Source: David Christopher, Bankless

Compiled & Edited by: BitpushNews

Hyperliquid’s Ascendancy: A 2025 Retrospective on the Decentralized Perps Powerhouse

As we cast our gaze back at the monumental growth of the crypto industry in 2025, one name unequivocally stands out: Hyperliquid. This decentralized perpetuals exchange concluded 2024 with an epic airdrop and stellar price performance, reigniting the attention of crypto enthusiasts across social media.

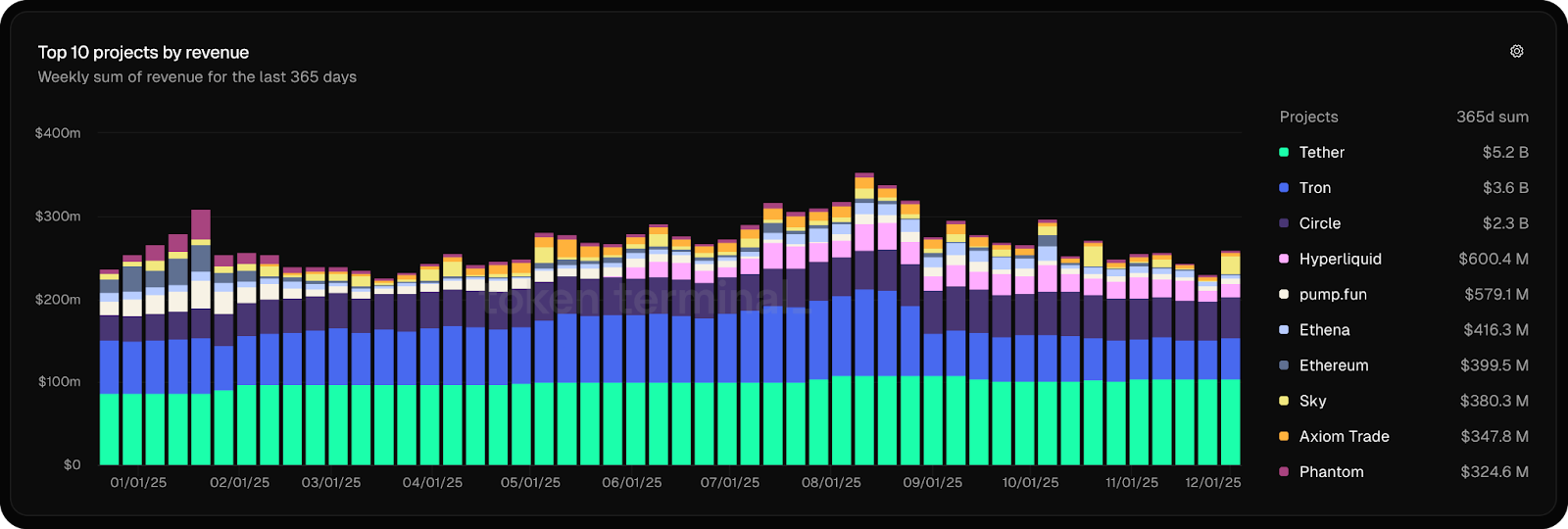

By the close of 2025, Hyperliquid had undergone a complete metamorphosis, evolving into a paradigm-shifting platform. It secured the fourth spot in overall revenue across the crypto ecosystem, raking in over $650 million, and at one point commanded an astounding 70% of the entire perpetual contract trading volume.

For those not meticulously tracking Hyperliquid’s every move, this meteoric rise might seem to have materialized from thin air. Yet, the platform’s conquest was the deliberate outcome of meticulous design, unconventional growth strategies, and well-earned external validation.

Join us for a comprehensive review of Hyperliquid’s groundbreaking journey throughout 2025, and discover why 2026 is poised to be its ultimate proving ground.

Q1 2025: The Crypto-Native Edge

Hyperliquid’s year of explosive growth commenced with a powerful demonstration of its innate ability to stay ahead of the industry curve. In January, with the launch of the TRUMP token, Hyperliquid swiftly listed perpetual contracts, outpacing other exchanges and cementing its reputation as the premier venue for trading nascent, pre-launch tokens.

