Bitcoin’s Elusive Santa Rally: Macro Headwinds, Capital Shifts, and Technical Consolidation

As Christmas week unfolded, global markets delivered a clear message that initially bypassed the cryptocurrency sector. Amidst a weakening U.S. dollar and declining U.S. Treasury yields, risk aversion surged, propelling gold and silver to new historical highs. These precious metals emerged as the primary beneficiaries of capital flows, becoming the hottest destinations for investors seeking safety.

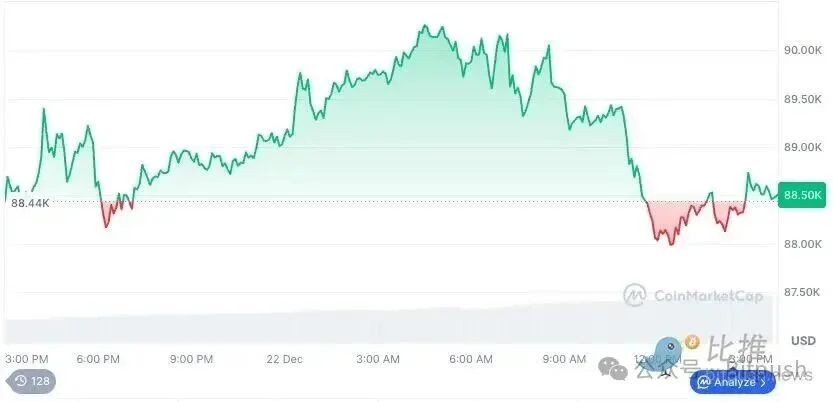

In stark contrast, the cryptocurrency market remained remarkably subdued. Bitcoin, rather than capitalizing on the favorable macroeconomic tailwinds, continued its oscillation within the $88,000-$89,000 range, conspicuously lacking the aggressive momentum typically observed ahead of holiday periods.

This pronounced divergence reignited the perennial market discussion: “Will Bitcoin experience a Santa Rally?” Originating in traditional finance, a Santa Rally refers to a seasonal phenomenon where risk assets see a temporary uplift around Christmas, driven by improved sentiment and shifts in liquidity. However, this pattern has historically proven inconsistent in the volatile crypto market. This year, the central question remains whether Bitcoin is merely “lagging” due to heightened risk aversion or subtly accumulating strength within its elevated price band. The answers lie in a deeper examination of real price action and underlying capital structures.

Macro Environment: Awaiting Validation as Capital Exits Risk Assets

Gabriel Selby, Head of Research at CF Benchmarks, emphasized that market participants are unlikely to significantly increase their allocations to risk assets like Bitcoin until the Federal Reserve observes several consecutive months of clear data indicating a sustained decline in inflation. In his assessment, the current macroeconomic landscape is firmly in a “waiting for validation” phase.

This cautious sentiment is inextricably linked to investor focus on a series of critical U.S. economic data releases. The third-quarter GDP figures are imminent, with market consensus predicting an annualized growth rate of approximately 3.5%, a slight dip from Q2’s 3.8%. Additionally, indicators such as the Consumer Confidence Index and weekly jobless claims will offer further insights into the health of the labor market. The outcomes of these reports will directly influence market perceptions of the Federal Reserve’s policy trajectory, thereby shaping overall risk appetite.

While a weakening U.S. dollar and falling U.S. bond yields theoretically provide a supportive environment for risk assets, actual capital flows present a different narrative.

According to data from SoSoValue, recent ETF activity shows a distinct divergence. Bitcoin ETFs recorded a net outflow of approximately $158.3 million, while Ethereum ETFs experienced outflows of about $76 million. Conversely, XRP and Solana ETFs registered modest inflows of approximately $13 million and $4 million, respectively. This suggests an ongoing internal market adjustment and a broader structural reallocation of capital within the digital asset space.

Expanding to the broader digital asset investment product landscape, CoinShares’ latest weekly fund flow report revealed a total net outflow of approximately $952 million from these products last week. This marks the first net redemption after four consecutive weeks of inflows. CoinShares partially attributes this significant outflow to regulatory uncertainty stemming from the slower progress of the U.S. Clarity Act, which has prompted institutional investors to reduce their short-term risk exposure.

Technical Structure: A Predominantly Sideways Trajectory

From a technical standpoint, Bitcoin’s current price action is neither distinctly bearish nor particularly strong. The $88,000 to $89,000 range has solidified as a repeatedly validated core oscillation zone in the short term, while the $93,000 to $95,000 area represents critical resistance that bulls must decisively overcome.

