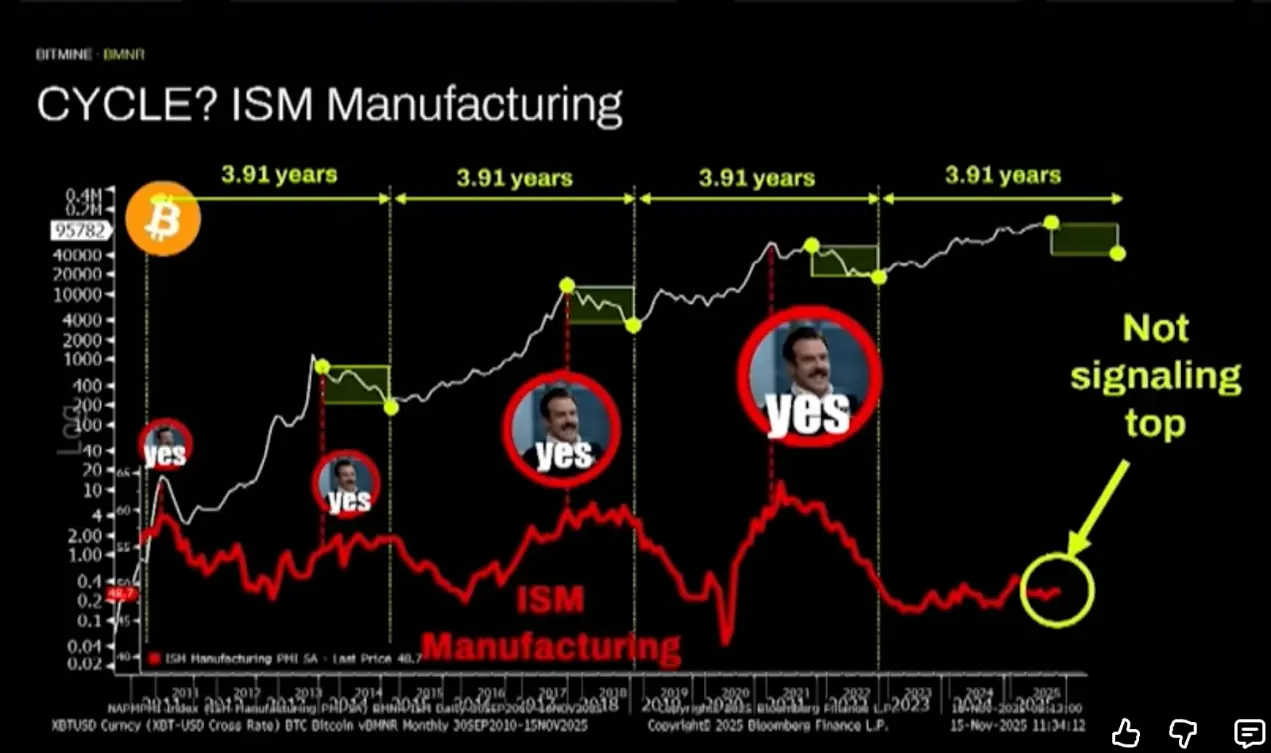

Additionally, Tom Lee addressed the “Bitcoin four-year cycle” that has perplexed many. He noted that historically, it accurately predicted market tops and bottoms three times, with mainstream explanations typically revolving around halving cycles and monetary policy. However, the Fundstrat team discovered that the “copper-gold ratio” and the “ISM Manufacturing Index” (representing traditional economic cycles) exhibit an even stronger correlation with Bitcoin’s cycles.

According to Tom Lee, in the past, both the copper-gold ratio (a measure of industrial activity versus the monetary base) and the ISM Index demonstrated a highly correlated four-year cycle with Bitcoin’s price. This time, however, neither of these indicators has followed the four-year cycle. The copper-gold ratio should have peaked this year but did not; the ISM Index has remained below 50 for nearly three and a half years, also without peaking.

Therefore, he concluded, since the industrial cycle and copper-gold ratio cycle, which historically drove Bitcoin’s cycles, have failed to adhere to their pattern, there is no reason to believe Bitcoin itself should still follow a four-year cycle. He does not believe Bitcoin’s price has peaked and is willing to bet that Bitcoin will reach new all-time highs by January of next year.

