Bitcoin’s Next Bull Run? VanEck Points to Miner Capitulation as a Key Indicator

A recent report from asset management giant VanEck has sent ripples through the crypto community, suggesting that the current cooling trend in Bitcoin mining activity could be a powerful precursor to an impending bull market. Historically, such periods of reduced network participation have often signaled the return of significant upward price momentum for Bitcoin.

Hash Rate Decline: A Contrarian Bullish Signal

VanEck’s research, published earlier this week, delves into market patterns observed since 2014. Their findings are compelling: when Bitcoin’s network hash rate — a measure of the total computational power dedicated to mining — experiences a contraction, there’s a 65% probability of positive investment returns over the subsequent 90 days. This stands in stark contrast to periods of continuous hash rate growth, which historically yield positive returns only 54% of the time.

VanEck analysts describe this phenomenon as a “contrarian indicator,” emphasizing that “a decline in hash rate could actually be a bullish signal for long-term holders.” At the heart of this trend is what’s known as “miner capitulation.” This occurs when falling Bitcoin prices and escalating operational costs squeeze profit margins, forcing less financially robust miners to power down their equipment and, in some cases, sell off their Bitcoin holdings to cover expenses and survive.

Historically, this “great cleansing” event has often marked the formation of a market bottom, typically followed by a robust price rebound as weaker hands are flushed out and the market stabilizes.

Current Market Aligns with Historical Precedent

The current market landscape appears to be mirroring these historical trends precisely. In the month leading up to December 15th, Bitcoin’s network hash rate witnessed an approximate 4% decline. This marks the most significant single-month drop since April 2024, signaling a notable shift in mining dynamics. VanEck’s report further posits that the longer this hash rate compression persists, the more pronounced and vigorous the subsequent price rebound tends to be.

Profitability Squeeze and Industry Consolidation

The prevailing weakness in Bitcoin’s price has placed immense pressure on the mining sector’s profitability. VanEck’s data highlights this squeeze, citing the Antminer S19 XP — a popular mid-tier mining machine — as an example. The “breakeven electricity price” for this model, which represents the maximum electricity cost a miner can bear without incurring losses, has plummeted from previous highs of approximately $0.12 per kilowatt-hour (kWh) to around $0.077 per kWh by mid-December.

This rapid decline in the breakeven point underscores thinning profit margins across the industry. Consequently, only miners with access to lower electricity costs and stronger capital structures are positioned to withstand the current market pressures and continue operations, leading to a period of industry consolidation.

Institutional Accumulation: The Smart Money Moves In

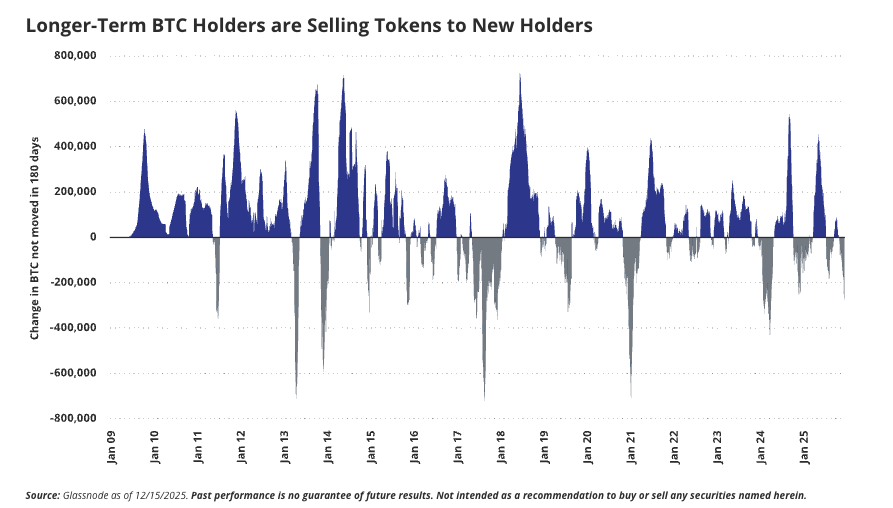

Despite the headwinds faced by miners, VanEck’s analysis reveals a contrasting trend: a significant increase in accumulation by long-term institutional buyers. Specifically, “hoarding companies” — entities that strategically acquire and hold Bitcoin — have accelerated their dip-buying efforts over the past month, signaling confidence in Bitcoin’s long-term value.

The report details that from mid-November to mid-December, cryptocurrency reserve companies collectively purchased approximately 42,000 Bitcoins. This represents a substantial monthly increase of about 4%, elevating their total holdings to an impressive 1.09 million Bitcoins.

This recent surge in institutional buying marks the largest single-month accumulation wave since mid-July to mid-August 2023, a period that saw over 128,000 Bitcoins added to institutional reserves.

Future Funding Strategies for Bitcoin Acquisition

Looking ahead, VanEck anticipates a strategic shift in how these cryptocurrency reserve companies fund their Bitcoin acquisitions. They expect a gradual reduction in the issuance of common stock, which can dilute existing equity, in favor of raising capital through preferred stock. This method is projected to become the primary funding source for future Bitcoin purchases, indicating a sophisticated approach to capital management and asset accumulation.

Disclaimer: This article is provided for market information purposes only. All content and views expressed herein are for reference only and do not constitute investment advice. They do not necessarily represent the views or positions of the author or publisher. Investors are encouraged to conduct their own research and make independent investment decisions. The author and publisher will not be held responsible for any direct or indirect losses incurred by investors’ transactions.