Author: Trend Research

Ethereum’s Resurgence: Navigating Market Volatility with Wall Street’s Embrace and Technical Strength

Following the significant market downturn on October 11th, the broader cryptocurrency landscape has experienced a period of subdued activity. Market makers and investors alike have faced considerable losses, and the restoration of capital flows and market confidence will undoubtedly require time. However, the crypto market is inherently defined by its volatility and the boundless opportunities it presents. We maintain an optimistic outlook for the future.

Crucially, the overarching trend of digital assets integrating with traditional finance remains undeterred. In fact, this convergence has accelerated, fortifying its foundations during the very period of market contraction.

1. Wall Street’s Unwavering Consensus on Blockchain Integration

A pivotal moment signaling this shift occurred on December 3rd, when US SEC Chairman Paul Atkins, in an exclusive interview with FOX at the New York Stock Exchange, declared: “Within the next few years, the entire U.S. financial market may migrate onto the blockchain.”

Atkins elaborated on the transformative potential of tokenization, highlighting several key advantages:

- Enhanced Transparency: The core benefit of tokenization lies in its ability to provide unparalleled transparency regarding asset ownership structures and attributes when assets reside on a blockchain. This stands in stark contrast to the current system, where publicly traded companies often lack clear visibility into the identities, locations, and holdings of their shareholders.

- Real-time Settlement (T+0): Tokenization promises to revolutionize settlement cycles by enabling “T+0” settlement, effectively replacing the existing “T+1” standard. On-chain Delivery Versus Payment (DVP) and Receipt Versus Payment (RVP) mechanisms are poised to significantly reduce market risk and boost transparency, addressing the systemic risks currently inherent in the time lag between clearing, settlement, and fund delivery.

- Inevitable Financial Evolution: Atkins firmly believes that tokenization is an inevitable trajectory for financial services. Major banks and brokerage firms are already actively pursuing tokenization initiatives. He suggested that this global transformation could materialize in a matter of years, rather than decades. The U.S. is proactively embracing these new technologies to ensure its leadership in the burgeoning field of cryptocurrencies and digital assets.

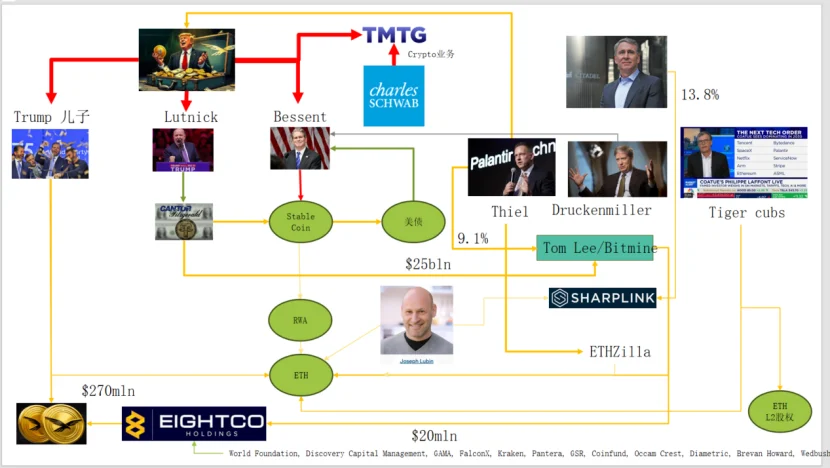

Indeed, a robust capital network connecting Wall Street and Washington to the cryptocurrency ecosystem is already firmly established, forming a new, powerful narrative chain: U.S. Political & Economic Elites → U.S. Treasury Bonds → Stablecoins / Crypto Treasury Companies → Ethereum + RWA + L2.

The intricate connections within this ecosystem are evident in the diagram above, linking entities such as the Trump family, traditional bond market makers, the Treasury Department, technology firms, and cryptocurrency companies. The green oval connections represent the primary backbone of this network:

- (1) Stablecoins: Assets like USDT, USDC, and WLD, backed by USD, primarily hold short-term U.S. Treasury bonds and bank deposits, often facilitated through brokerage firms such as Cantor.