This agility was partly attributed to its freedom from the “corporate guardrails” that often impede larger, more regulated exchanges. Crucially, however, Hyperliquid benefited from deep “insider intelligence.” Its team’s profound integration with on-chain dynamics allowed them to rapidly identify emerging opportunities and grasp the strategic advantage of being first to market with new listings. This solidified Hyperliquid’s status as the go-to platform for new assets, often before established giants could even react.

February saw the unveiling of HyperEVM, a general-purpose smart contract layer built upon HyperCore, Hyperliquid’s core exchange engine. While it initially took time to gain traction, its success was entirely organic, devoid of any top-down incentive programs. This meant that by the time HyperEVM truly hit its stride in Q2, it had cultivated a dedicated user base drawn not by “airdrop farming” rewards, but by genuine belief in the chain’s vision and a desire to leverage its unique features, such as seamless interoperability with HyperCore, for intrinsic value rather than fleeting incentives.

HyperEVM Feb 2025 is pretty unrecognizable compared to HyperEVM Dec 2025

A case study on how much an ecosystem can change in less than a year. Funny to read this a year later and see all the change in the Hyperliquid ecosystem + what pieces remain

On the lending side, we had:… https://t.co/OLjHWlOlqf

— Charlie.hl (@0xBroze) December 9, 2025

Q2 2025: The Full-Blown Explosion

Market recognition for Hyperliquid arrived far sooner than most anticipated. Beyond the HYPE token’s nearly fourfold surge from its April lows, May witnessed Hyperliquid capturing a staggering 70% of all on-chain perpetual contract trading volume – an astonishing feat for a platform that shunned VC funding and token incentives.

The HYPE token’s peak performance, the exponential growth of HyperCore activity, and the burgeoning HyperEVM ecosystem collectively amplified Hyperliquid’s narrative across the crypto sphere. As the broader market rebounded, Hyperliquid’s superior user experience (UX) and deep liquidity effectively absorbed a torrent of order flow, propelling its total trading volume to an impressive $1.5 trillion.

Simultaneously, HyperEVM gained significant momentum, with its Total Value Locked (TVL) skyrocketing from $350 million in April to $1.8 billion by mid-June. This surge was fueled by the launch of innovative projects like Kinetiq, Felix, and Liminal, alongside users’ exploration of new earning avenues – all while continuously burning HYPE tokens in the background. During this period of relentless expansion, Hyperliquid’s presence became ubiquitous.

It graced national television programs, garnered coverage from Bloomberg, and became a central topic in discussions surrounding CFTC policy. The exchange had become an undeniable force.

CNBC did an interview with @novogratz and he was asked about altcoins:

+ New ecosystems need strong narratives

+ He used Hyperliquid as an example: a decentralized Binance that transparently uses exchange profits for token buybacks

