Author: Wenser, Odaily Planet Daily

While the broader cryptocurrency market grapples with persistent volatility and a downward trend, a select group of altcoins has defied expectations, charting their own course of dramatic price swings. This article dissects these “anomaly tokens” that have recently captured significant attention due to their exceptional performance. By analyzing their shared characteristics, we aim to provide insights that could help investors identify the next potential breakout sensation.

PIPPIN: An AI Agent Legacy, Marred by “Insider” Maneuvers

From late last year into January, AI Agent tokens dominated the crypto spotlight, with projects like ai16z (ELIZAOS) and Swarms frequently leading the gainers’ charts. PIPPIN emerged from this same wave of AI-themed tokens.

However, nearly a year later, PIPPIN stands out—perhaps handpicked by a “wild market maker” for its ease of manipulation. Over the past fortnight, its price has seen a relentless ascent. On November 23rd, PIPPIN was trading at merely $0.05, only to surge past $0.17 within a single week:

On December 1st, PIPPIN surged over 60% against the market trend, reaching close to $0.18. At the time, analyst @frontrunnersx noted PIPPIN’s concentrated accumulation pattern, with certain addresses continuously buying without significant selling, triggering a cascade of short liquidations during its upward climb. One address, having bought approximately $200,000 worth of PIPPIN six days prior, doubled its investment and subsequently sold, reportedly now employing a similar strategy with ARC.

On December 2nd, Bubblemaps reported that 50 associated addresses had purchased $19 million worth of PIPPIN. Furthermore, they identified 26 addresses that, over two months, withdrew 44% of PIPPIN’s total supply from the Gate platform, totaling $96 million. Most of these wallets were newly funded, with the majority of withdrawals occurring on October 24th and November 23rd. By then, PIPPIN’s price had already soared by 1,000%, with insiders reportedly controlling half of the token supply, valued at $120 million.

In essence, the “wild market maker” behind PIPPIN began accumulating over a month prior, with the true parabolic pump commencing roughly a month and a week after initial accumulation.

Subsequently, a “diamond hand” wallet liquidated its previously accumulated 24.8 million PIPPIN tokens, seeing its unrealized gains shrink from a peak of $7.6 million to $3.65 million.

On December 6th, Onchain Lens observed a whale spending 23,736 SOL (approximately $3.3 million) to acquire 16.35 million PIPPIN at $0.20, realizing over $740,000 in unrealized gains at that point.

On December 16th, Bubblemaps issued another alert, noting PIPPIN’s continued price increase while insider addresses now held approximately 80% of the supply, valued at around $380 million. Bubblemaps highlighted the emergence of 16 new wallets exhibiting the same pattern since their last disclosure (December 2nd): funded by HTX, receiving similar SOL amounts, no transaction history, and large PIPPIN withdrawals from CEXs. Additionally, they identified a group of 11 wallets linked to Bitget, collectively holding about 9% of the supply, with highly consistent fund flows and timing, suggesting control by a single entity.

That evening, as PIPPIN’s price dipped below $0.3, this “anomaly token” saga appeared to reach a temporary conclusion. However, the very next day, December 17th, PIPPIN surged again, briefly touching $0.5, triggering another massive wave of short liquidations. The brutal tactics of these “wild market makers” in a bear market are truly relentless.

As of writing, PIPPIN is trading at approximately $0.44, up over 15% in the last 24 hours, with its volatile performance continuing.

FOLKS: Cross-Chain DeFi Token Soars Nearly 24x on S2 Incentive Announcement

Folks Finance, a cross-chain DeFi protocol primarily operating on the Algorand blockchain and offering lending, staking, and trading services, initially garnered limited attention. However, the official announcement of its S2 incentive program reignited significant market enthusiasm for its token.

Notably, Folks Finance had previously distributed 1.5 million FOLKS tokens during its S1 incentive program, including Chainlink incentives. On November 6th, FOLKS officially listed on Binance Alpha, with its all-time low price around $2.

Following the official Folks Finance announcement on December 9th, the FOLKS token price surged dramatically from under $10.

By December 14th, after nearly a week of intense speculation, the FOLKS token price first broke above $40, ultimately peaking near $47—a nearly 24-fold increase from its lower price points.

