2025 Crypto Stock Market: The Great Reshuffle Where Fundamentals Triumphed Over Narratives

The year 2025 witnessed a dramatic shake-up in the cryptocurrency-related stock market. While a select group of mining and crypto service companies delivered stellar triple-digit returns, many token-centric and narrative-driven stocks experienced significant declines. This divergence highlighted a maturing market where tangible utility and robust fundamentals began to outweigh speculative hype.

The Ascendance of Compute Power: Mining Stocks Lead the Charge

Leading the pack were companies focused on mining and computing power. BitMine (BMNR) emerged as the year’s dark horse, skyrocketing an astonishing 345%. Not far behind, Iris Energy (IREN) and Cipher Mining (CIFR) also posted impressive gains, ranging from 200% to 300%. These remarkable surges were fueled by a confluence of factors: strategic asset announcements, occasional narrative boosts, and a robust influx of investor capital targeting companies positioned to benefit from the escalating demand for computing and mining capabilities.

Narrative-Driven Stocks Face a Harsh Reality Check

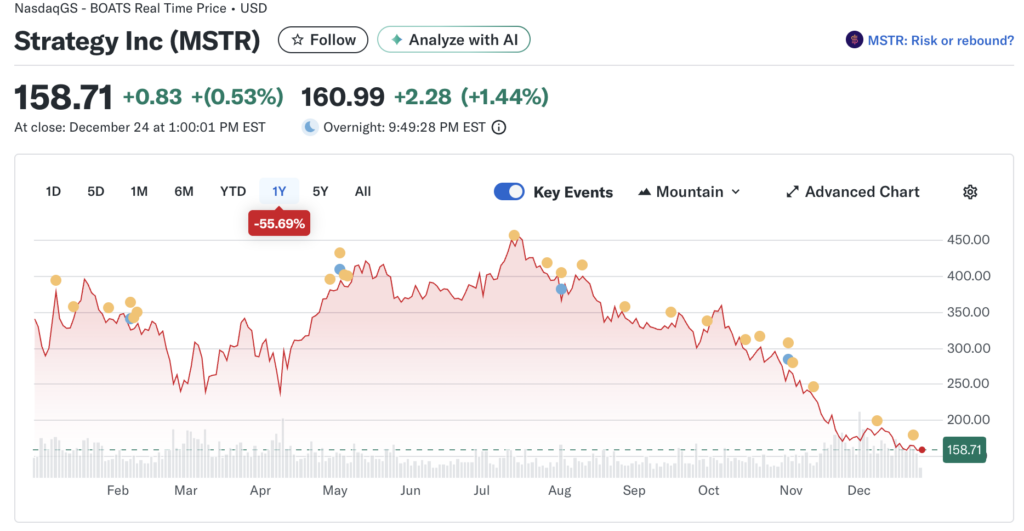

In stark contrast, companies heavily tied to specific token narratives or those whose valuations had baked in overly optimistic growth projections faced severe reversals. Sol Strategies plummeted 88%, Fold saw a 75% decline, and Strategy (formerly MicroStrategy), despite its prominent position, fell 44%. Market analysts and commentators attributed these sharp corrections to a process of narrative de-risking, widespread profit-taking after earlier speculative surges, and a critical refocus on core fundamentals. Key concerns included balance sheet dilution, the quality of revenue streams, and an uncomfortable exposure to the inherent volatility of cryptocurrency prices.

A Market Divergence: S&P 500 Up, Bitcoin Flat, Crypto Stocks Divided

The performance of these crypto-related stocks stood in stark contrast to both the broader market and the cryptocurrencies themselves. The S&P 500 enjoyed a robust year, climbing approximately 17-20%. Meanwhile, Bitcoin ended 2025 with a modest single-digit decline year-to-date, and notably, fell about 4% or more from its October peak. This significant divergence underscored a clear shift in capital allocation: investors gravitated towards stocks perceived as integral to long-term structural themes such as AI, advanced computing, and energy infrastructure. This re-evaluation of underlying company fundamentals occurred even as the pure price momentum of cryptocurrencies waned.

Key Investment Lessons from 2025

Overall, the market patterns of 2025 delivered two critical insights for investors in the crypto space:

- **High Narrative and Event Risk:** Within the same industry, speculative narratives and isolated events can create both enormous winners and devastating losers.

- **Fundamentals Prevail:** Over time, company-specific fundamentals—including asset quality, dilution risk, and revenue stability—become increasingly decisive in determining long-term success.

The market movements of 2025 offered investors an invaluable lesson: “narratives” might ignite short-term rallies, but “fundamentals” ultimately crown the enduring champions.

Core Analysis: Unpacking the Market’s Bifurcation

Why did this stark divergence occur in 2025?

- AI’s Gravitational Pull (The “Vampire Effect”): Capital migrated from purely speculative crypto holdings (like companies solely warehousing Bitcoin) towards computing power infrastructure capable of generating tangible productivity. Crypto miners began to reposition themselves as “energy and computing power providers,” effectively becoming “picks and shovels” plays for the burgeoning AI era. Their valuation logic shifted from being mere “coin price multiples” to sophisticated “data center EBITDA multiples.”

- The Unwinding of the Premium Bubble: Companies like Strategy previously commanded substantial premiums, where investors were willing to pay significantly more than the underlying value of their Bitcoin holdings. By 2025, with the widespread availability and adoption of Bitcoin ETFs, the necessity for investors to indirectly gain Bitcoin exposure through stock purchases evaporated. This led to a rapid and significant unwinding of these premiums, effectively a deleveraging event.

- A Resurgent Focus on Fundamentals: In an environment of tightening liquidity and increased market volatility, investors became far more discerning about balance sheet health and sustainable business models. The sharp downturns experienced by Fold and Sol Strategies signaled the market’s intolerance for “growth at all costs” narratives, instead demanding clear paths to sustainable revenue generation and profitability.

The profound reshuffling of crypto stocks in 2025 undeniably signaled the industry’s maturation. Pure cryptocurrency investments—such as token-pegged strategies or Bitcoin treasury models like Strategy/MSTR—underperformed significantly. This occurred despite regulatory tailwinds failing to fully translate into sustained price appreciation, compounded by a general weakening of the bullish momentum observed post-2024.

Conversely, winners like mining stocks thrived by strategically diversifying into the AI and data center sectors. These moves aligned them with broader, more robust market themes—such as energy infrastructure and the insatiable demand for computing power—effectively decoupling their performance from the inherent volatility of cryptocurrencies. The approximately 90% gain recorded by the CoinShares Bitcoin Mining ETF, even amidst Bitcoin’s price declines, stands as a testament to this successful strategic pivot.

This stark divergence from the S&P 500’s robust rally underscored a clear investor preference for “real-world” utility over pure speculation. Fundamentals, including revenue stability and the critical assessment of dilution risk, gained paramount importance as the cryptocurrency market cooled after reaching an “all-time high” of $4.4 trillion.

While early regulatory tailwinds—including policy shifts from the U.S. SEC and new stablecoin legislation—initially boosted market sentiment, they ultimately proved insufficient to prevent dramatic price volatility. This led to brutal corrections for over-leveraged and narrative-driven investments, highlighting the enduring power of market forces over initial optimism.

Disclaimer: This article is intended solely for providing market information. All content and views are for reference only and do not constitute investment advice. They do not represent the views or positions of BlockBeats. Investors should make their own decisions and conduct their own trades. The author and BlockBeats will not assume any responsibility for direct or indirect losses incurred by investors’ transactions.