Bitcoin’s Mystery Volatility: $305M Liquidated Amid Thin Liquidity and Looming CPI Data

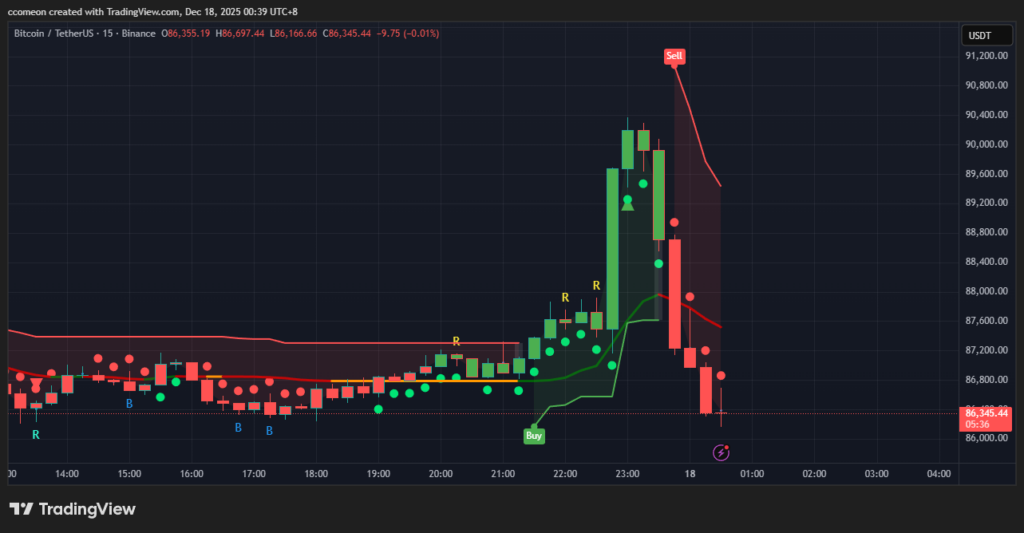

Bitcoin experienced another dramatic liquidation event last night, coinciding with the opening of the US stock market. In a bewildering display, BTC surged by nearly $4,000 within two hours, briefly breaching the $90,000 mark, only to plummet by a similar amount in the subsequent two hours, settling back to the $86,000 level. This intense four-hour period saw an estimated $305 million in both long and short positions liquidated, all without any apparent news catalysts. The market, still pondering the “10 o’clock manipulation” theory from earlier this week, witnessed an even more potent “double liquidation” scenario unfold.

Historically, such significant Bitcoin price swings would often trigger liquidations exceeding $1 billion. However, last night’s comparatively smaller $305 million liquidation suggests a considerably thinner market depth and reduced liquidity. This scarcity of liquidity creates an environment ripe for institutional players to strategically manipulate prices, achieving both liquidation effects and more favorable entry or exit points. While the latter part of the US stock market session did show a downward trend, and anticipation for a national address from Donald Trump was present, these broader market dynamics didn’t fully explain Bitcoin’s highly specific, two-way price action. The initial surge briefly hinted at potential insider information, but the subsequent sharp decline solidified suspicions of pure price manipulation.

Looking beyond crypto’s internal dynamics, market attention now shifts to critical macroeconomic announcements. Tonight, the United States is set to release its latest Consumer Price Index (CPI) and unemployment data. Expectations are for a modest increase in CPI, a sentiment largely driven by the public’s experience with rising prices, potentially linked to former President Trump’s tariff policies.

The crucial factor for investors will be whether the CPI increase aligns with the anticipated 0.1% or if it surpasses this forecast. A higher-than-expected inflation figure could signal a worsening inflationary environment, making a Federal Reserve interest rate cut in January next year highly improbable. Such an outcome would likely inject negative sentiment into the broader market, making the upcoming CPI data a pivotal release for traders and investors alike.

Following the US data, market participants will also be closely monitoring the Bank of Japan’s interest rate decision on Friday, another significant event with global economic implications.

Disclaimer: This article is intended solely to provide market information. All content and views are for reference only and do not constitute investment advice. They do not represent the opinions or positions of the author or BlockTempo. Investors should make their own decisions and conduct their own transactions. The author and BlockTempo assume no responsibility for any direct or indirect losses incurred by investors as a result of their trading activities.