Author: Jae, PANews

Aave’s Identity Crisis: Who Truly Owns DeFi’s Crown Jewel?

In the dynamic realm of decentralized finance (DeFi), where innovation often outpaces established norms, a profound power struggle is unfolding within Aave, one of the sector’s most venerable lending protocols. This isn’t just a squabble over funds; it’s a high-stakes battle to define the very essence of decentralized governance, pitting the founding development team against its passionate community of token holders.

Aave, a titan in the DeFi landscape, manages an impressive $34 billion in assets and has long been lauded as a beacon of on-chain governance. Yet, in December 2025, the protocol found itself embroiled in its most significant trust crisis in its eight-year history. What began as a seemingly minor dispute over frontend fee allocation rapidly escalated, triggering a domino effect that has pushed this DeFi giant to a critical juncture.

This conflict peels back layers, exposing a core tension at the heart of the decentralization narrative: in a system built on distributed power, who ultimately holds the reins? Is it the founding team, wielding control over code and brand, or the decentralized autonomous organization (DAO) community, empowered by governance tokens?

Aave’s predicament isn’t isolated; it’s a pivotal moment for the entire DeFi ecosystem. It compels us to confront a pressing question: as protocols mature, how can the commercial incentives vital for development teams be harmonized with the fundamental governance rights of token holders?

The $10 Million Discrepancy: Aave Labs Accused of Community Disenfranchisement

The genesis of Aave’s internal strife can be traced to a technical optimization update.

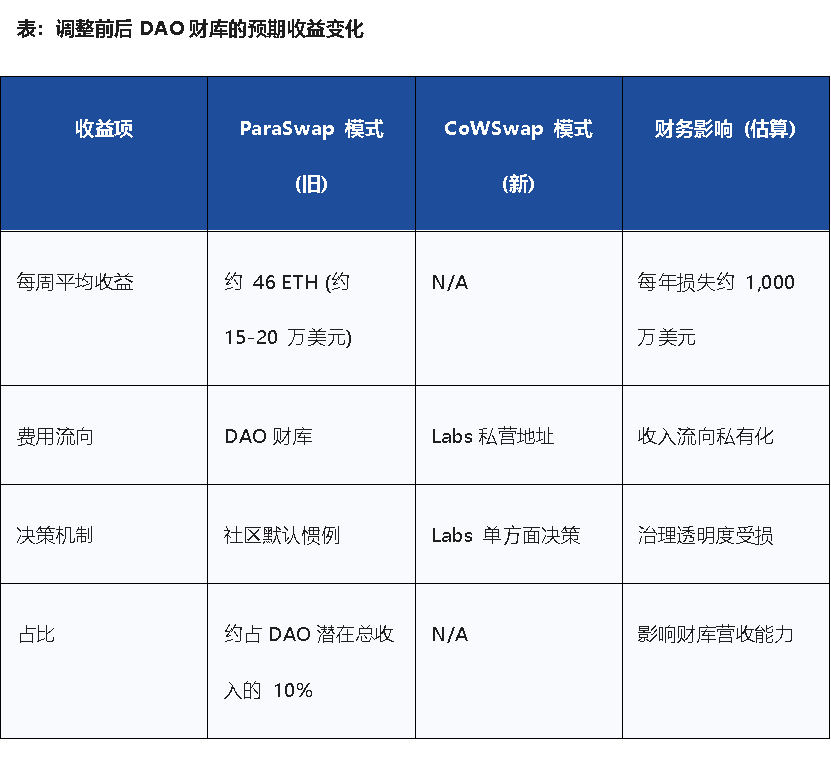

On December 4, 2025, Aave Labs announced a strategic shift: changing its official frontend (app.aave.com) asset swap provider from ParaSwap to CoWSwap, citing enhanced pricing and robust MEV protection. However, the accompanying financial ramifications were conspicuously absent from the announcement.

A vigilant community representative, EzR3aL, unearthed a critical detail through on-chain analysis: post-transition, user-generated transaction fees were no longer routed to the DAO’s public treasury. Instead, they were directed to an address controlled by Labs. Historical data suggested this “missing” annualized revenue could soar to an estimated $10 million.