Ethereum’s ‘1971 Moment’: Unlocking Vast Undervalued Potential

“Ethereum in 2025 is experiencing its own ‘1971 moment’,” Tom Lee declared. He drew a parallel: just as Wall Street created countless financial products to uphold the U.S. dollar’s reserve status, today, amidst the wave of tokenization across stocks, bonds, and real estate, Ethereum has emerged as Wall Street’s preferred platform.

Tom Lee cited early Bitcoin developer Eric Voorhees’s perspective, stating that “Ethereum has won the smart contract war.” He pointed out that virtually all major financial institutions are building products on Ethereum, with the vast majority of Real World Asset (RWA) tokenization products appearing on the platform. Under the tokenization narrative, Ethereum’s utility value is rapidly increasing. Concurrently, Ethereum itself is undergoing continuous upgrades, including the recent Fusaka upgrade. From a price chart perspective, Ethereum has begun to break out after a five-year consolidation, and the ETH/BTC exchange rate is also poised for a breakout.

Furthermore, as a Proof-of-Stake (PoS) blockchain, Tom Lee believes that Ethereum reserve companies are gradually transforming Wall Street’s traditional roles. These companies are essentially crypto infrastructure businesses, providing network security through Ethereum staking while earning staking rewards as a revenue stream. Simultaneously, treasury companies act as a bridge between traditional finance and DeFi, fostering their integration and development. The key metric for measuring the success of such companies is their stock liquidity.

