CryptoQuant Sounds Alarm: Bitcoin Demand Weakens, Bear Market Looms with Critical Support at $70K and $56K

On-chain data analytics firm CryptoQuant has issued a significant warning, indicating that the cryptocurrency market may have entered a bear market. The firm points to a noticeable weakening in Bitcoin’s demand momentum, suggesting that the subsequent downside risk should not be underestimated.

In a recent report, CryptoQuant stated, “Bitcoin’s demand growth has visibly slowed, signaling an impending bear market. Since 2023, Bitcoin has experienced three distinct waves of spot demand, primarily driven by the launch of US spot ETFs, the US presidential election, and accumulation by Bitcoin reserve companies.”

However, since early October, this demand growth has fallen below its long-term trend line. This critical development suggests that the new buying interest that propelled the recent cycle has largely been absorbed by the market, causing Bitcoin to lose its crucial support momentum.

Key Price Levels and the “Smallest Bear Market” Paradox

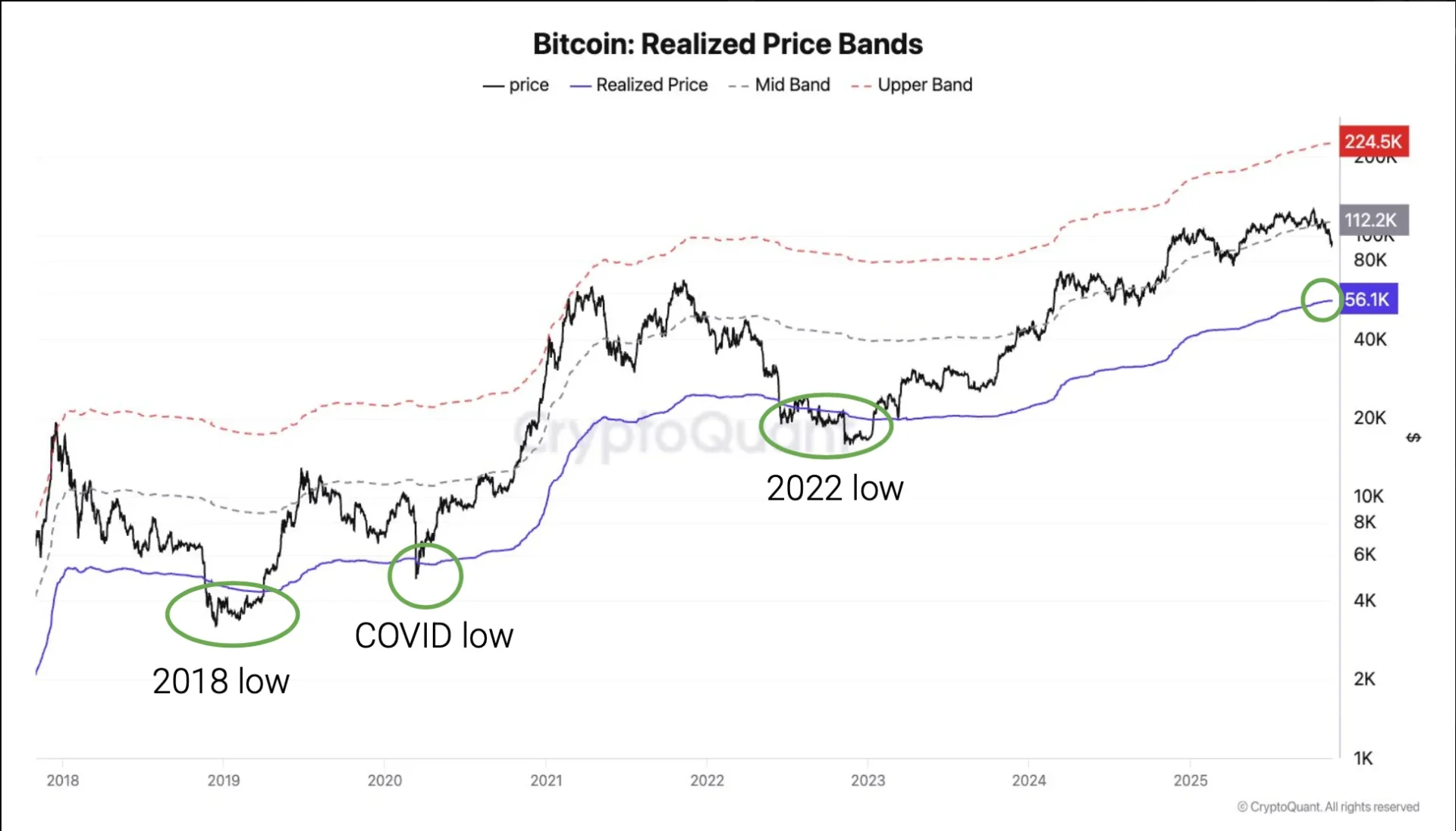

Based on the current subdued sentiment, CryptoQuant believes Bitcoin’s downside risk is progressively materializing. The report identifies $70,000 as the first significant support zone. Should the market fail to rekindle bullish momentum, a further decline to $56,000 is not ruled out. The report elaborates:

Historically, Bitcoin bear market bottoms often align closely with the ‘Realized Price,’ which reflects the average cost basis of all holders. Currently, this indicator sits around $56,000.

A retest of this price level would represent approximately a 55% drawdown from Bitcoin’s historical high. Paradoxically, this could make it the smallest percentage pullback ever recorded for a Bitcoin bear market.

Bitcoin’s medium-term support is positioned around $70,000.

Timing the Downturn: CryptoQuant’s Projections

Addressing market concerns about the timeline, Julio Moreno, Head of Research at CryptoQuant, provided specific projections: “A retracement to $70,000 could materialize within the next 3 to 6 months. As for a deeper decline to $56,000, if it occurs, it might fall in the second half of 2026.”

Moreno further added a crucial detail: “This current wave of the bear market effectively commenced in mid-November this year, following the largest cryptocurrency liquidation event in history on October 10th.”

Three Data Points Confirming Fund Retreat

CryptoQuant supports its “bear market has arrived” thesis with three compelling data points:

-

ETF Shift to Net Sellers

