Strategy Bolsters Bitcoin Portfolio with Nearly $1 Billion Acquisition Amidst Policy Advocacy

Strategy, the corporate entity formerly known as MicroStrategy, has once again made headlines with a significant expansion of its Bitcoin holdings. According to an 8-K filing with the U.S. Securities and Exchange Commission (SEC) on Monday, the company invested approximately $980.3 million to acquire an additional 10,645 Bitcoins between December 8th and 14th. This latest purchase was executed at an average price of $92,098 per Bitcoin, underscoring Strategy’s unwavering commitment to the leading digital asset.

A Growing Empire of Bitcoin

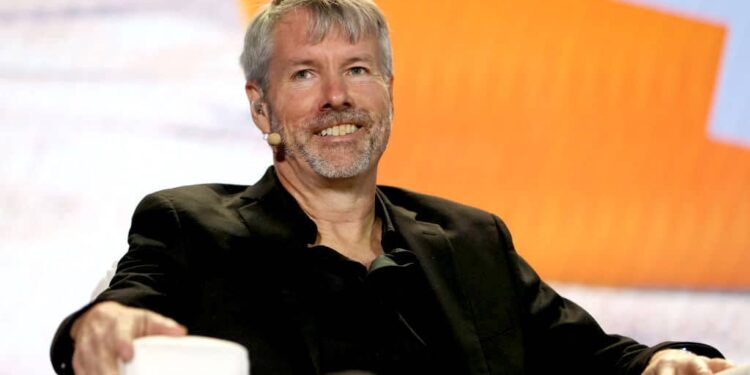

With this mammoth acquisition, Strategy’s total Bitcoin treasury now stands at an impressive 671,268 BTC. Michael Saylor, co-founder and Executive Chairman of Strategy, confirmed the current valuation of these holdings to be approximately $60 billion. Since initiating its pioneering Bitcoin acquisition strategy in 2020, Strategy has cumulatively invested around $50.3 billion, securing an average acquisition cost of $74,972 per Bitcoin.

While the company’s long-term bet on Bitcoin continues to yield substantial unrealized gains, its reported paper profit currently sits at approximately $9.7 billion. This figure represents a slight decrease from the $10.6 billion unrealized profit reported just last week, reflecting recent market fluctuations.

Strategic Funding and Ambitious Plans

This marks the second consecutive week that Strategy has invested in excess of 10,000 Bitcoins, demonstrating a consistent and aggressive accumulation strategy. The funding for these substantial purchases primarily originates from the sale of its common stock, MSTR, alongside proceeds from three of its perpetual preferred stocks: Strike (STRK), Strife (STRF), and Stride (STRD).

These perpetual preferred stocks are integral to Strategy’s ambitious “42/42” fundraising initiative. This plan aims to raise a staggering $84 billion by 2027 through the issuance of stocks and convertible bonds, with the sole purpose of further expanding its Bitcoin reserves. The company’s four perpetual preferred stocks—STRK, STRC, STRF, and STRD—have issuance sizes of $21 billion, $4.2 billion, $2.1 billion, and $4.2 billion respectively, highlighting the scale of this long-term financial strategy.

Advocating for Digital Asset Inclusion

Beyond its active investment strategy, Strategy is also a vocal advocate for the digital asset space. Concurrent with its latest Bitcoin acquisition announcement, the company issued a strong appeal to MSCI, a global index provider, urging them to reconsider a proposed rule. This controversial regulation suggests the exclusion of companies with over 50% of their holdings in digital assets from MSCI’s equity indices.

Strategy has warned that the implementation of such a rule could lead to frequent and disruptive rebalancing of index components, thereby increasing market volatility. Furthermore, the company argues that this policy would directly contradict the current direction of the U.S. government, which is actively encouraging innovation in digital assets and blockchain technology. This proactive stance underscores Strategy’s broader commitment not just to holding Bitcoin, but also to fostering an environment conducive to its wider adoption and acceptance.

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views and positions of the author or Blockcast. Investors should make their own decisions and trades. The author and Blockcast will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.