+ Note: Galaxy Digital owns HYPE

Hyperliquid pic.twitter.com/aVnPKqOy7H

— steven.hl (@stevenyuntcap) May 16, 2025

Q3 2025: Peak Momentum and Emerging Competition

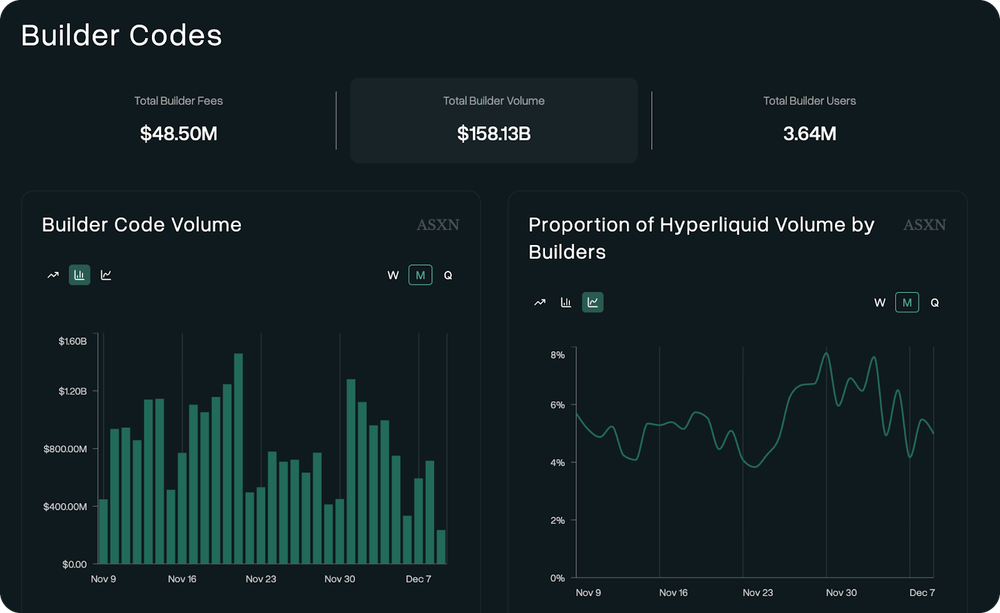

The third quarter kicked off with a clear indication of Hyperliquid’s infrastructure becoming indispensable beyond its own ecosystem. The Phantom wallet, rather than integrating with Solana-based perpetual platforms, opted to integrate Hyperliquid via “builder codes.” These unique Hyperliquid mechanisms allow external platforms to earn fees by routing trades directly to HyperCore.

Rabby quickly followed suit, soon joined by MetaMask. A cascade of mobile trading applications subsequently onboarded through these builder codes. In aggregate, these strategic integrations saw “partners” collectively earn nearly $50 million in fees, having routed an impressive $158 billion in trading volume.

September brought the highly anticipated USDH bid war, an event that vividly underscored Hyperliquid’s burgeoning value and prominence. The core issue was straightforward: Hyperliquid held approximately 8% of Circle’s USDC supply within its cross-chain bridge. This effectively meant an annual leakage of roughly $100 million in revenue to a direct competitor, Coinbase, revenue that Hyperliquid’s own ecosystem couldn’t reclaim. The solution proposed was to launch a native stablecoin, potentially redirecting an estimated $200 million in annual revenue back into the Hyperliquid ecosystem.

The call for stablecoin issuance proposals drew bids from numerous industry heavyweights. Ethena presented a compelling offer of $75 million in growth commitments and institutional partnerships. Paxos leveraged its connections, proposing PayPal and Venmo integrations, even securing a mention of Hyperliquid from PayPal on Twitter.

Ultimately, however, Native Markets clinched the winning bid. This team, led by respected HYPE contributor Max Fiege, former Uniswap Labs COO MC Lader, and Paradigm researcher Anish Agnihotri, was a smaller, less capitalized contender. Their victory highlighted a preference for a team more aligned with Hyperliquid’s founding spirit: bootstrapped, unified in vision, and committed to building something truly organic, mirroring Hyperliquid’s own origins.

Hyperliquid currently loses >$200m a year to firms who treat it as an afterthought at best.

I’m co-founding Native Markets to reclaim this value leakage for the ecosystem and to kickstart Hyperliquid’s next chapter. pic.twitter.com/oU6RYXE4E9

— max.hl (@fiege_max) September 8, 2025

The ripple effects of this stablecoin initiative extended beyond Hyperliquid. MegaETH swiftly announced its own native stablecoin plans, with Sui following suit in November.

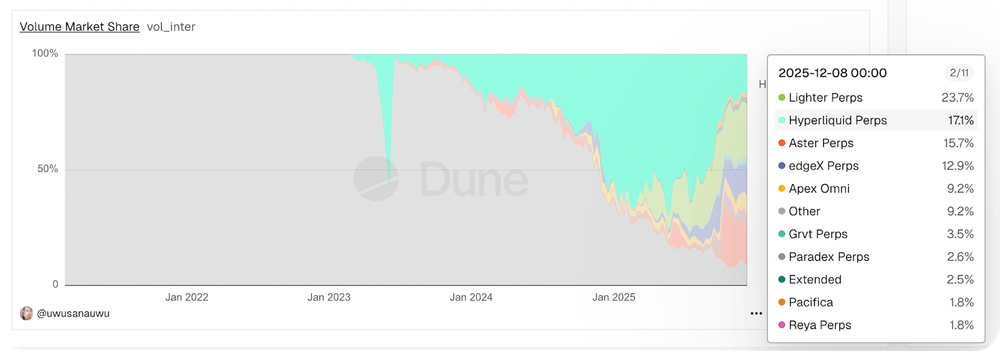

Yet, mid-September also marked the HYPE token’s peak, coinciding with the emergence of significant competition. Aster (a Binance-based exchange backed by CZ) and Lighter (an Ethereum L2 perpetuals platform) both launched with aggressive airdrop campaigns. This led to a fragmentation of trading volume and a reduction in Hyperliquid’s market share, which stood at 17.1% by the end of the quarter.

