Bitcoin’s Bull Run Endures: On-Chain Data Reveals Resilience Amidst Recent Price Correction

Despite Bitcoin’s recent pullback of over 30% in the past 10 weeks, which has understandably rattled many investors, crucial on-chain data suggests that the underlying momentum of the bull market remains robust and far from extinguished.

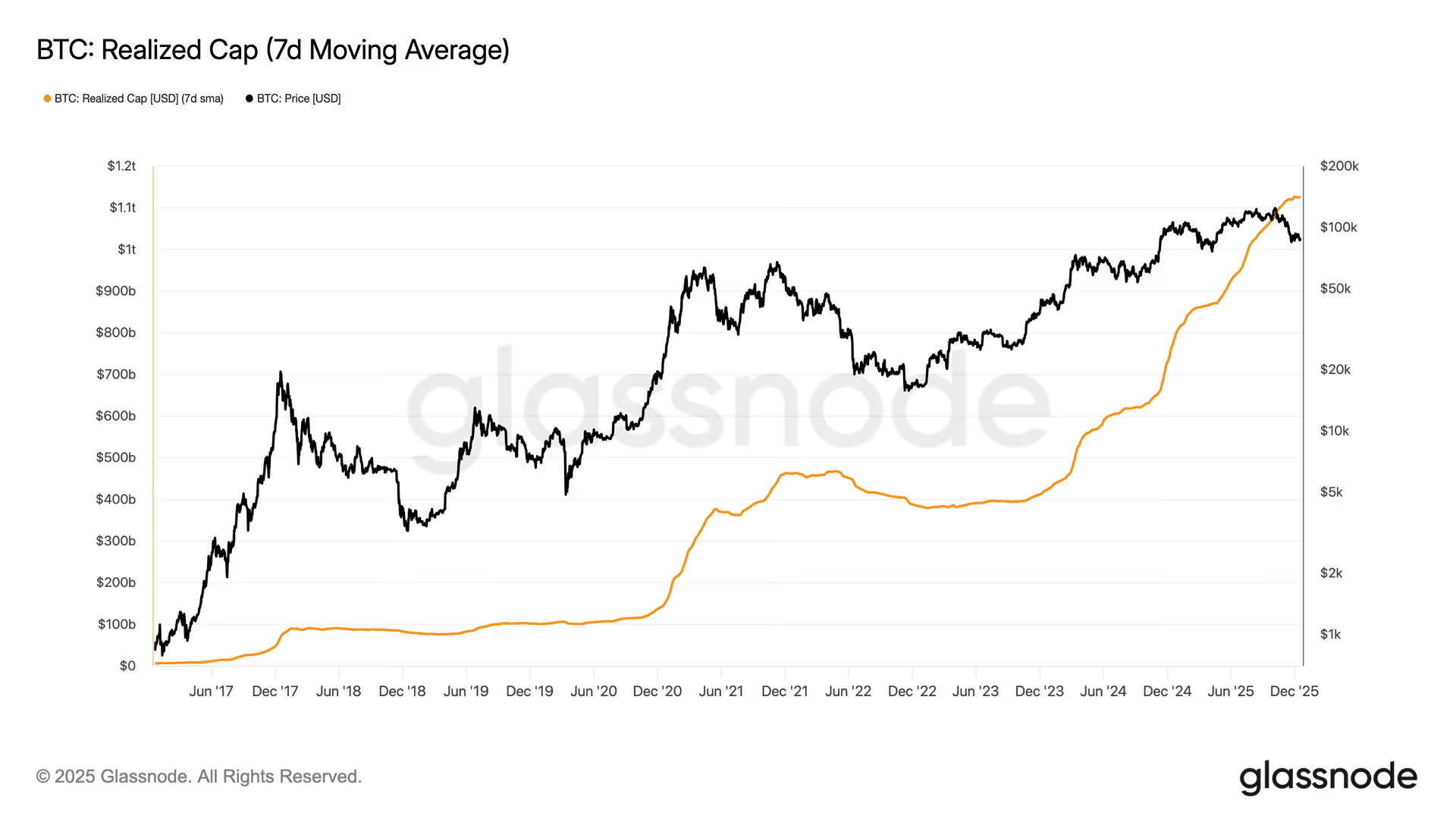

According to insights from blockchain analytics firm Glassnode, Bitcoin’s “Realized Cap” continues to hold strong at an impressive $1.125 trillion. This steadfast figure indicates an absence of large-scale capital exodus from the market, signaling that the structural integrity of the bull market remains firmly intact.

Understanding Realized Cap: A Deeper Dive into Bitcoin’s Value

Unlike the commonly referenced “Market Cap” (calculated as current price multiplied by total circulating supply), the Realized Cap offers a more profound and insightful perspective. This sophisticated on-chain metric determines the total value of Bitcoin by assessing the price of each coin at the last time it moved on-chain. This methodology effectively filters out short-term speculative noise, providing a clearer picture of investors’ actual cost basis and the true inflow of capital into the asset.

In essence, while the Market Cap can fluctuate dramatically with Bitcoin’s price swings, a stable and high Realized Cap signifies that holders are reluctant to sell. It indicates that widespread loss realization has not occurred, reinforcing a bullish sentiment among long-term investors.

Historical Precedent: Resilience in the Face of Volatility

Glassnode’s data further reveals that even as Bitcoin corrected by over 30% from its historical peak in October, the Realized Cap not only maintained its level but continued to ascend during the correction period, only recently consolidating around the $1.125 trillion mark.

This pattern of resilience is reminiscent of past market corrections, such as a significant dip observed in April, where despite a price drop, on-chain capital levels held firm, paving the way for a strong rebound and subsequent new highs.

Contrast this with the 2022 bear market: as prices plummeted, investor confidence evaporated, leading to massive sell-offs at a loss. This resulted in the Realized Cap bleeding from $470 billion down to $385 billion. Crucially, the current market landscape shows no signs of such panic-driven “great escape” or “collective surrender” behavior.

Consequently, this data-driven resilience has prompted analysts to question the long-held “Four-Year Cycle” theory, a narrative often considered sacrosanct in the crypto community.

The “Four-Year Cycle” Narrative Challenged: A 2026 Surprise?

Andre Dragosch, Head of European Research at asset management firm Bitwise, posits that Bitcoin is poised to break free from the traditional “Four-Year Cycle” constraints, potentially experiencing an unexpected surge as early as 2026.

Dragosch elaborates that this optimistic outlook is underpinned by a confluence of macroeconomic factors: a resilient global economy, ongoing interest rate cuts by major central banks leading to steepening yield curves, and expanding overall liquidity. Such an environment typically weakens the US dollar, and historical trends consistently demonstrate that a “weak dollar” is a significant tailwind for risk assets like Bitcoin.

“In my opinion, Bitcoin’s current price severely underestimates the prevailing macroeconomic environment, to an extent comparable to the COVID-19 recession period and the market panic triggered by the FTX collapse. However, today, the US shows no signs of an economic recession; instead, we are observing clear signals of accelerating growth.”

Disclaimer: This article is provided for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses resulting from investor transactions.