By: BitPush

Bitcoin’s Macro Quandary: Is a $10,000 Revisit by 2026 a Real Threat?

The cryptocurrency market faced a challenging weekend, failing to find its footing amidst ongoing volatility. After several days of tight range trading, Bitcoin experienced significant downward pressure from Sunday evening into Monday’s U.S. trading session, breaching the critical $90,000 psychological barrier and further testing the $87,000 level.

This isn’t an isolated incident. Since reaching its all-time high in mid-October, Bitcoin has seen a cumulative retracement of over 30%, with subsequent rallies proving fleeting and tentative. While systematic outflows from Bitcoin ETFs haven’t materialized, the pace of marginal inflows has notably decelerated, no longer providing the robust “emotional floor” for the market seen previously. The cryptocurrency landscape appears to be shifting from an era of unbridled optimism to a more intricate phase demanding greater patience and strategic foresight.

Against this backdrop, Mike McGlone, a veteran Senior Commodity Strategist at Bloomberg Intelligence, has released a provocative report. He contextualizes Bitcoin’s current trajectory within a grander macroeconomic and cyclical framework, presenting a deeply unsettling prognosis: Bitcoin could potentially revert to $10,000 by 2026. This isn’t mere sensationalism, McGlone argues, but a plausible outcome stemming from a unique “deflationary” cycle.

The controversy surrounding McGlone’s prediction isn’t solely due to the starkness of the target price. Rather, it stems from his analytical approach, which reframes Bitcoin not as an isolated crypto asset, but as an integral component within a long-term coordinate system encompassing “global risk assets, liquidity dynamics, and wealth reversion.”

The Macro Lens: McGlone’s Deflationary Inflection

To grasp McGlone’s contentious forecast, one must understand his interpretation of the impending macroeconomic environment, rather than his specific views on the crypto industry. He consistently highlights a crucial concept: the Inflation/Deflation Inflection. McGlone posits that global markets are currently at such a pivotal juncture. As inflation peaks and economic growth momentum wanes across major economies, the prevailing asset pricing logic is transitioning. It’s moving from “inflation hedging” to navigating “post-inflation deflation” – a period characterized by widespread price declines following the conclusion of an inflationary cycle. As he eloquently states, “Bitcoin’s decline may echo the stock market’s situation in 2007 when facing Fed policy.”

This isn’t his first cautionary note. As early as November last year, he accurately predicted Bitcoin’s descent towards the $50,000 mark.

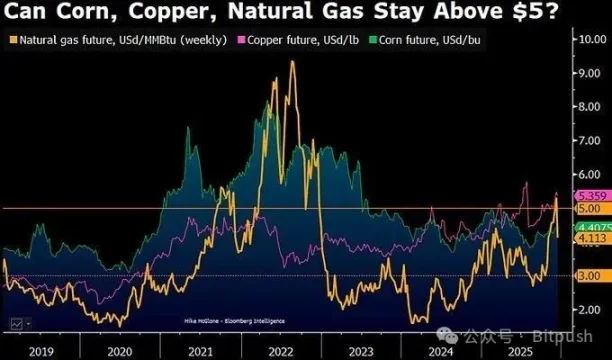

McGlone projects that by approximately 2026, commodity prices will likely oscillate around a key central axis. The “inflation-deflation demarcation line” for essential commodities like natural gas, corn, and copper could settle near $5. Intriguingly, he suggests that among these, only copper, an asset underpinned by genuine industrial demand, might sustain its position above this central axis by the close of 2025.

He underscores a fundamental market shift: as liquidity recedes, the distinction between “real demand” and “financialized premium” becomes starker. Within McGlone’s analytical framework, Bitcoin is not “digital gold” but rather an asset highly correlated with speculative cycles and overall risk appetite. When the inflation narrative fades and macroeconomic liquidity tightens, Bitcoin, he contends, tends to reflect these changes with greater speed and intensity.

Three Pillars of a Bearish Outlook

McGlone’s rationale isn’t predicated on a singular technical indicator but on the confluence of three long-term trajectories:

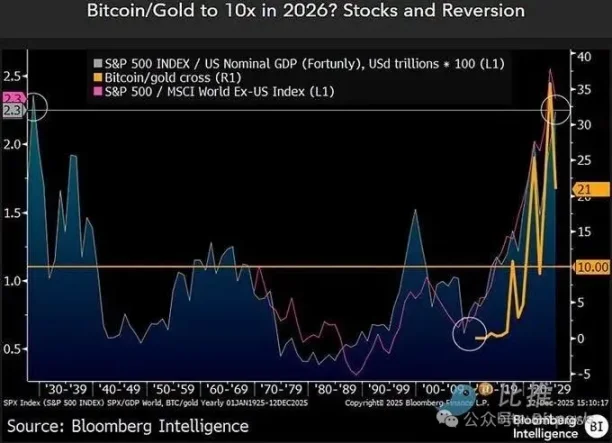

- Mean Reversion After Extreme Wealth Creation: Bitcoin, McGlone consistently emphasizes, has been one of the most potent wealth amplifiers during the past decade of global loose monetary policy. When asset prices surge far beyond the growth rates of the real economy and cash flows over an extended period, the subsequent reversion is typically not gentle but violent. Historical precedents, from the 1929 U.S. stock market crash to the 2000 tech bubble, share a common characteristic at their peaks: markets relentlessly sought a “new paradigm,” only for the eventual adjustments to far exceed even the most pessimistic contemporary expectations.