Subsequently, FOLKS experienced a rapid correction, plummeting by approximately 80%.

As of writing, FOLKS is trading at around $6.4, down over 24% in the last 24 hours. Its circulating supply is approximately 12.7 million tokens (representing 25.4% of the total supply), with a market capitalization of roughly $81 million.

BEAT: The Enigmatic “Anomaly Token” That Needs No Introduction

BEAT, another altcoin establishing its roots within the BNB Chain ecosystem, presents a classic case study of an “anomaly token,” reminiscent of predecessors like MYX and COAI.

Intriguingly, the project behind the BEAT token positions itself as a “Web3 AI Entertainment Platform + IP Creation Platform,” essentially a rehashed version of popular concepts. After its listing on Binance Alpha and futures in early November, BEAT’s official channels claimed an astonishing 1.2 million unique on-chain holding addresses—a bold claim that certainly raises eyebrows.

Mirroring the trajectory of previous “anomaly tokens,” BEAT commenced with a low market capitalization. After an initial surge upon its Binance Alpha listing, its market cap remained around $25 million. Following this, the price embarked on a rapid ascent, characterized by aggressive pumps and dumps.

As of writing, BEAT is trading at approximately $2.7, up over 14% in the last 24 hours. Its circulating market cap is roughly $440 million, with approximately 126,000 on-chain holding addresses.

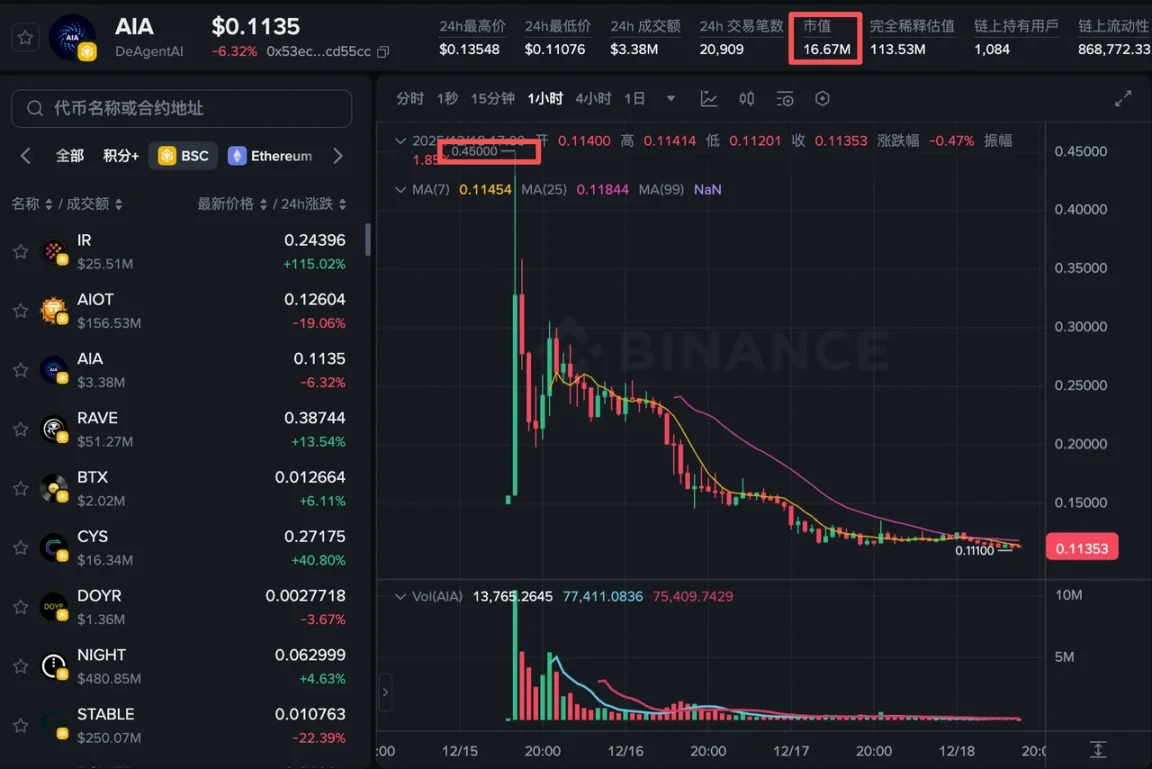

AIA: Decentralized AI Agent Token Sees Volatility from Contract Swap

AIA, the project token for DeAgent AI, previously garnered significant market liquidity and attention following a substantial surge after its listing on Binance Futures, briefly exceeding $1. However, constrained by an increasingly subdued market and the cooling of the AI narrative, the token’s price gradually entered a prolonged decline.