Several traders suggest that if Bitcoin fails to breach this resistance zone effectively within the Christmas week, any short-term rebound should likely be interpreted as a technical correction rather than a definitive trend reversal. Conversely, if the price continues to consolidate at elevated levels, it indicates that the market is awaiting new catalysts rather than actively committing to a specific direction.

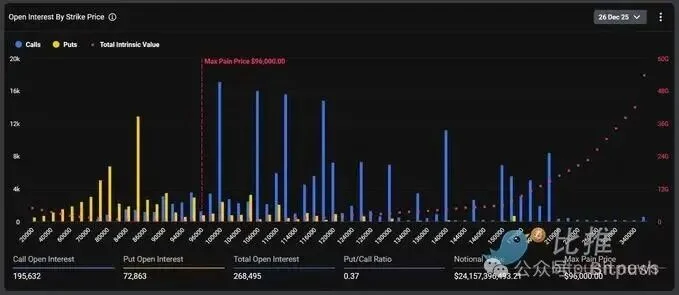

The structure of the derivatives market further elucidates Bitcoin’s cautious behavior during Christmas week. This Friday, the Bitcoin market is poised for its largest options settlement in history, with a staggering total value of $24 billion. Currently, bulls and bears are engaged in fierce contention at key price levels:

- Bulls: Are betting on BTC breaking the $100,000 psychological barrier.

- Bears: Are aggressively defending the $85,000 support level.

- Decisive Point: $96,000 is widely considered the watershed for the current trend; a sustained hold above this level would help maintain upward momentum, while failure to do so could see the market remain under pressure.

Analyst Perspectives

Multiple market observers concur that this year’s Christmas week appears more akin to a “structural examination” rather than a window for sentiment-driven, unidirectional price movement.

Gabriel Selby of CF Benchmarks, in a recent interview, explicitly stated that Bitcoin’s current price behavior does not align with the typical characteristics of a Santa Rally. He argues that genuine holiday rallies are often marked by sustained buying dominance and trend continuation, not repeated tug-of-war within a high-level range. “What we’re seeing now looks more like the market digesting previous gains rather than preparing for the next upward move,” Selby remarked, an assessment further supported by persistently low trading volumes.

Cryptocurrency analyst DrBullZeus noted that BTC continues to fluctuate between established support and resistance levels without a clear breakout. He predicts that the price will remain in a range-bound oscillation until a definitive breakthrough occurs. A successful breach of resistance would open the path towards the $92,000 level, whereas a fall below support could lead to a retreat to the $85,000 area.

Legendary trader Peter Brandt, in his latest market review, highlighted that Bitcoin has experienced five cycles of “parabolic growth followed by an 80% retracement” over the past 15 years. He suggests that the current cycle’s correction has not yet found its bottom. Despite these harsh short-term patterns, Brandt’s cyclical analysis projects the next bull market peak to arrive in September 2029.

Brandt emphasized that the inherent asset characteristics of BTC dictate that it must forge new highs through periods of extreme market “shakeouts” and volatility.

Historically, Bitcoin’s “Santa Rally” has been notoriously unpredictable. While some years, like 2012 and 2016, saw impressive gains of 33% and 46% during the holiday period, others were marked by stagnation or even decline. Statistically, since 2011, Bitcoin’s average gain during the Christmas period has been approximately 7.9%.

However, given the current market dynamics, a typical “Santa Rally” appears unlikely this year. The pronounced strength in gold and silver predominantly reflects a concentrated release of market risk aversion. In contrast, Bitcoin’s relative “calmness” once again underscores its prevailing status as a widely perceived risk asset within global asset allocation.

Therefore, rather than simply attributing Bitcoin’s current performance to “falling behind,” it is more accurate to characterize its position as crucial yet delicate. On one hand, it lacks sufficient macroeconomic tailwinds to propel it directly into a new upward trajectory. On the other hand, there are no clear signals of a decisive breakdown or weakening trend.

What will truly determine Bitcoin’s year-end performance is not merely the “Christmas” time-label itself, but rather whether market capital demonstrates a renewed willingness to invest at current price levels. Until such a commitment is clearly confirmed, narrow-range oscillation is likely to remain the dominant theme this Christmas week.

(The above content is excerpted and reproduced with authorization from our partner PANews, original link | Source: BitPush)

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses resulting from investor transactions.