- The Bitcoin/Gold Relative Pricing Relationship: McGlone places particular emphasis on the Bitcoin/Gold ratio. This metric stood at approximately 10x at the close of 2022, then rapidly expanded during the bull market, briefly surpassing 30x in 2025. However, this year has seen the ratio decline by roughly 40%, settling around 21x. He argues that if deflationary pressures persist and gold strengthens due to safe-haven demand, a further return of this ratio to its historical lower range is not an aggressive assumption.

- Systemic Issues in Speculative Asset Supply: While Bitcoin itself boasts a clear, finite supply cap, McGlone repeatedly highlights that the market doesn’t trade Bitcoin’s “uniqueness” as much as the collective risk premium of the entire crypto ecosystem. In a deflationary environment, when millions of tokens, projects, and narratives vie for the same finite risk budget, the entire sector tends to face a uniform discount. In such a scenario, Bitcoin, he suggests, would find it challenging to entirely decouple from this comprehensive revaluation process.

It’s crucial to note that Mike McGlone isn’t a partisan advocate for either bull or bear markets in cryptocurrencies. As a senior commodity strategist for Bloomberg, his extensive research spans the cyclical relationships among crude oil, precious metals, agricultural products, interest rates, and risk assets. While his predictions aren’t always perfectly timed, their value lies in his consistent ability to pose structural, contrarian questions precisely when market sentiment is most unified.

In his most recent commentary, McGlone candidly reviewed his past “errors,” including underestimating the timeline for gold to break $2,000 and deviations in his judgment regarding U.S. bond yields and stock market rhythms. Yet, in his view, these very deviations underscore a recurring theme: markets are most susceptible to illusions about prevailing trends just before significant cyclical turning points.

Diverging Perspectives: A Divided Market

Naturally, McGlone’s assessment is far from a universally accepted market consensus. In fact, attitudes among mainstream financial institutions reveal a clear divergence.

Traditional financial powerhouses like Standard Chartered have recently tempered their medium-to-long-term Bitcoin price targets. They’ve adjusted their 2025 forecast from $200,000 down to approximately $100,000, and their 2026 projection from $300,000 to around $150,000. This indicates a revised institutional assumption: the expectation that ETFs and corporate allocations will provide continuous marginal buying at any price point is no longer absolute.

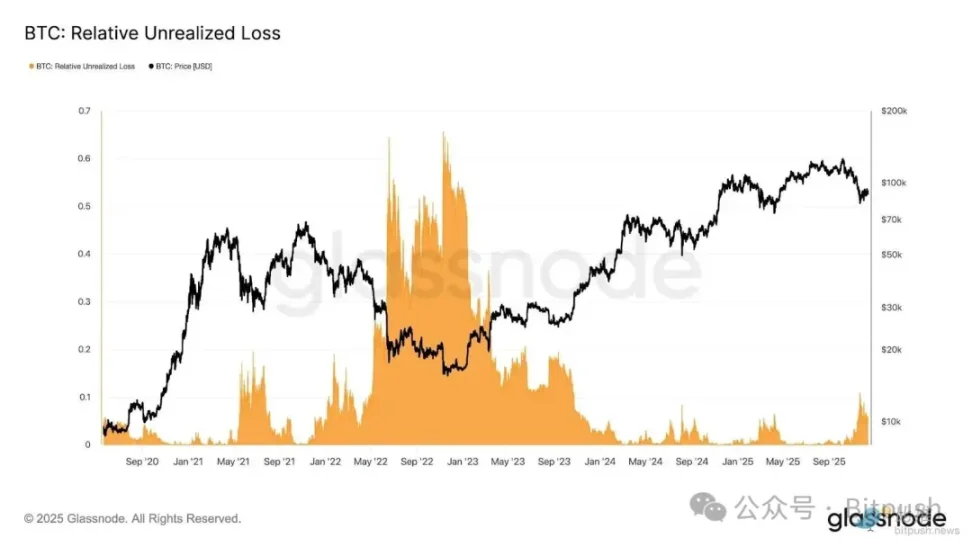

Research from Glassnode highlights that Bitcoin’s current oscillation between $80,000 and $90,000 has induced market pressure comparable in intensity to the dynamics observed in late January 2022. The market’s relative unrealized loss is now nearing 10% of its total market capitalization. Analysts further elaborate that this market behavior signifies a state of “liquidity constraint and sensitivity to macro shocks,” though it hasn’t yet escalated to the level of panic selling typically associated with a full-blown bear market capitulation.

Meanwhile, 10x Research, known for its quantitative and structural analyses, offers an even more direct conclusion: they believe Bitcoin has entered the early stages of a bear market. Their assessment, based on on-chain indicators, fund flows, and market structure, suggests that the downward cycle is far from over.

The Critical Macroeconomic Juncture

From a broader temporal perspective, Bitcoin’s current uncertainties are no longer confined to the cryptocurrency market itself; they are deeply intertwined with the global macroeconomic cycle. The upcoming week is being flagged by numerous strategists as the most critical macroeconomic window of the year-end. The European Central Bank, Bank of England, and Bank of Japan are all slated to announce their interest rate decisions, while the U.S. will release a series of delayed employment and inflation data. These pivotal data points will collectively provide a much-anticipated “reality check” for global markets.

The U.S. Federal Reserve, at its December 10th FOMC meeting, already sent unusual signals. Not only did it implement a 25-basis-point rate cut, but it also saw a rare three dissenting votes. Furthermore, Chairman Powell directly indicated that previous months’ job growth figures might have been overestimated. The deluge of macroeconomic data expected this week will fundamentally reshape core market expectations for 2026: will the Fed continue its trajectory of rate cuts, or will it be compelled to maintain a pause for an extended period? For risk assets, the answer to this question may prove far more significant than any bull-bear debate surrounding a single asset.

(The above content is excerpted and reproduced with permission from partner PANews. Original Link | Source: BitPush)

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.