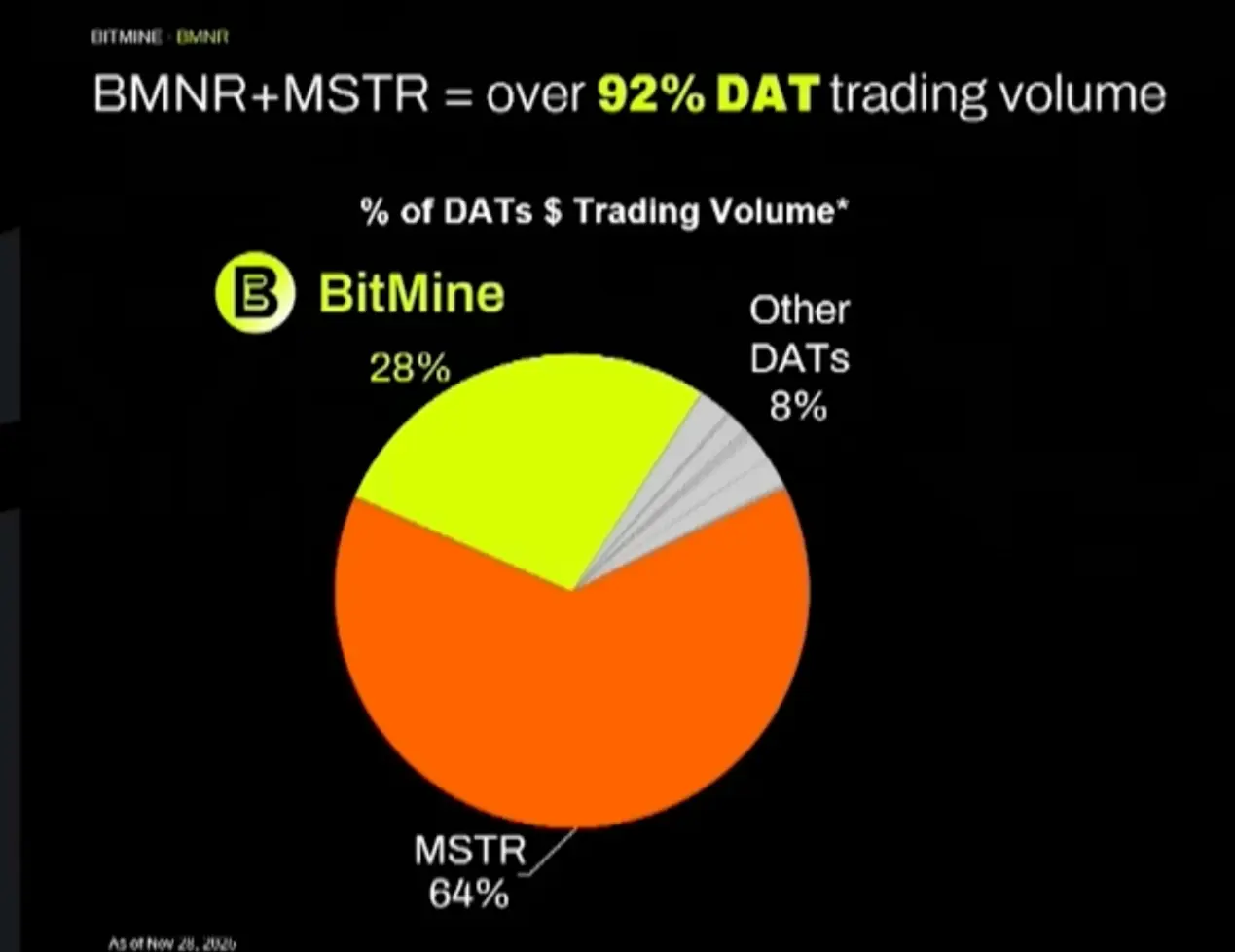

- MicroStrategy is now the 17th most traded stock in the U.S. market, with a daily trading volume of nearly $4 billion, surpassing JPMorgan.

- BitMine, founded just three to four months ago, has become the 39th most traded stock in the U.S. market, with a daily trading volume of $1.5 billion. Its trading volume has already exceeded that of General Electric (GE), which has a market capitalization 30 times larger, and is approaching that of Salesforce, with a market capitalization 20 times larger.

Currently, MicroStrategy and BitMine collectively account for 92% of the total trading volume of all crypto treasury companies. MicroStrategy’s strategy is to become a “digital credit instrument,” while BitMine’s strategy is to connect Wall Street, Ethereum, and DeFi.

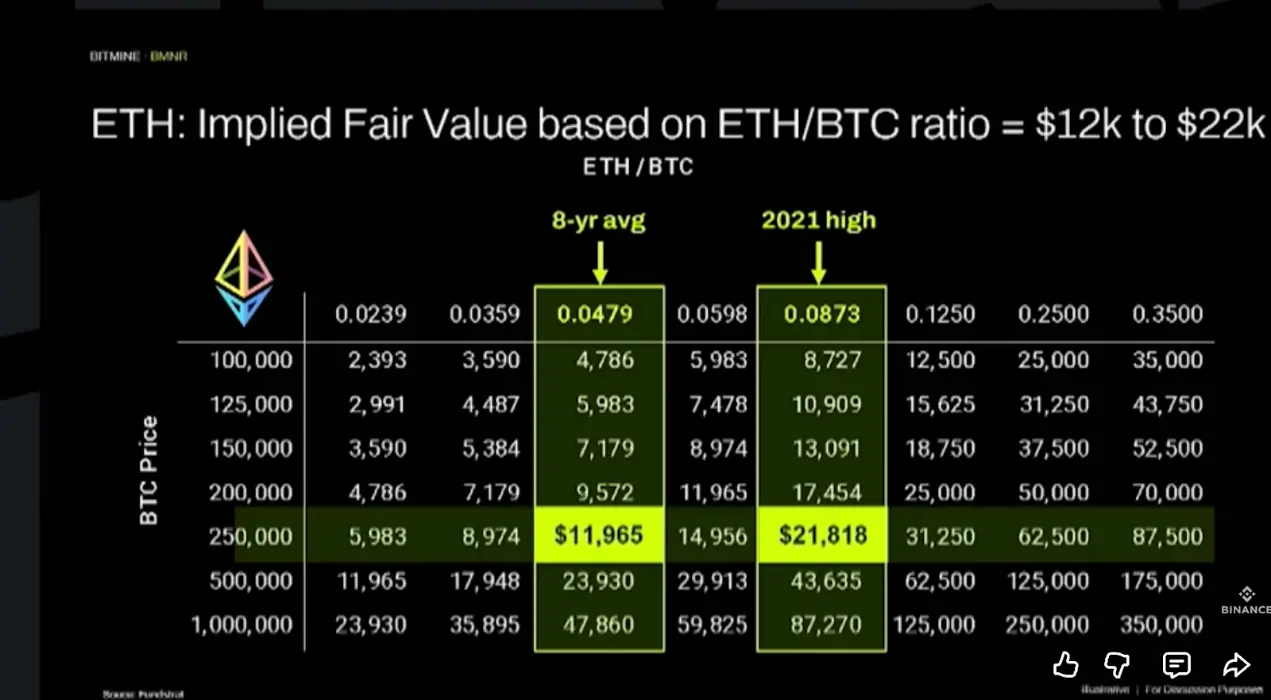

Based on this analysis, Tom Lee presented the following conclusions through his price prediction model:

- Assuming Bitcoin reaches $250,000 in the coming months.