Marc Zeller, a prominent Aave community leader, swiftly labeled this move a “hidden privatization of brand assets.” He argued that Labs was leveraging technology and brand value, originally fostered by DAO funding, for its own commercial gain, thereby eroding a long-standing implicit trust within the ecosystem.

Aave founder Stani Kulechov offered a contrasting perspective, drawing a sharp distinction between the protocol and the product. He asserted that while the core Aave protocol, built on smart contracts, belongs to the DAO, the frontend product (app.aave.com), with its substantial operational and maintenance costs, should grant commercial rights to its developers, Labs. Kulechov characterized previous fee contributions to the DAO as mere “voluntary donations.” This stance directly challenges the prevailing DeFi ethos, which dictates that governance tokens should capture the economic value generated across the entire protocol ecosystem.

To many in the community, Stani’s reasoning amounted to an act of sovereign deprivation. As the primary user interface and traffic conduit, concerns mounted: if frontend revenues could be unilaterally appropriated by Labs, what would prevent similar actions for future endeavors like Aave V4, the GHO stablecoin, or Horizon RWA? In such a scenario, the fundamental value proposition of the AAVE governance token – its promise of value capture – risked becoming an empty pledge.

Escalation: The “Poison Pill” and the Fight for Brand Ownership

When amicable negotiations proved fruitless, a more assertive faction within the community adopted an aggressive strategy. On December 15, user “tulipking” introduced a bombshell governance proposal, ominously dubbed the “Poison Pill Plan,” featuring three uncompromising demands:

- Mandatory Asset Transfer: Labs must unconditionally transfer all codebases, intellectual property (IP), and trademarks to the DAO, under threat of legal action.

- Equity Forfeiture and Subsidiarization: The DAO should acquire 100% of Labs’ equity, transforming the independent company into a wholly-owned DAO subsidiary, with founders and employees transitioning to DAO employment.

- Recourse for Past Revenue: Labs must return all historical frontend revenue generated from the use of the Aave brand to the DAO treasury.

Though procedural issues temporarily sidelined this audacious proposal, its deterrent effect was undeniable. It signaled the community’s readiness and capacity to leverage governance voting to effectively “reverse-acquire” development teams unwilling to align with DAO objectives.

In the wake of this extreme proposition, former Aave CTO Ernesto Boado presented a more constructive, yet equally resolute, proposal: “Phase One – Ownership.” This initiative sounded the clarion call for sovereignty reclamation, aiming to:

- Reclaim control of key domains such as aave.com.

- Reassert ownership over official social media accounts, including X and Discord.

- Secure control of the GitHub code repository.

Boado emphatically stated that true decentralization must encompass the decentralization of “soft assets.” He proposed the creation of a DAO-controlled legal entity to hold these brand assets, thereby establishing legal recourse within traditional jurisdictions. This marked a significant evolution, as the DAO sought to transcend its identity as a loose on-chain voting collective and transform into a “digital sovereign entity” with tangible legal standing and assets.

Market Jitters and Procedural Discord: AAVE Token Falls, Whales Exit

As internal governance friction intensified, the secondary market responded with a decisive “vote of no confidence.” While the $34 billion in assets locked within the Aave protocol remained largely stable, the AAVE token, directly tied to holder interests, plummeted by over 25% within two weeks.

On December 22, the second-largest AAVE holder capitulated, liquidating 230,000 AAVE tokens at approximately $165, having accumulated them at an average price of $223. This resulted in an estimated paper loss of $13.45 million. This whale’s departure underscored deep investor unease regarding Aave’s governance chaos and, more critically, cast a shadow of doubt over its future value capture potential. If revenue streams could be so easily diverted, the very foundation of the token’s valuation model would crumble.

Adding fuel to the fire, Aave Labs unilaterally fast-tracked Boado’s proposal to the Snapshot voting stage without the original author’s consent. This move sparked widespread community outrage, with several representatives condemning it as a breach of established governance procedures.

Crypto KOL 0xTodd highlighted two key concerns: 1) The voting period (December 23-26) coincided with the Christmas holiday, potentially leading to significantly reduced participation. 2) Boado’s proposal was still in the discussion phase, which typically requires 3-6 months of iterative communication and refinement before proceeding to a vote.

Stani Kulechov, however, defended Labs’ actions, asserting that the new ARFC proposal vote adhered fully to the governance framework and that voting was the most effective and ultimate path to resolution. This exchange highlighted a fundamental divergence: the DAO’s emphasis on procedural correctness versus Labs’ prioritization of efficiency and results.

