Bitcoin’s Explosive Rally: Decoding the Trump-Fed Connection and Market Dynamics

Bitcoin (BTC) experienced a dramatic overnight rally, soaring from $90,000 to breach the $93,000 mark. This rapid ascent triggered the liquidation of nearly $140 million in short positions, catching many off guard. The sudden bullish momentum appears to be closely tied to recent comments made by former President Donald Trump during an interview with Politico. Two key takeaways from his remarks stood out: the consideration of reducing certain tariffs and, more significantly, the impending announcement of his nominee for the Federal Reserve Chair. The latter is widely believed to be the primary catalyst for the market’s enthusiastic response. The favored candidate, Kevin Hassett, is known for advocating substantial interest rate cuts, a stance that aligns perfectly with Trump’s economic philosophy. This alignment led the market to proactively price in this anticipated positive development, driving BTC’s impressive surge.

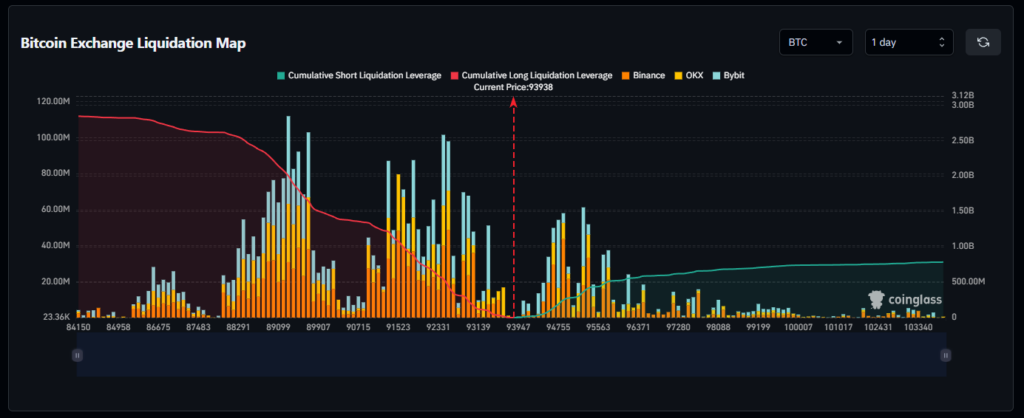

While the liquidation of $140 million in short positions might seem substantial, it’s surprisingly modest given the generally cautious sentiment prevailing in the crypto market. This suggests that many investors, anticipating a Federal Reserve rate cut, likely refrained from opening short positions against the market at such a sensitive juncture. However, a closer look reveals a concerning trend: short-term long positions are accumulating rapidly, with nearly $800 million now clustered in the $88,000 price range. This significant concentration of long interest could potentially serve as “fuel” for a sharp market correction once the initial bullish catalysts have been fully absorbed and priced in. Investors are therefore advised to exercise extreme caution.

Later today, the Federal Reserve is scheduled to announce its interest rate decision. Market consensus widely anticipates a 25 basis point (0.25%) rate cut. However, it’s crucial to remember that this particular meeting has been marked by significant internal division within the Fed regarding the necessity of a rate reduction. A primary reason for this divergence stems from the earlier U.S. government shutdown, which prevented the release of crucial economic data. Consequently, the Fed has been forced to make its assessment of the U.S. economic situation with incomplete information, potentially introducing bias into its rate decision. Despite these challenges, the current economic environment clearly indicates a slowdown, making a rate cut seem all but inevitable. The critical factor to watch will be Federal Reserve Chair Jerome Powell’s post-meeting remarks – specifically, whether they lean towards a hawkish stance that could temper market enthusiasm.

Disclaimer

Disclaimer: This article provides market information for reference only. All content and views expressed herein are not investment advice and do not represent the opinions or positions of Blockcast. Investors should make their own decisions and trades. The author and Blockcast will not bear any responsibility for direct or indirect losses incurred by investors as a result of their trading activities.