In Q4, US Bitcoin spot ETFs transitioned into a “net outflow” state, witnessing a reduction of approximately 24,000 Bitcoins in their holdings. This stands in stark contrast to the robust buying momentum observed during the same period last year.

-

Whales Scale Back Accumulation

The growth rate of addresses holding between 100 and 1,000 Bitcoins (a category that includes ETFs and corporate entities) has fallen below its long-term trend line. This deterioration in demand mirrors the conditions seen in late 2021, just prior to the significant 2022 bear market.

-

Derivatives Market Cools Down

Perpetual futures funding rates, when calculated using a 365-day moving average, have plummeted to their lowest point since December 2023. A decline in funding rates typically signals a reduced willingness among long-position holders to maintain leverage, a classic characteristic of a bear market. Furthermore, Bitcoin’s price has fallen below its 365-day moving average, a line often regarded as a key technical indicator separating bull and bear markets.

Challenging the Halving Narrative: The Demand Cycle Theory

CryptoQuant also put forth a disruptive perspective, suggesting that “the core engine driving Bitcoin’s 4-year cycle is ‘demand cycles,’ not ‘halving events.'” The firm posits that when demand growth peaks and subsequently declines, a bear market often ensues, irrespective of supply-side dynamics.

Wall Street’s Divergent Outlook: A Market Divided

It is crucial to note that CryptoQuant’s pessimistic outlook stands in sharp contrast to the more optimistic views recently expressed by several major Wall Street institutions, highlighting an intense tug-of-war between bullish and bearish sentiments in the market:

- Citigroup: Its base-case scenario forecasts Bitcoin rising to $143,000 within the next 12 months, with the most optimistic scenario reaching $189,000.

- JPMorgan: Maintains its projection of Bitcoin reaching $170,000, based on a comparative valuation against gold.

- Standard Chartered: While adopting a more cautious stance and halving its 2026 target price for Bitcoin, it still holds a target of $150,000.

- Bitwise: Remains steadfast in its belief that Bitcoin will achieve new historical highs again in 2026.

Disclaimer: This article is provided for market information purposes only. All content and views are for reference only, do not constitute investment advice, and do not represent the views and positions of the author or publisher. Investors should make their own decisions and trades. The author and publisher will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.