CFTC Unveils Landmark Digital Asset Pilot Program: Paving the Way for Crypto Collateral in Derivatives

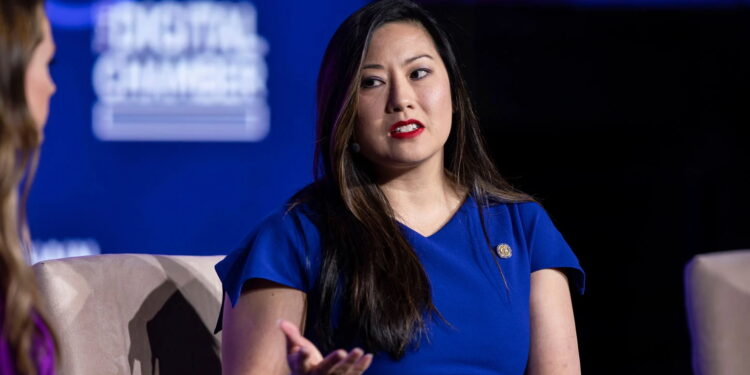

In a significant stride towards modernizing the U.S. financial landscape, the Commodity Futures Trading Commission (CFTC) has launched a pioneering initiative. CFTC Acting Chairman Caroline Pham announced the “Digital Asset Pilot Program,” a groundbreaking move that will permit the use of select cryptocurrencies as collateral within the derivatives market.

Expanding Collateral Options for Qualified FCMs

This innovative pilot program is initially targeted at eligible Futures Commission Merchants (FCMs) who meet stringent criteria. Under this framework, these qualified firms will now be authorized to accept prominent digital assets such as Bitcoin (BTC), Ethereum (ETH), and payment-focused stablecoins (like USDC) as margin collateral for both futures and swap contracts.

Robust Regulatory Framework and Oversight

While embracing digital innovation, the CFTC is simultaneously upholding its commitment to market integrity and stability. Participating FCMs will be subject to rigorous reporting and custody requirements. This includes mandatory weekly disclosures of digital asset holdings for the initial three months, alongside an obligation to promptly report any operational issues, disruptions, or failures to the CFTC.

Essentially, this establishes a meticulously monitored environment where a registered futures commission merchant can, within a compliant structure, accept Bitcoin as collateral from clients to facilitate commodity-linked leveraged swap contracts. The CFTC will maintain close surveillance over asset custody, operational protocols, and risk management to safeguard overall market stability.

Strategic Regulatory Clarification: No-Action Letter and Guidance Withdrawal

Further reinforcing this progressive stance, the CFTC has also issued a “No-Action Letter.” This critical document allows FCMs to hold specific digital assets within segregated client accounts, provided they adhere to strict risk management principles. This provides essential regulatory clarity and operational flexibility.

Crucially, the CFTC has simultaneously rescinded its 2020 guidance, which had previously posed significant barriers to the widespread use of cryptocurrencies as collateral. This older directive often prevented financial institutions from implementing crypto collateral solutions, even when market demand was present. The formal passage of the “GENIUS Act” has rendered the previous rules obsolete, prompting the CFTC to fully abolish them and align its regulations with the evolving digital asset ecosystem.

A New Era for Digital Assets in Traditional Finance

The launch of the Digital Asset Pilot Program, coupled with the strategic withdrawal of outdated guidance, marks a pivotal moment for the integration of digital assets into mainstream financial markets. It signifies the CFTC’s proactive approach to fostering innovation while ensuring robust risk management and regulatory oversight, potentially unlocking new efficiencies and opportunities within the U.S. derivatives landscape.

Disclaimer: This article is provided for market information purposes only. All content and views are for reference only and do not constitute investment advice, nor do they represent the views and positions of BlockBeats. Investors should make their own decisions and trades. The author and BlockBeats will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.