Yet, an absolute adherence to procedural correctness could inadvertently stifle innovation and efficiency. If development teams are entirely stripped of commercial incentives, Labs’ motivation to drive crucial upgrades like Protocol V4 could wane significantly. Furthermore, managing brand assets solely through a DAO could pose challenges in traditional legal disputes, where the absence of a direct, accountable entity might hinder swift responses, potentially leading to regulatory seizure of the brand.

Currently, “for” votes account for a mere 3%, reflecting a lopsided outcome. The community may once again find itself trapped in a “proposal-vote” loop, escalating into a protracted deadlock. Aave has already expended considerable time navigating this governance stalemate.

Nevertheless, this trust crisis is likely a transient phase—a necessary “rite of passage” for Aave as a DeFi frontrunner.

Many seasoned DAO participants observe that even Aave, a gold standard for on-chain governance, teetering on the brink of schism, might suggest inherent challenges in the DAO governance model itself. However, the sheer transparency, intensity, and balanced nature of these internal debates within Aave are, in themselves, a testament to its advanced state of decentralized governance. This collective capacity for self-correction is precisely where the true value of decentralized governance lies.

A crucial external development also offered a glimmer of reassurance. On December 20, the U.S. SEC concluded its four-year investigation into Aave without taking any enforcement action. This was widely interpreted as tacit regulatory approval for highly decentralized governance models like Aave’s.

Amidst the storm, Aave’s underlying fundamentals have demonstrated remarkable resilience. Founder Stani Kulechov not only continued to address community concerns but also personally increased his AAVE holdings by a total of $15 million, absorbing over $2 million in paper losses. He also unveiled a “three-pillar” strategy aimed at rebuilding community consensus and trust. However, Stani’s actions also drew skepticism from some in the community, who perceived it as an attempt to bolster his own voting power. Even so, merely increasing Labs’ influence on governance is a symptomatic fix, not a fundamental solution.

Governance Evolution: The Path to a Hybrid Organization

As the controversy evolves, a new trajectory for governance may be emerging: Aave could transition from a purely on-chain protocol to a “hybrid organization.”

Revisiting Boado’s latest proposal, its core innovation lies in redefining the relationship between the two parties across three dimensions:

- DAO Sovereignty: The DAO would possess not only smart contracts but also critical “soft assets” like the brand, domain names, trademarks, and user distribution channels.

- Labs as a Professional Service Provider: Labs would no longer profit as an “owner” but would function as a top-tier service provider authorized by the DAO. Any frontend fees collected by Labs would be based on DAO authorization, potentially requiring a mutually agreed-upon sharing ratio to cover development costs and contribute back to the token’s value.

- Contractual Governance: All profit distribution would transition from “voluntary donations” to formalized on-chain service agreements, enhancing clarity and accountability.

This dispute bears a striking resemblance to the 2023 incident where Uniswap Labs’ collection of frontend fees sparked community dissatisfaction. Uniswap ultimately resolved the issue by clearly delineating Labs’ commercial rights from the decentralized protocol layer, achieving community consensus.

Aave, however, may be poised to go a step further. Its “Phase One – Ownership” proposal aims to address the fundamental question of “who owns the brand” at a legal level. If this proposal passes, any future commercialization efforts by Labs would require explicit procedural authorization from the DAO, effectively eliminating the possibility of “hidden privatization.”

Aave’s current dilemma reflects a universal challenge confronting all decentralized protocols. Does the market prioritize an efficient, potentially centralized “product,” or a decentralized, potentially less efficient “protocol”? This isn’t merely a question of governance token boundaries; it’s a fundamental determinant of DeFi’s future trajectory.

Currently, this multi-billion dollar DeFi experiment stands at a crossroads. Its future path will be meticulously charted, one on-chain vote at a time.

(The above content is excerpted and reprinted with authorization from our partner PANews, original link)

Disclaimer: This article is provided for market information purposes only. All content and opinions are for reference only and do not constitute investment advice. They do not represent the views and positions of BlockBeats. Investors should make their own decisions and trades. The author and BlockBeats will not bear any responsibility for direct or indirect losses resulting from investor transactions.