- (2) U.S. Treasury Bonds: These are issued and managed by the Treasury Department and entities like Bessent. They serve as low-risk interest rate base positions for major players like Palantir, Druckenmiller, and Tiger Cubs, and are also the yield-generating assets sought by stablecoin and crypto treasury companies.

- (3) Real World Assets (RWA): Encompassing everything from U.S. Treasury bonds, mortgages, and accounts receivable to housing finance, these assets are being tokenized through Ethereum’s L1 and L2 protocols.

- (4) ETH & ETH L2 Equity: Ethereum serves as the foundational blockchain for RWA, stablecoins, DeFi, and AI-DeFi. Equity or tokens in L2 solutions represent a claim on future transaction volumes and the associated fee-based cash flows.

This interconnected chain illustrates a clear flow: U.S. Dollar Credit → U.S. Treasury Bonds → Stablecoin Reserves → Various Crypto Treasury/RWA Protocols → Ultimately settling on the Ethereum (ETH) / L2 ecosystem.

Notably, when examining the Total Value Locked (TVL) in Real World Assets (RWA), Ethereum stands out. While other public chains experienced declines during the 1011 market event, ETH was the only one to rapidly recover and even surpass its previous levels. Its current RWA TVL is an impressive $12.4 billion, representing 64.5% of the total RWA in the crypto market.

2. Ethereum’s Strategic Evolution: Enhancing Value Capture

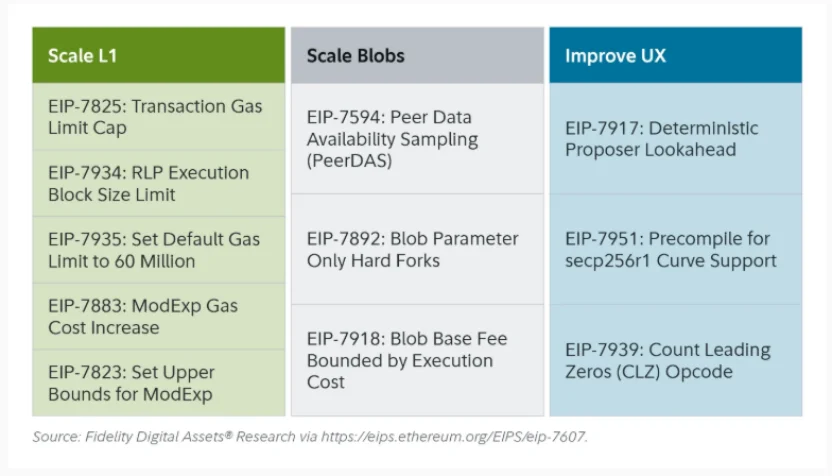

The recent Ethereum Fusaka upgrade, while not creating immediate market fanfare, represents a “milestone event” from the perspective of network structure and economic model evolution. Fusaka is not merely about scaling through EIPs like PeerDAS; it’s a deliberate effort to address the challenge of insufficient L1 mainnet value capture, a byproduct of the rapid growth of L2 solutions.

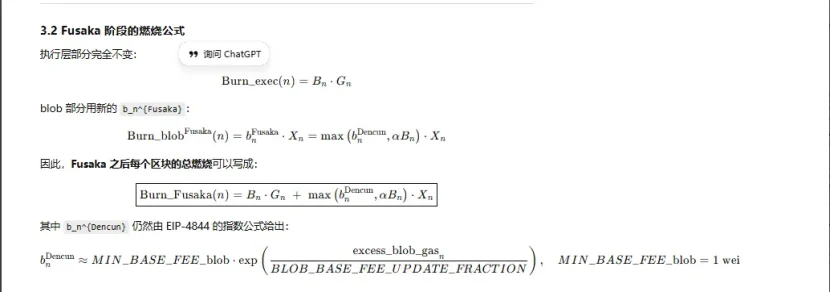

A key component of this upgrade is EIP-7918, which introduces a “dynamic floor price” for blob base fees. This mechanism ties the lower limit of blob fees to the L1 execution layer base fee, stipulating that blobs must pay Data Availability (DA) fees at a unit price approximately equivalent to 1/16th of the L1 base fee. This crucial change prevents Rollups from utilizing long-term unit price payments at near-zero cost, ensuring more consistent value accrual to the mainnet.