- If the ETH/BTC exchange rate returns to its 8-year average, Ethereum’s price would be $12,000.

- If it returns to its 2021 high, the price would be $22,000.

- And if Ethereum truly becomes the future financial payment rail, with a ratio of 0.25, then Ethereum’s price could soar to $62,000.

Therefore, he believes that Ethereum’s price of $3000 is severely underestimated.

Q&A Session: Macro Forces, Ethereum’s Fundamental Value, and BitMine’s Vision

During the community Q&A session, Tom Lee delved into the decisive impact of the macro environment on cryptocurrencies, Ethereum’s fundamental value in the era of tokenization, and BitMine’s strategic role, concluding with his bold price predictions for the end of 2026.

Host: How do macro factors like monetary policy or regulation truly influence the long-term adoption and prevalence of cryptocurrencies, beyond just impacting prices?

Tom Lee: Macro factors are absolutely critical. Legendary investor Stan Druckenmiller once said that 80% of an investment’s success depends on macro. This means that even if you conduct the most thorough research on a project, and your judgment is impeccably accurate, it only accounts for 20% of its success or failure.

Why is this the case? Because cryptocurrency does not exist in a vacuum; it is profoundly influenced by the macro environment. For example:

- Regulatory Risk: This is the most direct impact; a single policy can determine the life or death of a project or an entire sector.

- Monetary Policy: Whether the Federal Reserve tightens or loosens directly affects global liquidity. When there’s more money flowing, assets like gold and Bitcoin naturally tend to rise.

- Market Sentiment: Price itself drives sentiment. The price drop after October 10th caused market sentiment to collapse rapidly, reaching a level of pessimism comparable to the deep bear market of 2018.

Therefore, it is almost impossible to succeed in the crypto world without understanding macroeconomics.

Host: There’s a common question in the community: When financial institutions like banks use Ethereum in the future, will they truly need to hold ETH? Or will they simply leverage Ethereum’s technology, much like we use the Linux system without needing to hold stock in the Linux company?

Tom Lee: That’s an excellent question, and it directly addresses a core debate about Ethereum’s future. Many indeed believe that Wall Street will merely treat Ethereum as a free, useful technological foundation (L2) and won’t care about the ETH token itself.

However, I believe this perspective overlooks a fundamental logic of the crypto world, which is the “fat protocol” thesis. Simply put, value is captured more by the protocol layer (like Ethereum) than by the application layer.

Let me offer a more common analogy: gamers and Nvidia.

Suppose you’re a top-tier gamer, proficient in all the popular games. You realize that all these cool games rely on Nvidia’s graphics card support. At this point, you have two choices:

- Spend your money within the games, buying various skins and items.

- Buy Nvidia stock while continuing to play games.

The outcome is evident: those who choose the latter will become very wealthy because they invested in the cornerstone of the entire gaming ecosystem.

Banks will view Ethereum similarly in the future. When they tokenize thousands of assets and place them on Ethereum, they are essentially staking their entire future on this neutral blockchain. Their primary concern will be whether this foundation is 100% secure, stable, and reliable.

Historically, only Ethereum among mainstream public chains has achieved long-term 100% stable operation, and it continues to upgrade. Therefore, to safeguard their interests and have a voice in network development, they will inevitably participate deeply—whether through staking ETH or directly holding substantial amounts of ETH. This is akin to multinational banks needing to hold U.S. dollars. If someone says, “My business is all settled in U.S. dollars, but I don’t care about the value of the U.S. dollar,” doesn’t that sound absurd? Similarly, when everything runs on Ethereum, everyone will care about ETH’s performance.

Host: If financial institutions truly begin to adopt Ethereum on a large scale as a financial rail, what changes will occur in Ethereum’s price in the long run? Beyond the obvious answer of “price increase,” can you analyze this from a deeper perspective?

Tom Lee: To predict Ethereum’s future price, I believe the simplest and most effective method is to benchmark it against Bitcoin. Bitcoin is the value anchor of the crypto world; if Bitcoin falls, no other asset can remain unaffected.

So, Ethereum’s value will ultimately depend on its value ratio relative to Bitcoin. As Ethereum plays an increasingly central role in the financial tokenization process, its total network value should logically converge with Bitcoin’s. If one day Ethereum’s network value can stand shoulder-to-shoulder with Bitcoin’s, then we would be discussing an Ethereum price of $200,000 per coin.