Q4 2025: Maturity and Growing Pains

October brought the highly anticipated launch of HIP-3, which enabled permissionless listings on HyperCore, significantly expanding the exchange’s reach and decentralization. Now, any entity staking 500,000 HYPE could deploy custom markets, including:

- Stock perpetual contracts from platforms like Trade.xyz by Unit and Felix Protocol.

- Perpetual contract markets utilizing yield-bearing collateral (e.g., sUSDE) from protocols such as Ethena.

- Markets offering synthetic exposure to private companies like SpaceX or Anthropic via platforms such as Ventuals.

However, despite the strategic importance of HIP-3, the HYPE token’s price experienced a nearly 50% decline from its September peak. Beyond broader market conditions and escalating competition, two key factors contributed to this downturn.

Firstly, this quarter witnessed Hyperliquid’s first Auto-Deleveraging (ADL) event in over two years. During a market crash on October 10, excessively leveraged positions depleted their margin faster than the liquidation engine and Hyperliquid Liquidity Providers (HLP) could absorb. The protocol triggered over 40 ADL events within 12 minutes, forcibly reducing the most profitable positions to rebalance the ledger. While some argued that affected positions were still “green-closed,” others contended the mechanism liquidated more than necessary to cover bad debt. Although the system remained solvent without external capital intervention, Hyperliquid, much like the wider market, may require time to fully recover from this incident.

Secondly, November marked the commencement of team token unlocks. While the total unlocked amount was lower than initially anticipated, this vesting schedule likely contributed to HYPE’s underperformance. The actual selling volume was minimal – only 23% went to OTC desks, with 40% being re-staked – yet the future pace of unlocks remains ambiguous. This suggests the core team might still be calibrating a timeline that balances contributor equity with ecosystem health. However, for a protocol lauded for its transparency and “honesty,” such uncertainty can unnerve the market. Hyperliquid’s initial unlock released 1.75 million HYPE after the lock-up period, but the full schedule for future team unlocks has not been publicly disclosed.

The Perpetual Contracts Crucible

Despite a cooling market and a deceleration in trading activity, understanding HYPE’s underperformance necessitates acknowledging the profound evolution of the perpetual contract ecosystem itself, an evolution Hyperliquid has significantly driven. On-chain competitors like Lighter and Aster, while potentially inflated by “airdrop hunting” activity, undeniably offer genuine alternatives.

In the off-chain landscape, Coinbase’s perpetual contracts product is rapidly emerging, soon to contend with Robinhood’s strategic entry into this domain. As perpetual contracts continue their march towards mainstream adoption, an even greater influx of competitors is inevitable.

In essence, Hyperliquid is currently undergoing its most significant trial by fire, a challenge that will extend well into 2026.

The fundamental question isn’t whether Hyperliquid achieved remarkable feats in 2025 – it undeniably did. The real test is whether, in an increasingly crowded arena, the exchange can prove that its growth trajectory, powered by integrations like builder codes and decentralized models such as HIP-3, still holds a decisive advantage.

What propelled Hyperliquid to its current stature was the relentless pursuit of a superior product and a more robust ecosystem, without resorting to shortcuts. What will ensure its continued leadership is the ability to achieve precisely that, once more.

(The content above is an authorized excerpt and reproduction from our partner, PANews. Original Link | Source: BitpushNews)

Disclaimer: This article is provided for market information purposes only. All content and views expressed herein are for reference only, do not constitute investment advice, and do not represent the opinions or positions of BlockBeats. Investors are advised to make their own decisions and conduct their own trades. The author and BlockBeats shall not be held responsible for any direct or indirect losses incurred by investors’ transactions.