Ethereum’s history includes three significant upgrades related to its “burning” mechanism, each evolving its economic model:

- London (Single Dimension): This upgrade initiated the burning of fees only from the execution layer, marking the beginning of structural ETH burning tied to L1 usage.

- Dencun (Dual Dimension + Independent Blob Market): Dencun expanded burning to include both the execution layer and blobs. While L2 data written to blobs would burn ETH, the blob portion could be negligible during periods of low demand.

- Fusaka (Dual Dimension + Blob Tied to L1): Fusaka ensures that using L2 (via blobs) necessitates a payment that is a fixed proportion of the L1 base fee, which is then burned. This directly and more stably maps L2 activity to ETH burning, strengthening Ethereum’s economic model.

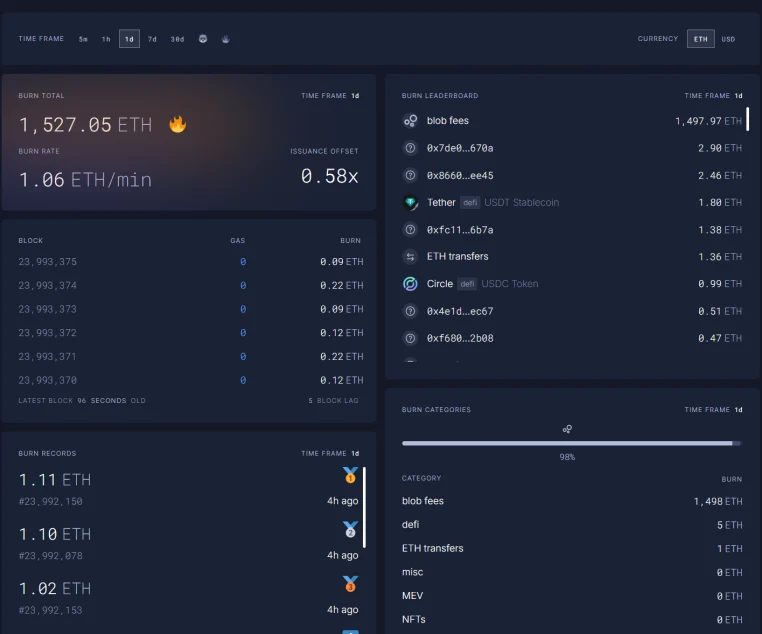

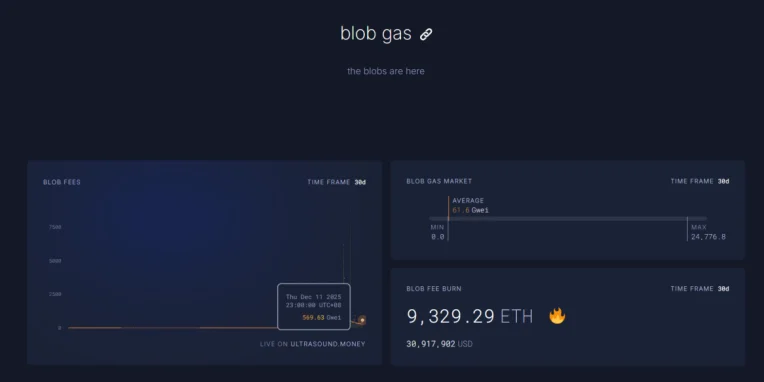

The immediate impact of Fusaka has been profound. On December 11th, blob fees within a single hour surged to 569.63 billion times their pre-upgrade levels, leading to the burning of 1527 ETH in one day. Blob fees now contribute a staggering 98% to the total ETH burned. As ETH L2 activity continues to grow, this upgrade is strategically positioned to drive Ethereum back into a deflationary state, enhancing its long-term value proposition.