Host: Given your strong belief in Ethereum’s long-term value and its potential to become a financial cornerstone, what role does a company like BitMine intend to play in this grand future? What are its long-term business objectives?

Tom Lee: We firmly believe that Ethereum is poised for an unprecedented “supercycle.” Bitcoin’s success lies in earning the title of “digital gold,” becoming a recognized store of value. However, the story of the next decade revolves around “Wall Street asset tokenization.”

And there’s a crucial point in this story that is often overlooked: liquidity. If you tokenize an asset but nobody trades it, lacking liquidity, it becomes a failed asset. Therefore, Wall Street urgently needs partners in the crypto world who can provide liquidity and understand both languages. The Ethereum community is technically strong but not adept at serving Wall Street; Wall Street is vast but lacks native crypto understanding. BitMine’s mission is to be the bridge connecting Wall Street with the Ethereum world.

We not only hold substantial amounts of Ethereum, but more importantly, we leverage our macroeconomic perspective and financial resources to build communication and value channels between traditional finance and DeFi. As the Ethereum ecosystem grows exponentially, as deep participants and builders, we will also reap significant returns.

Host: You’ve mentioned being a “translator” and a “bridge,” and you yourself are one of Wall Street’s earliest and most steadfast cryptocurrency advocates. We’re all curious, how did you initially enter this field? What was the catalyst that ignited such firm conviction in you?

Tom Lee: This goes back to 2017. At that time, I founded Fundstrat, an independent research firm. One day, I happened to see Bitcoin’s price had risen to $1,000 on TV. I immediately recalled 2013, when it was only $70, and my colleagues at JPMorgan had discussed it, but the prevailing view then was that it was merely a tool for black market transactions.

My intuition told me that nothing rises from $70 to $1,000 without a reason. So, we spent an entire summer researching it. I discovered that while I didn’t understand all the technical details, 97% of the price increase could be explained by “network effects”—that is, the growth in the number of wallet addresses and their activity. I instantly understood: this is a network value asset!

When I first recommended Bitcoin to clients, I encountered immense resistance, even losing several important hedge fund clients. They thought I was crazy, recommending something with “no intrinsic value.” During that period, I was filled with passion, but my business was suffering, which was very difficult.

Until I remembered my early experiences. Before I became a strategist, I researched wireless communications. In the early 90s, mobile phones were considered “toys for the rich”; no one thought they would become widespread, and the mainstream view was that they were merely a supplement to landlines. But at twenty-something, I genuinely felt how much convenience mobile phones brought to my social life.

That’s when I realized a truth: only young people truly understand new technology. Older generations always tend to evaluate new things based on their already established lifestyles. So, we understand cryptocurrency not because we are so smart, but because we didn’t view it with old-fashioned eyes; instead, we tried to think from a young person’s perspective.

So, if you’ve been in the crypto world for many years, congratulations, your persistence is remarkable. But at the same time, be vigilant not to let your thinking become rigid. What you truly need to pay attention to is what young people in their twenties are doing, what they care about. They might be more concerned about the social impact of a certain project; they might want to invest not in the entire Tesla company, but in a specific future product like the “Optimus robot.” This is the future, full of infinite possibilities, that cryptocurrency will unlock for us.

Host: Tom, you’re known for your bold market predictions. Please give us a price forecast for Bitcoin and Ethereum! Let’s set the timeline for the end of 2026.

Tom Lee: My core judgment is that Bitcoin’s four-year cycle will be broken. I believe it will reach new all-time highs as early as the beginning of 2026. If this prediction holds true, then Bitcoin’s trajectory will resemble that of U.S. equities more closely. I predict that U.S. stocks will truly take off in the second half of next year.

So, my prediction is that by the end of 2026, Bitcoin’s price will be around $300,000.

And if Bitcoin can reach that price point, then Ethereum’s performance will be phenomenal. I believe that by the end of next year (2026), Ethereum could exceed $20,000.

Host: $300K Bitcoin and $20K Ethereum! We heard it here first. Tom, we absolutely must invite you back next year to see if the prophecy comes true!

Tom Lee: If I’m wrong, I might not come back, haha.

(The above content is an authorized excerpt and reprint from our partner PANews. Original link)

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice, nor do they represent the views or positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.