Yet, the news of “Binance Futures delisting AIA” injected a new wave of volatility into its liquidity.

On December 11th, according to an official announcement, Binance Futures stated it would close all AIAUSDT perpetual contracts and conduct automatic settlement by 20:15 (UTC+8) on December 11, 2025. Following settlement, the contract would be delisted, causing AIA to plummet over 90% initially.

However, Binance subsequently announced that Binance Alpha 2.0 would support the contract swap for DeAgentAI (AIA). Effective from 20:00 (UTC+8) on December 11, 2025, Binance Alpha 2.0 temporarily suspended AIA trading to execute this contract swap. The swap was performed at a 1:1 ratio, with the snapshot taken at 20:00 (UTC+8) on December 11, 2025. Binance Alpha 2.0 resumed DeAgentAI (AIA) trading at 16:00 (UTC+8) on December 15, 2025.

On December 15th, official data from Binance Alpha confirmed that DeAgentAI (AIA) had completed its smart contract swap and officially resumed trading at 16:00 (UTC+8). Market data showed AIA surging significantly upon reopening, with gains exceeding 160% at one point, topping the Binance Alpha section’s gainers list.

As of writing, AIA is trading at approximately $0.11, down 6.3% in the last 24 hours, with a circulating market cap of roughly $16 million.

RAVE: A Community-Driven Cultural Platform Backed by Trump Jr. and CZ

RaveDAO, a DAO organization championing a “decentralized music and cultural community and platform ecosystem,” has experienced astonishing growth. Following months of community and project development, RaveDAO previously completed several sales of its member NFTs.

On November 10th, RaveDAO officially announced its tokenomics and airdrop plans. The project stated that its token aims to connect artists, organizers, and fans through tokenomics, fostering a decentralized entertainment ecosystem where “culture is protocol.” RAVE has a total supply of 1 billion tokens, allocated as follows: 30% to the community, 31% to the ecosystem, 20% to the team and co-builders, 5% to early supporters, 5% for liquidity, 3% for airdrops, and 6% for the foundation and public good pool. Approximately 23.03% was set to be in circulation after the Token Generation Event (TGE), with the remainder subject to a 12-month cliff and a 36-month linear vesting schedule.

A month later, on December 10th, Binance Alpha announced the upcoming listing of RaveDAO (RAVE).

The very next day, news spread rapidly about RaveDAO receiving dual ecosystem support from WLFI and Aster. Upon its listing on Binance Alpha on December 12th, its trading volume surpassed $25 million within just one hour.

Furthermore, RaveDAO’s “top-tier outreach” proved exceptionally effective. On the evening of December 12th, Donald Trump Jr. retweeted and followed developments regarding the partnership between Aster and USD1. As a participant in this collaboration, RaveDAO gained immense exposure. CZ subsequently retweeted the same post, sending RAVE’s price soaring.

- On December 13th, RAVE’s price briefly touched $0.67, marking a 24-hour surge of over 410%.

- On December 14th, Binance Futures listed RAVE U-margined perpetual contracts.

- On December 15th, RAVE was listed on multiple centralized exchanges including OKX, Bybit, Bitget, Aster, Gate, Kucoin, and MEXC, at which point its price had retreated to approximately $0.41.

As of writing, RAVE’s on-chain price is approximately $0.38, up over 12% in the last 24 hours, with a circulating market cap of roughly $88 million.

(The above content is an authorized excerpt and reproduction from our partner PANews, Original Link | Source: Odaily Planet Daily)

Disclaimer: This article provides market information only. All content and opinions are for reference purposes only and do not constitute investment advice. They do not represent the views or positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo shall not be held responsible for any direct or indirect losses incurred by investors’ transactions.