3. Ethereum’s Strengthening Technical Foundation and Macro Tailwinds

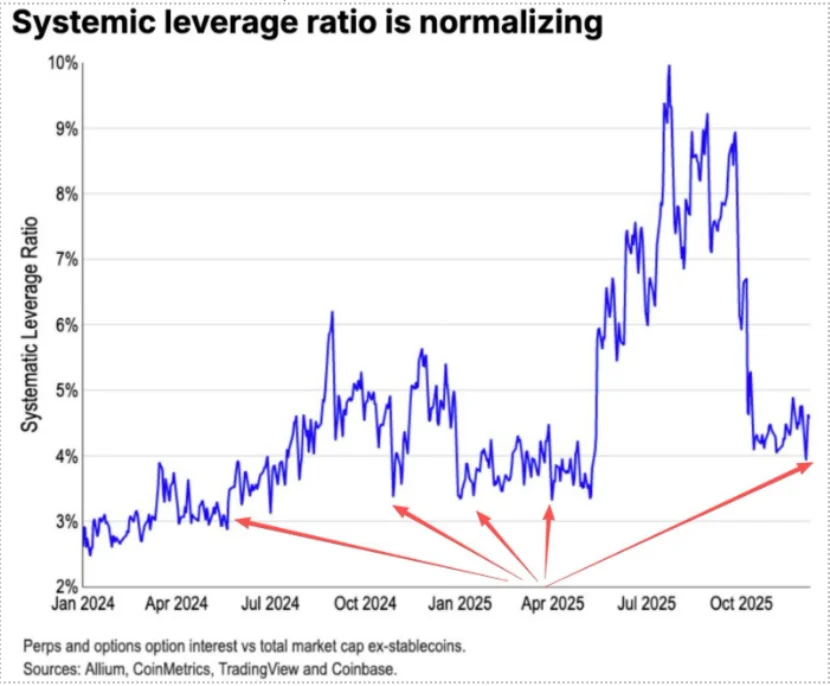

The 1011 market downturn served as a necessary cleansing event, thoroughly liquidating leveraged futures positions on ETH and even impacting spot leverage. This period also saw a significant number of early adopters, whose conviction in ETH may have wavered, reduce their holdings. According to Coinbase data, the speculative leverage across the crypto market has plummeted to a historical low of 4%, indicating a much healthier and less overheated market.

Historically, a substantial portion of ETH short positions originated from traditional “Long BTC/Short ETH” pair trades, a strategy that often performed exceptionally well during bear markets. However, this dynamic has shifted unexpectedly. The ETH/BTC ratio has demonstrated remarkable sideways resistance since November, challenging conventional bearish bets against Ethereum.

Furthermore, the current ETH supply on exchanges stands at a mere 13 million tokens, representing approximately 10% of the total supply—a historical low. As the “Long BTC / Short ETH” pair trade falters from November onwards, and with market sentiment still recovering from extreme panic, a significant “short squeeze” opportunity for Ethereum could gradually emerge.

Looking ahead to 2025-2026, both the United States and China are signaling more favorable monetary and fiscal policies. The U.S. is expected to actively pursue tax cuts, interest rate reductions, and a more relaxed regulatory stance on cryptocurrencies. Concurrently, China is anticipated to adopt appropriate easing measures and maintain financial stability by suppressing volatility.

Amidst these expectations of relative easing from the world’s two largest economies, which aim to suppress asset downside volatility, and despite residual market panic and incomplete capital/sentiment recovery, Ethereum remains positioned within an attractive “buying zone.” Its fundamental developments, coupled with a cleaner market and supportive macroeconomic shifts, paint a compelling picture for future growth.

(The above content is an excerpt and reproduction authorized by partner PANews, original link | Source: Cycle Trading)

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice. It does not represent the views and positions of BlockTempo. Investors should make their own decisions and transactions. The author and BlockTempo will not bear any responsibility for direct or indirect losses resulting from investor transactions.